February 25, 2022

A Geopolitics Premium for Gold

Russian invasion of Ukraine boosts gold

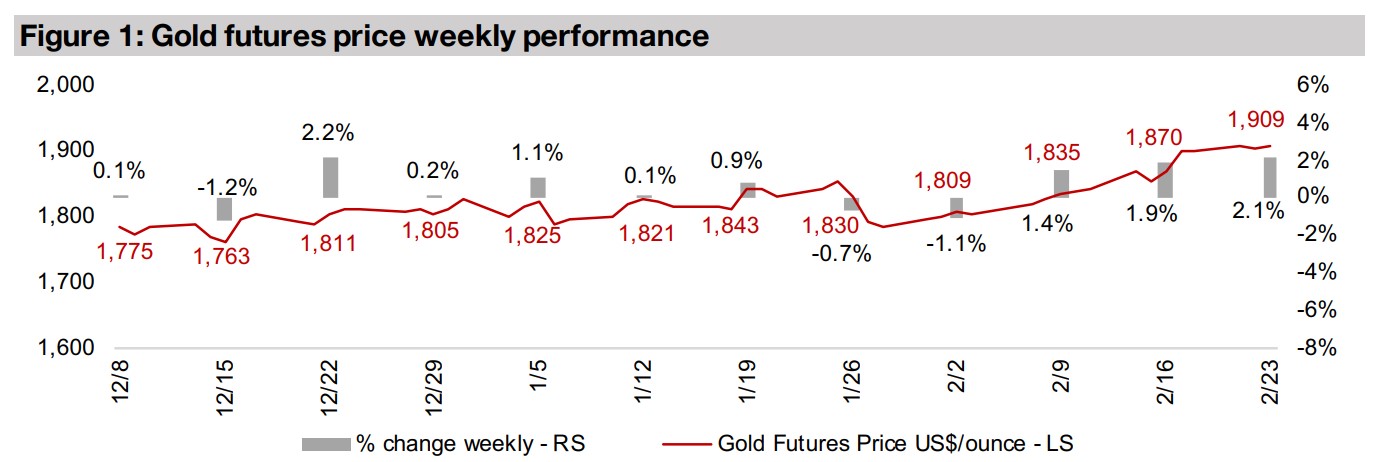

The gold price rose 2.1% to US$1,909/oz as of Wednesday, and briefly surged on Thursday to over US$1,950/oz on a flight to safety driven by Russia's invasion of Ukraine, before settling back down to near flat versus the previous close.

Major producers reporting Q4/21 so far looking good overall

The major gold producers that have reported so far in the current Q4/21 results season, including Barrick, Agnico-Eagle, B2Gold and Yamana, have overall seen strong production, moderate costs and decent levels of profitability.

A Geopolitics Premium for Gold

Gold rose 2.1% to US$1,909/oz this week as of Wednesday, but then had a brief

surge on Thursday to over US$1,950/oz on Russia's invasion of Ukraine, before

settling back down to US$1,909/oz, ending up flat versus the previous close. This

new geopolitical risk has added to the potential upside for gold, which can benefit

from a general flight to safety. The invasion has also likely exacerbated the main

underlying factor we see as driving gold, that being expectations of very high inflation.

With Russia a major global oil and gas provider, issues of reduced supply there can

drive up energy prices, which can feed through to the prices of most other goods,

and oil briefly broke through US$100 per barrel yesterday before closing at just under

US$95 per barrel. While we started the year expecting that gold would at least hold

up around 2021 levels, between the higher than expected inflation and rising

geopolitical tensions, its seems like the probability of upside surprises may be rising.

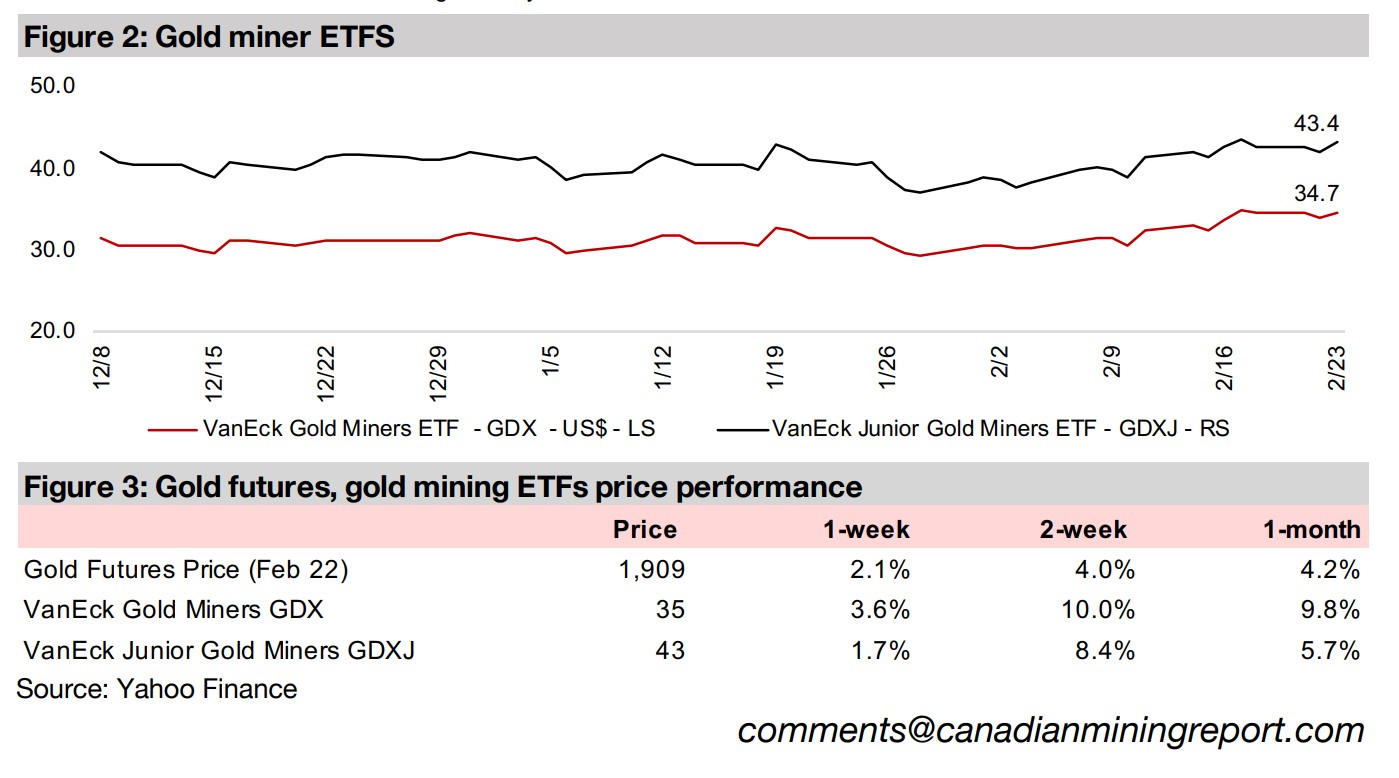

Even with the surge in gold on Thursday, mining stocks declined, with the producing

gold miner ETF GDX down -1.93% and the junior gold miner ETF down -2.28%. This

is inline with our overall thesis that while gold itself could do well this year, that overall

equity markets may remain under pressure, especially riskier small caps, and that this

could offset the boost the junior miners could get from a rising gold price. This is

mainly because the Fed has made clear its intentions to hike rates, which would mean

higher discount rates, therefore bringing down the valuations of all equities. How far

equities decline will depend a lot on just how high and how fast the Fed boosts rates.

While we expect that the Fed will be limited in how far they can go without driving an

economic and stock market decline, we believe that even a few small consecutive

rate hikes could be all that it takes to scare markets into assuming that the rate hikes

will continue, and prompt a significant sell off.

Major producers reporting Q4/21 so far looking good overall

With the Q4/21 results season nearly halfway through, the major producers that have reported so far, Barrick, Agnico Eagle, B2Gold and Yamana are looking good overall, with production levels solid, costs moderate and profitability levels decent, especially when compared to 2019, which saw gold exit its 2013-2018 bear market only in the second half of the year. Of the top five global gold producers, only Newmont, the largest by far in terms of market cap, has yet to report. The strong results have a key read across for the junior gold miners, with the strong profitability and cash generation of these majors leaving them in a strong position to finance or acquire many more projects. While many of the majors have been returning cash to shareholders with high dividend payouts, they still have plenty of capital remaining even after these distributions to invest heavily in the industry to replace or expand depleting reserves. With major consolidation in the industry also continuing, the large producers are becoming bigger and their numbers declining, meaning that large capital sources for the junior miners are becoming more concentrated.

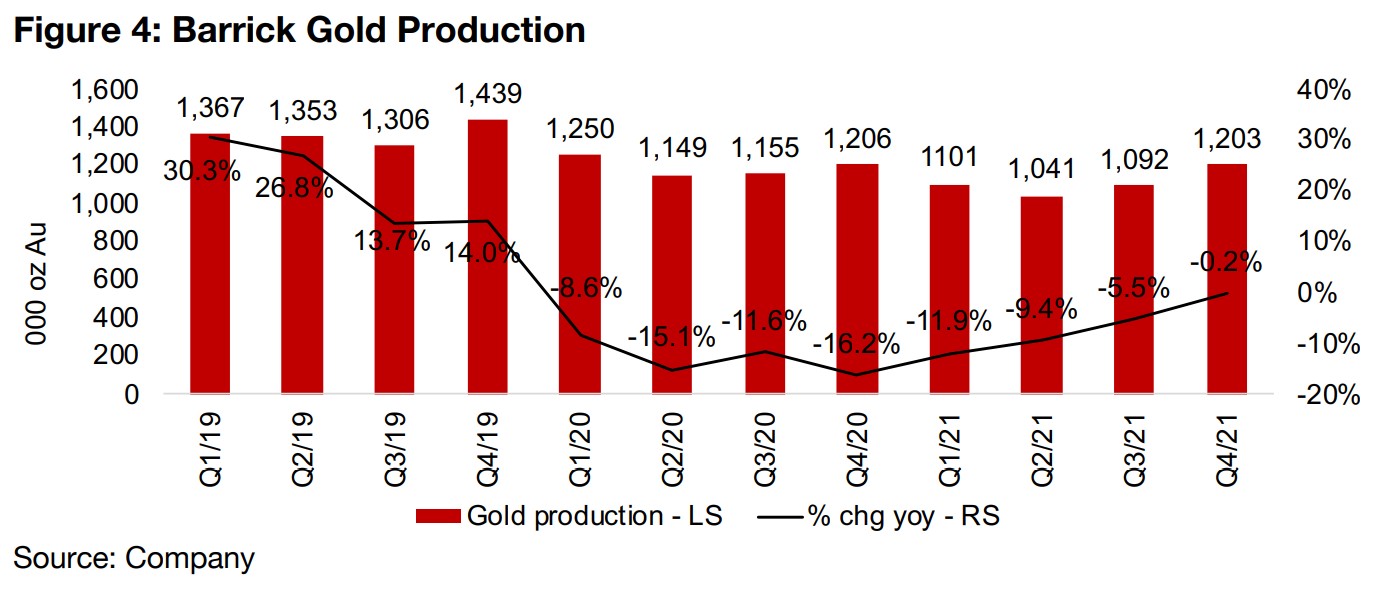

Barrick Gold Q4/21 results strong

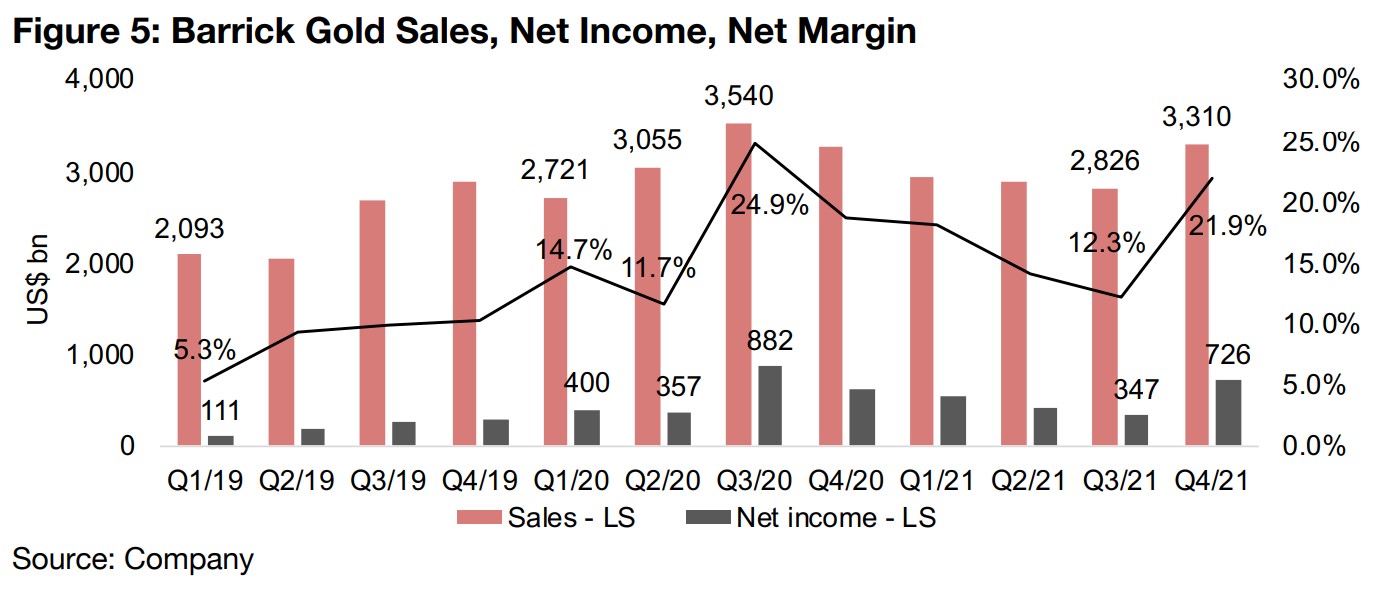

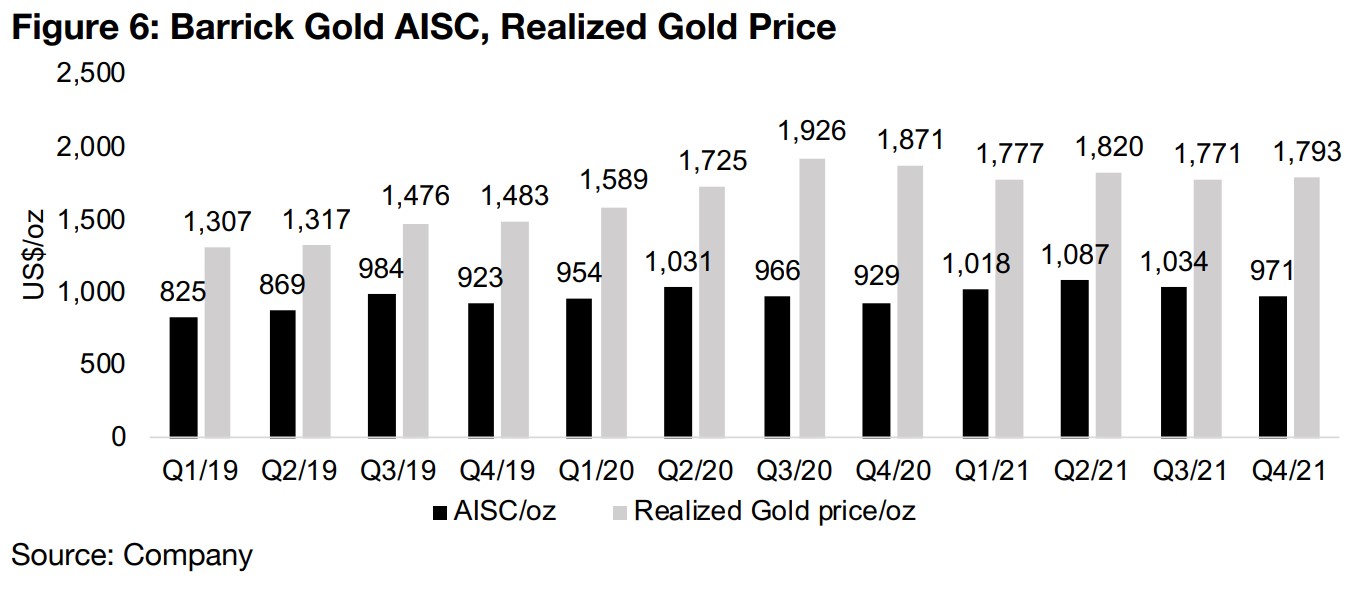

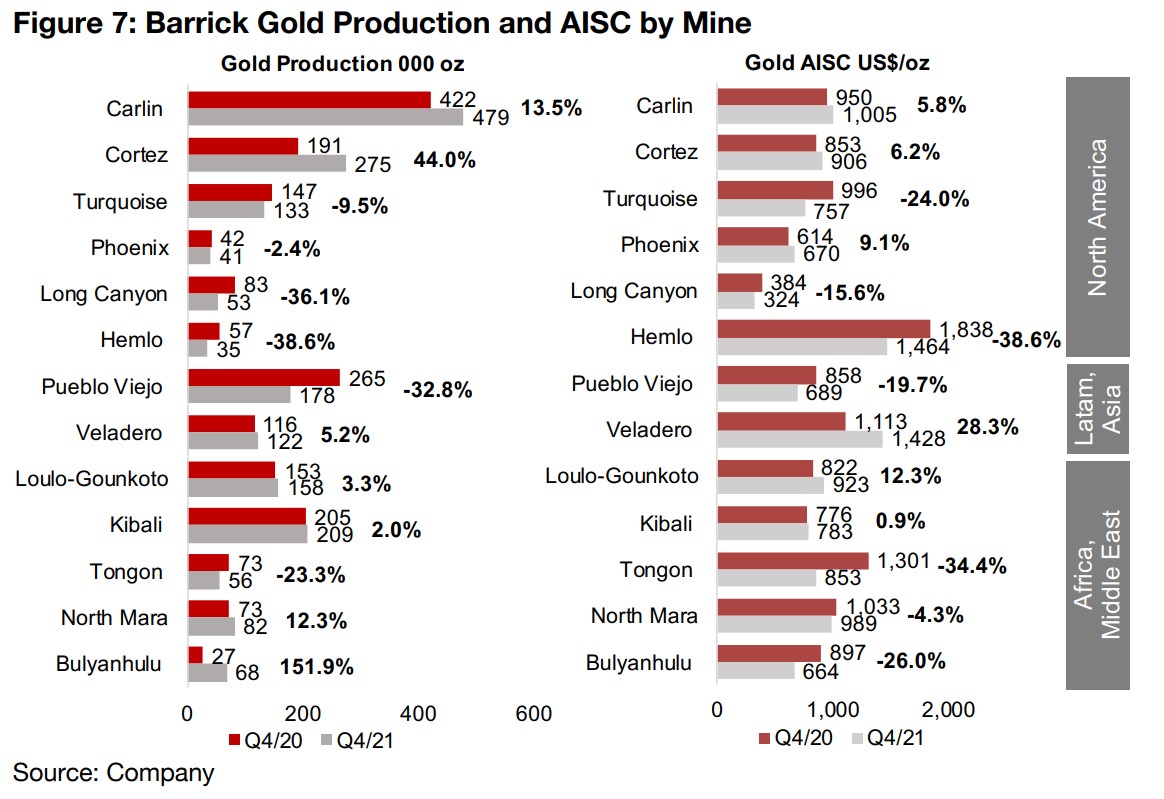

Barrick Gold, the second largest global gold producer reported strong Q4/21 results. Production growth continued to pick up, reaching near flat, at -0.2% yoy, to 1.2mn oz, up from a low of -16.2% yoy in Q4/20 driven by the global health crisis (Figure 4). Sales reached US$3.31bn, up 21.9% yoy, with net income at US$726mn, and its net margin at 21.9%, all at the highest levels since the previous Q3/20 peak, which saw revenue of US$3.54bn, net income of US$882mn and a net margin of 24.9% (Figure 5). While Barrick's costs picked up yoy, with its AISC/oz rising 4.5% to US$971/oz, they were still down from levels over US$1,000/oz that held from Q4/20 to Q3/21, and while the realized gold price was also down yoy to US$1,793/oz from US$1,871/oz, it was up qoq from US$1,771/oz (Figure 6). The gains in production yoy were mainly from North America, especially from Carlin, up 13.5% yoy and Cortez, up 44.0% yoy. Two smaller mines, North Mara and Bulyanhulu, both in Tanzania, Africa, also saw strong growth, of 12.3% and 151.9% (Figure 7). Cost inflation yoy at most of Barrick's largest mines remained moderate overall (Figure 8).

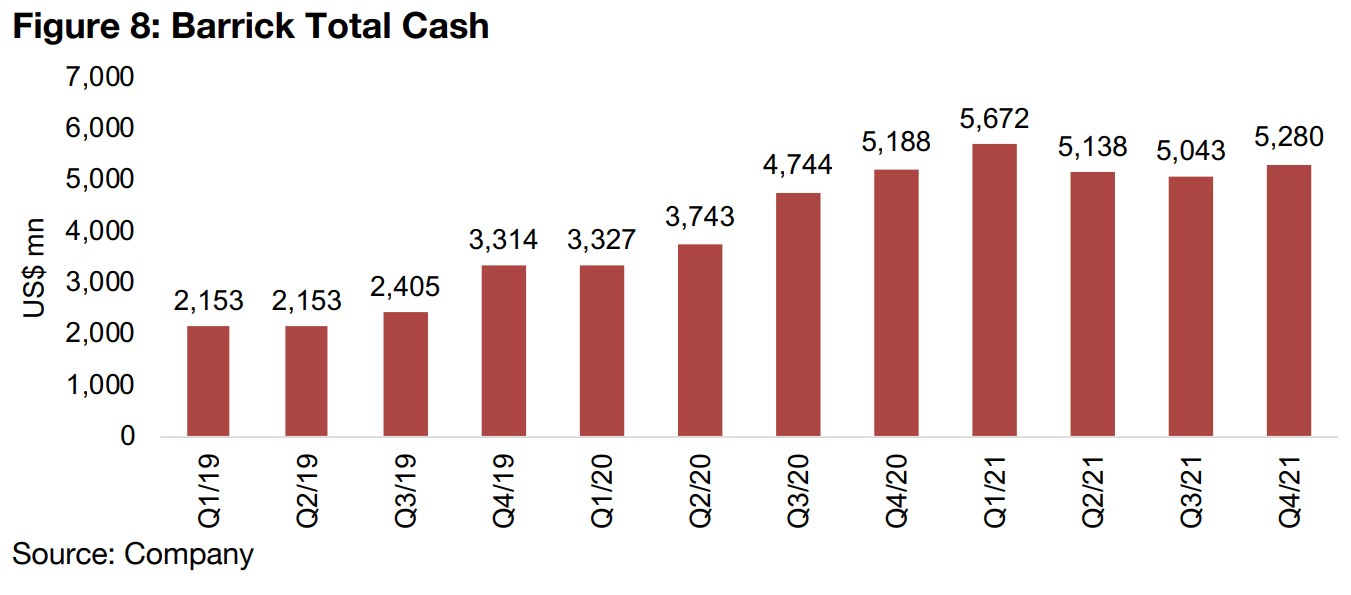

Barrick's cash balance was US$5.28bn in Q4/21, up slightly yoy and qoq, but up 145% from just US$2.15 bn in Q1/19 (Figure 8). Such a big jump in the availability of cash for investment in the industry will likely continue to be a boon especially for juniors with very strong projects as the company look to deploy this capital. However, with such a large cash pile and a continued high gold price, we are likely to see even higher risk projects get increased access to funding.

Agnico Eagle Q4/21 results the last before Kirkland Lake merger

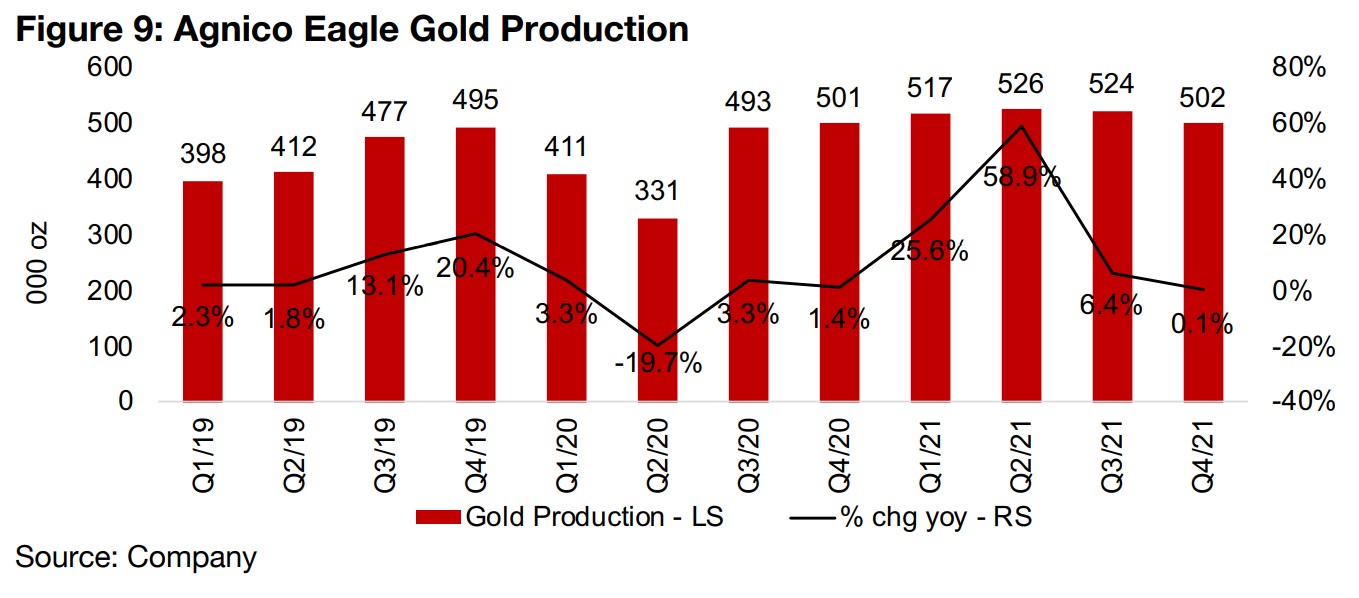

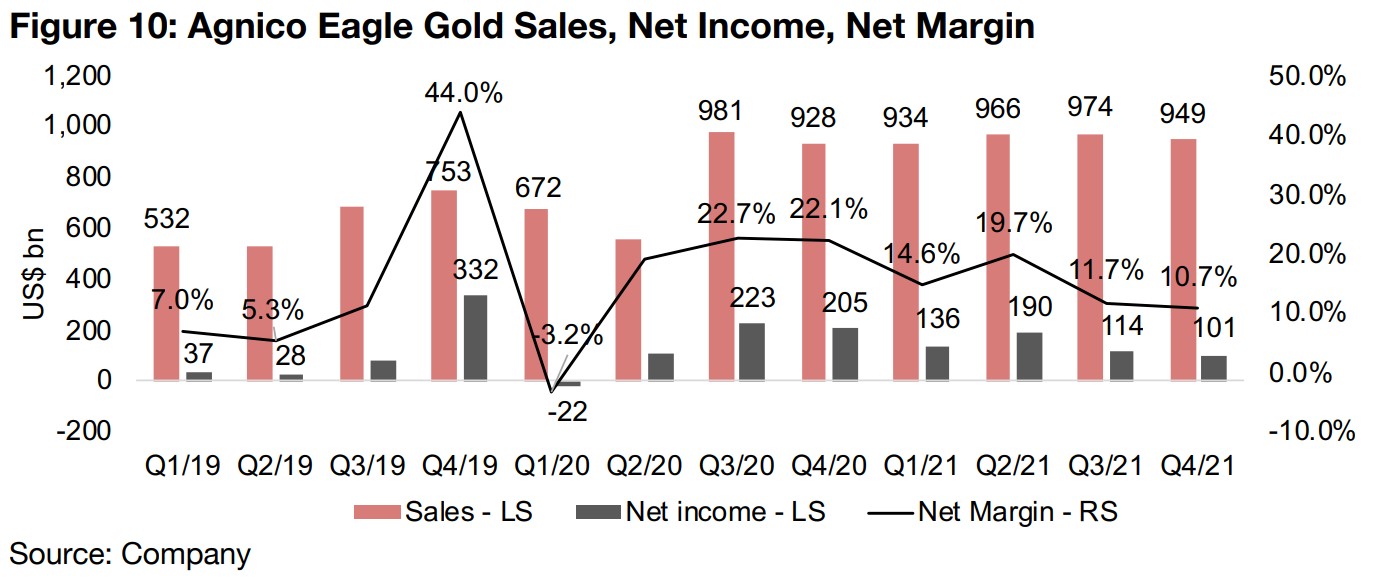

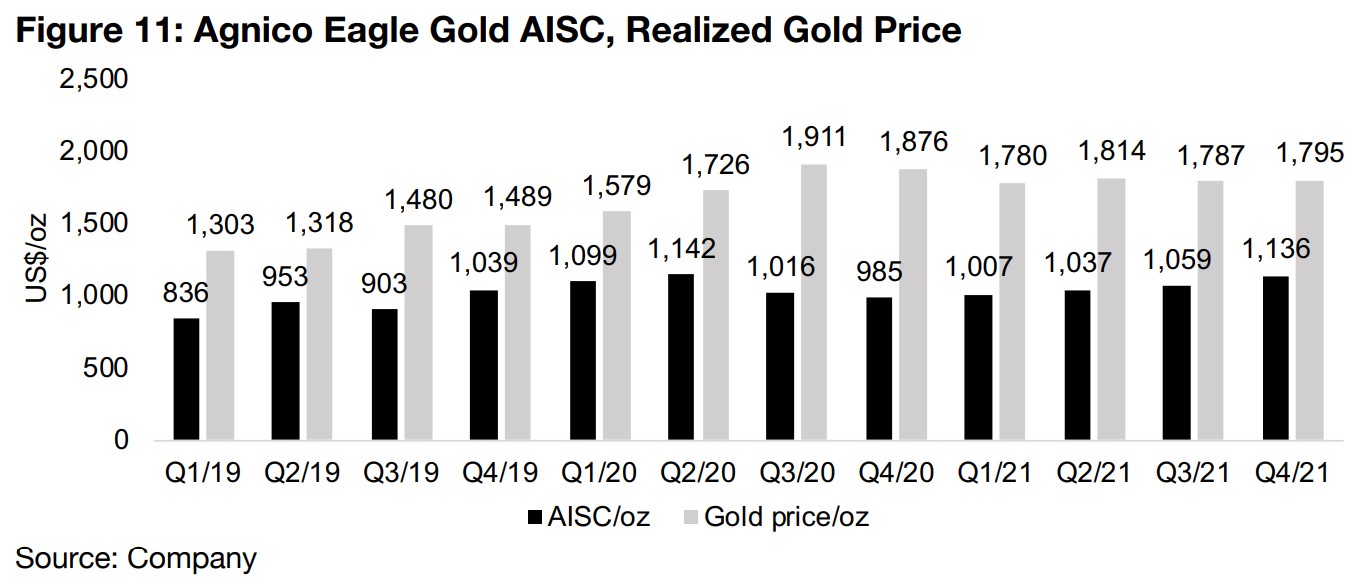

Agnico Eagle's Q4/21 results will be their last full quarter before they reflect the merger with Kirkland Lake Gold which was completed in February 2022, so the Q1/22 results will not be comparable qoq or yoy. Production growth was near flat, up 0.1% to 502k oz Au, and while this is down from peak growth of 58.9% in Q2/21, that was off a very low production base in Q2/20 because the global health crisis (Figure 9). Revenue was US$949mn in Q4/21 and has remained relatively stable since Q3/20 (Figure 10), although net income has been trending down, to US$101mn in Q4/21 from US$223mn in Q3/20, with margins at 10.7%, down from 22.7% in Q3/20. This has been driven by a considerable rise in costs, with AISC/oz Au at US$1,136/oz in Q4/21, trending up consistently from a low of US$985/oz in Q4/20 (Figure 11). This downward trend in margins will be alleviated to a degree by the merger with Kirkland Lake, which had net margins averaging 35.9% over the three years to Q4/21.

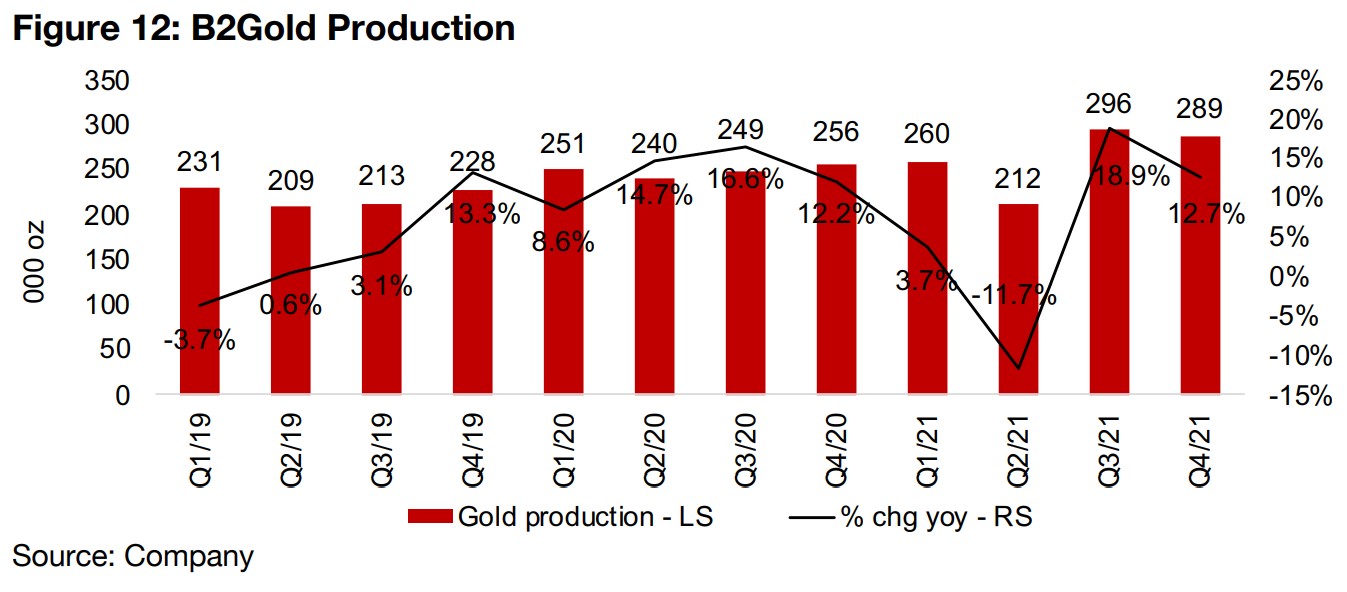

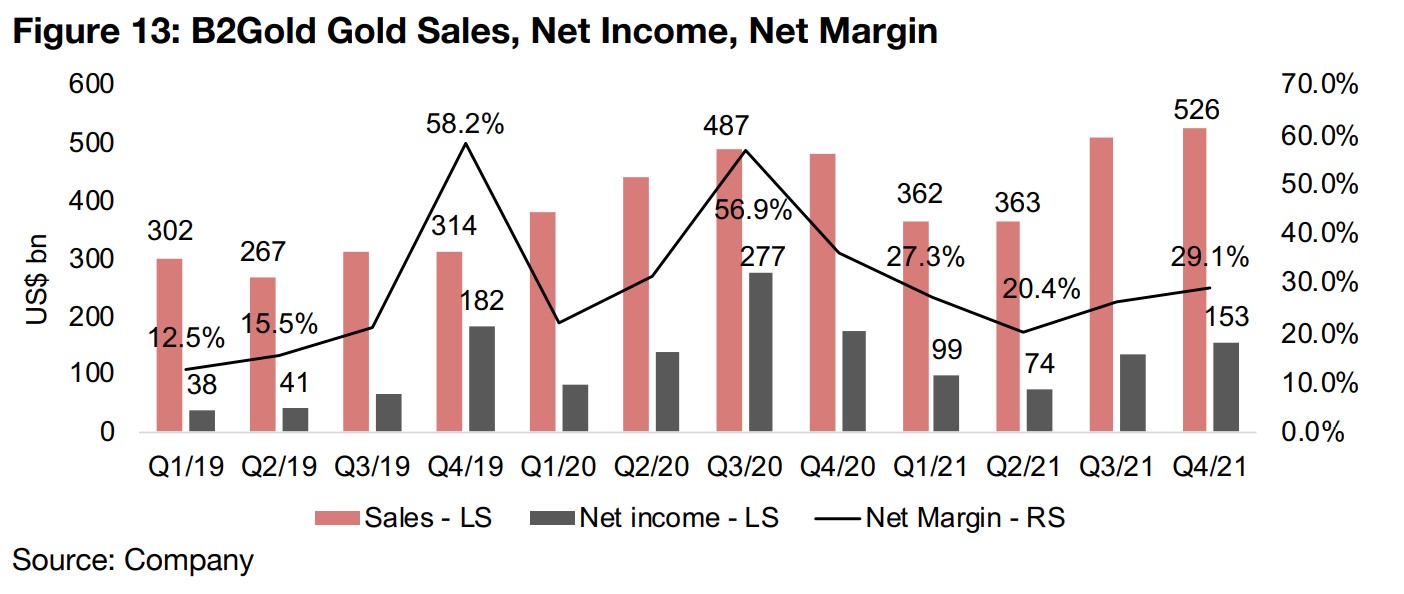

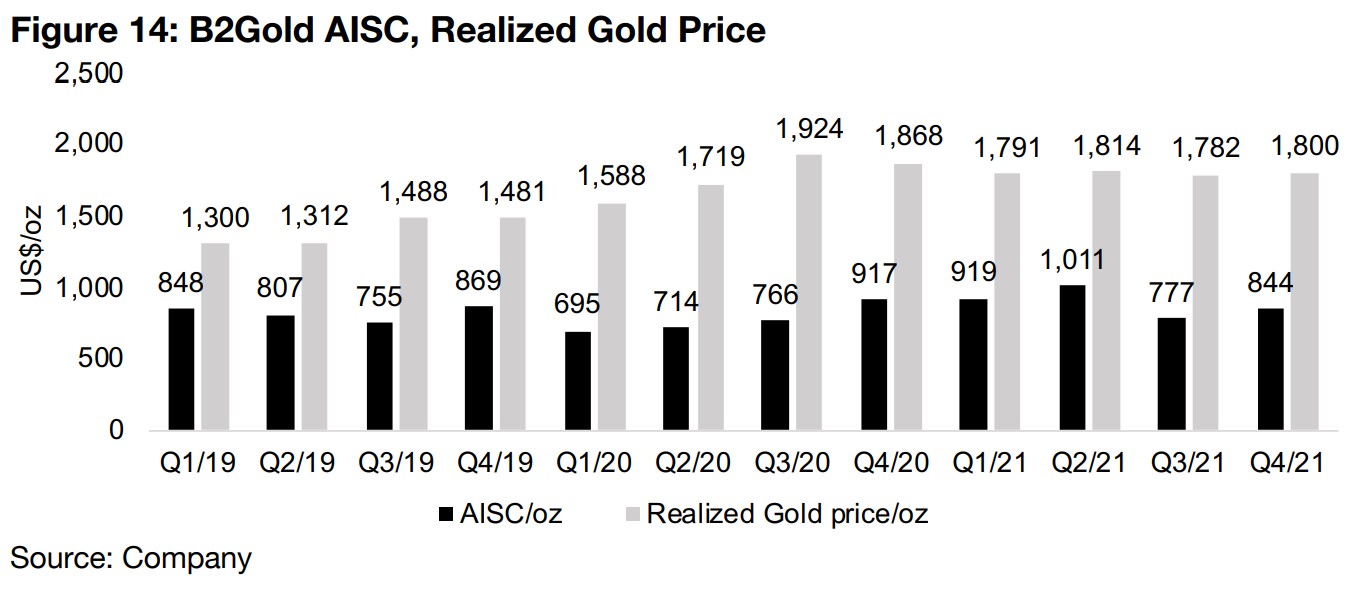

B2Gold's Q4/21 a second consecutive strong quarter after weaker H1/21

B2Gold's Q4/21 production was 289k oz Au, up 12.7%, down slightly off a Q3/21 peak, the second strong quarter after a relatively weak Q1/21 and Q2/21 (Figure 12). Production has generally trended up over the past two years, apart from the dip in Q2/21 because of planned waste stripping at some mines. The company's revenue reached a high in Q4/21 at US$526mn, and its net income at US$153mn and net margin at 29.1% were strong, and while down from a peak in Q3/20, that high had been driven by gains from exceptional items (Figure 13). B2Gold's costs have declined yoy, with an AISC at US$844/oz in Q4/21, down from US$917/oz in Q4/20 and the company has much lower costs than Barrick, Agnico Eagle and Yamana (Figure 14).

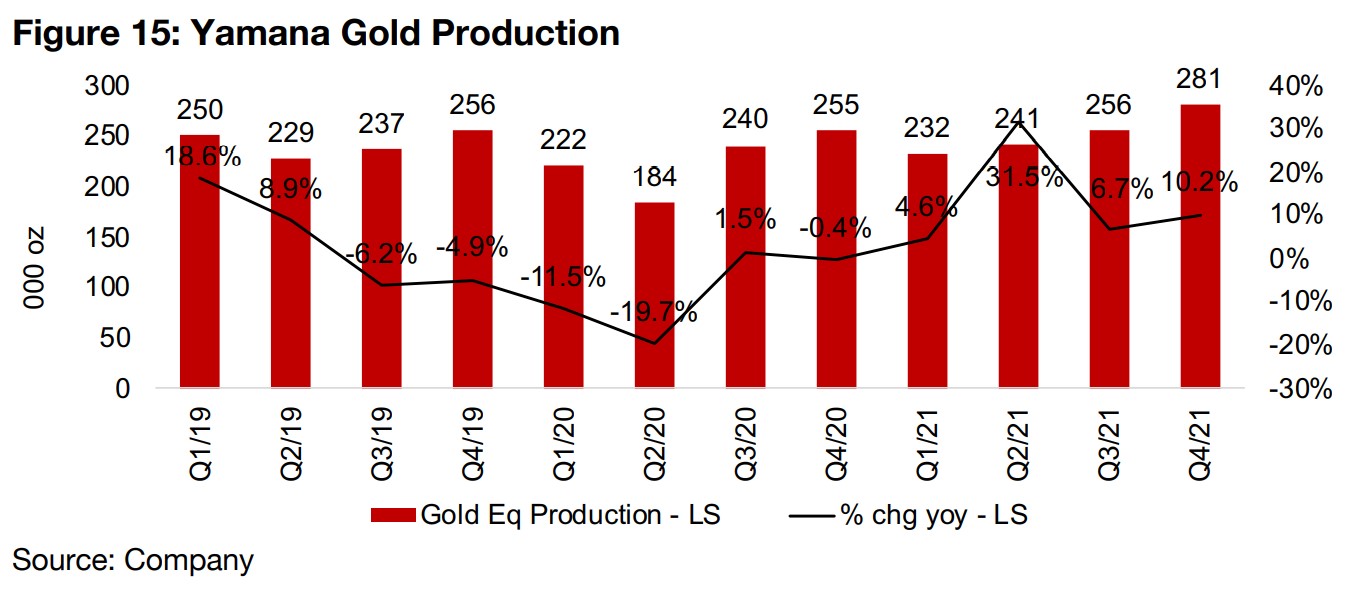

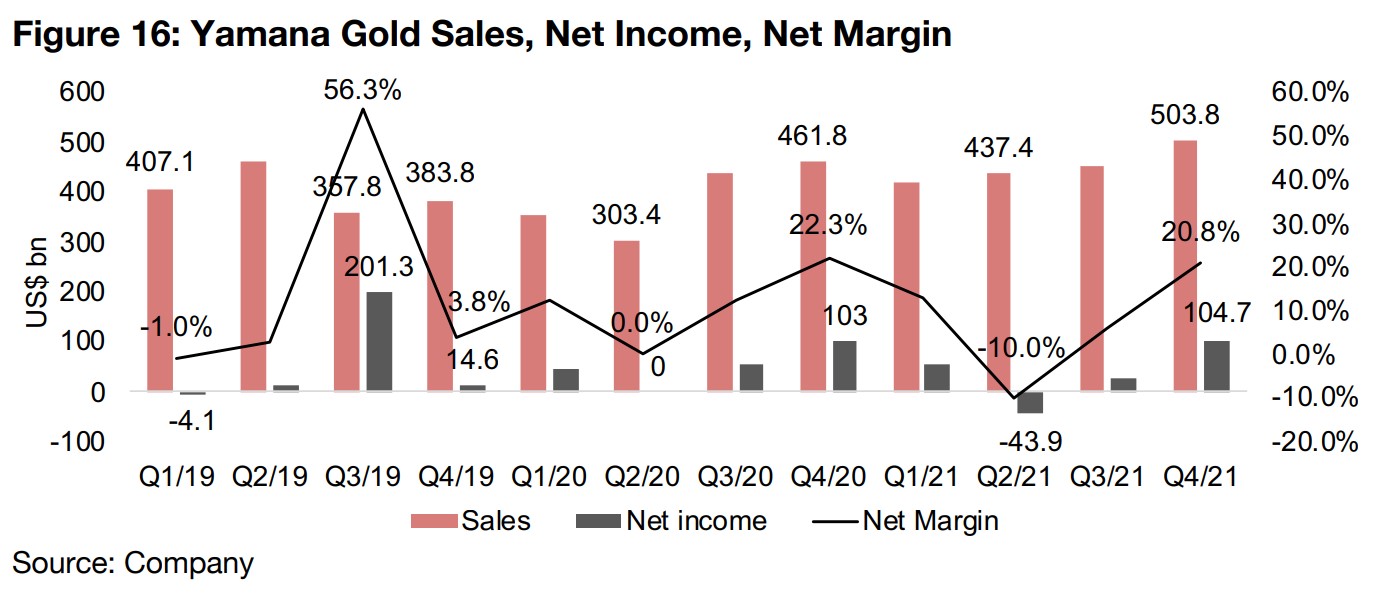

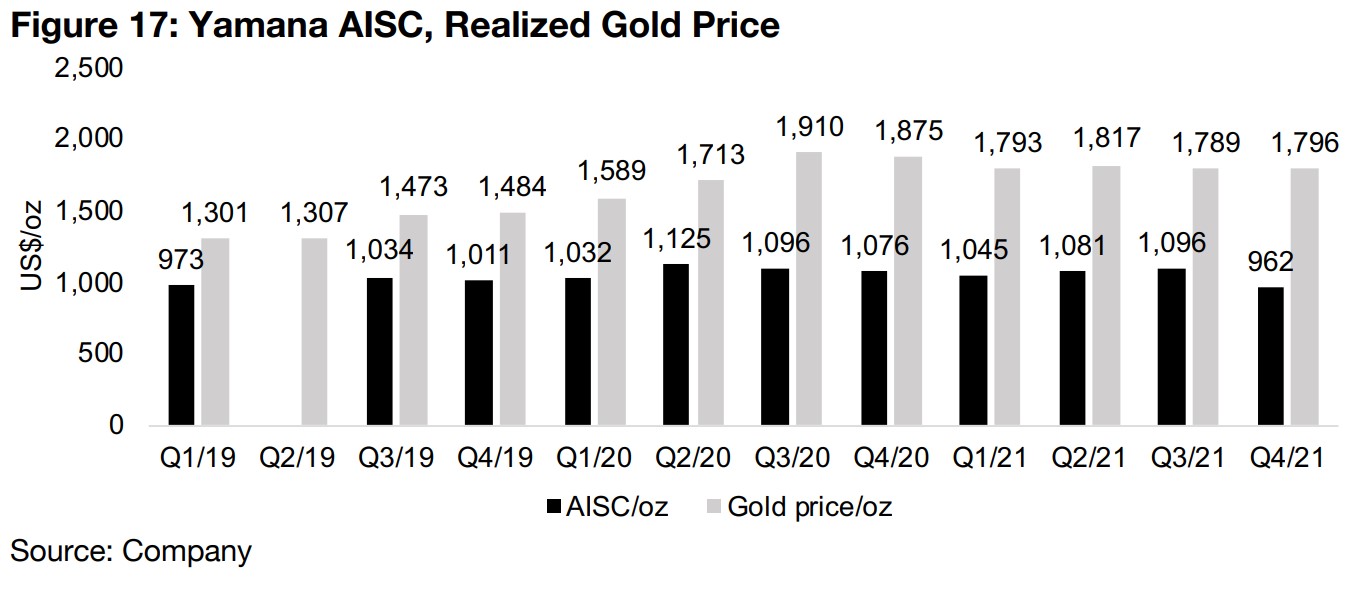

Yamana Gold Q4/21 sees strong production, revenue and net income

Yamana saw a strong Q4/21, with production rising 10.2% yoy to 281k oz Au, trending up for the third consecutive quarter (Figure 15). Sales reached a multi-year high of US$503.8mn and net income was US$104.7mn, up slightly yoy, but marking its second strongest quarter of profit since 2019 (Figure 16). The company's net margin was 20.8%, its highest since Q4/21, as costs declined, with an AISC of $962/oz, down yoy from US$1,076 and qoq from US$1,096/oz (Figure 17).

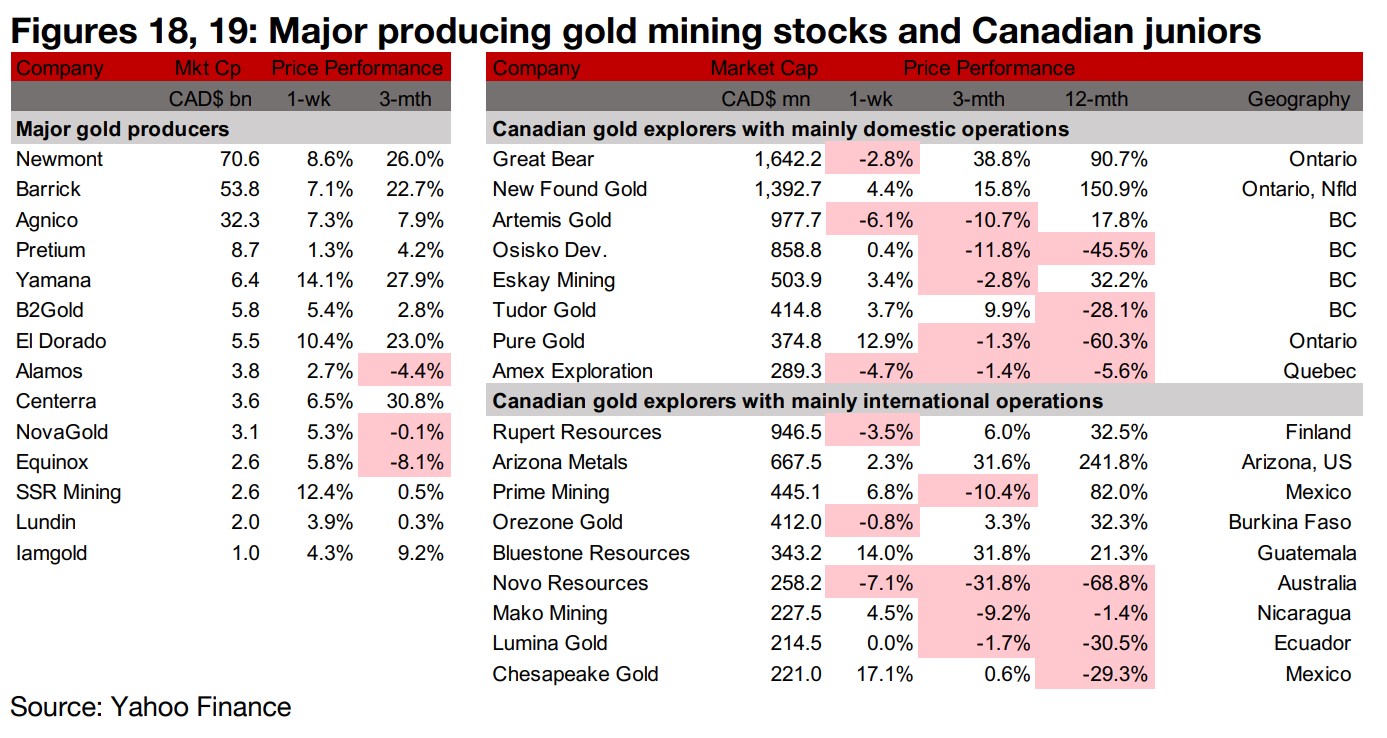

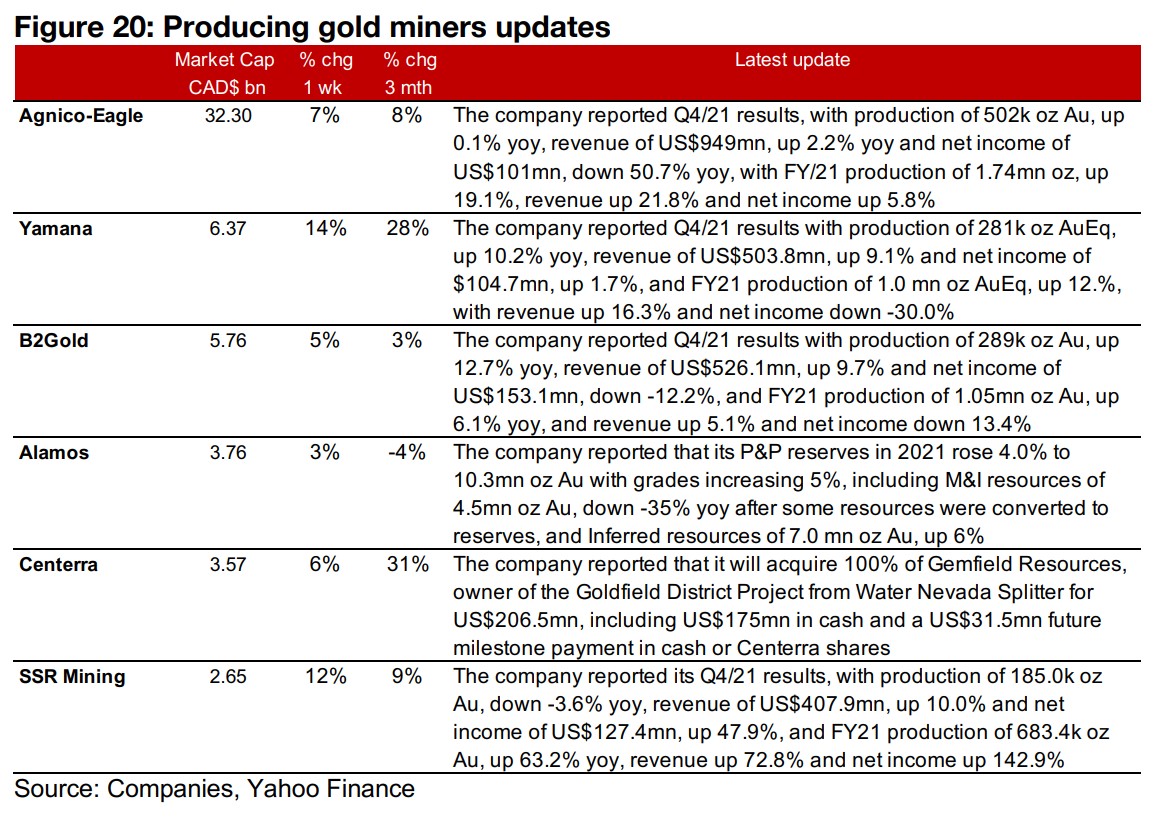

Producers surge on gold jump, Q4/21 results released

The producing gold miners all surged on the jump in gold (Figure 18). The news flow was mainly related to Q4/21 results, with Agnico Eagle, Yamana Gold, B2Gold, and SSR Mining all reporting. Alamos Gold reported its reserves and resources for 2021, with P&P Reserves up 4.0% and M&I Resources down -35% and Inferred Resources up 6.0%, and Centerra reported that it will acquire Gemfield Resources, owner of the Goldfield District Project for US$175mn in cash a US$31.5mn future milestone payment in cash or Centerra shares (Figure 20).

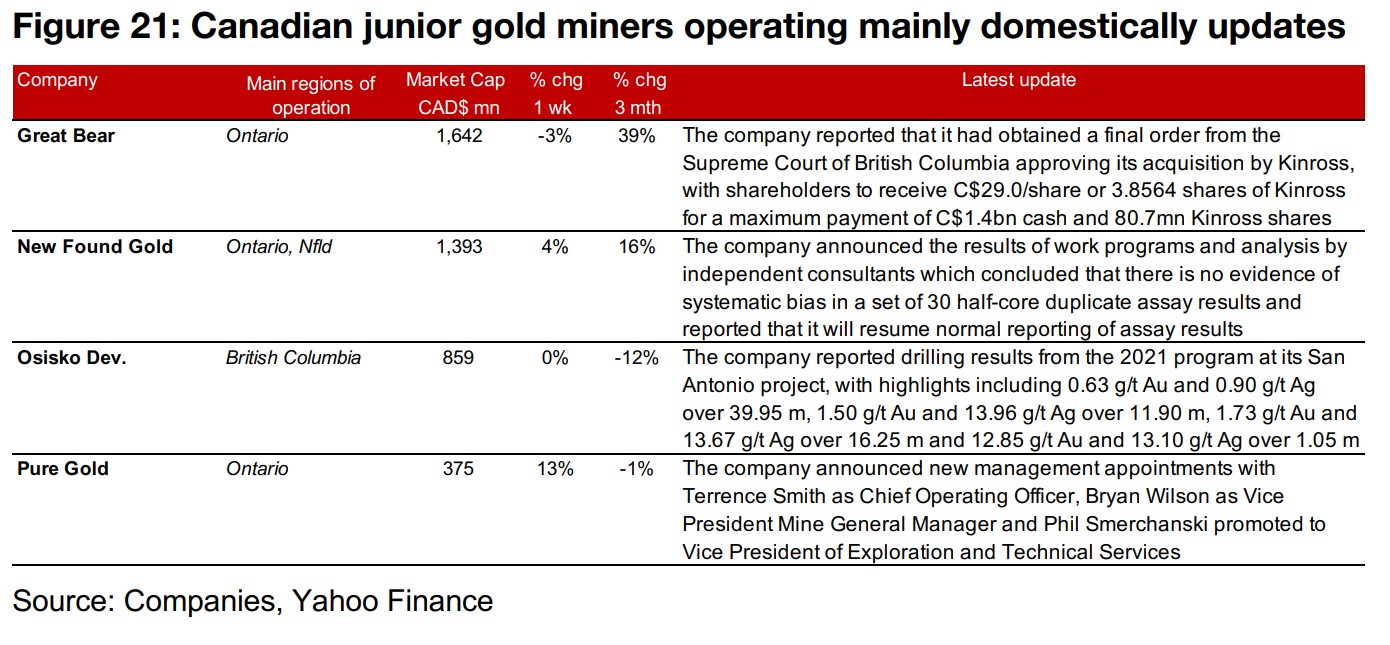

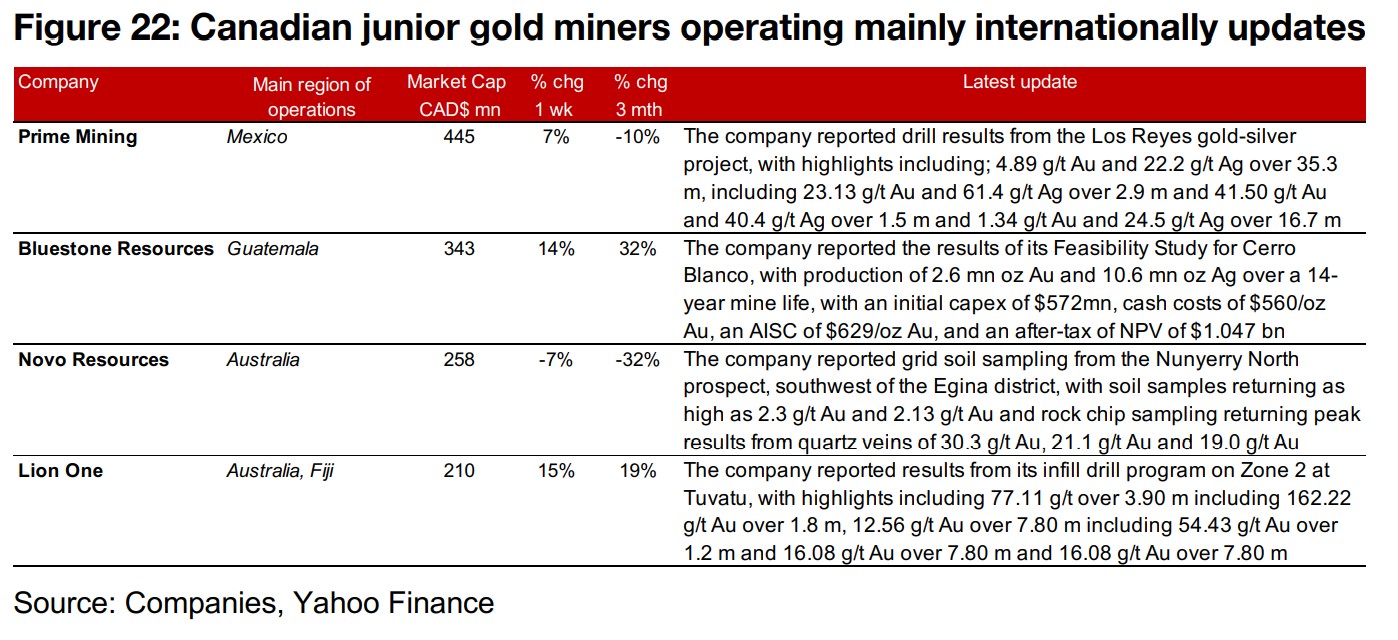

Canadian juniors mostly up as gold rises

The Canadian juniors were mostly up on the rise in gold (Figure 19). For the Canadian juniors operating mainly domestically, Great Bear obtained a final order from the Supreme Court of British Columbia approving its acquisition by Kinross, New Found Gold announced that consultants found no evidence of systematic bias in its assay results, Osisko Development reported drilling results from its 2021 program at San Antonio and Pure Gold announced new management appointments (Figure 21). For the Canadian juniors operating mainly internationally, Prime Mining reported drill results from the Los Reyes project, Bluestone announced the results of its Feasibility Study for Cerro Blanco, Novo Resources reported grid soil sampling from the Nunyerry North prospect, southwest of the Egina district, and Lion One announced results from its infill drill program on Zone 2 at Tuvatu (Figure 22).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.