June 13, 2022

A Pause in Inflation

Author - Ben McGregor

Gold boosted as inflation surprises to upside in May 2022

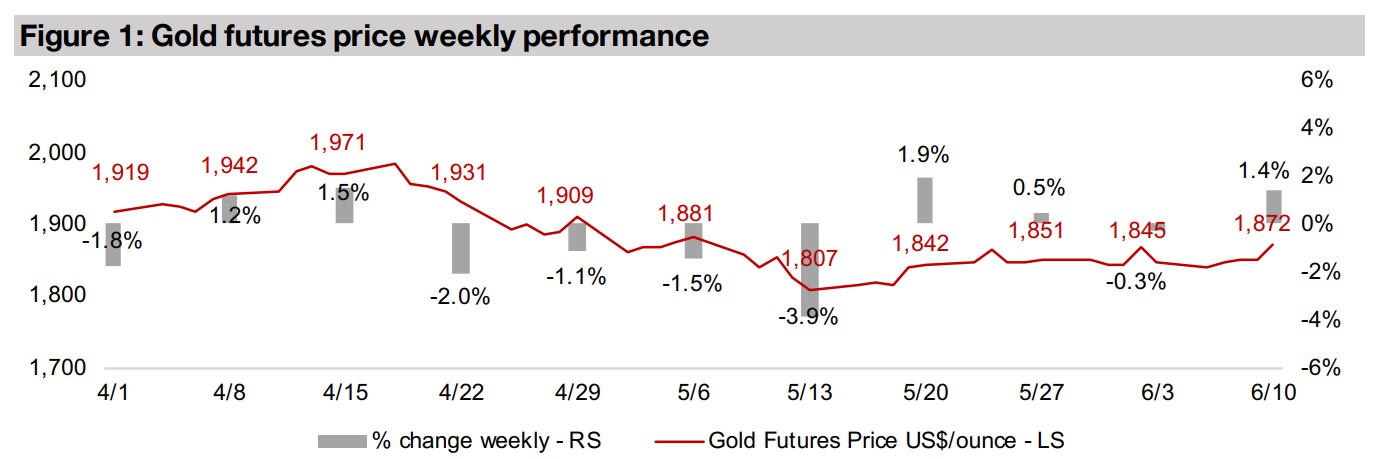

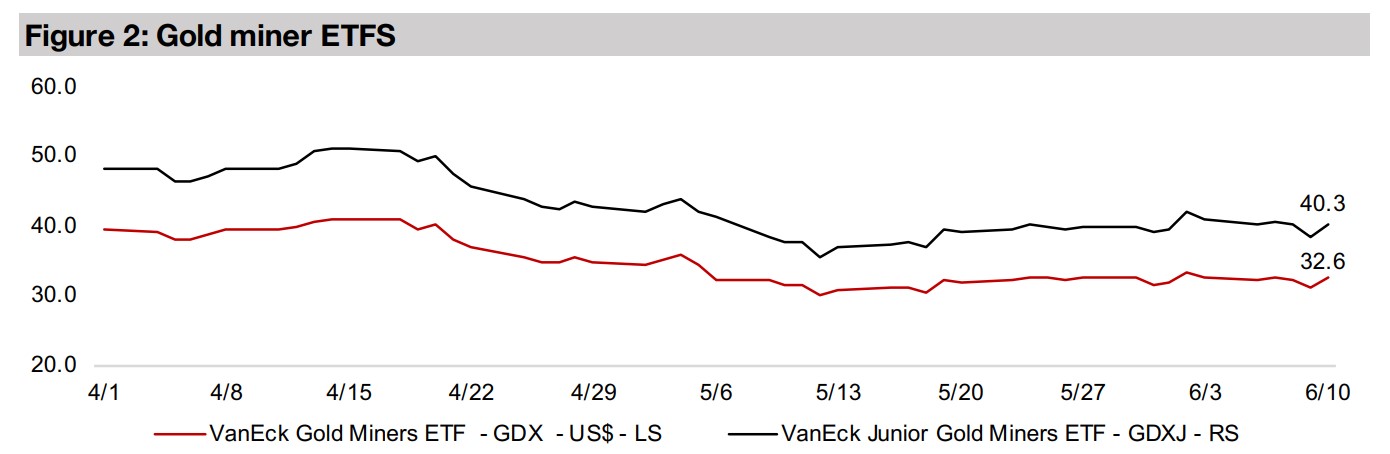

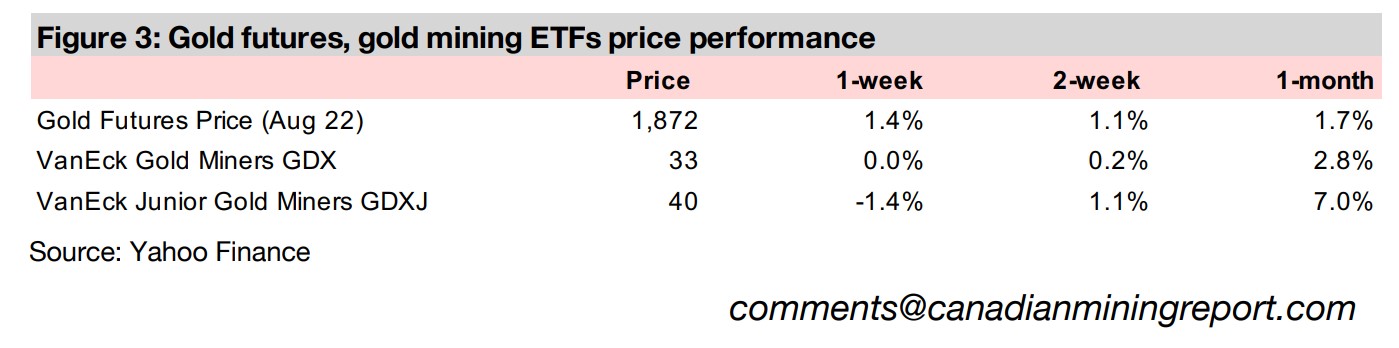

Gold rose 1.4% to US$1,872/oz this week, as US CPI Inflation for May 2022 surprised to the upside, rebounding to 8.5% after a decline to 8.2% in April off a peak of 8.6% in March 2022, but overall appears to be pausing over the past three months

A look at the TSX, TSXV mid-Sized royalty, streaming Companies

This week we look at the performance of the TSX and TSXV mid-sized royalty and streaming companies, which have mostly seen considerable declines along with the rest of the sector, with the exception of Nomad Royalty, which has held up flat.

A Pause in Inflation

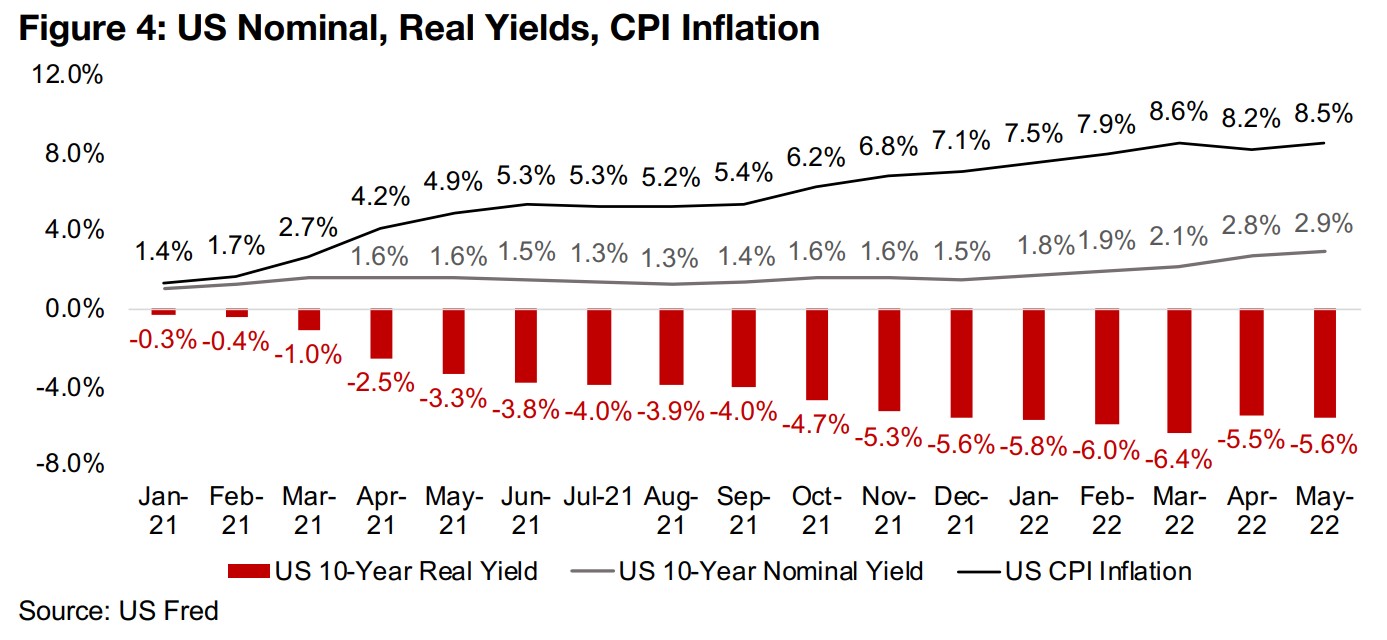

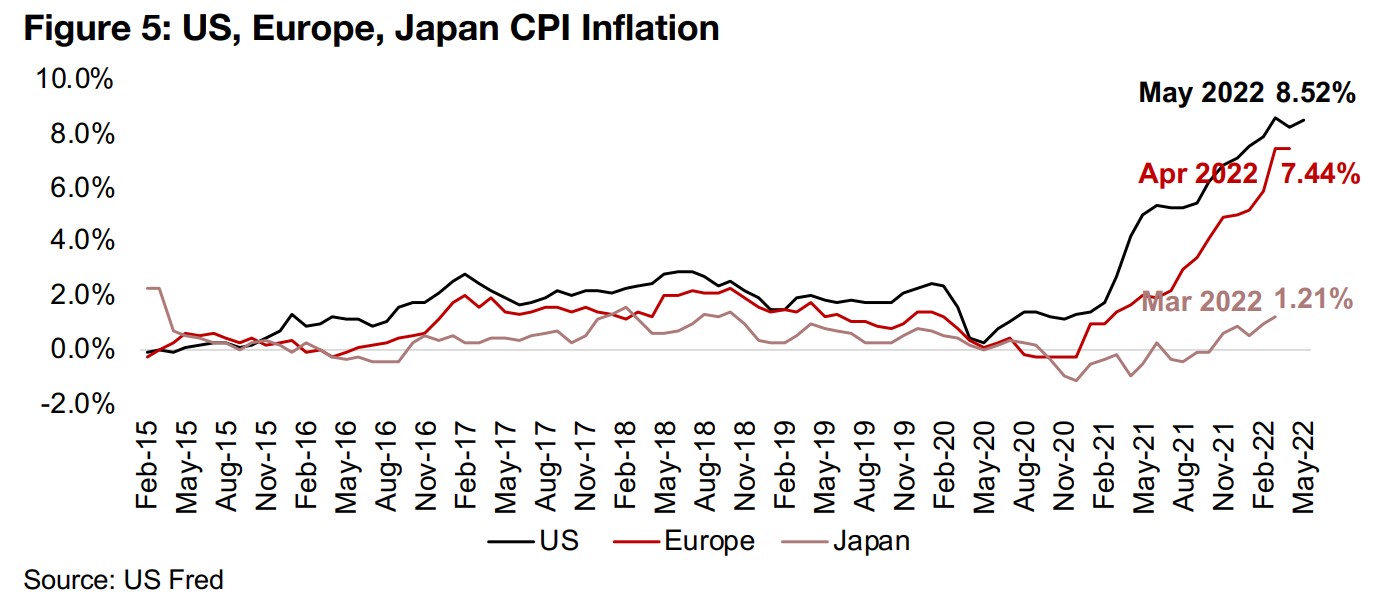

Gold rose 1.4% for the week to US$1,872/oz, as US CPI inflation for May 2022 surprised to the upside at 8.5% and US 10-year real yields became more negative, down to -5.6% in May 2022 from -5.5% in April 2022, supporting the gold price (Figure 4). After the decline in inflation in April 2022 to 8.2% off a peak of 8.6% in March 2022 following over a year-long uptrend in inflation from just 1.4% in January 2021, the market appears to have been hoping for more signs that inflation was clearly abating. Regardless of the market's disappointment short-term, if we look at the trend of the last three months, inflation does appear to have been taking a pause, and we note that it did not decline for a single month from January 2021 to March 2022, making the dip in April 2022 quite significant, and while it has rebounded in May 2022, it has not moved back above the 8.6% March 2022 highs.

There has been a similar trend in the recent European inflation data, with the CPI for the region flattening at exactly 7.44% yoy for the most recently reported March and April 2022 data, after quite a parabolic rise since late 2021 (Figure 5). In contrast to the US and Europe, Japanese inflation has continued to rise, and while well below these other two regions in absolute terms, at just 1.21% as of the most recently reported March 2022 figures, is high in relative terms, given that Japan has spent most of the past three years in deflationary territory.

Several factors could drive a continued pause, or even decline, in inflation

While it is probably too early to rule out resurgence in inflation, for the first time since

the global health crisis started, there are several factors that could be pushing

towards at a least a continued pause in rising prices. The most key factor is obviously

the Fed's aggressive rate hikes, which look set to continue at least until the end of

this year. While there can be a substantial delay in seeing the full effects of monetary

policy shifts on the economy by up to a year, the rate hikes, which began in March

2022, will already be causing their initial ripples in the business sector, which will now

be factoring in higher rates to their decisions, and the household sector, which is now

facing much higher mortgage rates. This could drive an eventual pullback in

investment and consumption for both of these sectors.

In addition to this, there is also a major stock market decline ongoing, which could

send the wealth effect, in which business and households tend to spend more as

stocks and housing prices rise because of rising perceived wealth, into reverse.

Meanwhile, the major demand rebound from the global health crisis that has driven

strong yoy growth rates in 2021 after major weakness in 2020 has mostly run its

course, and a large proportion of the supply chain distortions of 2021 that had been

driving inflation have started to subside. There is also the question of whether the

recent spike in energy prices will continue, driving consumers to adjust their

consumption patterns to reduce energy consumption, a phenomenon that was seen

during the energy crisis of the 1970s and was a considerable factor in curbing energy

prices. While such adjustments are not immediate, the spike in energy prices in the

US and Europe are likely starting to have just enough of a visceral effect on the

consumers in recent months to start driving changes in consumption patterns.

A major decline inflation could hit the gold price short-term

A major decline in inflation could hit the gold price short-term, especially if accompanied by rising yields along with Fed rate hikes, which could drive much less heavily negative real bond yields, making bonds increasingly more attractive. Given the many factors outlined above, and with some signs of inflation at least pausing over the past three months, it is something that gold investors should keep an eye on. However, all of the above scenarios outlined above would surely drive a major economic and stock market decline, which would see political pressures likely to compel the Fed to once again cut rates, giving support to the gold price.

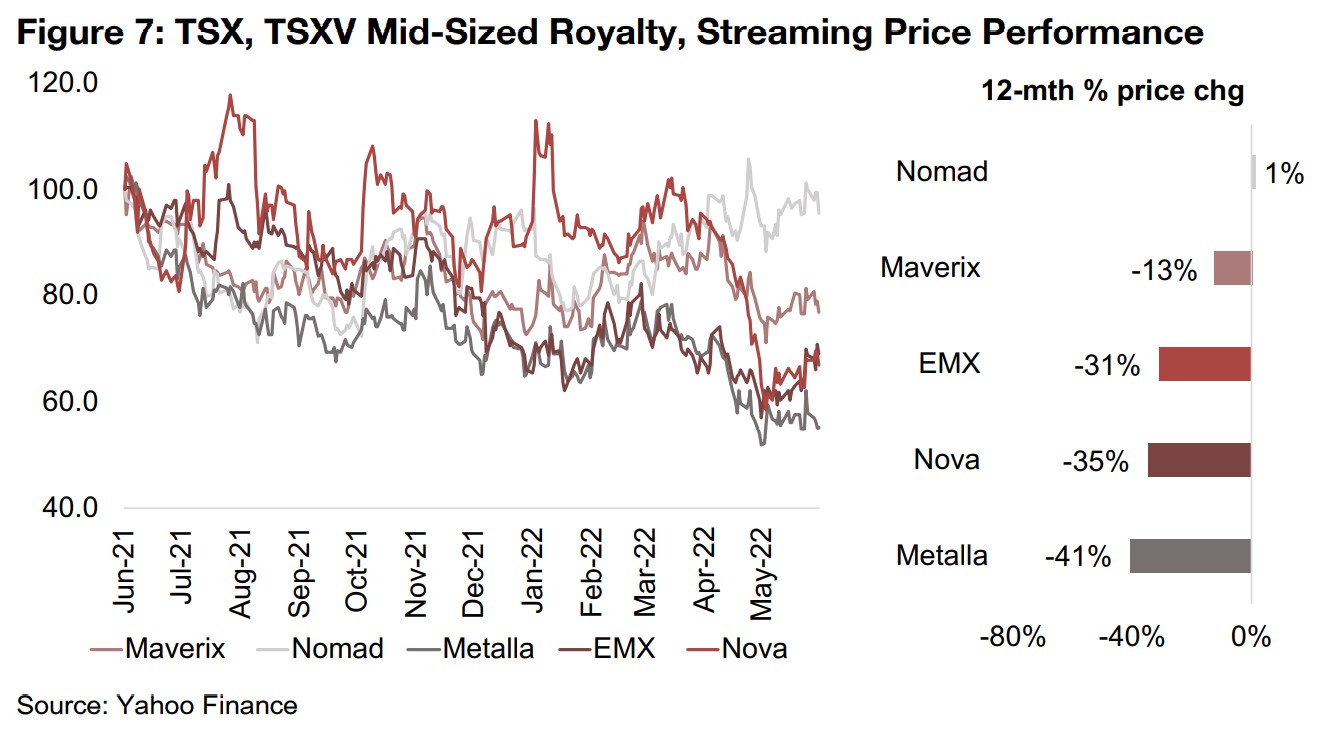

Royalty and streaming companies not spared from market downturn

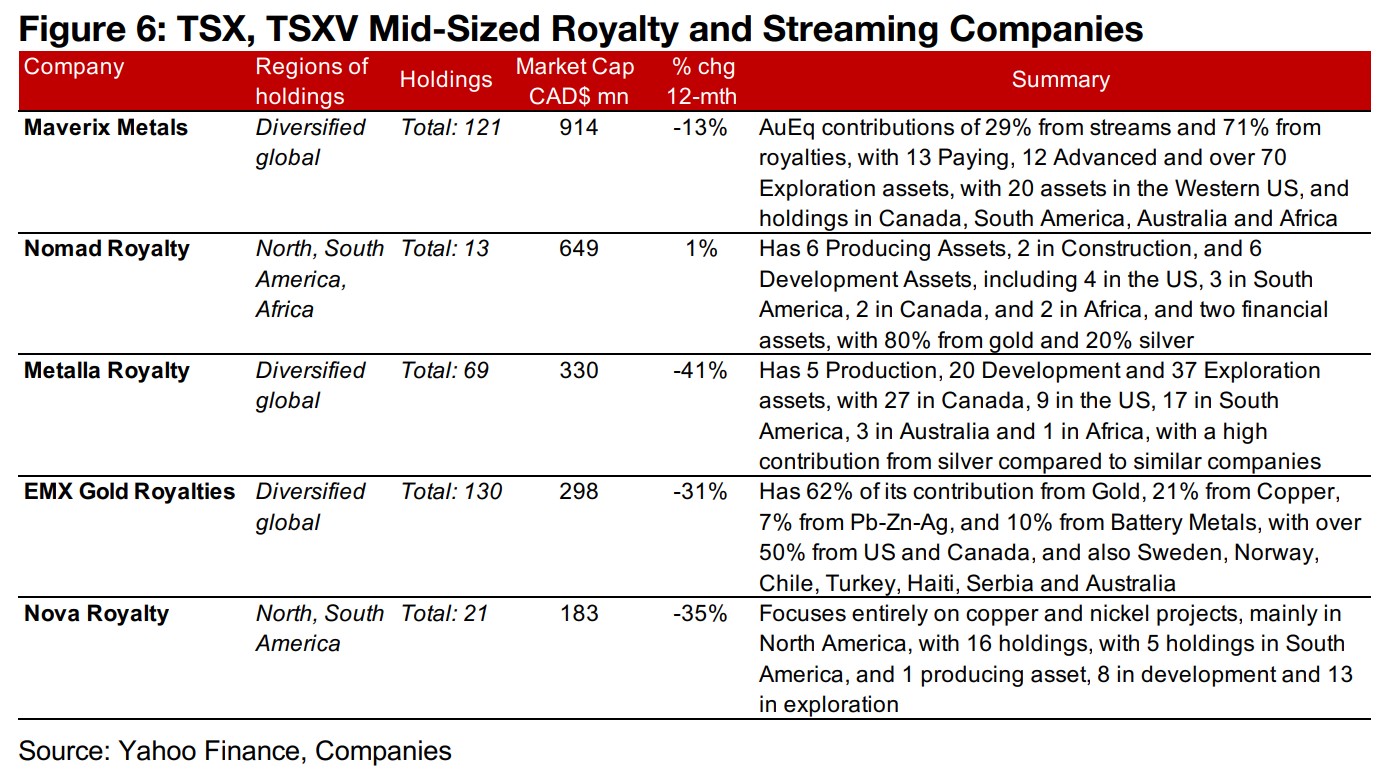

This week we take a look at the performance of the mid-sized TSX and TSXV-listed royalty and streaming companies, including Maverix Metals, Nomad Royalty, Metalla Royalty, EMX Gold Royalties and Nova Royalty (Figure 6). While we might theoretically expect these companies to outperform the rest of the junior mining space, given diversification across many companies and relatively low operational risk, overall they haven't been spared from the market downturn.

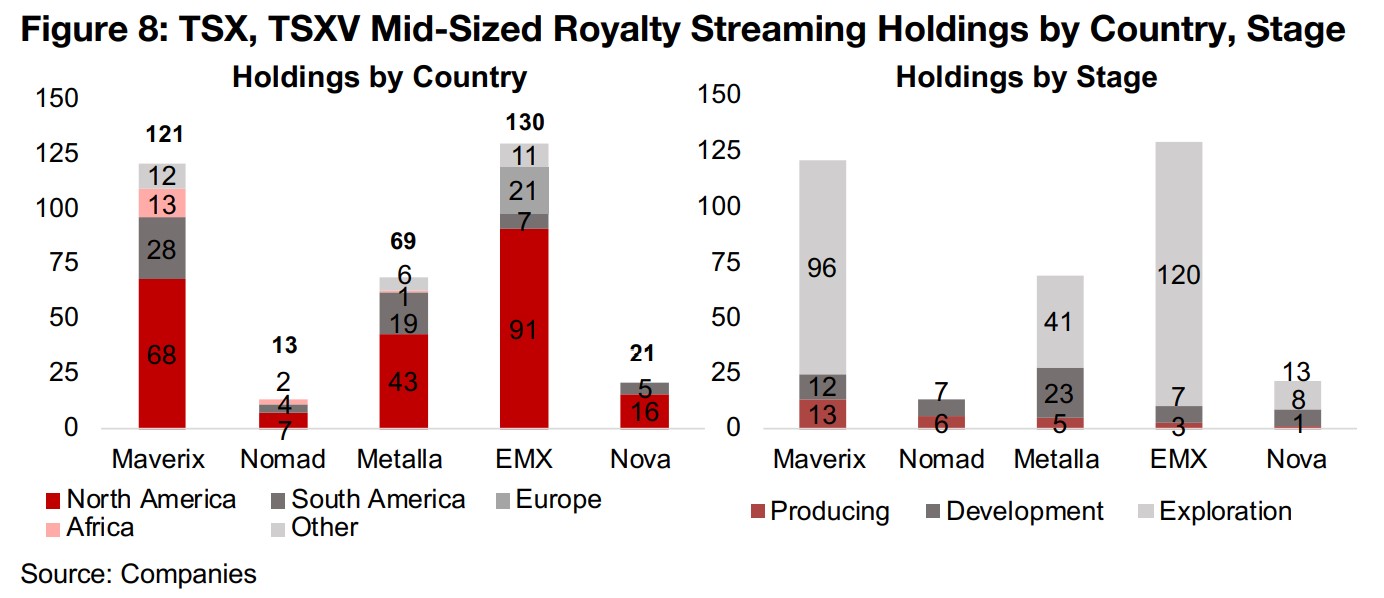

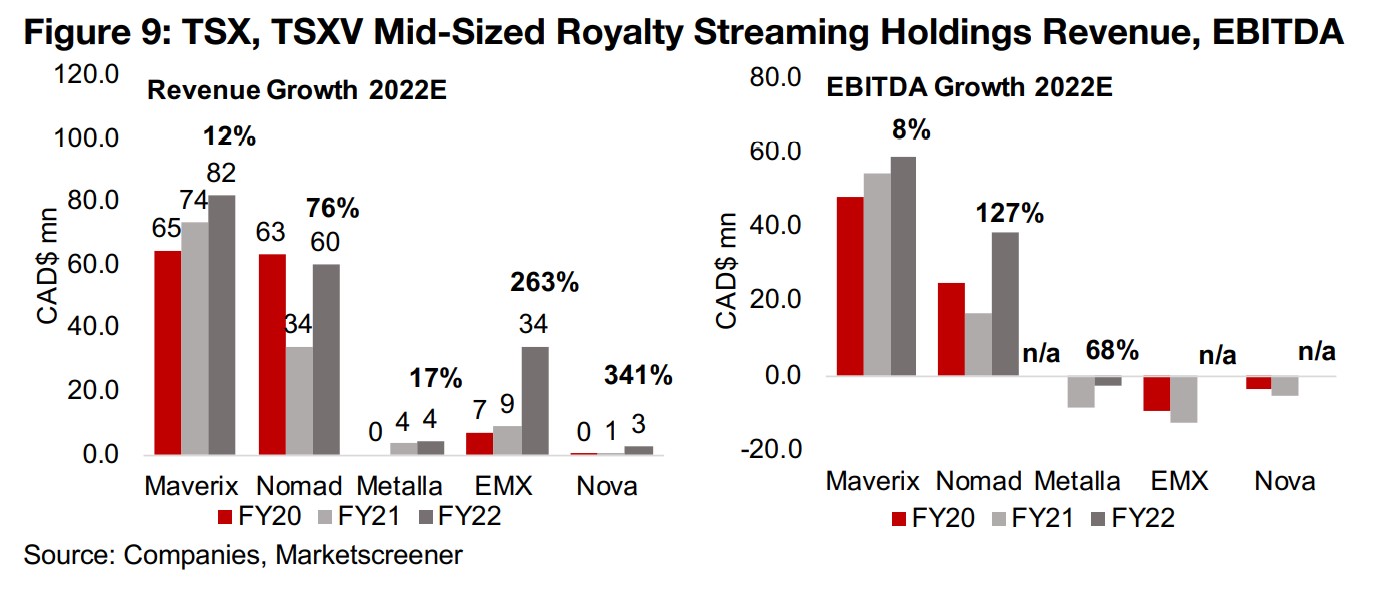

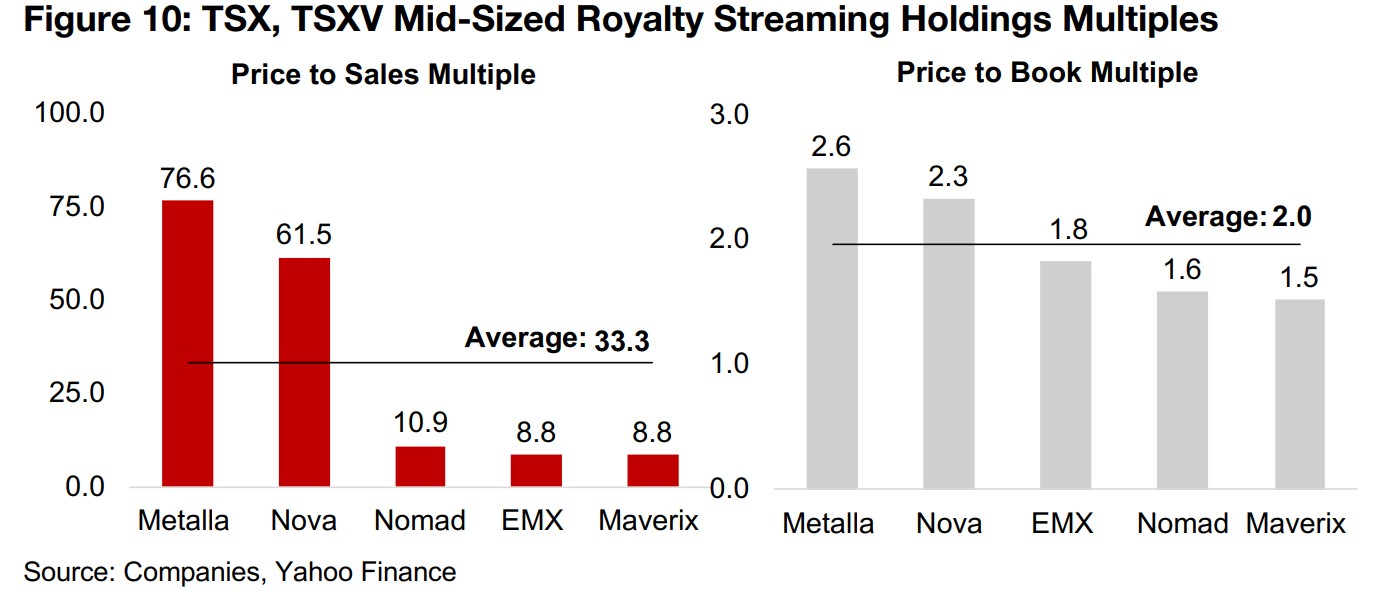

Even the best performer, Nomad Royalty, is up just 1% (Figure 7), which has probably been supported by the fact that the company has only relatively advanced companies in its portfolio, with six already producing and seven in development, and no projects in the riskier exploration stage, in a period where the market is heavily discounting riskier, smaller cap operations (Figure 8). Nomad also has a substantial 76% expected growth in 2022 revenue and 127% growth in 2022 EBITDA (Figure 9), as well as relatively moderate valuations of 10.9x price to revenue and 1.6x price to book helping to support its price (Figure 10). The second best performer Maverix has the largest market cap of the group and is well diversified globally, and while it does have a large number of riskier exploration stage projects in its portfolio, it has both the lowest price to sales and price to book multiples of the group, which has likely assisted in curbing its downside. The rest of the group is over 30% over the past year, with most of the losses occurring during the broader market decline of the past few months. Metalla is differentiated from the group for a large contribution from silver as well as gold, EMX sees a major contribution from gold, but also copper and battery metals, and Nova Royalty is focused entirely on copper and nickel projects.

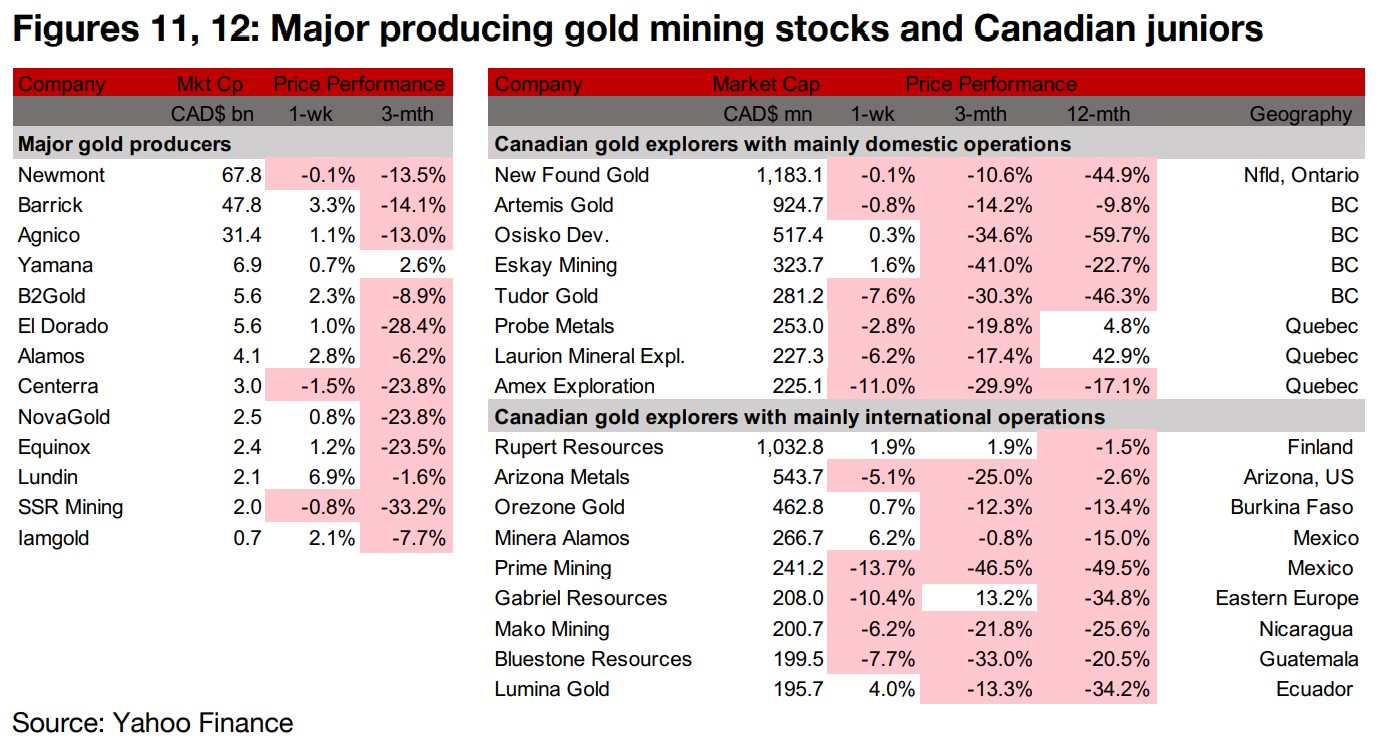

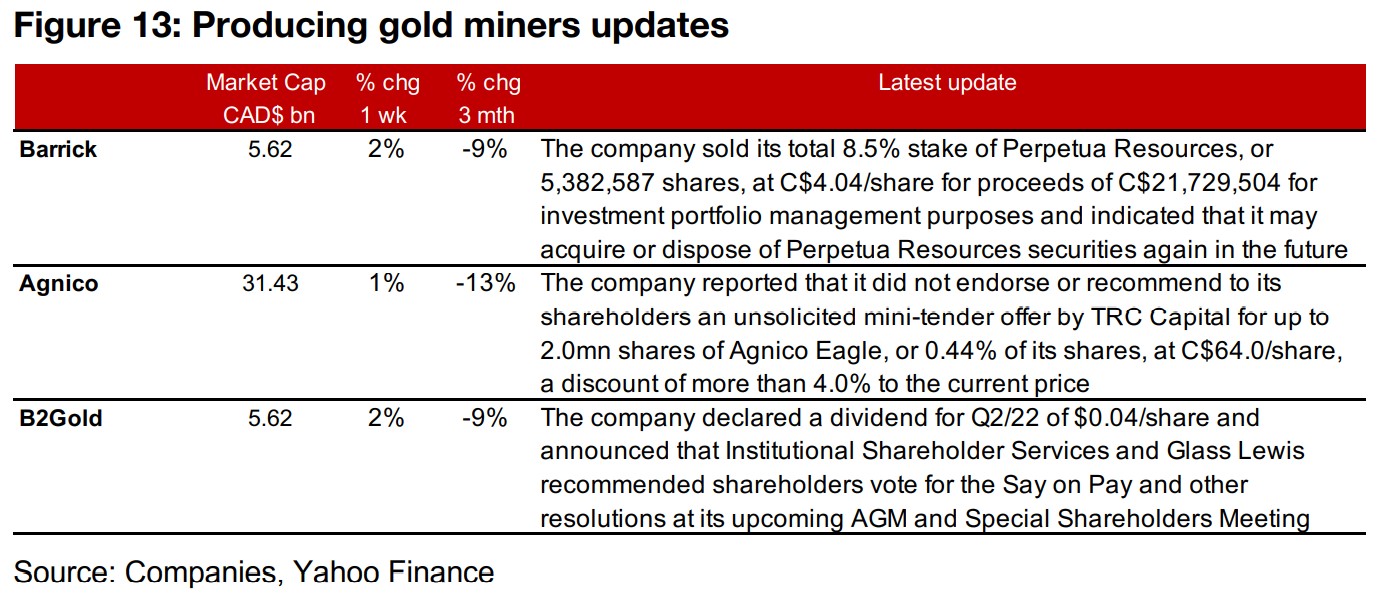

Producing miners mainly gain with gold up

The producing gold miners mostly gained on the rise in the gold price (Figure 11). Barrick sold its 8.5% stake of Perpetua Resources for investment portfolio management purposes, Agnico Eagle reported that it did not endorse or recommend to shareholders a below market mini-tender offer by TRC Capital, and B2Gold declared a $0.04/share dividend for Q2/22 and announced that both ISS and Glass Lewis recommended that investors vote for the Say on Pay and other resolutions at its upcoming AGM and special shareholders meeting (Figure 13).

Canadian juniors mostly down even as gold gains

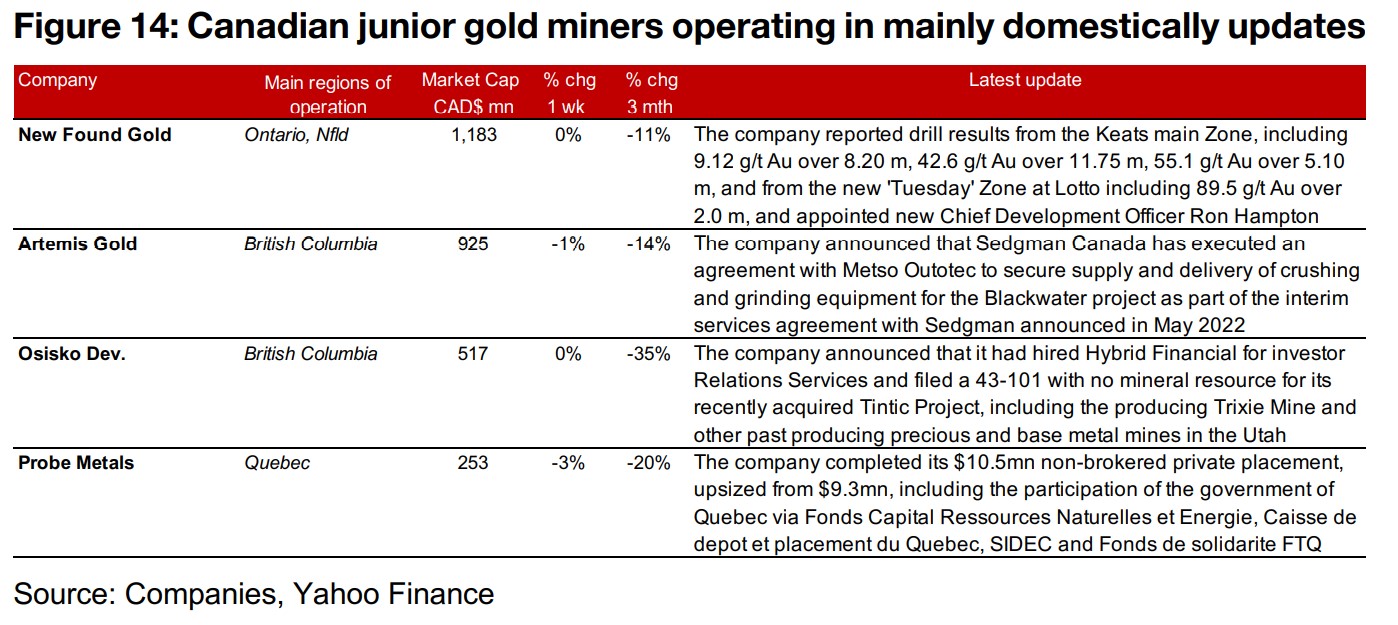

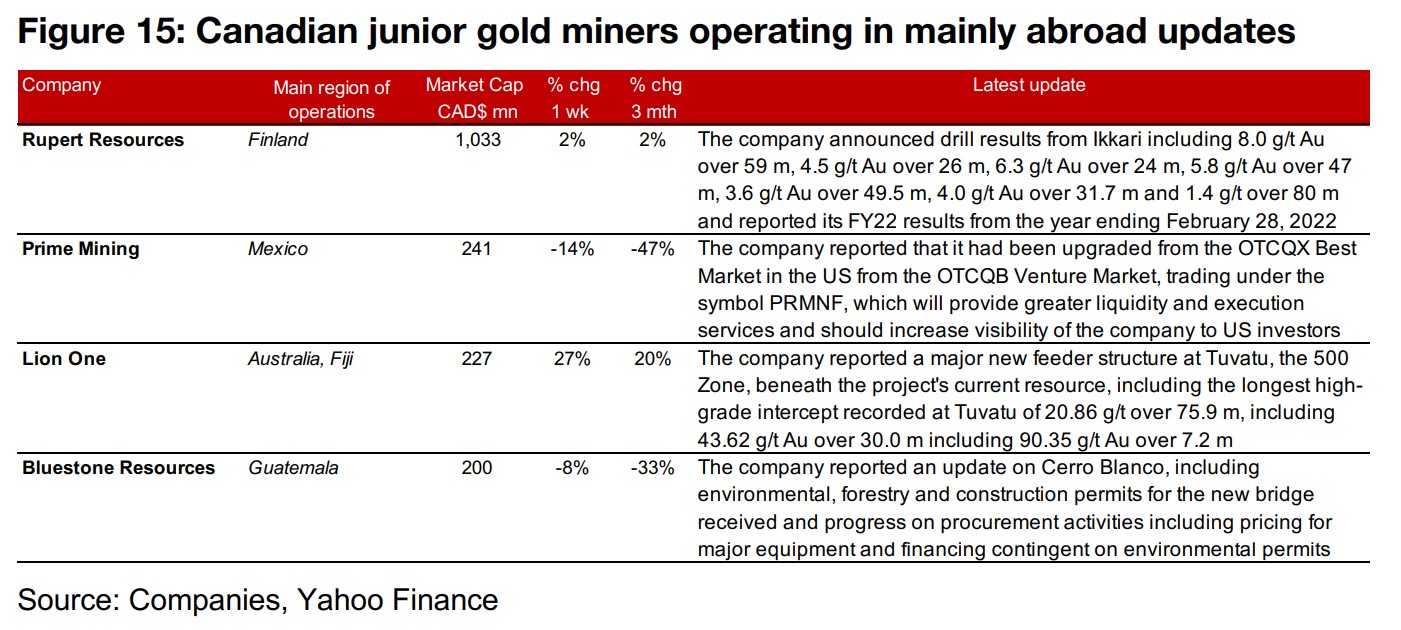

The Canadian juniors were mostly down even as gold gained (Figure 12). For the Canadian juniors operating mainly domestically, New Found Gold reported drill results from the Keats main zone and the Tuesday zone at Lotto, and appointed a new Chief Development Officer, Ron Hampton. Artemis Gold reported an agreement by its supplier Sedgman with Metso Outotec for the delivery of crushing and grinding equipment, Osisko Development hired Hybrid Financial for investor relations services and filed a 43-101 for Tintic, and Probe Metals completed its upsized $10.5mn private placement (Figure 14). For the Canadian juniors operating mainly internationally, Rupert reported drill results from Ikkari, Prime Mining reported that it had been upgraded to trading on the OTCQX in the US, Lion One reported drill results from new feeder structure, the 500 Zone, at Tuvatu and Bluestone provided an operational update on Cerro Blanco (Figure 15).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.