Sep 18, 2020

A look at producing silver stocks

Author - Ben McGregor

Gold remains range bound for two months

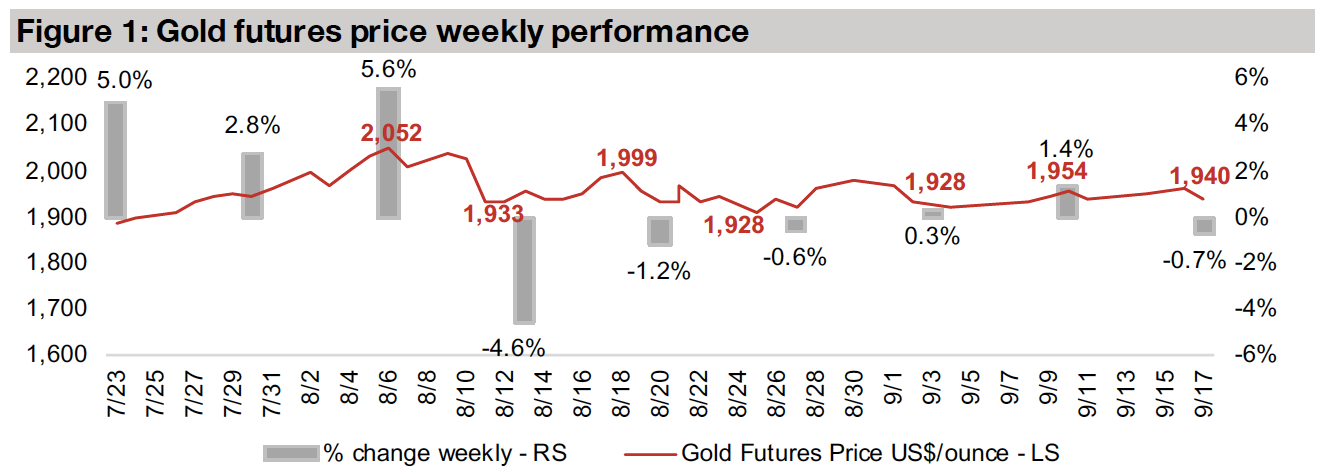

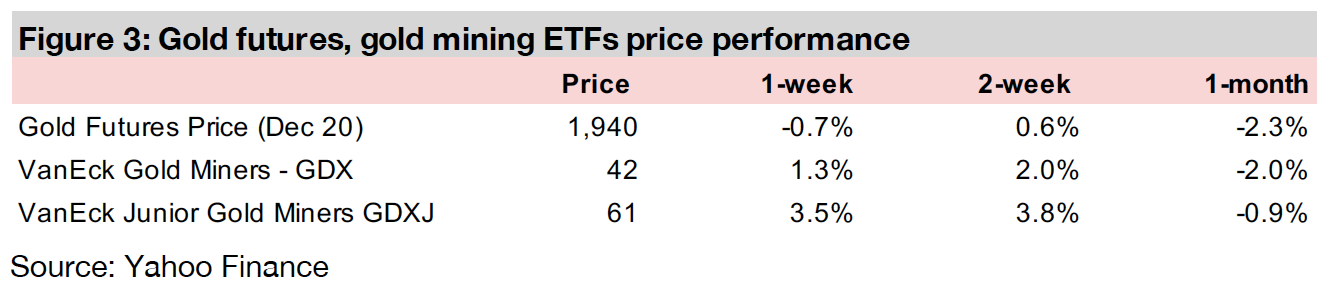

The gold price closed at US$1,940/oz, down -0.7% this week, and has now remained range bound for eight weeks between around US$1,900-US$2,000, which could hold for another month as the market awaits the US election as a major catalyst.

Taking a look at the producing silver stocks

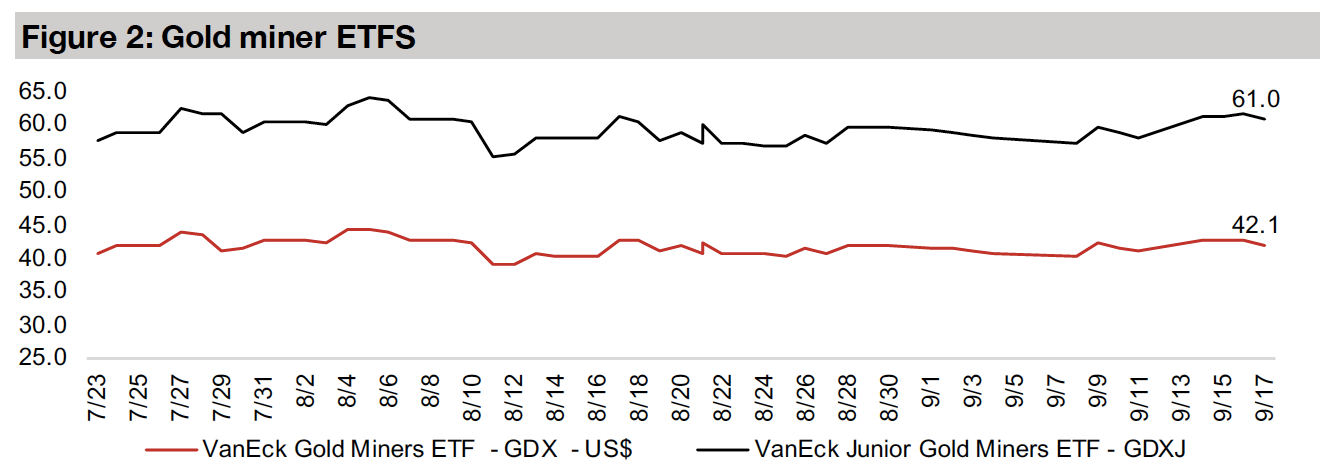

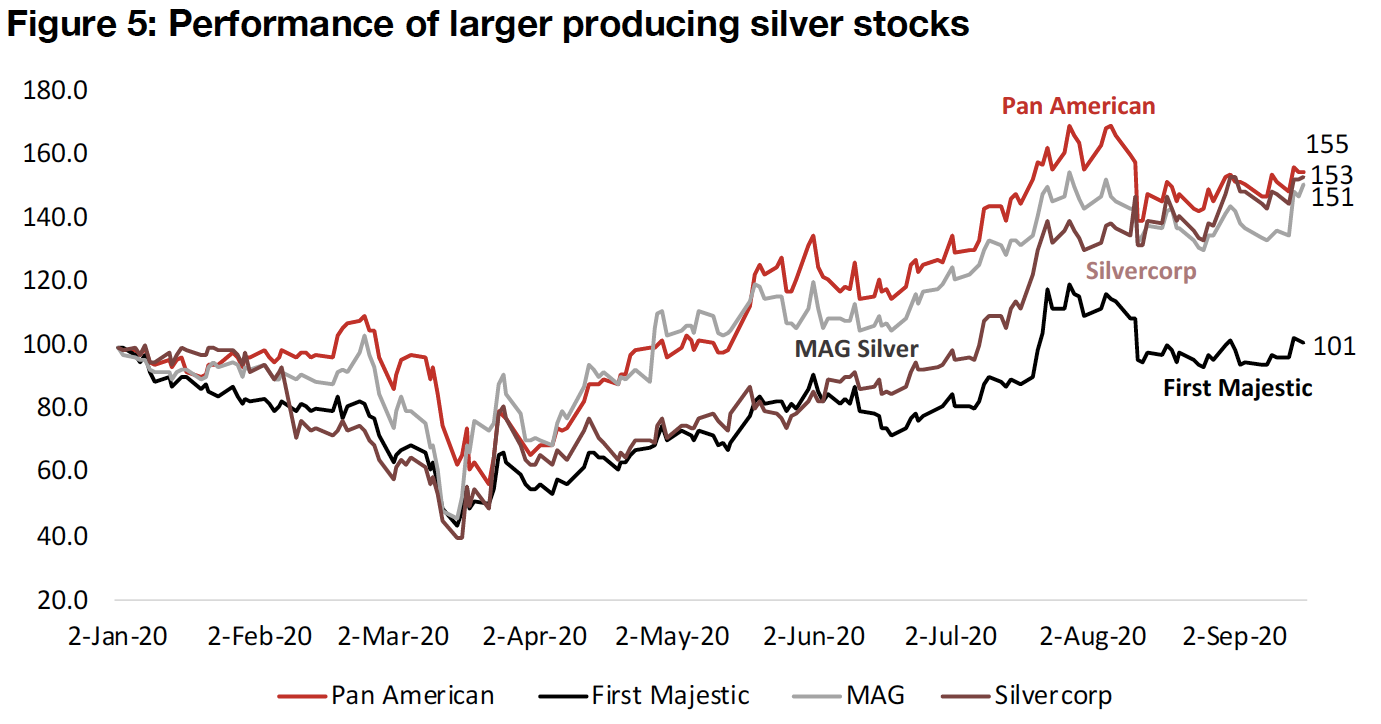

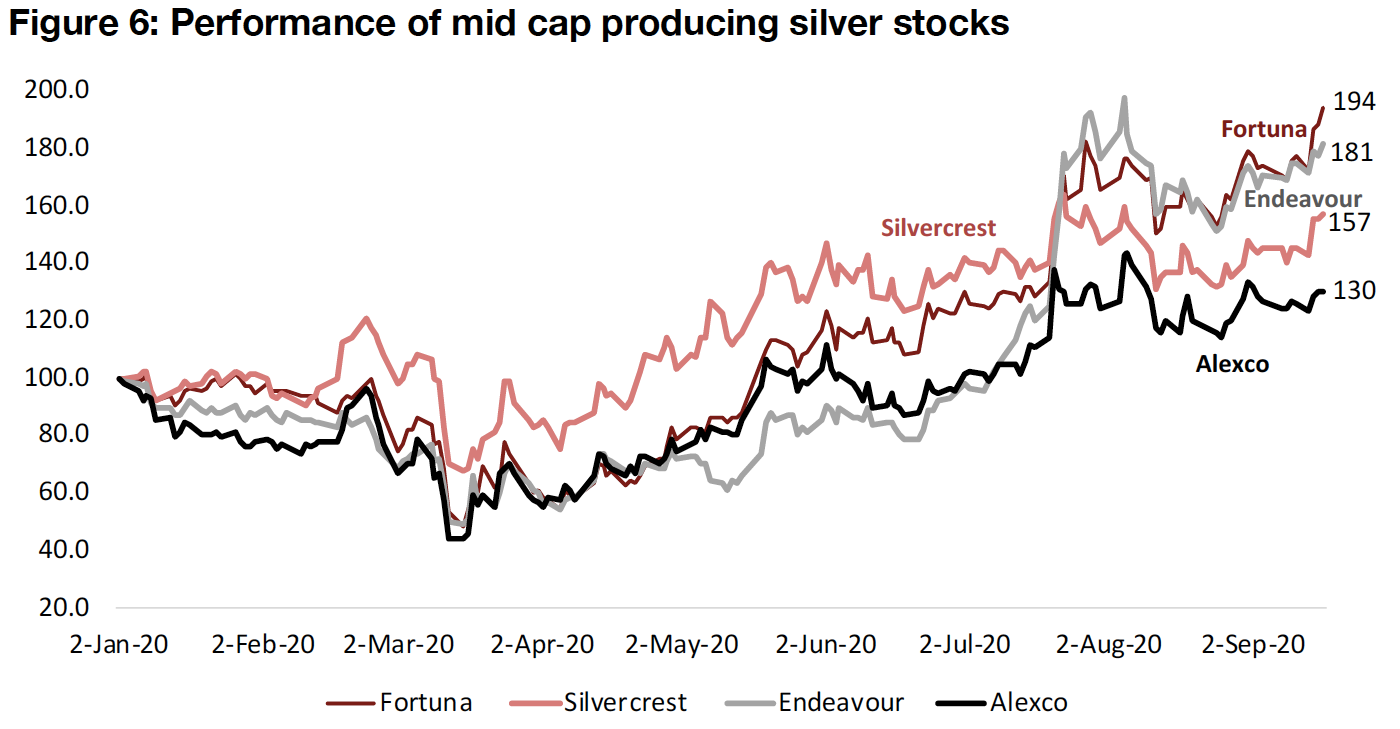

While producing miners were mixed this week, they have also remained range bound for the past two months, along with the gold price. This week we shift our focus to large producing silver miners, which have outperformed gold miners in recent months.

Gold remains range bound, likely awaiting US election catalyst

The gold price closed at US$1,940/oz this week, down -0.7%, remaining within a range of around US$1,900/oz-US$2,000/oz for two months now, as risks remain elevated, but trending neither convincingly up or down. Part of this holding pattern may be the market holding on for the November 2020 U.S. election before making major directional bets on gold. The U.S. election is likely to be a critical catalyst for gold, as there will be extremely different political and economic policy directions depending on which party wins. This is likely to have an immediate and strong effect on the US dollar, and in turn gold, in addition to many secondary effects on US economic growth expectations and global trade. The current trading range could, therefore, hold for an extended period.

Source: Yahoo Finance

Source: Yahoo Finance

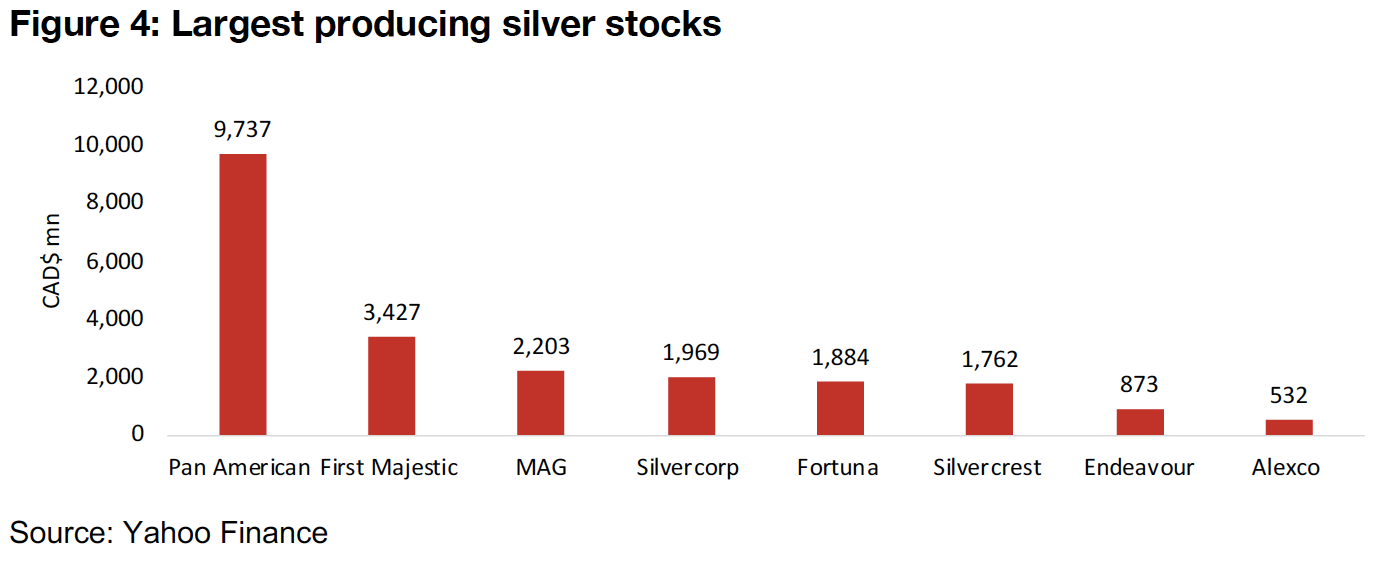

An overview of some of the largest silver stocks

With gold likely to remain on hold for now, and with silver seeing a particularly strong

performance over the past two months, this week we take a look at the major silver

stocks (Figures 4, 5, 6, 7). The silver futures price started to outperform gold for the

year in July 2020, and is now up 50.2%, compared to 27.3% for gold, and the

performance of a leading silver ETF, SIL, is now up 46.1% YTD, and in July it

surpassed the main gold ETF, GDX, which is up 43.4% YTD. The July 2020

performance for silver was its strongest since 1979, with the gold to silver ratio having

gotten particularly high this year, prompting a rotation to silver, which was

increasingly viewed as undervalued.

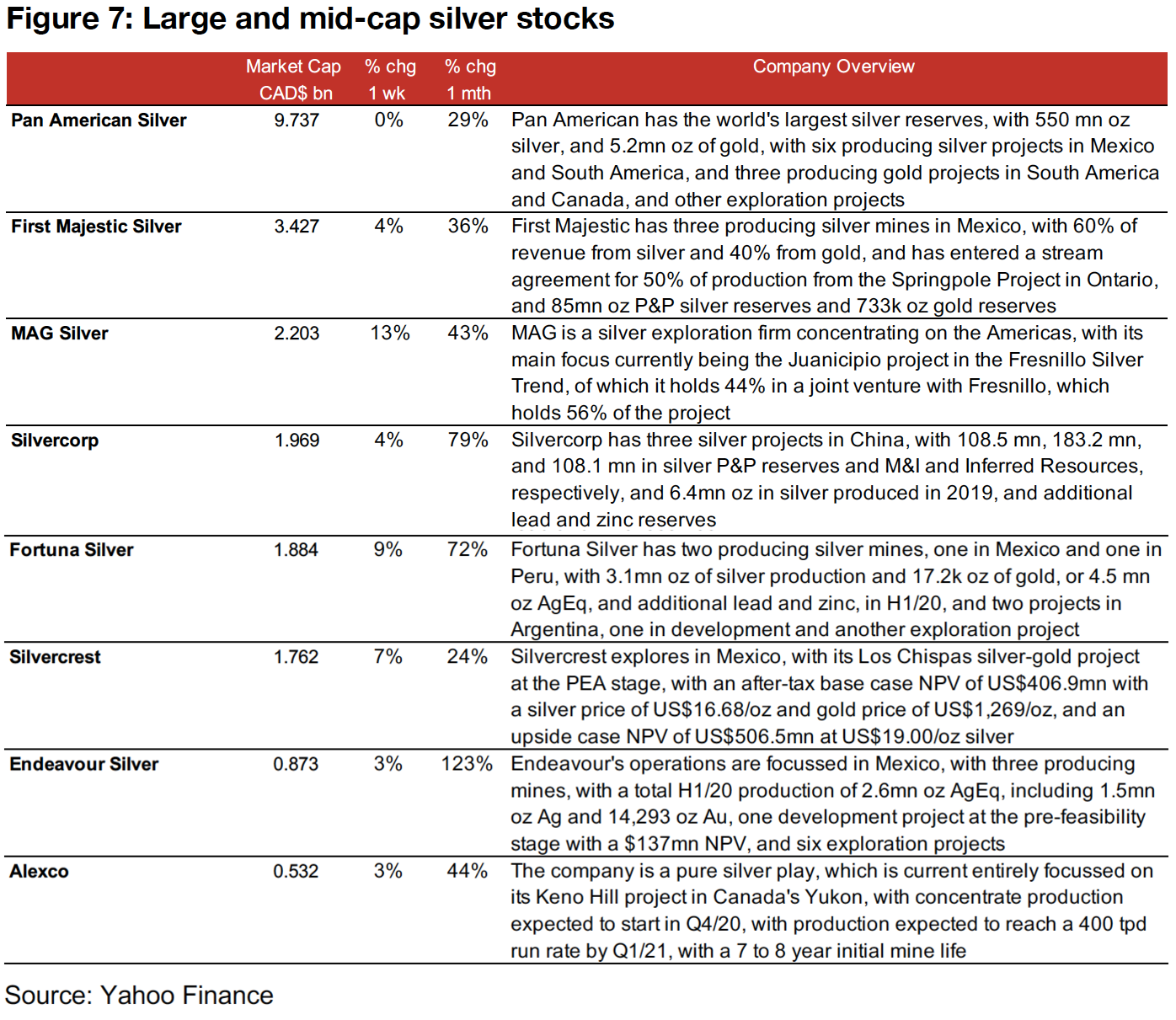

The largest cap silver producer by a wide margin, Pan American, with an $9.7 bn

market cap, is up 55% YTD, with a yoy decline in H1/20 silver production offset by a

rising silver price. The second largest, First Majestic, with a $3.4bn market cap, was

near flat YTD, up just 1%. The other large cap silver producers, MAG Silver and

Silvercorp, with markets caps of $2.20bn and $1.97bn, respectively, have also seen

strong performances, of 51% and 53%. The best performance of the major silver

miners has come from mid-cap Fortuna (with a $1.88bn market cap), up 94% YTD.

Two other mid-caps, Endeavour ($0.87bn) and Silvercrest ($0.53bn), have gained

81%, and 57% this year, and Alexco ($0.53bn), has gained 30.0%.

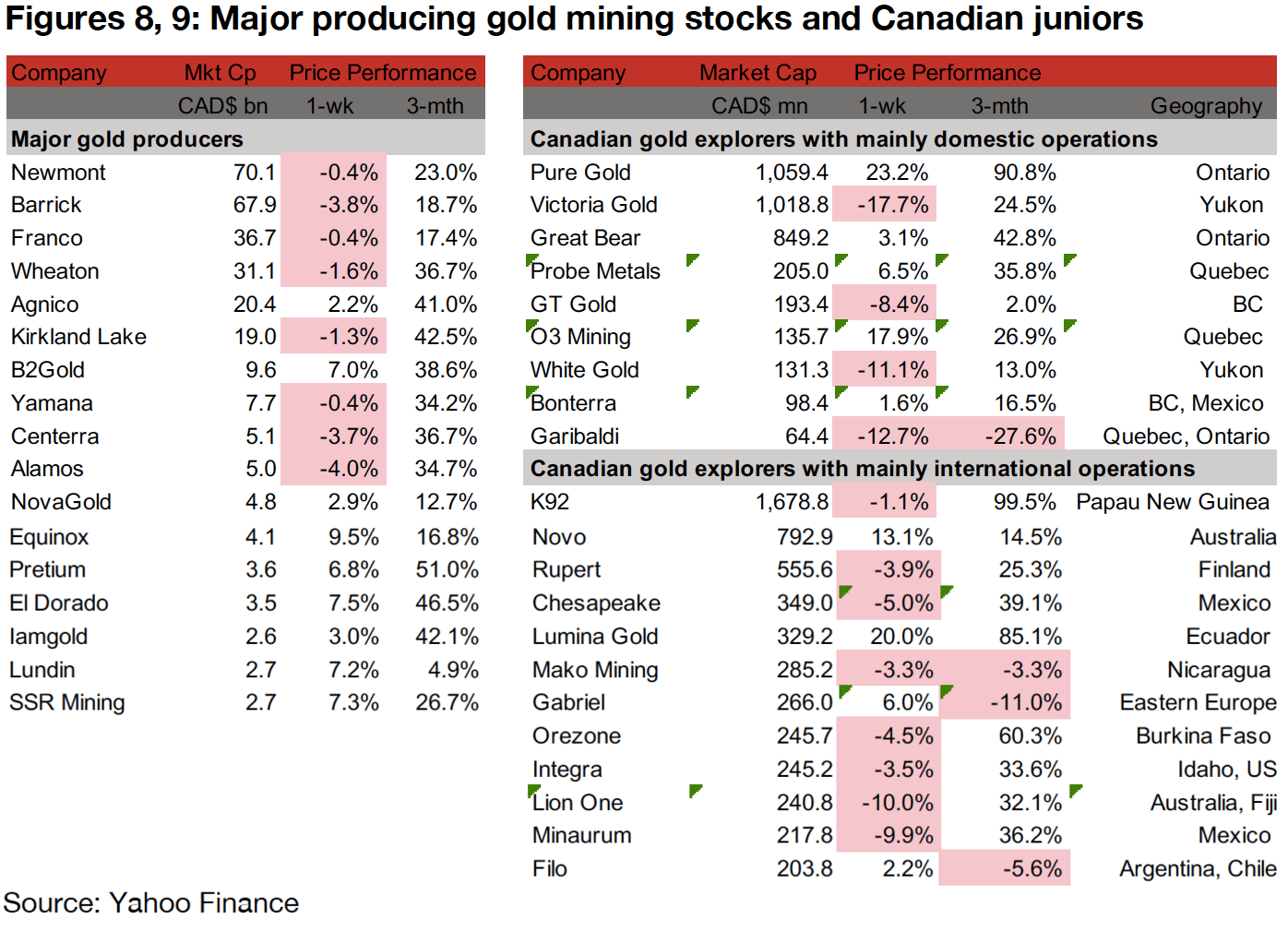

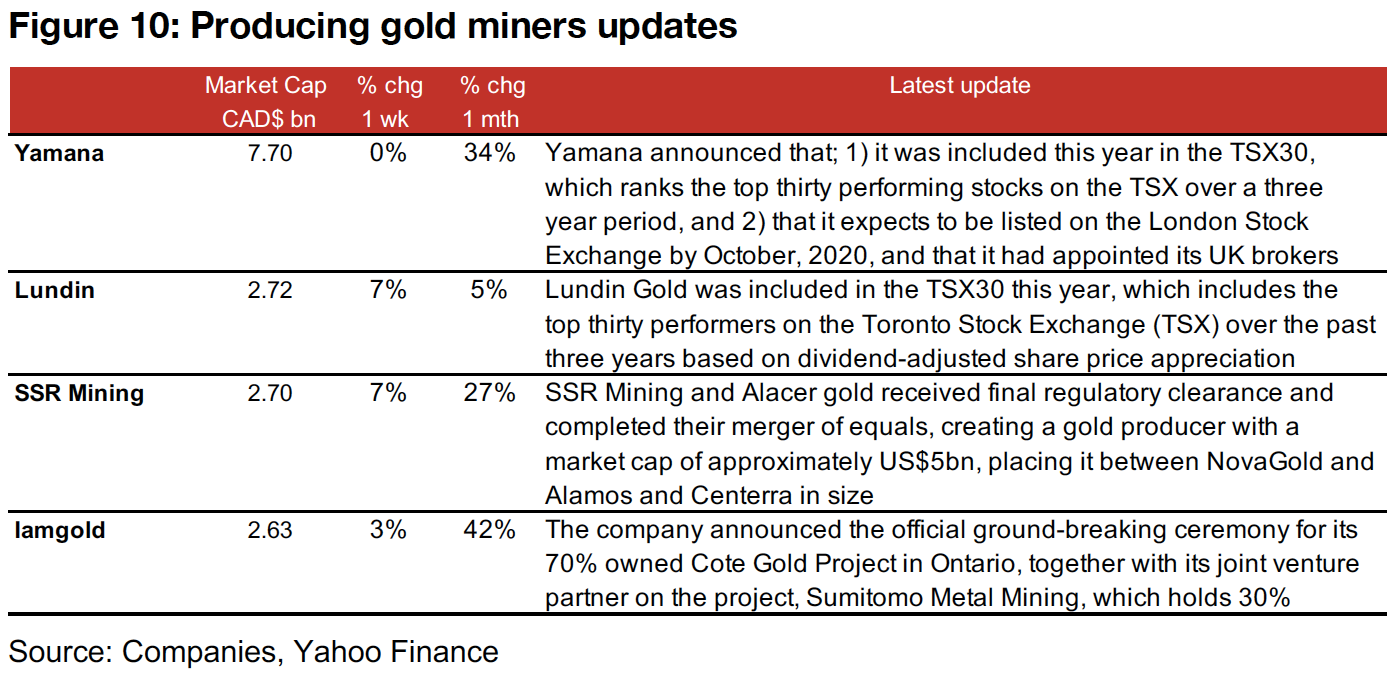

Producing gold miners mixed

The producing miners were mixed this week, as gold continued to lack strong direction (Figure 8). Yamana and Lundin Gold announced that they had been included in the TSX30, the top thirty performers on the TSX based on three-year dividendadjusted price appreciation (Figure 10). The most material announcement was the completion of SSR Mining and Alacer Gold's merger of equals, creating a CAD$5bn market cap firm, and Iamgold announced that it broke ground on its Cote Gold project.

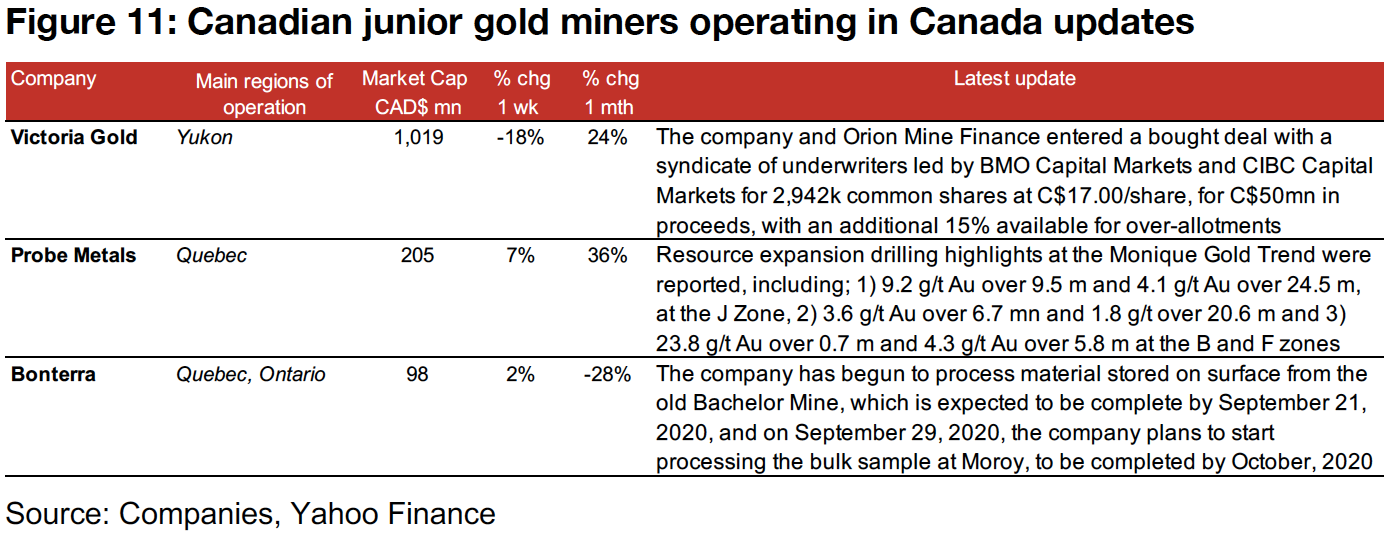

Canadian gold juniors operating domestically mixed

The Canadian juniors operating internationally were mixed this week (Figure 9). Victoria Gold announced a $50mn bought financing deal with Orion Mine Finance, led by BMO capital markets and CIBC capital markets, Probe Metals announced resource expansion drilling highlights from the Monique Trend and Bonterra has begun processing old mine material and expects to begin processing material from the new Moroy bulk sample starting near the end of September (Figure 11).

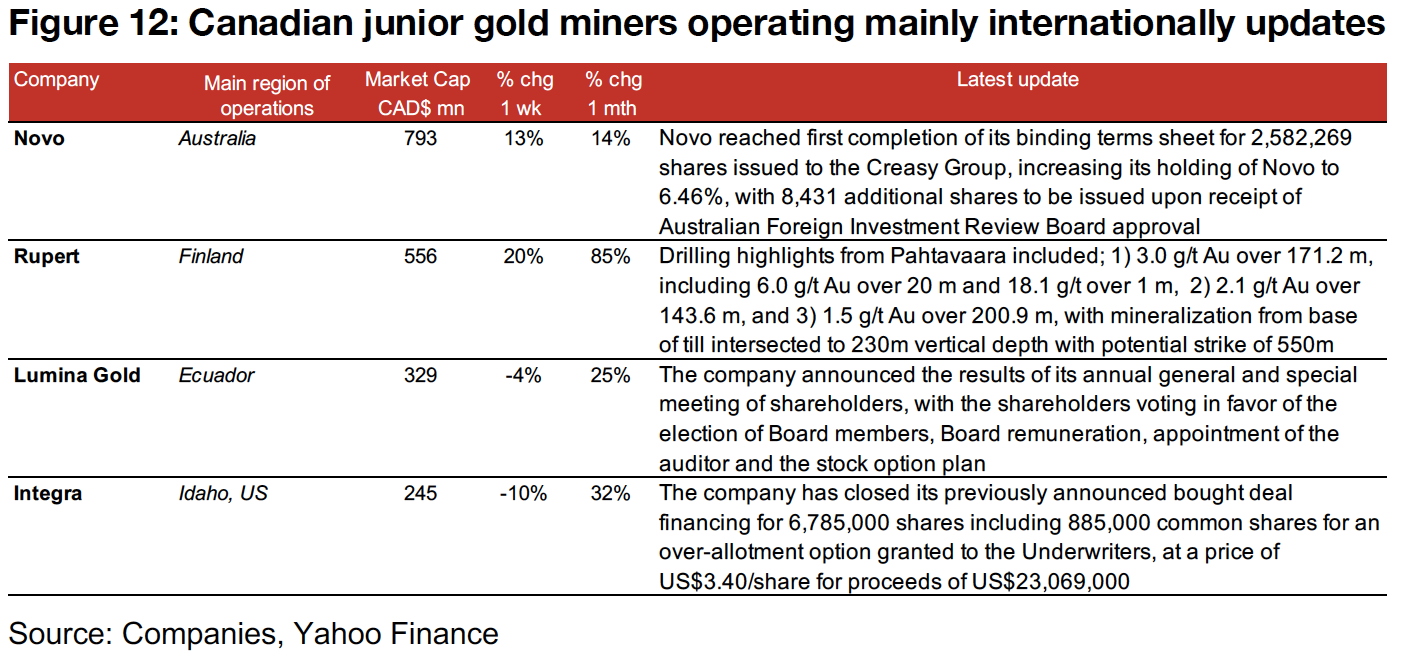

Canadian gold juniors operating internationally mostly down

The Canadian juniors operating internationally mostly declined this week (Figure 9). However, Novo was up 13% on the completion of a binding terms sheet for shares issued to the Creasy Group, and Rupert Resources jumped 20% on the release of drilling results from Pahtavaara (Figure 12). Lumina dipped -4%, although it announced only the successful results of its annual shareholders meeting and Integra was down -10% even as it announced the closing of a previously announced US$23mn bought deal financing.

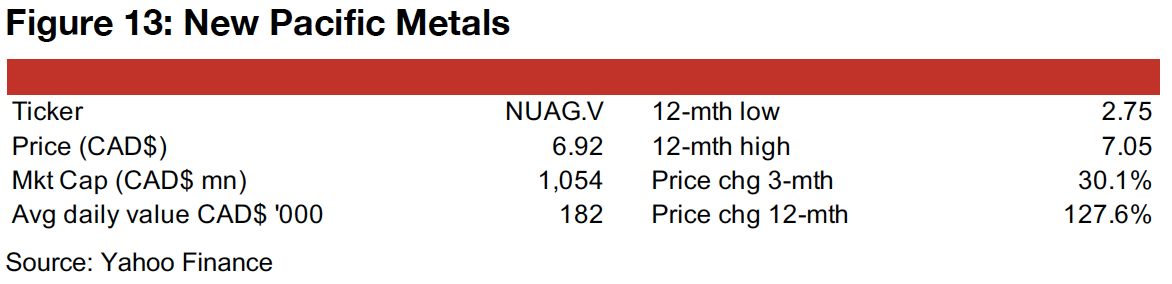

In Focus: New Pacific Metals

Focused on Bolivia, lowly ranked by Fraser, but improving

New Pacific Metals focusses on silver exploration in Bolivia, with two core projects, Silver Strike and Silver Sand. While Bolivia has historically been a relatively weak district, ranking near the bottom of the Fraser Institute's Investment Attractiveness Index for global mining districts, it has seen improvement, from a recent low of 33.68 (coming in 83 out of 104) in the survey in 2017, to 49.53 in 2018 (86/91) and 62.36 (74/83). This has partly been driven by new mining laws issued in 2014 and 2016 which were aimed at increasing foreign investment.

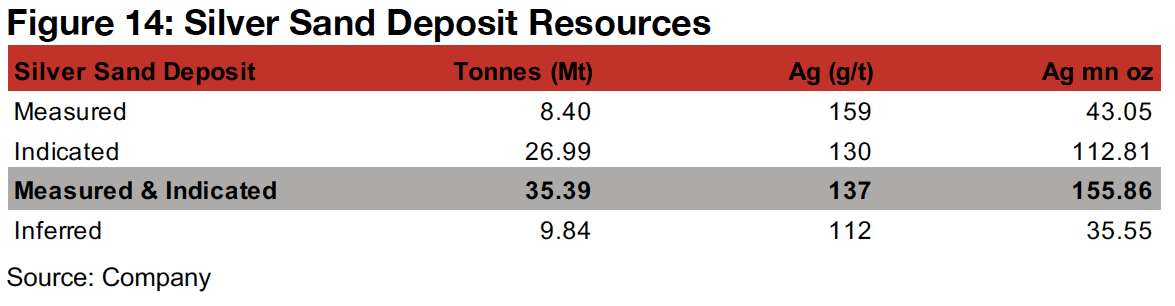

The company's most advanced project is Silver Sand, which it acquired in 2017, with decent exploration results reported over the following two years. In early 2019 the company signed a mining production contract with COMIBOL, the state mining company, which will potentially expand the project's geography following government approval, and continued definition drilling. The company released its inaugural Resource estimate for Silver Sand in April 2020, with 43.05mn oz silver, 112.82 mn oz Ag Indicated Resources, and 35.55 oz Ag Inferred Resources (Figure 14). New Pacific reports that the Resource has large-near-surface mineralization which could allow for open-pit extraction, with around 70% of the Resources within 200 m of the conceptual pit surface, and high Ag laboratory-based recoveries ranging from 87%-97% for the various oxide-transition and suphide mineral domains. The project also remains open to the north and the south, with the system untested at depth, and the company is continuing resource expansion drilling.

The company's other main project is Silverstrike, which is in the historic producing

Berenguela Mining District, but for which there has been limited prior exploration.

Mineralization for Silverstrike starts at near-surface which suggests potential for an

open-pit mine. It was announced in July 2020 that New Pacific's third project, the

100%-owned Tagish Lake Gold Project in Yukon, Canada, was spun out to a new

subsidiary, Whitehorse Hold Corp, with the plan to list on the TSXV. This is to allow

the company to monetize the project and take advantage of the high gold price, and

allow New Pacific to concentrate on its core projects in Bolivia.

In Q3/20 the company began its PEA for Silver Sand, and restarted drilling, and

continued Silverstrike target generation. For Q4/20, the company targets Silver Sand

project exploration updates, and an initial Silverstrike drill test, while the PEA

continues. By Q1/21 the company expects to release Silverstrike assay results and

undertake environment and community studies, and by H1/21, release a PEA.

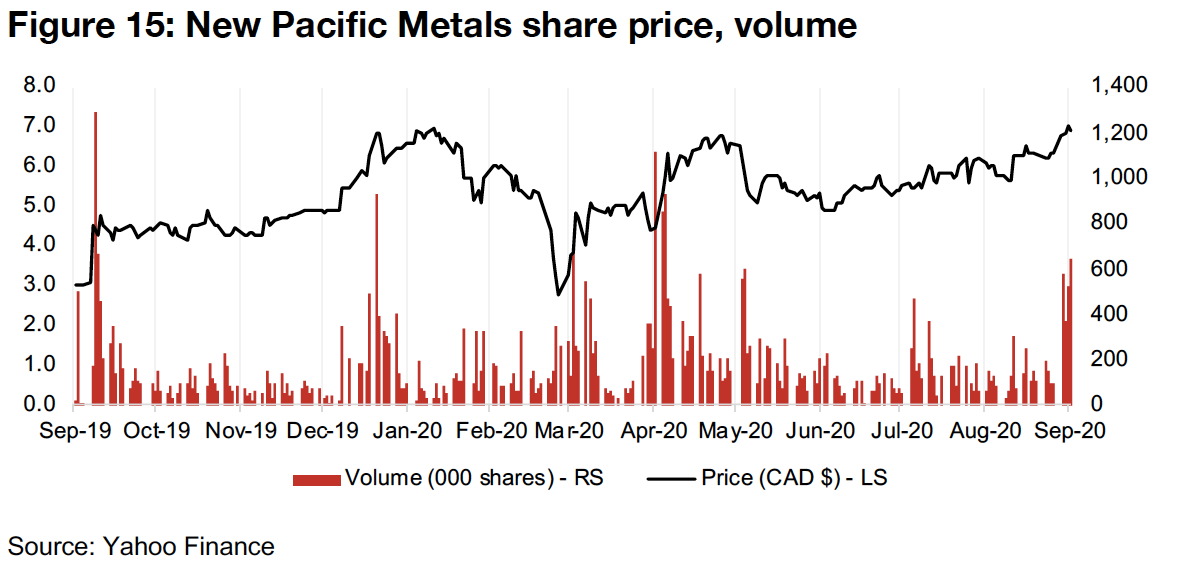

The company has industry backing from larger silver producers, with Silvercorp

Metals holding 28.8% and Pan American Silver 9.7%. The share price had seen

substantial gains over the past year, up 127.6%, and this week had briefly touched

CAD$7.05/share, surpassing the CAD$6.95/share highs set in January 2020,

although it pulled backed to close at CAD$6.92/share.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.