China Takes the Long View on Gold-Silver... and So Should You / Commodities / Gold and Silver 2018

A cursory look at Chinese history can convince you thatChina should not be underestimated when it sets its sights on a particulargoal.

A cursory look at Chinese history can convince you thatChina should not be underestimated when it sets its sights on a particulargoal.

Even before Mao Zedong took over the reins in 1949, andthe first Five Year Plan began in 1953, centuries of history demonstrated thatlong-term planning, while not always meeting expectations, is a core behavioraltrait of the Chinese psyche.

And more often than not, it has enabled them to hit themark.

Expect eventual success for the One Belt, One RoadInitiative – the world's largest construction project, estimated to cost $80trillion dollars – linking the Asian mainland, (including Central Asia) withEurope via high speed rail, communications links and vibrant financial tradingplatforms.

And expect this project to be a major factor inbringing about what Doug Casey and others believe could become the greatestcommodities bull-run that most of us now living are going to see.

The petro-yuan. Agame-changer?

And oh, by the way, China recently officially launcheda petro-yuan contract at the Shanghai International Energy Exchange. It marksthe first time overseas investors have been able to access a Chinese commoditymarket – an oil futures contract – that can be settled, not only with U.S.dollars, but also Chinese Yuan, eventually a basket of currencies... and gold.

Asian Analyst, Pepe Escobar sees clearly where this isheading, saying:

As the yuan progressively reaches full consolidationin trade settlement, the petro-yuan threat to the US dollar, inscribed in acomplex, long-term process, will disseminate the Holy Grail: crude oil futurescontracts priced in yuan fully convertible into gold...

That means China’s vast array of trade partners willbe able to convert yuan into gold without having to keep funds in Chineseassets or turn them into US dollars... Still, the whole petrodollar edificelies on OPEC – and the House of Saud– pricing oil in US dollars; as everyoneneeds greenbacks to buy oil, everyone needs to buy (spiraling) US debt. Beijingis set to break the system – as long as it takes.

Meanwhile gold will continue rising to a level where atsome point, Beijing decides to set a conversion rate. When this "goldenmoment" arrives, the effects on global oil trade – and U.S. continuedsupremacy in this arena – will be profound. Mining Analyst, Byron King doesn'tmince any words about it. Says he,

China’s vast array of trade partners will be able toconvert yuan into gold without having to keep funds in Chinese assets or turnthem into U.S. dollars. It’s a straight-up way to bypass the buck. And what ifSaudi Arabia – among China’s largest oil suppliers – agrees to accept yuaninstead of dollars? It’ll be a bomb-down-the-funnel for U.S. dollar hegemony inthe world.

Gold-for-Oil isjust one element which will take precious metals to new all-time highs.

For the last several years, we've discussed many ofthese factors, about which readers can fully test their understanding byperusing scores of reports and essays archived here at https://www.moneymetals.com/news You can also find asteady stream of informative, relevant, actionable information on "TheSilver Guru" DavidMorgan's Blog.

Once this trend fully gets under way – sooner than mostexpect – the price you're looking at for physical gold (and silver with its 90%directional gold- correlation price movement) will quickly recede in therear-view mirror.

Here are just a few recent commentaries that shouldgive you a sense of the structural changes in these markets, making themincreasingly subject to explosive moves on the upside – without sending you aninvitation to board the train beforehand.

The bottom line is gold is nearing a major bullbreakout above $1365. That will turn psychology bullish and bring traders backin droves. Gold is rallying ever closer to new bull-market highs as evidencedby its massive multi-year ascending-triangle chart pattern now nearing abullish climax. Today gold is only a couple percent below that decisive breakout,which will finally blast it back onto the radars of investors. - Adam Hamilton, Zeal Speculation andInvestment

“We see a massive base building in gold. Massive. It’sa four-year, five-year base in gold. If we break above this resistance line,one can expect gold to go up by, like, a $1,000. . .” Doubleline CEO, JeffGundlach, the "Bond King"

"With the growth of high-end consumption and thedevelopment in second and third-tier cities, the Chinese market will show itssubstantial demand, mostly unexplored, for physical gold, as more and morepeople start to realize gold's stored and retaining values in the longterm." - Song Xin, China Gold Association, April 18, 2018.

So how should youconsider handling this situation?

Yes, we've been waiting "quite awhile" forthis trend to get underway, creating fireworks for metals' holders. And yes, afew people have become impatient, and actually sold back their metal – whichmay have taken years to accumulate. But just remember, it's less a question ofif, rather than when this all comes together.

Successful metals' owners who have prospered since thebeginning of the bull run in 2000, got there – and stayed onboard – byfollowing a few sensible rules.

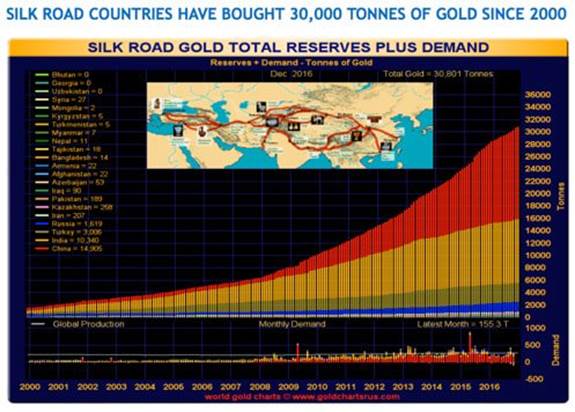

Doesthis look like an established trend? (Courtesy goldchartsrus.com)

They listen to the "experts" and payattention to big changes, like the Chinese yuan-for-oil event we'rediscussing here.

In addition, they look at what the charts tell them –that Asia continues to suck up gold and silver from the West like a proverbialvacuum cleaner. The Silk Road Gold TotalReserves Plus Demand chart nearby confirms this in spades. They touch basewith risk tolerance, taking stock of their financial capability to participate.And acquire metal on a regular basis (without going 'all in' at any particularprice point), regardless of that the price is doing that month.

They understand that profoundly positive things come tothose who are patient, have a plan... and who then act on it. So, ask yourselftoday, "Am I willing – like the Chinese – to persevere for 'as long as ittakes'"?

David Smith isSenior Analyst for TheMorganReport.com anda regular contributor to MoneyMetals.com.For the past 15 years, he has investigated precious metals’ mines andexploration sites in Argentina, Chile, Mexico, Bolivia, China, Canada, and theU.S. He shares his resource sector findings with readers, the media, and NorthAmerican investment conference attendees.

© 2018 David Smith - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.