A New Day Has Dawned for Gold and Silver / Commodities / Gold & Silver 2020

Most resource sector writers (including me) have for a long timebeen "wrong" about gold and silver.

When they ran from $250 and $5 an ounce, respectively, to $1,920and $49 in 2011, those who listened, acted, and sold a bit did quite well. Weargued the "longer time bullish case" as these metals dropped intotheir final cyclical bear market graves in late 2015.

But that was then… and this is now.

What we DID get right was that when the Big Turn finally came,it would change directions so swiftly and violently that anyone waiting for"the bottom" would miss it, as rising premiums more than offsetdeclining prices.

Now in the first half of 2020 it seems that, like the brokenclock we're sometimes accused of being – we are gettingit right. Really right!

Speaking for my colleague David Morgan and myself, I can sayunreservedly that I don't intend to ride this bull down into another multi-yeartrough when it finally gives up the ghost – three, five or more years hence.

In fact, we feel so strongly about this that we wrote a book onhow to avoid doing just that, discussing how to employing every skill we'velearned to extract as much profit as possible. "How to Make – and Keep– Big Profits from the Coming Gold and Silver Shock-Wave" tilts theodds sharply in favor of anyone who acts upon its distilled wisdom.

Forcingthe Hoover Dam through a Garden Hose

Over the last few months, the tenor and strength of the metals'market has changed in a big way.

We're not going back to the corrosive experience that seemednormal in the last decade.

Expect gold and silver to moveirregularly higher in violent impulse moves, followed by broad sidewayscorrective action that stores energy for the next burst higher.

Doug Casey uses the analogy that the effect of buyers rushinginto gold and silver will be like trying to force the output of the Hoover Damthrough a garden hose.

Market sentiment has fundamentally changed. If you keep waitingand hoping for a return to last year's prices with low premiums and plentifulsupply, that's what you'll be doing... waiting and hoping.

A New Day for Gold and Silver Has Dawned!

The gold and silver markets have fundamentally changed. Plan tochange with it.

Expect bouts of amped up investment desire leading to recurrentshortages and steep premiums. To run with this trend, institute a regularprogram of adding to your holdings.

Nick Barisheff spells the math out this way, saying, "Globally,there are around $350T of financial assets - in stocks and bonds. If just 5%moved into gold, that would be $3.5T. But there's only around $1.5T of aboveground investible grade (London Good Delivery bars) gold totals! So,"Who you gonna' call?"

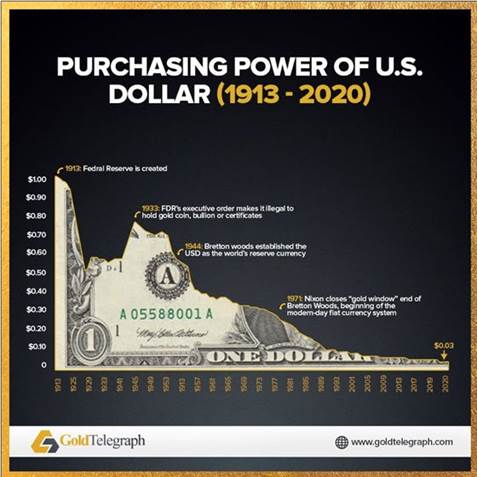

Holding justfiat currency offers "reward-free risk."

Don't do what I did in 1977.

In 1977, as a young man with limited financial savvy, I ranacross a few ounces of gold (at $165/ounce x 3 = $495) that I didn't rememberacquiring.

Of course the idea of having this kind of money and notspending it on something meant that the coins burned a hole in my pocket, so Ipromptly went to the local coin shop and exchanged them for some of thoseinfamous pieces of currency David Morgan has long referred to as "paperpromises."

I don't even remember how I spent the cash. Had I held it forjust another three years, its value would have tipped the scales at... $2,250!

The late Richard Russell, the most prolific and long-publishednewsletter writer of the modern area, once said: "Take your position ingold and gold shares and forget it. You don't buy and sell your life insurance,and I feel the same way about gold."

The Money Metals Coil Like a Crouching Tiger

Before it makes a big move, gold – and especially silver – likesto drop down, break obvious chart support lines cleaning out the weak hands,then quickly move to the upside. This coiling effect is like a crouching tiger.The release of energy is the pounce.

The chart below shows one of the most unusual, powerful andpredictive technical chart signals, especially in a market which is quiteliquid and seldom leaves gaps of any kind.

6-MonthSilver Chart, Courtesy Jack Chan

The "island reversal" happens when the price (in thiscase down) drops so quickly that no trading takes place, then reverses, anddoes the same thing in the other direction!

Usually these "islands" are of one or two daysduration. The SLV chart nearby created a one-week island. Prices that don't"fill" these gaps quickly can remain open for months or years,attesting to the coming move's potential power!

"Mr. Gold", Jim Sinclair, says:

The manipulators of papergold can temporarily do anything... (But) do you really believe that fiat paperwill maintain, and therefore store the value of what you have? Sorry, it simplywill not. As such GOLD is your savings account. End of story!

Jim Rickards gets it right:

Because it (The Fed) can’tstomach the consequences of withdrawing much of the stimulus it has injected,the Fed will be unable to defend the value of the U.S. dollar through interestrate hikes and balance sheet reductions. And by “dollar” I’m referring to itsexchange rate against real money: gold. This adds up to what’s likely to becomethe most bullish environment for investors in gold and silver in history... Youcan think of gold as a form of cash… but with a free option on higher pricesrelative to dollars.

If you haven't bought some (or enough) yet, start now. As itrises in value by several times, resist the temptation to let it "burn ahole in your pocket" too soon.

When you decide to sell a portion, hold some in reserve, perhapsindefinitely. After all, its greatest value is to be looked upon as insurance!

David Smith isSenior Analyst for TheMorganReport.com and a regular contributor to MoneyMetals.com aswell as the LODE Cryptographic Silver Monetary System Project. He hasinvestigated precious metals’ mines and exploration sites in Argentina, Chile,Peru, Mexico, Bolivia, China, Canada and the U.S. He shares resource sectorobservations withr eaders, the media and North American investment conferenceattendees.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.