A Tale of Two Precious Metal Bulls / Commodities / Gold & Silver 2020

This week gold priceshave smashed one record after another, well surpassing the previous high set in2011, of $1,920 an ounce.

At time of writing, spotgold’s last bid was $2,064.10.

The usual suspects arebehind the surge, ie., worrisome covid-19 infections, geopolitical concernsespecially US-China tensions over trade (PresidentTrump tried to force China-owned TikTok into selling its US operations) and theSouth China Sea, fears of inflation on the back of unlimited monetary stimulus,and low interest rates worldwide.

Bullion prices haveclimbed more than 30% year to date, as investors choose gold as a safe havenamid widespread economic uncertainty created by the pandemic. They believe goldwill hold its value better than other assets such as stocks and bonds.

How much higher can goldgo? Bank of America raised its 18-month target price to US$3,000 an ounce, dueto dovish central bank policies; Goldman Sachs analysts have their eye on$2,300, based on similar concerns over currency debasement. The influentialbank believes a weaker dollar will boost the purchasing power of major goldconsumers in emerging-market (EM) economies like China and India.

We wanted to know, whatcould send prices higher?

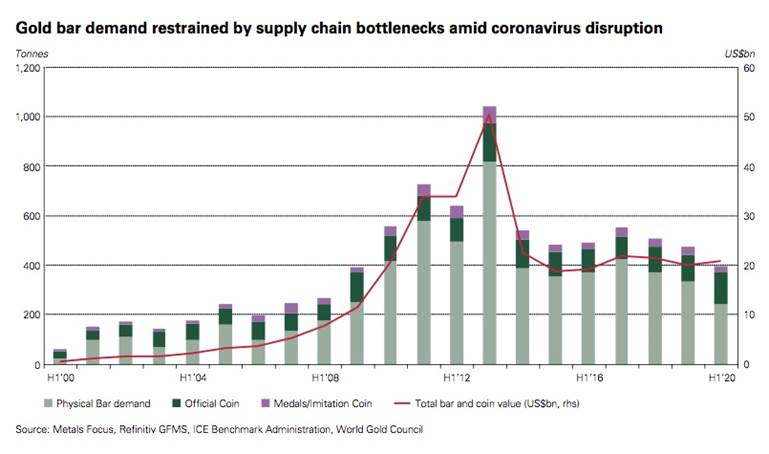

One factor that hasn’tbeen given much press, is the demand for physical bullion, ie. gold bars andcoins. Does a comparison of physical demand during gold’s 2011 run, to that ofthe current record-setting surge, tell us anything about future prices?

As a matter of fact, itdoes.

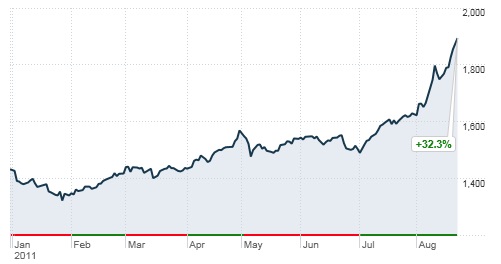

In 2011, gold pricesestablished a base of around $1,500 in April 2011, before climbing into the$1,800s in August, and briefly breaching $1,920 that month.

This year, prices basedthemselves at about $1,700, also in April, then began surging due to thecoronavirus and the economic fallout from it, including record-low bond yieldsand central bank monetary easing that has piled up US debt to record-highlevels. We know from previous articles that gold prices and debt to GDP ratiosstrongly correlate.

While investment demandfor gold in the first halves of both 2011 and 2020 was strong, propellingprices higher, the components of that demand were different.

In 2011, investmentdemand in the first quarter grew 26%, but fell 37% to 359.4 tonnes in Q2.Without covid-19 to contend with, the main factor driving gold investment inthe first half of 2011, was bar and coin sales, which shot up 52% in the firstquarter, and 9% in the second. The buying mostly took place in China, whichdoubled its demand to 90 tonnes.

Oddly, ETFs didn’t playmuch into investment demand in the buildup to $1,900 nine years ago. The firstquarter experienced net outflows of 56 tonnes, as investors took profits.

A price correction inJanuary 2011 prompted investors to buy the dip, with many choosing to do so bypurchasing gold bars and official gold coins like American Eagles.

In 2020, the pandemic hasbeen the main influence on the gold market, dragging down consumer demand forgold in the form of bars, coins and jewelry, but providing massive support forETF investments. Something interesting about the current gold run, is the factit has been able to set records despite the pandemic severely crimping physical demand.

In the first six monthsof this year, total investment demand for gold, including gold ETFs, bars andcoins, reached an all-time high of 1,130.7 tonnes, valued at a record $60billion.

“Many countries remainedunder lockdown restrictions in Q2,” the World Gold Council said. “This took itstoll on bar and coin demand, even as the gold price rallied, reachingsuccessive eight-year highs in U.S. dollar terms and breaking new records inmany other currencies.”

ETFs accelerated in Q2,taking H1 inflows to a record-breaking 734t.

On Monday, Aug. 3,worldwide gold-backed exchange-traded funds gained 3,365 tons, more gold than Germanyholds and second only to the US government, which holds 8,000 tons.

ETF strength has offsetweakness in other sectors.

As gold shops andrefineries were forced to either close or reduce staff/ hours, bar and coininvestment fell sharply in the second quarter of 2020, leading to a 17% declinein first-half demand to 396.9 tonnes - an 11-year low.

The World Gold Council report noted a divergence ininvestor behavior between East and West. Many gold holders in Asia and the Middledecided to sell their bullion and take profits whereas in Europe and NorthAmerica, bar and coin demand saw “substantial growth”.

In April, Bloomberg reportedthe coronavirus pandemic has frozenthe Chinese gold market, torpedoing demand at a time when investors elsewherein the world are clamoring for the safety of bullion.

China is the biggest buyer of goldbars, coins and jewelry, but the national shutdown to contain the virus hasemptied malls…

By contrast, in NorthAmerica and Europe, business was booming, despite the difficulty in securinggold products due to the closure of some mints and refineries.

In April, the managingdirector of BullionByPost, the UK’s largest online bullion trader, reported sales of goldcoins increasing five-fold. European investors amassed 137.4t of gold bars and coins in thefirst half of the year – the highest H1 total since 2010.

In the second quarter,bar and coin demand in the US more than quadrupled to 13.8t, resulting in anear- trebling of H1 demand to 29.3t.

For retail investors wantingto get their hands on some bullion, it doesn’t look like it’s going to get anyeasier. The US Mint has reportedly reduced the supply of gold and silver coins, as it takes measures to prevent thecoronavirus from spreading among its employees.

The agency saysproduction of all coinage, from loose change to commemorative/ investment coinsmade of gold, silver, platinum and palladium, will be affected for the next 12to 18 months.

Conclusion

It’s interesting toobserve the effects of the pandemic on gold markets. On the one hand, theuncertainty surrounding covid-19 and all of the economic fallout from it, hasdriven investors into the arms of gold like never before. There are recordinflows into gold-backed ETFs, seen by many investors as the best way to playthe rally.

On the other hand,government-imposed covid-19 restrictions have made it hard to buy physical gold- bars, coins and jewelry. In this way it is remarkable to see investmentdemand for gold surging, and record prices being recorded, despite a lot ofwould-be gold buyers simply unable to make a purchase.

Comparing the currentrally with the one in 2011 is instructive, in that it shows the pent-up demandfor physical gold. Consider: in the first half of 2011, bar and coin demand was673 tonnes. During the first half of 2020, bar and coin demand was 396 tonnes.In other words, demand for gold bars and coins in 2020’s run would have to increase another 8.90million ounces of gold, to match the amount of investment-grade physical gold demandedin the run-up to the last big gold run of 2011.

As countries continue torelax their coronavirus restrictions, we see a gradual return to physical buying,particularly in China and India, resulting in the next leg up for gold prices.

Could gold’s price climbanother US$1,000.00 to Bank of America’s US$3,000.00 target? Its my opinion,because of all the reasons listed above, gold’s bull run is going to continuefor a while yet, and that bodes well for AOTH’s gold focusedjuniors to continue their runs or be acquired by a major/mid-tier miner.

But what of silver? Silverhit US$50.00 an ounce when gold was US$1,900.00. Today with gold at + US$2,050.00,silver, despite a nice pop recently, is lagging golds last record-breaking runcurrently sitting at just US$28.61 anounce. Imo silvers got some serious running to do just to playcatch-up. If B of A’s call on $3,000.00 gold is right, my thinking is silver blowsright thru $50.00.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.