Bitcoin, Gold, and Copper Paint a Coherent Picture / Commodities / Bitcoin

Bitcoin was heralded as the new gold.But the “old” gold ultimately managed to move above its 2021 highs, while the“new” gold didn’t.

Gold didn’t disappear; they both coexist,and they both have a strong anti-dollar vibe.

Questioning Bitcoin'sRally

But… Could it be the case thatbitcoin’s rally is over? It hasn’t moved to new highs after all, despitehalving, which was supposed to ignite a powerful move up. It seemed like a surebet, as it limits the supply of bitcoins. Instead, it triggered another attempt(!) to move to new highs – one that failed, too.

How come? Those who have been in themarkets for longer know this – it’s because “sure bets” are already discountedin the price before the event takes place.

Think about it. If you knew that a givenmarket was going to move higher, would you wait with your purchase or would youbuy now, before this certain move takes place? Of course, you’d buy now. And sowould everyone else. The rally would, therefore, happen before the actual event. And when the event finally does takeplace, the only thing that people can do is sell, because everyone thatconsidered buying, already bought. There’s nobody left to buy and keep pushingprices higher.

Of course, I’m exaggerating a bit to makea point. In reality, people can also wait, which is why the sure-bet events arenot immediately followed by crashes. They tend to happen after some time. Likewhen the SLV ETF was launched (that was a sure-bet event that was supposed totake silver to the moon) – silver price crashed, butnot immediately after the event (it happened shortly thereafter, though).

Bitcoin halving was a sure-bet event, sopeople bought it beforehand. Some late comers bought it after it happened, butbitcoin’s inability to move to new highs and hold those levels proves thatsomething’s not right.

Can bitcoin really fall? It’s been onlyrising with bigger or smaller corrections for many years… Let’s go back intime, about 25 years. Could internet stocks fall after such apowerful rally? Apparently, they could.

Bitcoin andGold's Correlated Tops

Why am I elaborating on the situationin bitcoin today? Because it has a specific tendency to top along with gold ora bit before gold tops.

I marked the recent tops in bitcoin, andI added goldprice to the chart. Bitcoin is in blue.

The late-2017 (bitcoin) and early-2018top in gold perfectly correspond to this pattern. The same goes for themid-2019 top. In case of the 2021 tops, the link is not as clear, but still wesaw tops in bitcoin along with tops in gold, and the former topped earlier.

Perhaps 2021 is special as it was THE topin bitcoin – the one that turned out to be unbroken (at least not successfully,without an invalidation of the breakout) for years.

The early-2022 tops in bitcoin and goldwere also aligned, but this time, gold formed its intraday top first. Still,bitcoin formed its final top before gold formed its final top, before sliding.

And this is where we are now: in a situationwhere bitcoin topped in March, and gold topped (in a double-pattern style, justlike in 2011) in May – about two months after bitcoin’s top.

Since bitcoin just failed to move to newhighs despite its sure-bet event, it seems that the top (a major one) in it isin. And since gold topped after that, just like it often does, it increases theodds that gold formed a major top as well.

But wait, there’s more!

Electricity is used to produce bitcoins,and copper is often involved as it’s the second-best conductor of electricity(silver is the best one). What about the link between bitcoin and copper?

As one would have expected, those marketsare also aligned, and they also top at the same time.

Interestingly, in late 2017 and in early2021, bitcoin topped slightly before copper did, and in late-2021, bitcointopped a bit later.

And what did we see in copper recently? Amassive, crystal-clear invalidation of the move to new highs. That’s anextremely strong sell signal for copper.

Given how aligned copper is with bitcoin,it’s quite likely that both markets are going to fall further – which doesn’tbode well for gold.

Moreover, gold and bitcoin areanti-dollar assets, and the U.S. dollar…

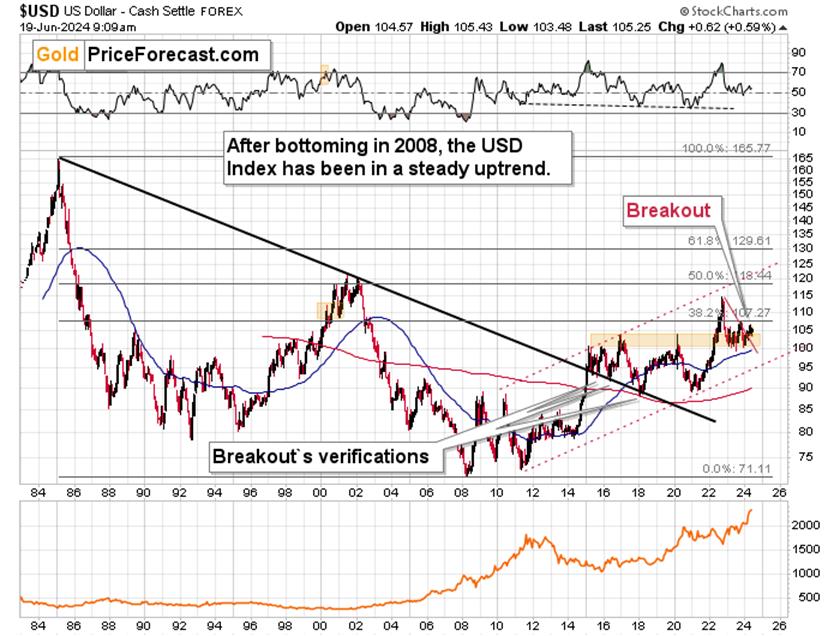

The U.S. dollar is after long-termbreakout, and a prolonged verification of this breakout. The breakout tookplace in 2015 and the consolidation ended in 2022, when the USDX soared abovethe 2016 and 2020 highs.

Based on the decline that we saw in 2023,the move above those highs (marked with orange rectangle) was verified. Whatused to be resistance, is now support.

This consolidation also appears to haveended, as the USD Index recently broke above the declining, medium-termresistance line (marked in red). This breakout was more than verified, and itseems that the door for rallies in the USD Index is wide open.

Soaring USD Index is – of course – afactor making the anti-dollar assets less appealing.This creates a great opportunity for those willing to think differently thanthe majority of the investment public.

Thank you for reading today's freeanalysis. If you'd like to get my analysis in its premium version, I encourageyou to subscribe to myGold Trading Alerts that feature all key trading details for the current opportunity. And if you're notyet on our free gold mailing list, I encourage you to signup today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.