July 11, 2023

A Critical Element of a Massive Megatrend

Contents

One billion pounds of this critical element are missing...

But only a small group of investors knows what it means. It means there's a megatrend in the making.

They want to keep this information private, but eventually, it will get out and change this CRITICAL market forever.

Those who choose to ignore it may end up with massive losses. But those aware of this trend can act NOW and position their portfolio for potential gains.

Time is running out to make your choice...

This is why a Gates-backed company invested $150 million into this sector last December. He's part of this "inner crowd" aware of what's going on in this critical market...

Robert Friedland, a self-made billionaire, got into this megatrend even earlier. Now he is fully committed, with his multi-billion empire operating in the epicenter of this megatrend.

The list goes on. You'll likely see more and more names supporting this megatrend.

And just to be clear, it has nothing to do with crypto, tech, or artificial intelligence (AI).

Instead, we are going to talk about tangible assets with an incredible long-term growth outlook.

Billionaires are betting on it in order to multiply their fortunes, and we're going to join this sophisticated group while there's still time.

In this article, we'll show how to position your portfolio for this megatrend. And as a bonus, you'll see the name of the company working on a potential megaproject exposed to this once-in-a-decade opportunity.

The Megatrend

Back to that "one billion pounds" number...

It's an estimate of the deficit in a certain market, according to a study done by the elite research agency S&P Global.

S&P Global estimates a one-billion-pound shortage for one of the most critical metals out there. Other analysts released similar estimates. Industry insiders, too, see an imminent imbalance in this market over the coming years.

If they are right, investors will have two options:

- Get ready for the potential massive gains in this element's price (deficits often lead to surging prices).

- Or lose this opportunity.

That's why we stress that acting now on this opportunity is crucial, as any delay may directly hurt your portfolio.

The commodity we're talking about is copper.

You may be wondering what makes copper so critical.

Let us explain... The metal lies at the center of the clean energy transition megatrend. And the global switch to clean and sustainable energy is not just about moving away from fossil fuels.

Yes, the era of oil and gas is coming to an end, and the new age of energy generation is taking over the world. And no matter how you generate clean power, whether using wind, sunshine, tidal waves, or nuclear reactions, you still have to deliver it to the final users.

This is where copper comes into play...

The metal has such unique conductive properties that it has no equal substitutes. Hence it can't be economically replaced with another metal. It just won't work.

No wonder modern electric vehicles (EVs) use more than three times more copper than their internal-combustion-engine counterparts.

On top of that, modern EVs can contain up to a mile of copper wires.

Bloomberg estimates EV sales will reach 80 million per year by 2050. This is an 8X gain over the past year's sales.

But even at this pace, EVs will only account for two-thirds of the global vehicle fleet.

In other words, this is not a short-term investment opportunity. It will take decades to move away from ICE cars.

This is why we are saying that there is a decades-long megatrend happening in the copper market.

It's massive, and it will last for a long time.

But it's not only about electric vehicles, of course.

Windmills, solar and nuclear plants heavily rely on copper. They use it to deliver energy to the final users. The rapidly growing EV charging networks that are replacing gas stations worldwide use massive amounts of the metal.

Solar plants, for instance, use around 5.5 tons (11,000 lbs) of copper per megawatt (MW) capacity.

And an average windmill with a 3 MW capacity has about 4.7 tons (9,400 lbs) of copper.

Both renewable energy sources are taking over the world. It's projected that by 2050 in the US alone, over 1,000 gigawatts (GW) of power will be generated from solar and wind sources.

Some of the most conservative estimates say that these will require 3.8 million tons (7.6 billion pounds) of copper.

The Ultimate Critical Metal

The world's leading nations have already started to worry about the copper shortage. They consider copper a critical metal.

In the US, President Biden signed the Inflation Reduction Act, which includes a vast allocation of funds towards clean energy and its distribution.

Securing enough copper became a matter of national economic security.

In Europe, copper was also declared strategic. Copper producers should get special treatment to increase production.

Can the leading nations fix this problem before the market enters a state of deficit?

We doubt it.

You see, the copper sector suffered from a decade of under-investment. Copper producers are lagging behind the soaring demand. Not only do they struggle to find new deposits... they also have trouble replacing mined-out reserves.

It's a second big problem for the sector.

Over the last decade, there were just a handful of new major copper discoveries. For comparison, between 2012 and 2021, geologists made only 12 of them. Between 2002 to 2011, there were 82.

In other words, the number of discoveries dropped by almost seven times!

This is a big setback for the industry as new copper mines become rare. And whether companies can increase production from the old ones is an open question.

On top of that, most of the copper in the world comes from Latin American countries. Chile and Peru are in charge of 34% of the global copper supply.

And both countries are famous for their unstable political regimes. Earlier this year, new Chilean President Gabriel Boric signed a bill that will hurt the copper industry in the coming years.

Mr. Boric imposed a new tax regime on the country's copper producers, forcing them to pay most of their earnings back to the government.

Insiders already estimate that it may lead to the closure of some low-grade mines. Whatever profits they could generate before are gone.

Expansion of the existing mines may also be delayed for the time being.

Chilean mining companies have already started reporting decreased production volumes. And this is only the beginning...

This trend will likely accelerate this year as the industry processes the effect of the disastrous new legislation.

Decreased supply and rapidly growing demand are a perfect setup for a market heading into a deficit.

Copper inventories are being quickly depleted at the leading global copper trading houses. London Metals Exchange (LME) and Shanghai Futures Exchange (SHFE) carried record-low stocks recently.

Over the past ten years, the global copper inventories dropped by 79% and now stand at just 185 thousand tonnes (408 million pounds)—an almost all-time low.

The copper sector is broken, and there is no easy fix with the clean energy megatrend unfolding.

And there is a company that, we think, is uniquely positioned to benefit from the current setup. It has a massive 506-sq-km (~200-square-mile) land package in one of the most prolific copper districts in the world.

This is why we call it a megaproject.

Let’s dig in...

Midnight Sun Mining Corp. (TSXV:MMA, OTCQB:MDNGF)

Most of the world-class mines appear in clusters. It's a geological feature where the chances of finding a new mine next to another one are much higher than exploring a completely new area.

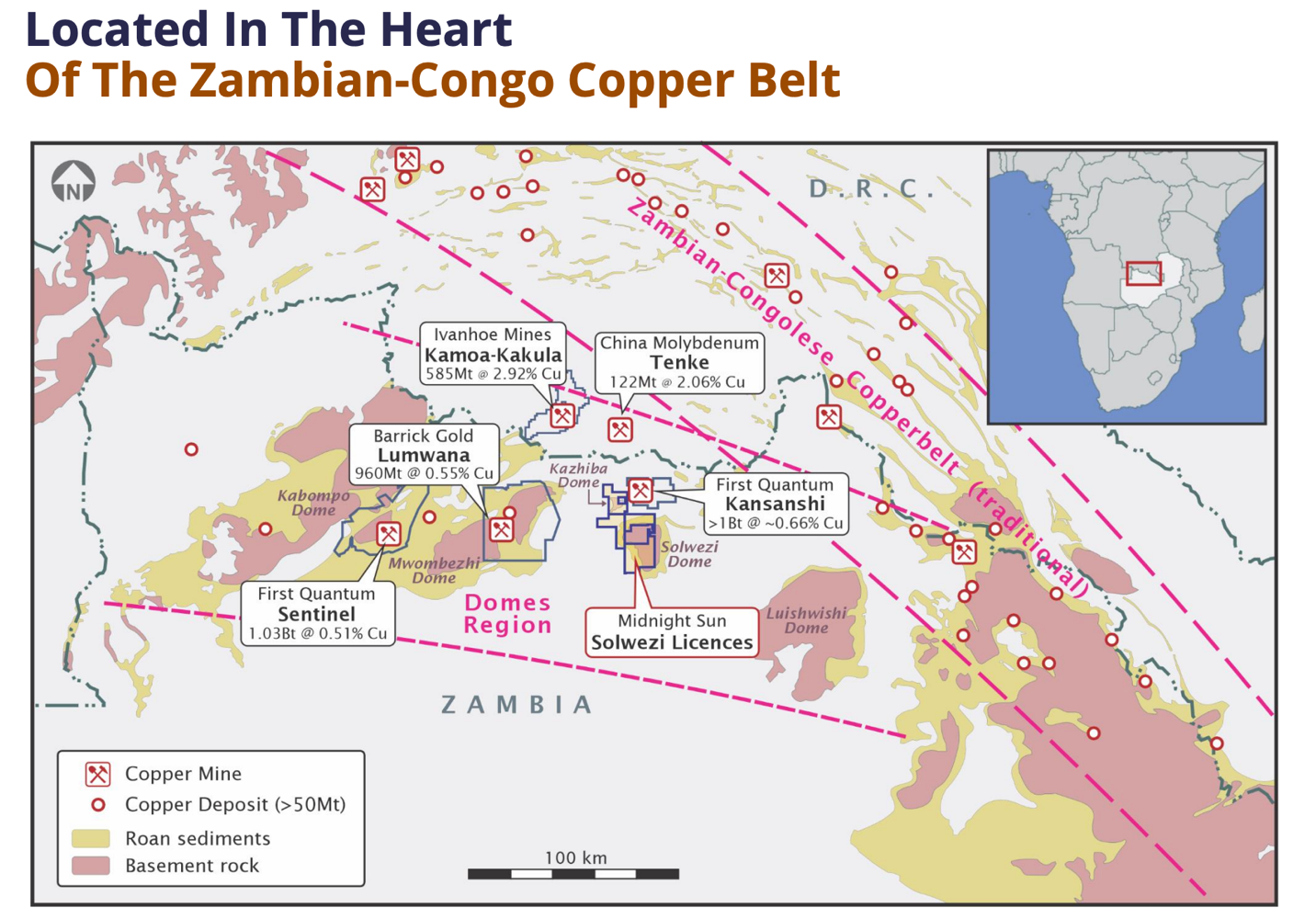

This is where Midnight Sun Mining has a massive advantage over its peers in the copper sector. The company is laser-focused on its Solwezi Megaproject in the Zambian-Congo copper belt in Africa.

This belt is a host to these major copper mines:

- Kansanshi copper-gold mine (First Quantum)

- Tenke copper-cobalt mine (China Molybdenum),

- Kamoa-Kakula copper mine (Robert Friedland's Ivanhoe Mines),

- Lumwana copper mine (Barrick Gold),

- Sentinel copper mine (First Quantum).

These are only some of the largest names in the 120-mile radius. But even these five mines produce well over a million tonnes of copper annually. This is close to the total copper output in the whole of the United States (1.3 million tonnes of copper in 2022).

Having these copper giants nearby could be a massive positive factor for the Solwezi Megaproject. The area has a solid infrastructure in place, and the local workforce is abundant.

It's not a problem to find contractors or run an exploration campaign.

The companies listed above have $10-$30 billion in market capitalization. At the same time, Midnight Sun Mining (TSXV:MMA, OTCQB:MDNGF) is trading at just $22 million.

The reason for this, of course, is that Solwezi is an early-stage project. But there could also be potential to reach higher valuations going forward.

Luckily for the company, Zambia is a pro-mining jurisdiction. For over a century, the country was a major source of copper supply. Right now, it is the second-largest copper producer in Africa.

Over the past several years, the total value of Zambia's copper exports reached $7.6 billion per year. The metal represents 75% of the country's total export. It is vital for the local economy.

The country's president supported local mining companies publicly and encouraged them to build more mines. After all, it will help the local economy with jobs and taxes.

The business community is also optimistic. Businesses that are working in the area confirm that the country is a friendly place to operate in. Barrick Gold CEO Mark Bristow recently said:

"He is a breath of fresh air," Mark Bristow said after meeting Zambian President. "Zambia is a good story."

Government support is crucial in the mining space.

Midnight Sun Mining (TSXV:MMA, OTCQB:MDNGF) was smart to choose Zambia, and Solwezi has excellent potential in the country's leading copper district.

This region is rich in copper. And having a large land package is a massive advantage here. First, it increases the odds of making an economically viable discovery. Second, such a large project has the potential to host multiple attractive targets.

Plus, the country's team has experience working in Africa.

Al Fabbro, President and CEO, has four decades of experience in finance and mining. For most of his career, he worked analyzing mining companies and arranging financings.

Al also led this same team to the discovery of the massive Yaramoko deposit in Burkina Faso. It was a core asset for Roxgold, which Fortuna Silver took over for C$1.1 billion (approx. USD836 million.)

The company's team has already started making progress. It has outlined major zones of mineralization at the Solwezi Megaproject and delivered excellent exploration results. The best drill results include:

- Discovery hole for the Kazhiba zone (22 Zone), SLZ-DD-14-010: 5.71% copper over 14.2 meters.

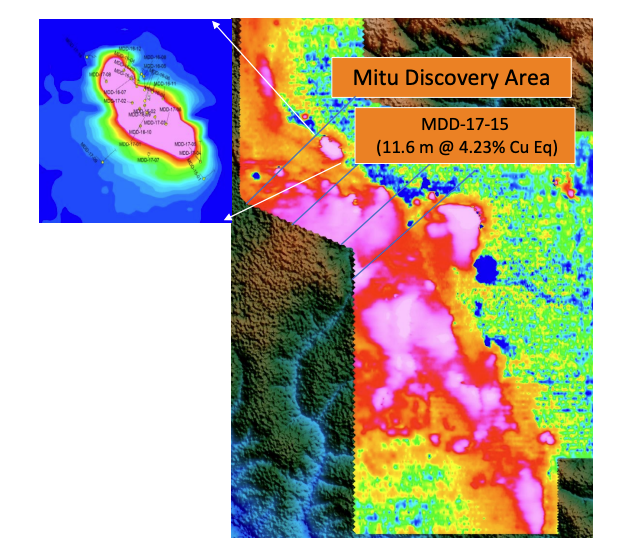

- Discovery hole for the Mitu zone, MDD-16-01: 1.22% copper, 0.09% cobalt, and 0.05% nickel over 8 meters.

- The best drill hole at the Mitu zone, MDD-17-15, delivered 3.44% copper, 0.07% cobalt, and 0.06% nickel over 11.6 meters.

For comparison, nearby copper mining operations feature grades in the range between 0.34%–5.5%.

These mines could potentially find it beneficial to expand their footprint with new high-grade deposits.

Defining a high-grade orebody could attract the attention of major local mining companies.

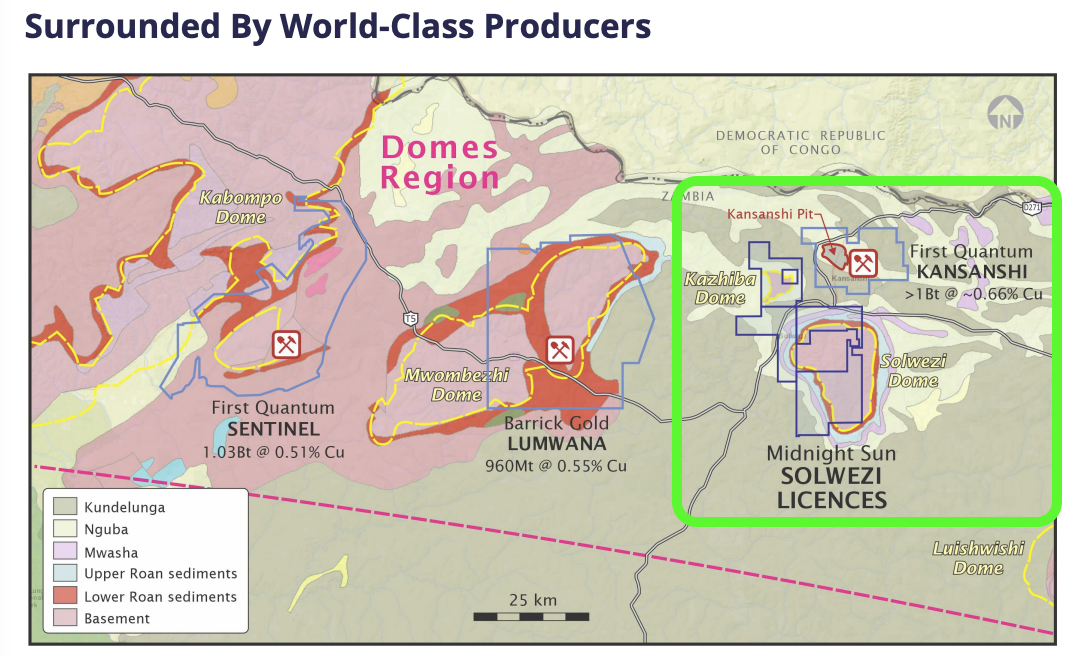

The closest one is the Kansanshi mine, Africa's largest copper mining complex, run by First Quantum. It's just 10 km (6.2 miles) away from Solwezi. It hosts over a billion tonnes of low-grade copper mineralization. Adding a high-grade component to the mine plan would be a no-brainer for First Quantum.

Just look how close it is to the Solwezi Megaproject (highlighted in green):

Solwezi has the potential to host numerous high-grade copper deposits. The company drilled exploration holes that intersected material featuring grades much higher than the average resource grade at Kansanshi. These samples are the best indication of the rich copper potential of the project.

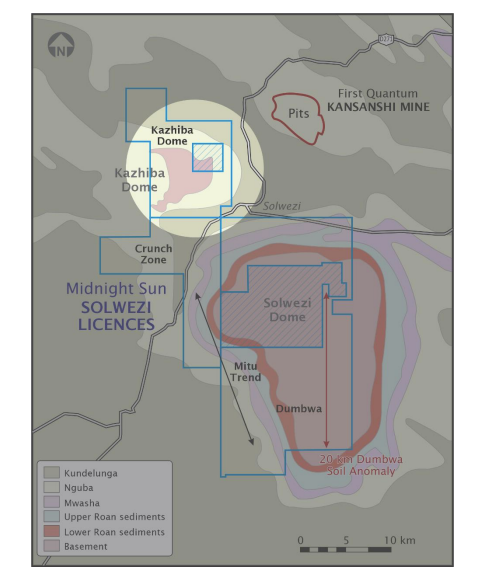

However, keep in mind that 506 square kilometers (195 square miles) is a massive piece of land. This Megaproject features four distinct copper targets:

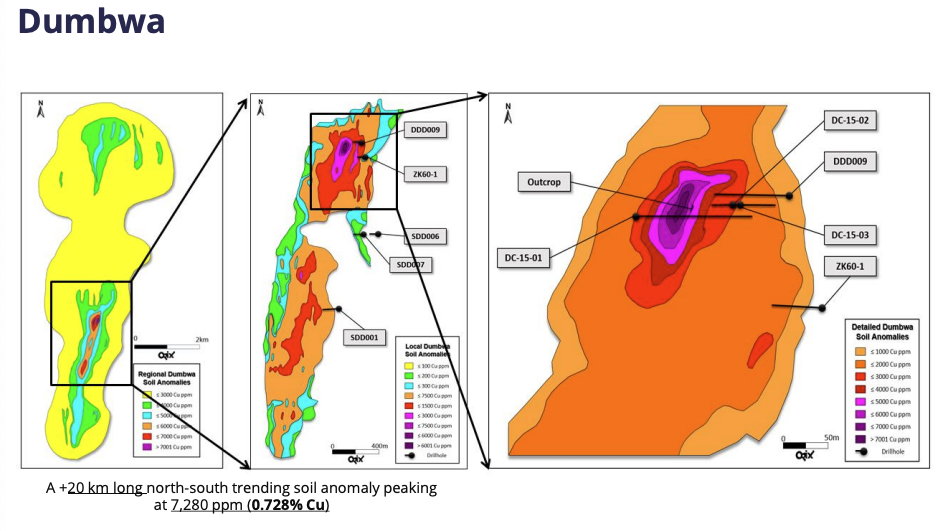

1. The Dumbwa zone with copper anomalies spread over 20 km, with up to 0.728% copper grade right in the surface soil. These anomalies are the strongest on record in Zambia, and mineralized horizons are similar to the Lumwana mine.

2. The Kazhiba zone is in the northwest part of the project, less than 10 km (6.2 miles) from the Kansanshi mine. Exploration results at Kazhiba returned rich copper grades, yet the source remains undiscovered.

3. The Mitu trend lies in the southwest part of Solwezi. The team has succeeded in finding copper in a small part of the trend, but recent geophysical and geochemical surveys outlined much larger anomalies.

All pink-red bright spots have a strong potential to host copper minerals in the soil. This trend is yet to be tested with systematic exploration.

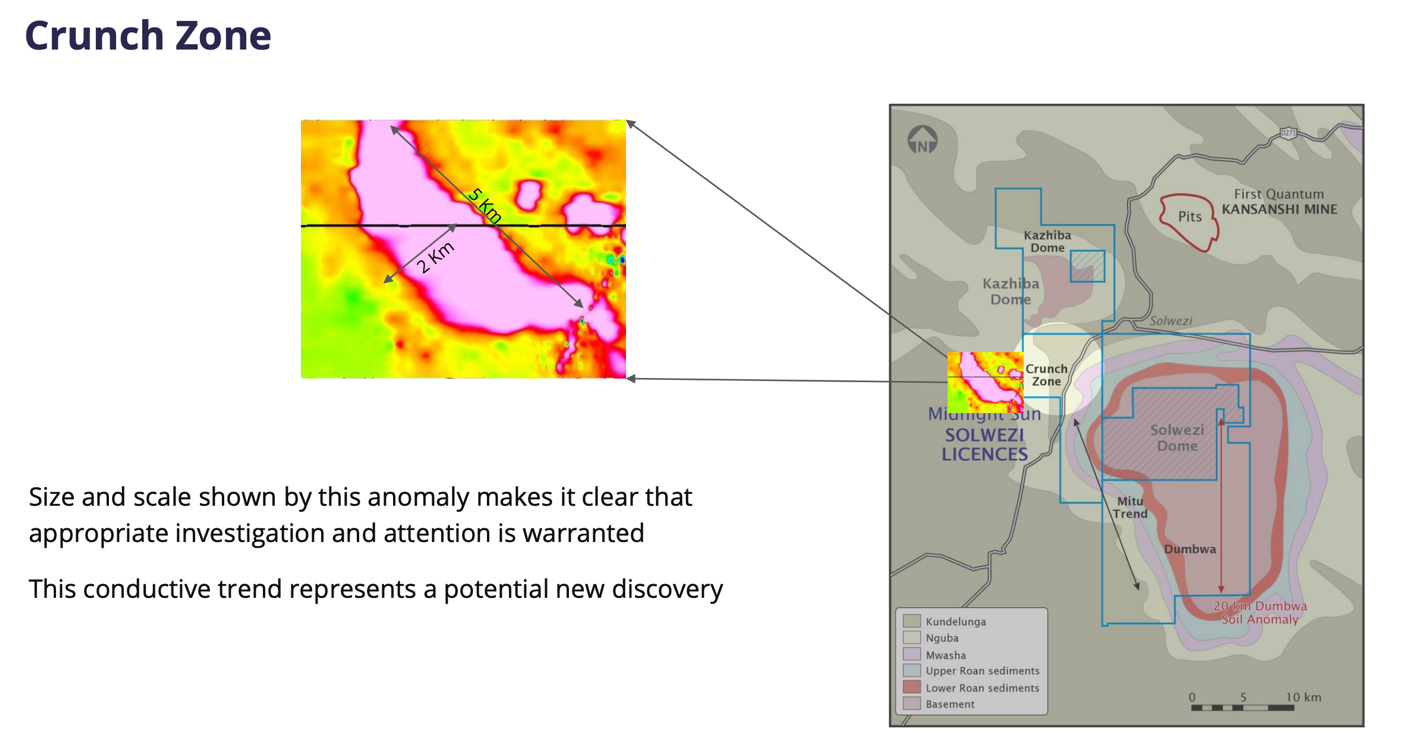

4. The Crunch zone is a new structural target where the team has identified a giant conductive target (image below).

It's two by five kilometers in size and is on the list of high-priority targets for the company.

Aside from the high-grade targets, the company aims to establish near-surface bulk-style resources. The company believes it can possibly outline over 50 million tonnes of oxide ore at 0.3% copper grade.

This is relatively low grade, but since it's located at a shallow depth (at surface), it is likely to be hosted in oxide rocks. This type of mineralization is usually cheap to mine and process.

The nearby Kansanshi Mine is currently processing oxide ore and set up to take advantage of a new source of material. This is an obvious strategic advantage for Midnight Sun and a potential source of revenue with little, if any, upfront capital cost.

Having a lot of targets is excellent, but the company isn't rushing to test them all at once. It's not cheap to drill multiple targets at the same time, which warrants having a more focused approach. The team aims to keep the share structure tight and only raise money judiciously.

This focused approach helped Midnight Sun Mining (TSXV:MMA, OTCQB: MDNGF) to keep its total share count at 117.9 million. The management and directors have skin in the game and hold approximately 10% of the shares.

There are also 20 million options and warrants.

That's an impressive share structure for a company that has been listed for over 15 years and has never done share consolidation. The management has been taking good care of its early investors.

Some of this success is also attributable to a joint venture with Rio Tinto, which funded over $10 million of exploration at the Solwezi Megaproject.

Rio Tinto shifted its focus to other assets and returned Solwezi to Midnight Sun with all the exploration data, saving Midnight Sun millions in drilling costs.

The company hired an independent consultant named Dr. Simon Dorling to assist it with the analysis of Rio Tinto's data. He is one of the best geologists when it comes to copper exploration. He reviewed Rio Tinto's work and confirmed that there is exploration potential at Solwezi's major targets.

These will be the focus of the team this exploration season.

And if any of the major mining companies step in and fund the exploration, it will be a big win for the shareholders. It would also be a major catalyst for the company.

More importantly, the company's share price follows the price of copper. During the last copper surge in late 2016, copper gained 29%.

At the same time, Midnight Sun's share price surged 361%.

In the past, the company's shares provided massive leverage to the underlying commodity.

Takeaway

We consider the shares of Midnight Sun Mining (TSXV:MMA, OTCQB: MDNGF) to be one of the best ways to get exposure to the price of copper.

The company's Solwezi Megaproject is surrounded by world-class copper mines, and it has the potential to turn into a massive project as well.

The metal itself has a robust long-term outlook. Copper prices are set for future gains, with a billion-pound deficit looming in the coming years.

The clean energy megatrend will provide strong support for copper.

The world's largest economies have already recognized copper as a critical mineral and released multi-billion funding initiatives. Major private investors such as Bill Gates are also getting exposure to copper.

It could be a wise decision to follow the "smart money" group and put Midnight Sun Mining (TSXV:MMA, OTCQB: MDNGF) on your watchlist.

SEE DISCLAIMER & DISCLOSURE BELOW

Sign up to receive our future articles and updates.

The Canadian Mining Report has been retained by Midnight Sun Mining Corp. to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by Midnight Sun Mining Corp. . and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in Midnight Sun Mining Corp. and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Sources

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient. Read More