October 9, 2020

A near flat week for gold

Author - Ben McGregor

Gold to silver ratio rising over past month

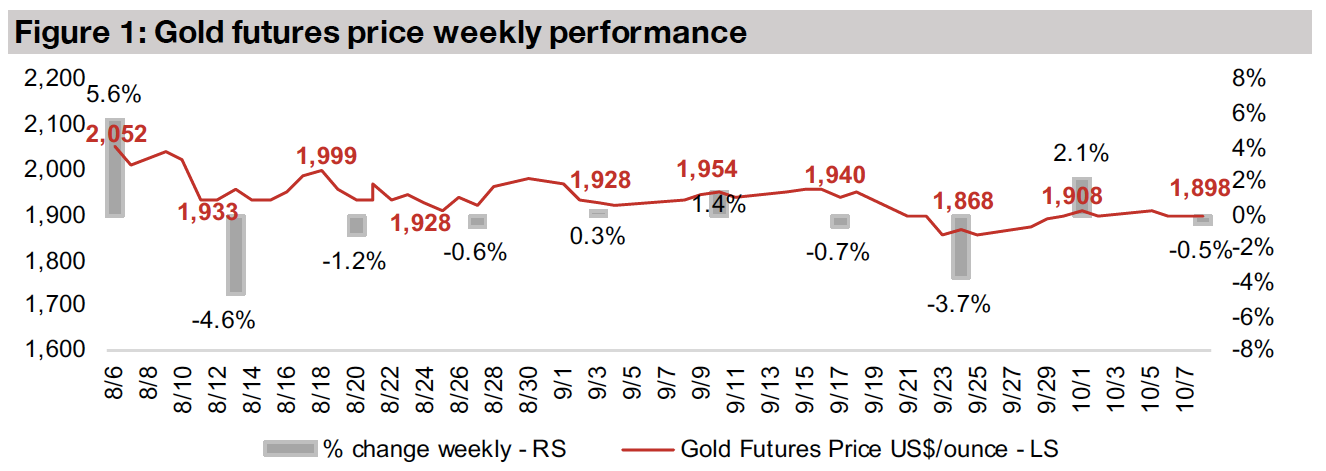

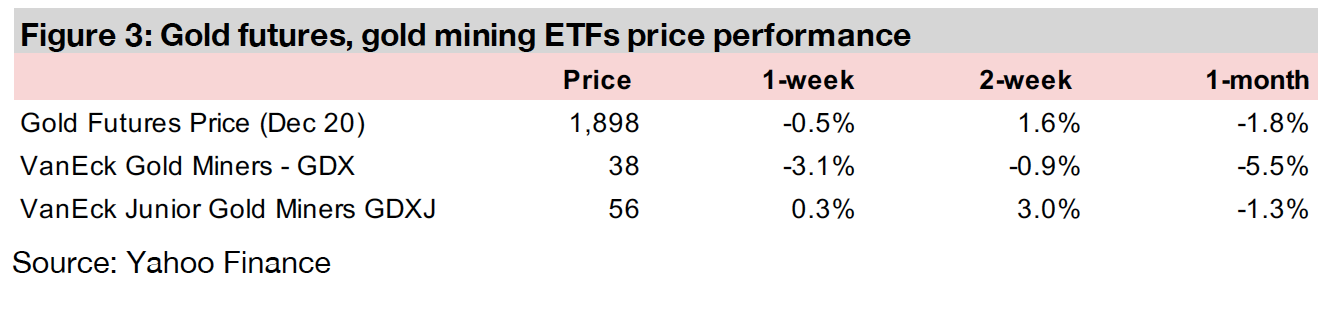

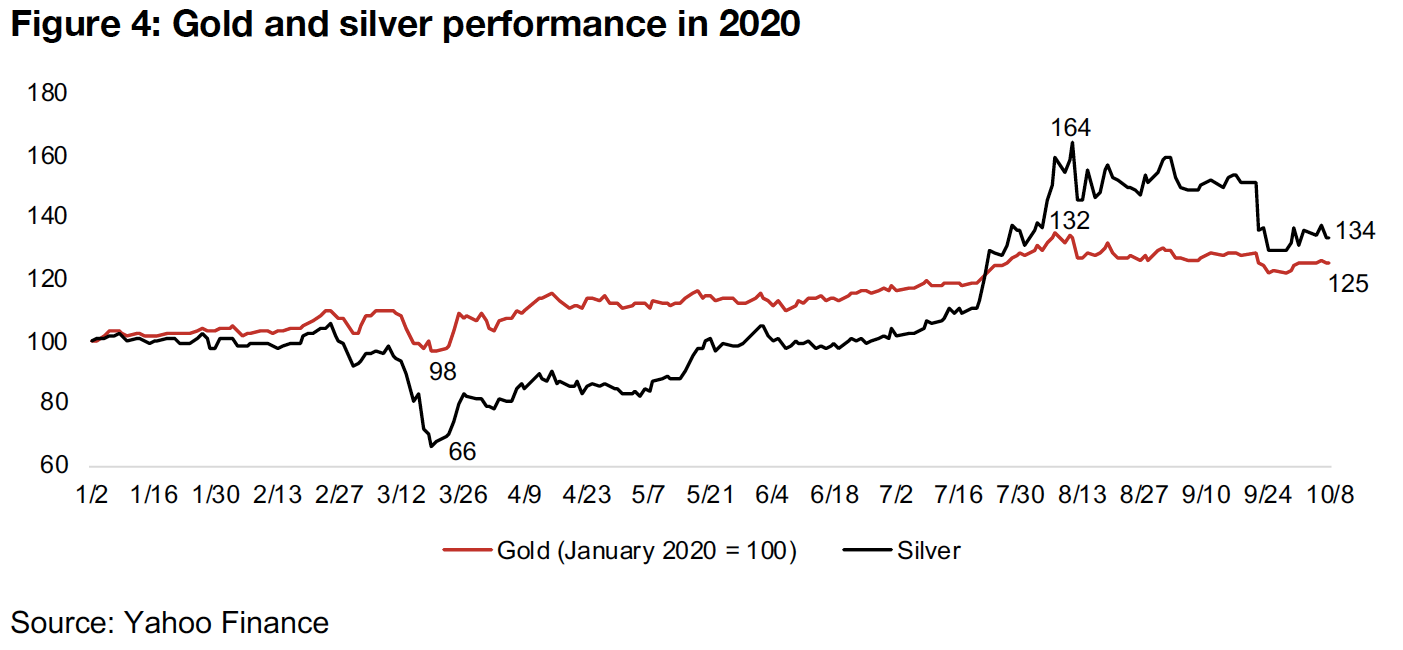

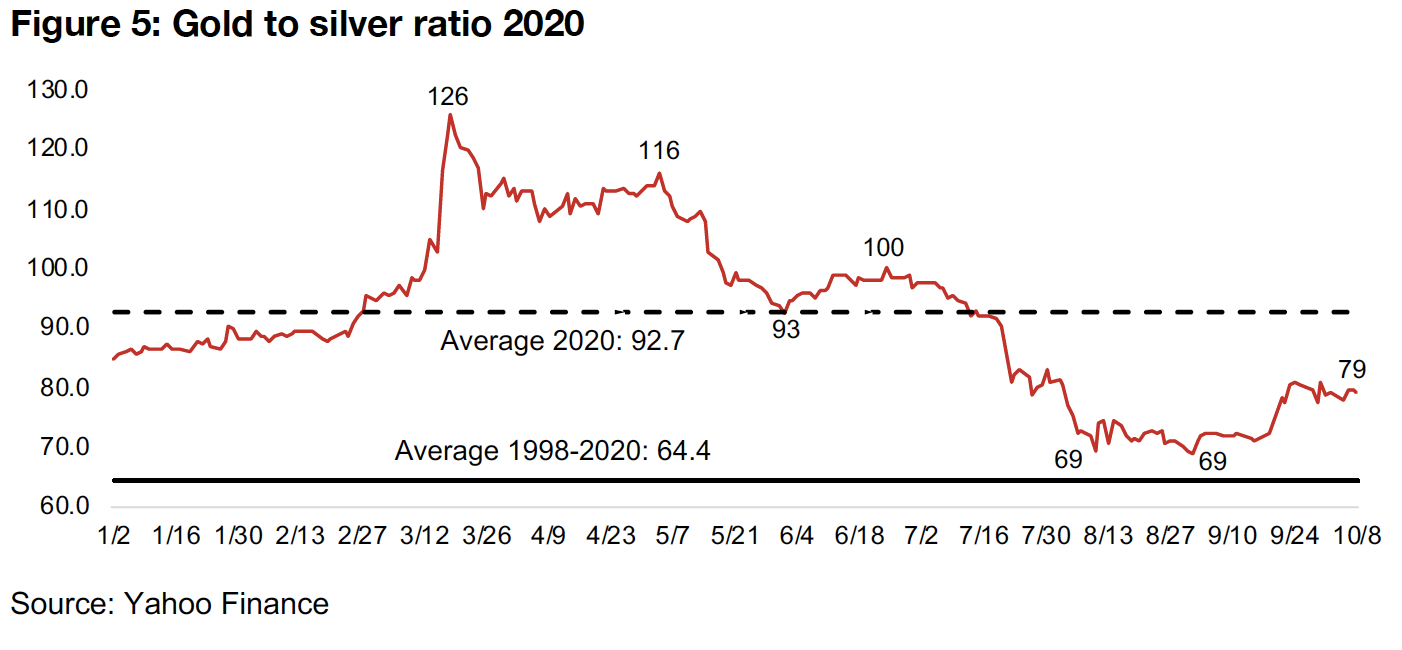

The gold price was relatively flat this week, closing at US$1,898/oz, down -0.5%. The gold to silver ratio has risen 10.1% over the past month, as silver has cooled -10.8% after its strong run, while gold has edged down only -1.8%.

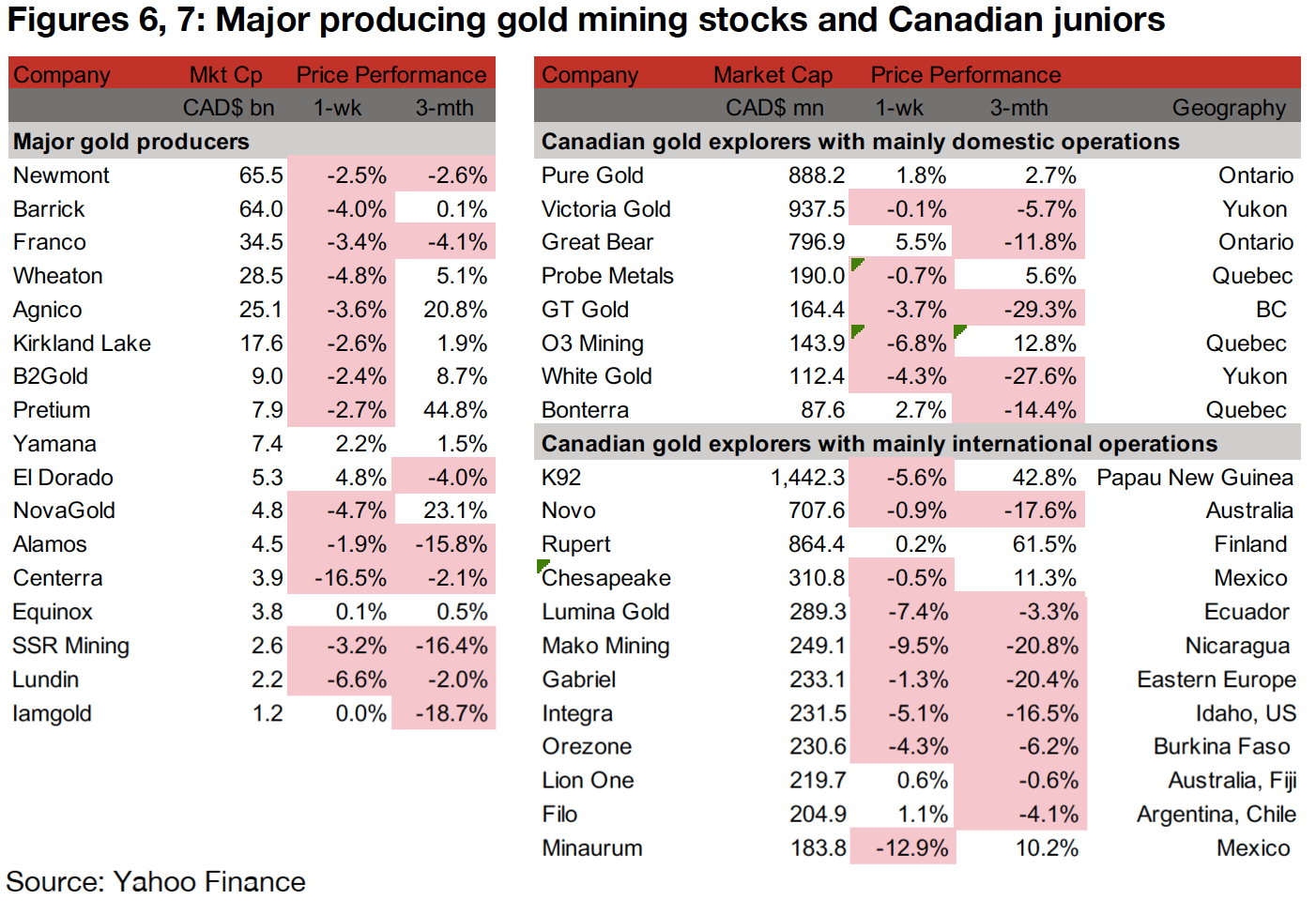

Most producing and Canadian junior gold miners down

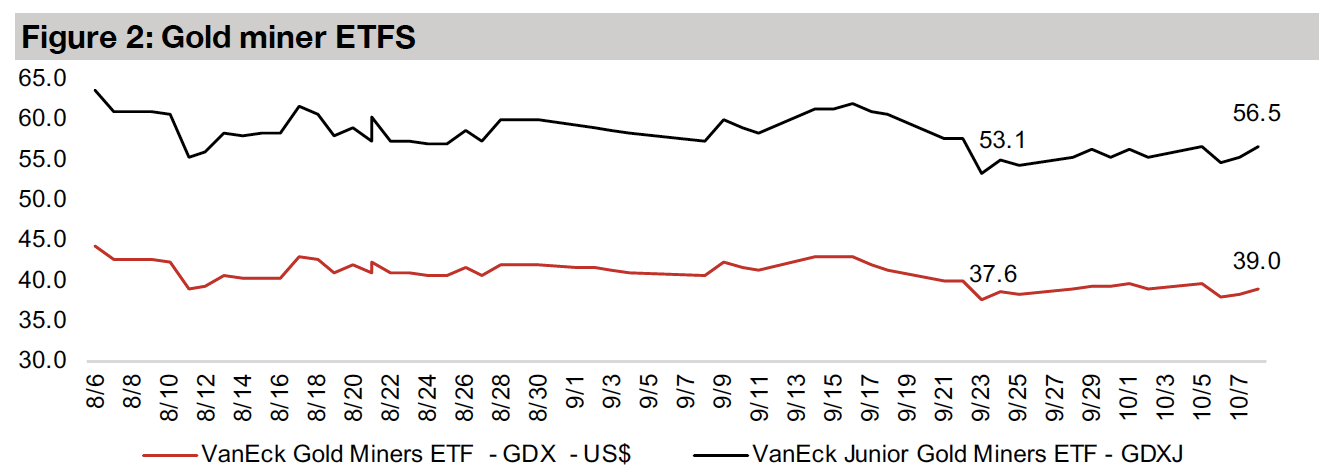

Most of the producing miners declined this week on gold's relatively flat performance, with the GDX down -3.1%, and while global gold juniors eked out gains, as the GDXJ rose 0.3%, most of the larger Canadian junior gold miners were down.

Both Silver One and GR Silver are In Focus this week

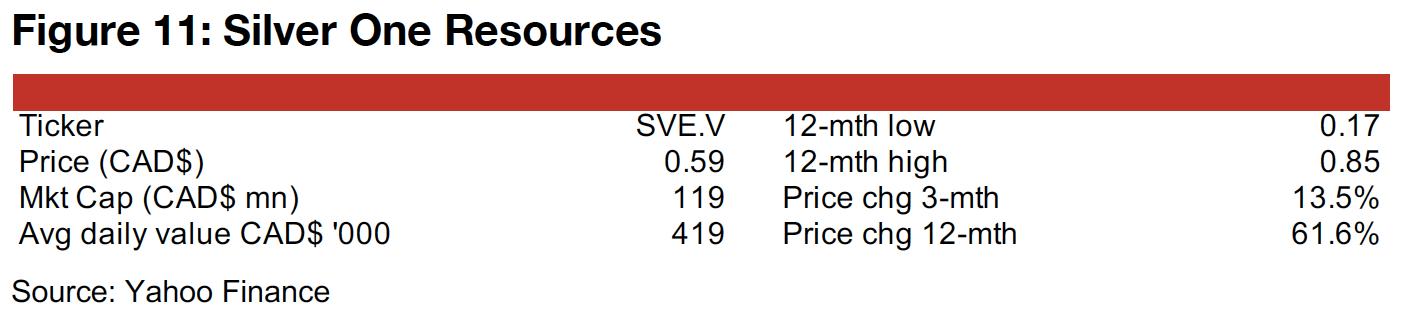

Although silver has cooled over the past month, in light of its strong performance this year, we continue to look at Canadian junior silver stocks this week, with Silver One, operating projects in Nevada, and GR Silver, with projects in Mexico, In Focus.

Gold has near flat week, but gold to silver edges up over past month

The gold futures closed at US$1,898/oz this week, quite a flat week, down -0.5%. However, the gold to silver ratio has been rising over the past month, even with gold relatively stagnant, down -1.8%, as silver has cooled -10.8% after an extremely strong run this year, although it is still up 34% to gold's 25% (Figure 4). The gold to silver ratio surged to 126 during the March crisis, some of its highest levels ever, on a considerable -34% dip in silver, as gold held up well, down just 2% during the worst of the crisis. However, moving out of the crisis, silver recovered, and shot up remarkably beginning in July, bringing the ratio below 100, where it finally reached a trough of 69, and has picked up to 79 as silver has pulled back (Figure 5). While this is below the average of 92.7 ratio YTD, it is still well above the average since 1998 of 64.4, and as we expect gold to remain robust this year, this points to further potential gains for silver if the ratio continues towards the medium-term average.

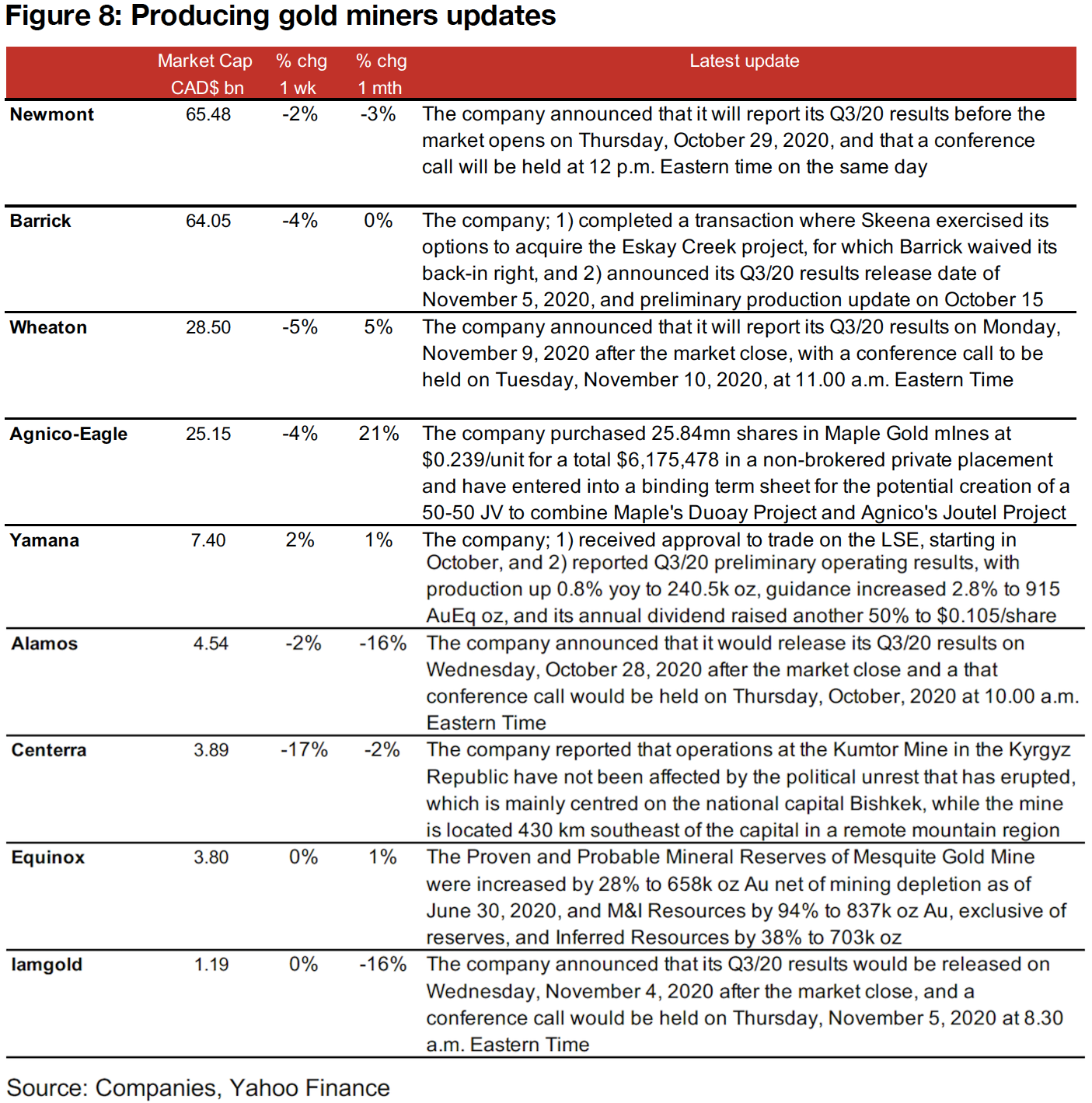

Producing gold miners preparing for Q3/20 results season

The producing miners were mainly down this week, as gold continued to stagnate (Figure 6). News flow was mostly related to announcements of the upcoming Q3/20 results season starting in late October and running into November, with Newmont, Barrick, Wheaton, Alamos and Iamgold all releasing dates for third quarter results. Other news included Barrick's waiver of a back-in right for Eskay Creek, which was acquired by Skeena, and Agnico-Eagle's purchase of shares in Maple Gold mines, and plans for a JV with the company. Centerra reported that its Krygyz Republicbased mine has not been disturbed by political upheaval there, as it is very remote from the capital city, where the issues are centered, and Equinox announced a major upgrade to the reserves and resources at its Mesquite mine, with Proved and Probable up 28%, Measured and Indicated up 94%, and Inferred up 38% (Figure 8).

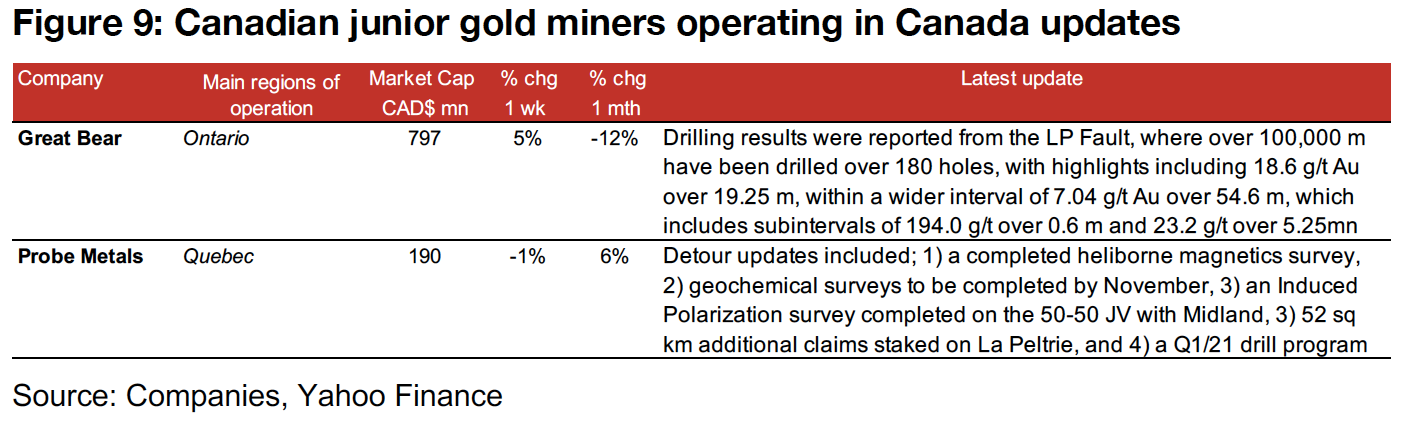

Canadian gold juniors operating domestically mostly decline

The Canadian juniors operating domestically mostly declined this week (Figure 7), with Great Bear standing out for gains of 5.5%, on another set of robust drilling results from the LP Fault at its flagship Dixie Project in Red Lake, Ontario, continuing a series of many strong drilling announcements this year. Probe Metals was near flat, down - 1.0%, after an update on its Detour project, including details on three surveys, additional claims staked, and plans for a Q1/21 drilling program (Figure 9).

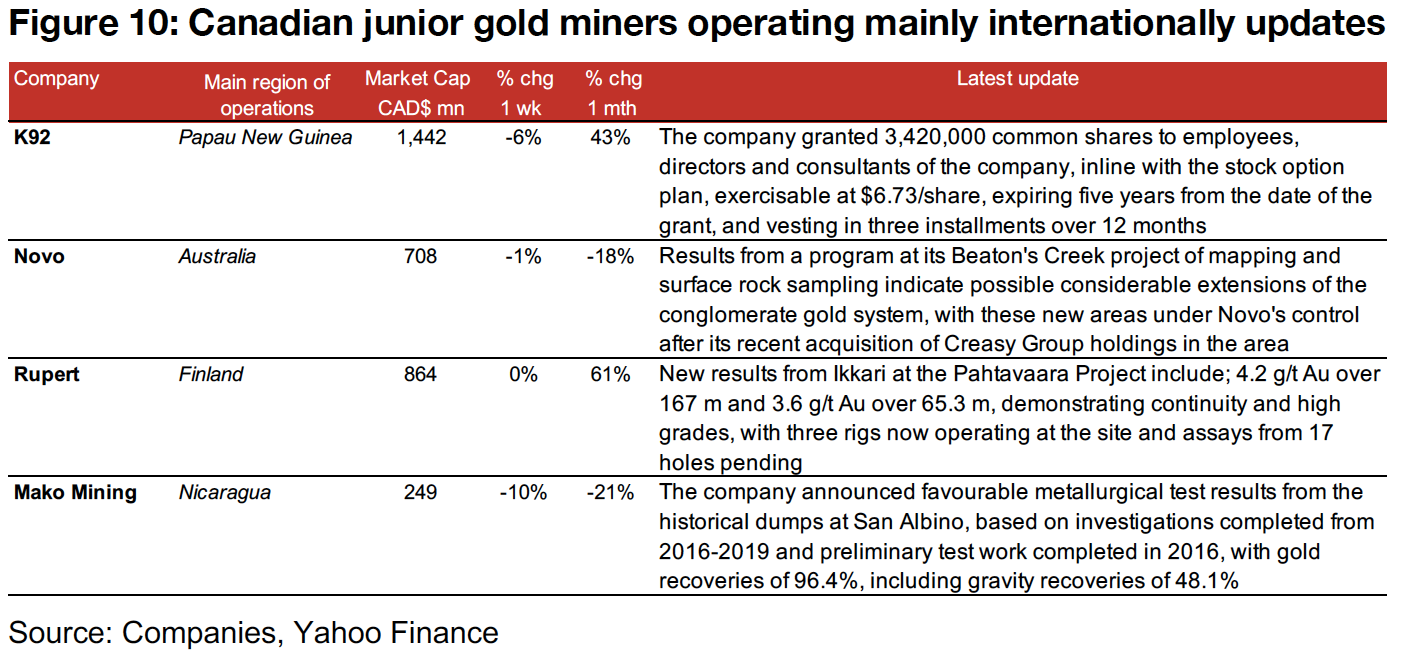

Canadian gold juniors operating internationally mainly fall

The Canadian juniors operating internationally almost all declined this week, with K92 down -6%, on limited material news, only issuing a press release regarding stock options, and Novo ticking down -1% on a mapping and sampling program suggesting the possible extension of a system at Beaton Creek (Figure 7). Rupert was flat on new results from Ikkari, but this is after an impressive 61% gain over just the past month, while Mako was down -10% after it announced metallurgical test results from historical dumps at San Albino, with gold recoveries of 96.4%, including gravity recoveries of 48.1% (Figure 10).

In Focus: Silver One Resources

Silver One projects all in Nevada after selling Mexico assets

Silver One operates three projects, two in Nevada and one in Arizona; 1) Candelaria in Nevada, a past-producing project for which it is has a 100% option, 2) Cherokee in Nevada, where it has a lease/purchase agreement to acquire five claims and 3) Phoenix Silver in Arizona, with a 100% option. The company had also previously held 100% of three projects in Mexico through its subsidiary KCP, but on September 28, 2020, Silver One announced that it had signed a letter of intent with Plymouth Realty, a capital pool company, to sell KCP and focus on its Nevada and Arizona holdings.

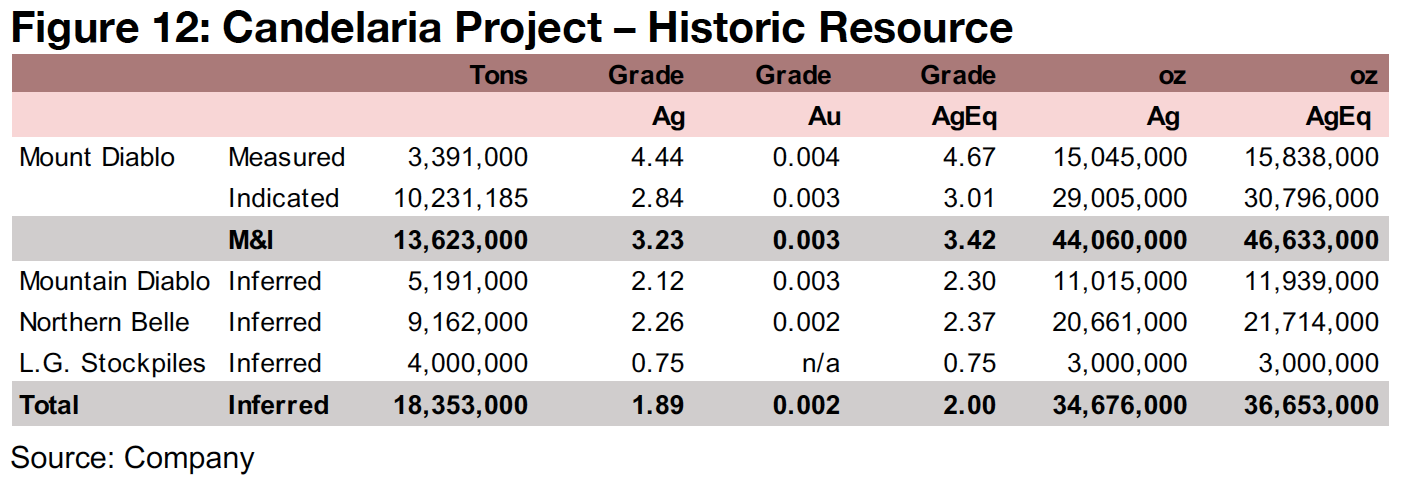

The Candelaria Mine has seen silver exploration and production since the mid-1850s, with output of 68 mn oz Ag with an average 1,250 g/t Ag. A historic resource for the mine is available from 2001, showing 44.0 mn oz Ag in M&I Resources from the Mount Diablo zone of the project, and additional 34.6 mn oz Ag in Inferred Resources, from Mount Diablo, Northern Belle and L.G. Stockpiles, combined (Figure 12). Including the small gold resources, M&I rises to 46.6 mn oz AgEq and Inferred to 36.6 mn oz AgEq. The company acquired a 100% option on Candelaria from SSR Mining in 2016, and this year has; 1) continued drilling, expanding the down-dip mineralization, as reported on May 26, 2020, and 2) has investigated the potential for reprocessing silver from historic leach pads, and released an estimate of 30.0mn oz Ag and 15.4mn oz Ag Inferred and 52.0k oz Au Indicated and 36.7k oz Au Inferred on August 6, 2020.

Sampling and mapping ongoing at Cherokee, Phoenix just acquired this year

Silver One issued a press released identifying targets at its Cherokee project on June 10, 2020, and announced that it began exploration on August 6, 2020, with a 90- day program of sampling and mapping to determine drill targets for a potential program in Q4/20. The company announced the acquisition of its third project, Phoenix, in Arizona, on February 5, 2020, in the Globe region of the state, where recent exploration has been focused mainly on copper, but which also has a history of silver production.

Well-funded for several years after recent financing

In addition to its connection to SSR Mining, which holds 6.7% of the company, it also has other major institutional shareholders, with Eric Sprott holding 10.8%, and First Mining Gold 4.1%, while Directors and Management hold 4.1%. The company remains well funded, having closed $5.2mn in financing in January, 2020, and then an additional $9.5mn in July, 2020. Adding to a total cash and short-term investments as of Q2/20 at CAD$5.5mn, the company had over $15.0mn in financing as of mid- 2020, and with spending of $0.86mn over H1/20, can continue to operate at this level for several years on the current capital available.

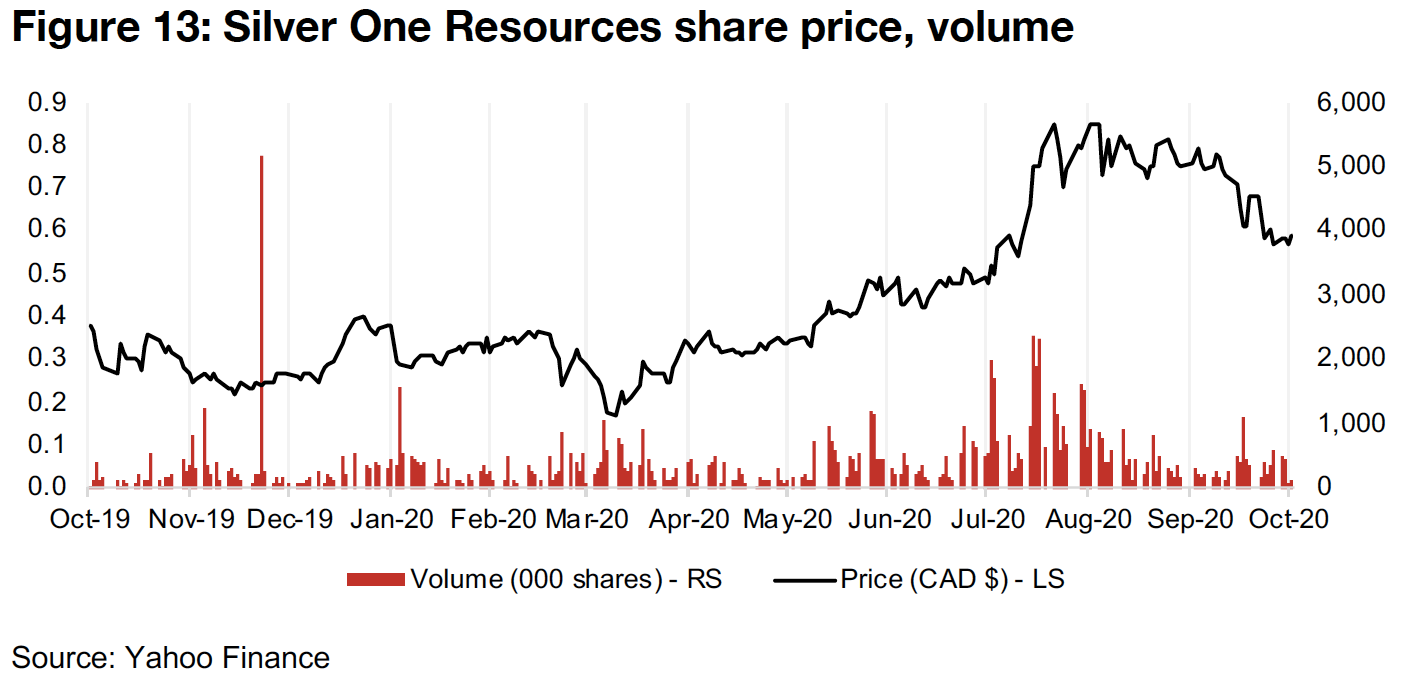

The other key financing news this year was the April 14, 2020 announcement that the company agreed that it would take on a one-time production payment due from SSR Mining to Kinross Gold related to Candelaria, which would allow the company to reduce its share issuance to SSR Mining as part of its Candelaria acquisition agreement. The company also announced on June 30, 2020 that it would begin trading on the U.S. OTCQX. The generally bullish news flow, along with the strong gains in the silver price, have led to a 61.6% 12-month rise in the share price.

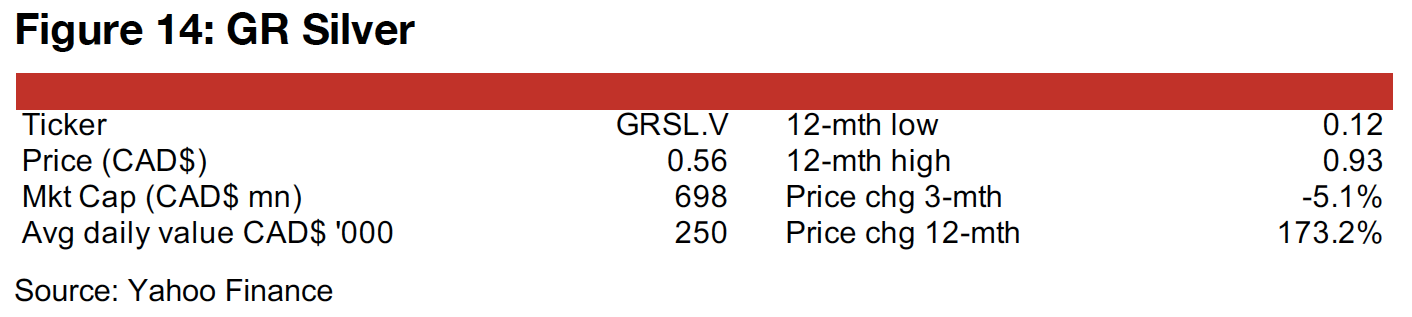

In Focus: GR Silver

Three silver projects in Mexico, with Plomosas the current focus

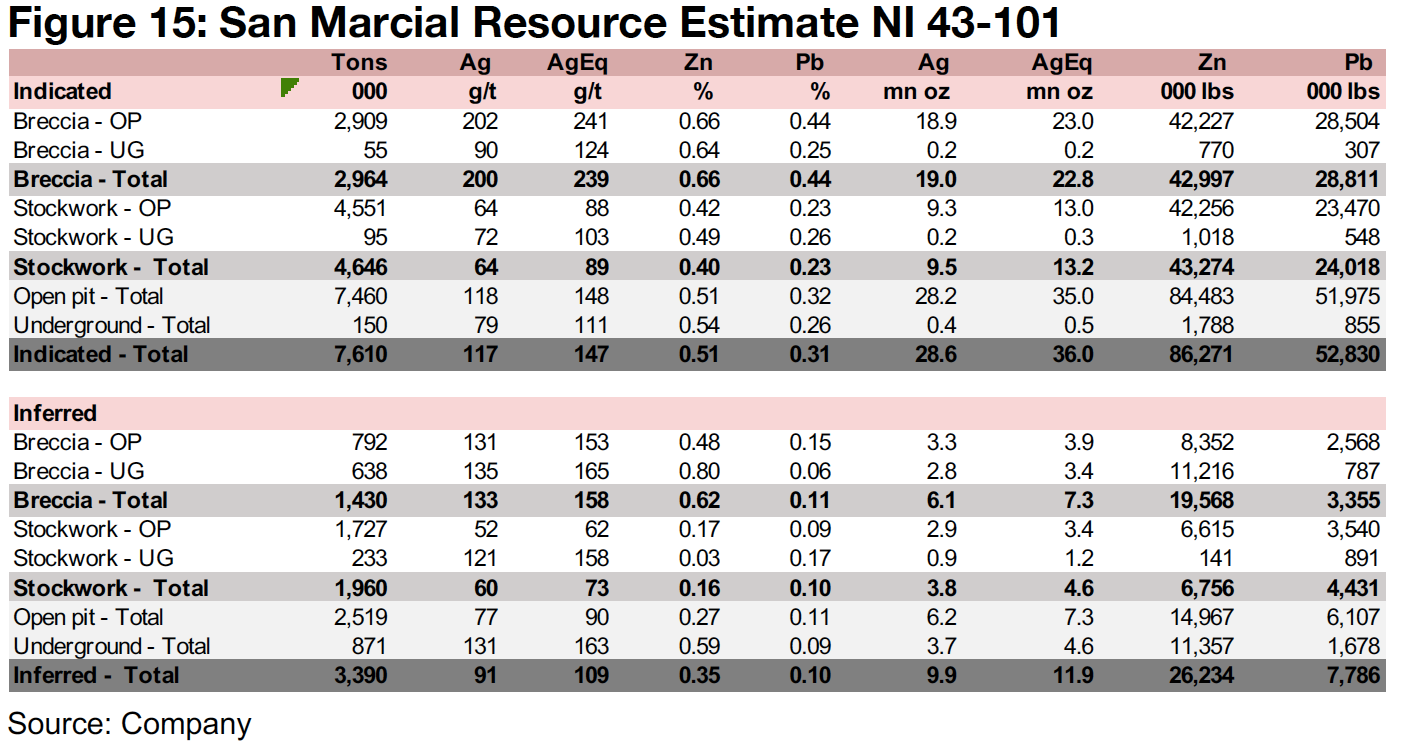

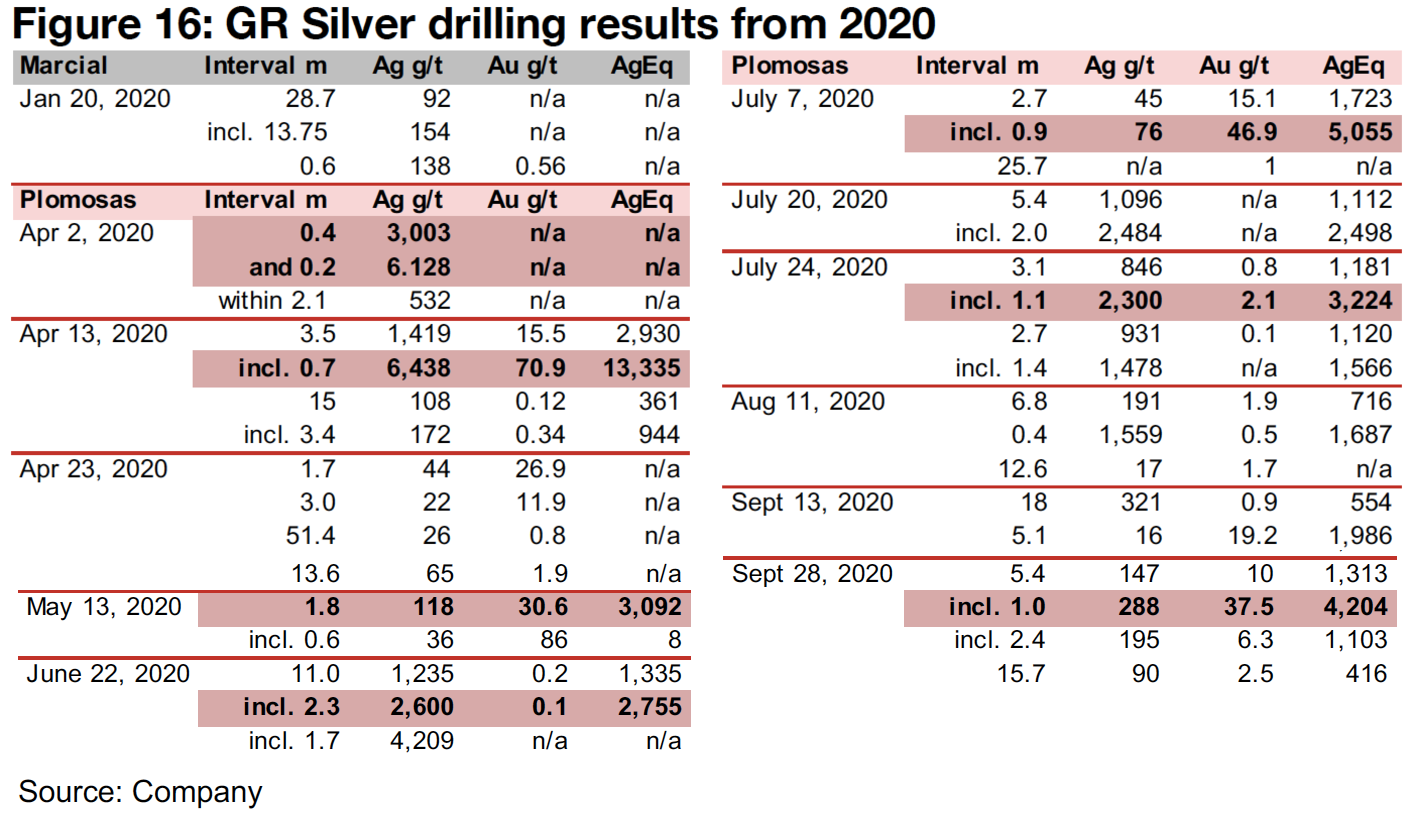

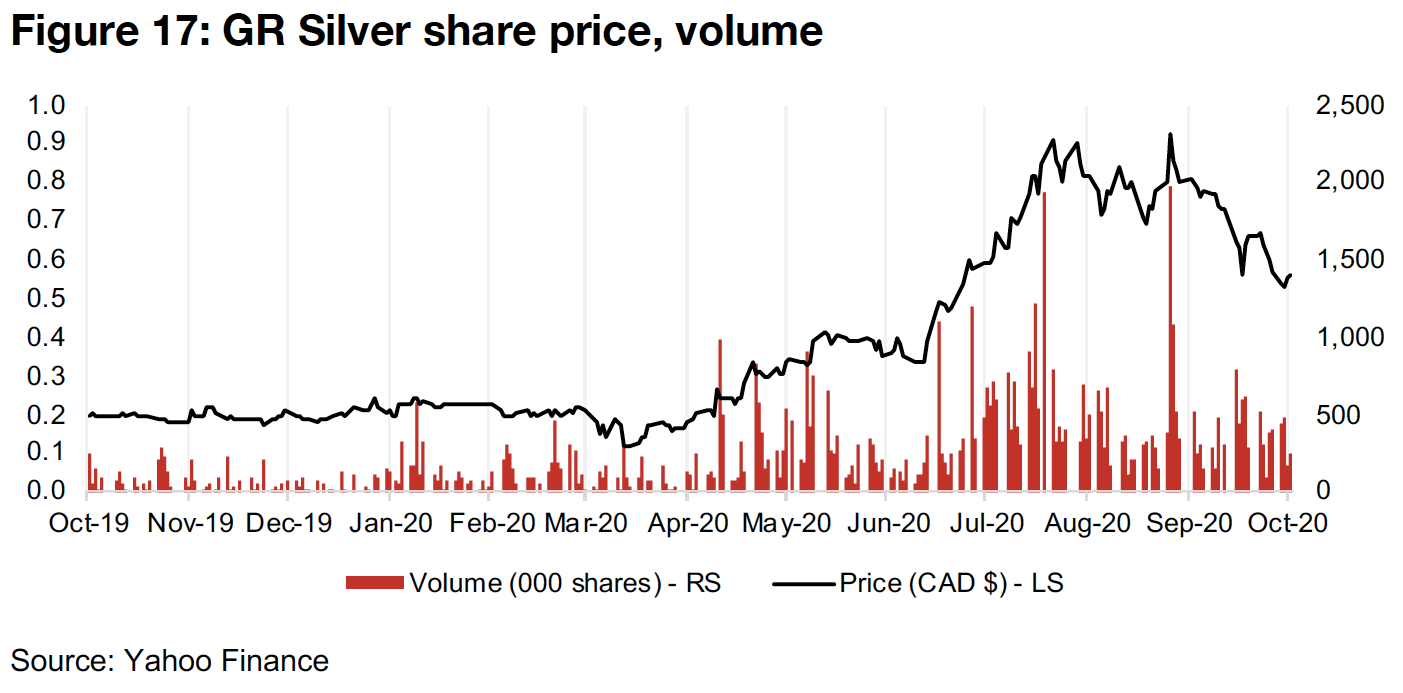

GR Silver operates three projects; 1) San Marcial, which was acquired in 2018, with a Resource Estimate released in 2019, with 36.0mn oz in AgEq (Figure 15), and for which one only exploration-related press release was made this year, in January (Figure 16), and 2) Plomosas, a past-producer acquired from First Majestic in 2020, which has been the main focus of the 2020 drilling program, with press releases this year mainly comprising Plomosas exploration results (Figure 16) and 3) the Rosario Silver-Gold Project, near the historically producing multimillion ounce Rosario mine. The company completed a $9.15mn financing in June 2020, and had $8.45mn in cash as of Q2/20, implying over a year of operations given $2.49mn in H1/20 operating expenses. The company's major shareholders include First Majestic, with 17%, JDS Mining, with 1.7%, and SSR with 1.2%, while Management and Insiders hold 10.2% and resource funds 27.8%. The Plomosas results, combined with the rising silver price, has driven up the share price 173.2% over the past 12-months.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.