Could Low PCE Inflation Take Gold to the Moon? / Commodities / Gold & Silver 2024

The PCE Index statisticswere released today, and you might wonder what impact they will have on theprice of gold.

Let’s dig in.

One might think that PCE is a criticaldriver of gold prices (and thus, you might be concerned with what the number isgoing to be), and there is some truth to it, but looking at how those reportshave indeed influenced gold price provides extra context to what might seemobvious.

Fed's Perspective

Oh, and why am I discussing thisparticular statistic? Because the Fed told us on numerous occasions that it’sthe statistic that they view as particularly important. Therefore, based onwhat the PCE numbers are going to be, investors might expect the Fed to cut (ornot) interest rates in the future. And since the markets are forward-looking,those expectations are likely to already drive price moves.

What might seem obvious is the following:

If inflation (as measured by the PCE) isbelow expectations, gold will go up significantly, and if inflation (PCE) isabove expectations, gold will go down significantly.

Seems to make sense, but let’s remainskeptical and let’s check.

The red lines mark the cases when PCE wasbelow expectations, and the green lines mark the cases when PCE was aboveexpectations.

What happened in reality?

PCE below expectations:

In 2 out of 6 cases, bullish implications

In 3 out of 6 cases, bearish implications

In 1 out of 6 cases, unclear expectations(late March 2023 – first a move up and then a bigger move down)

To sum up, PCE numbers below expectations had mostly bearish implications,even if the immediate-term or short-term reaction was bullish.

PCE above expectations:

In 1 out of 3 cases, bearish implications

In 2 out of 3 cases, bullish implications(one of them was rather unclear – in late April 2023, we first saw a short-termupswing and then a medium-term downswing)

To sum up, PCE numbers above expectations had mostly bullish implications, butit wasn’t particularly clear.

Overall, PCE is a rather weak indicationof the direction in which the gold market is about to move, and in general PCEbelow expectations tends to have bearish implications for gold and PCE aboveexpectations tends to have unclear or slightly bullish implications.

It’sa rather good indication that we likely have a turning point in gold right now,and it might be best to determine the direction in which gold is about to movebased on other factors.

After I sent out today’s early heads-upGold Trading Alert, in which I wrote about re-entering short positions in gold(with gold at about $2,347), gold moved slightly higher when PCE was releasedand now it’s turning south again.

Why did I do it? Because on a short-term basis gold already completed the rebound that was likely to happen. Gold reached its declining resistance lineand since this line helped to keep gold’s rally in check on June 20, it waslikely to do the same today. And that seems to have happened.

Of course, that was just a very short-term indication.

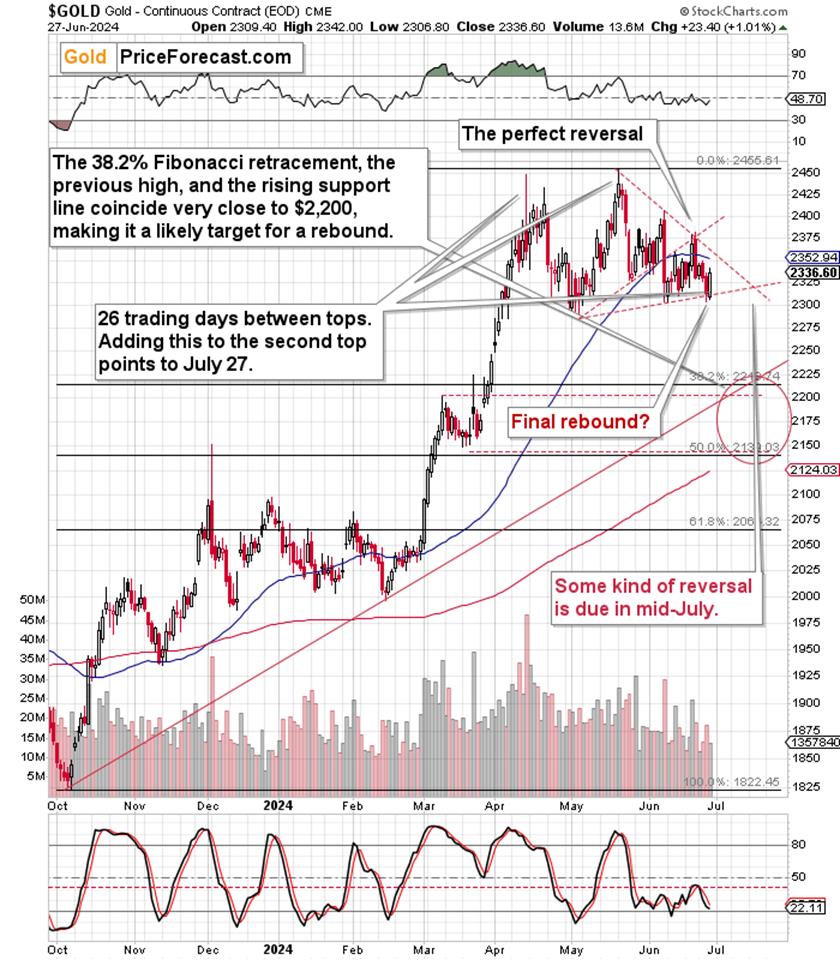

There are multiple techniques that pointto lower gold prices in the following weeks, and in today’s analysis, I’d liketo show you three that point to the $2,200 or its proximity as the next targetfor gold’s rebound.

These techniques are:

Expected Gold PriceMovement

How will gold deal withthis kind of support? Simple - it’s likely to bounce from there. This alsomeans that gold is likely to slide by about $150 from the current price levels,making this trading opportunity worthwhile.

Moreover, please note that gold’s nexttriangle-vertex-based turning point is due in mid-July. That’s where thesupport and resistance lines cross. Before dismissing this technique asridiculous, please note how perfectly it allowed us to time the entry for theprevious short position in gold.

This means that gold is likely to form some kind of reversal in mid-July. At this point, it’s notclear what kind of reversal it will be. We could see a quick (say, weekly)slide to $2,200 in gold soon, and then a rebound with a top in mid-July.However, a more conservative estimate would be to see the next short-termbottom in mid-July. We’ll see – we’ll know when gold moves to / below $2,200.

This kind of decline might seem big, but let’skeep in mind that based on the entire pattern, we’re likely looking at theearly stage of the move to $1,800 or so, which is what is in perfect tune withtwo monthly reversals that we saw in gold in April and May.

Depending on the way gold performs today,we might see a third monthly reversal in a row (if gold ends lower), but it’salso possible that we’ll see gold at similar price levels as it is right now orsomewhat higher. As long as it’s not ahuge rally, the bearish implications of the previous monthly reversals willremain intact.

Thank you for reading today's freeanalysis. If you'd like to get my analysis in its premium version, I encourageyou to subscribe to myGold Trading Alerts that feature all key trading details for the current opportunity. And if you're notyet on our free gold mailing list, I encourage you to signup today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.