A Massive Gold Bull Market Building / Commodities / Gold & Silver 2020

Imagine, if you will, there was nocoronavirus. No haz-mat suits, medical masks & gloves, no make-shiftmorgues. No terminally ill patients hooked up to ventilators, no horribledeaths without love ones close, no lockdowns, no social distancing, no desertedstreets, no bailouts, no emergency wage supplements, just a regular spring withbirds chirping and flowers blooming.

Of course there is no getting awayfrom the covid-19 pandemic that has slammed into populations and economies likea “God of chaos” comet. It seems to have permeated civilization, threateninglives, livelihoods, and the way we conduct ourselves professionally andsocially.

I’d just like to put it intoperspective, by looking back at where we were, before all this madness began.Because in the wise words of philosopher George Santayana, “Those who cannotremember the past are condemned to repeat it.”

It is tempting, while still in thethick of the pandemic, to don rose-colored glasses, but weeks before the onsetof covid-19, we were writing how things were not going as well as theyappeared, with the global economy.

And while it’s also tempting tobase gold’s current run on heavy demand for the world’s oldest safe haven, itis worth noting that, for all of 2019 and during the first two months of theyear, gold was reacting to events that had nothing to do with a global healthemergency.

In this article we are placing goldon a timeline that begins last summer, rolls into the present situation, andends with some bold predictions as to what the future could look like for gold,the grand-daddy of precious metals, and its little brother silver. Spoileralert:

We conclude that current economicconditions are forming an extremely solid foundation for a precious metals bullmarket that, imho, will last at minimum the length of the pandemic, and likelywell into the recovery.

Past

Our story begins with one-year pricecharts for gold and silver.

Both metals spiked last summerafter the US Federal Reserve began cutting interest rates. In July the Fedlowered rates three times before freezing the (benchmark) federal funds rate ata range of 1.5 - 1.75% in November. That, along with similarly dovish policiesamong other central banks, a record $17-trillion of negative-yielding sovereignbonds, and fresh safe haven demand due to tensions with Iran, and a lack ofprogress on trade talks, to name two key issues, powered the precious metals tonew heights. Gold reached $1,550 per ounce in September 2019, a level not seensince April 2013, and silver the same month hit a three-year high of$19/oz.

In December, North Americaninvestors were divided between those who believed the decade-long stock marketbull was going to keep running into the 2020s, and investors who, wary ofsomething terrible happening, were hoarding cash and gold. We described thispolarity of views in Gold vs cash in a crisis

In that article we predicted thenext crisis will be a debt crisis, based on the fact that worldwide, total debtincluding household, corporate and sovereign loans, in 2019 hit a record $250 trillion, led by the US and China.

The US national debt in Novembersurpassed $23 trillion. Driven by Congressional borrowing, it rose 5.6% up toQ3 2019, compared to the same period in 2018, against nominal GDP of just 3.7%.In other words, debt was outrunning economic growth.

Excess debt is a brake on aggregatedemand. Consider: over the last 13 years, global debt has increased by $128trillion, but GDP has only risen by $27 trillion. Ie. countries borrowed fivetimes more than their economies produced.

Wolfstreet asked a good question:

If the growth of the federal debtoutruns the economy during these fabulously good times, what will the debt dowhen the recession hits? When government tax receipts plunge and governmentexpenditures for unemployment and the like soar? The federal debt will jump by$2.5 trillion or more in a 12-month period. That’s what it will do.

Reading that question now, knowinghow badly two months of coronavirus has damaged the global economy, sends ashiver of fear up my spine.

Why? Because I know the answer. TheUS budget deficit this year is expected to reach nearly $4 trillion, afterCongress pumped about $2.5 trillion into the economy to stem the bleeding fromcoronavirus lockdowns.

The predicted $3.6 trillionspending shortfall amounts to 17.7% of GDP, nearly double the 2007-09 GreatRecession, when the deficit never reached even 10% of GDP. But guess what? Thegovernment doesn’t have the money; the gap will have to be bridged throughborrowing or printing money. No doubt much of it will be financed, pushing thenational debt to a new record high. According to usdebtclock.org, it has already reached $24.3 trillion.

Yet in February 2020, there appearedto be nothing wrong with the US economy.

Unemployment was at its lowest in50 years, wages in 2019 grew by 3.1%, and stock markets kept rollingalong.

Turns out much of this was “fakenews”. Marketwatch reported US companies cut back on investment last year, due toreduced exports and disruptions to the global economy from the US-China tradewar.

High US stock market performancemasked another economic indicator, that had fallen to its lowest level since2016 - the purchasing managers index.

The IHS Markit manufacturing PMI inJanuary fell to a three-month low - from 52.4 in December to 51.7;any reading below 50 indicates poor economic conditions.

This shows that, well before supplychain disruptions and industrial demand destruction owing to covid-19, USmanufacturing was slowing.

We said there would be moreinterest rate cuts, beyond the three last year, to deal with the looming threatof the coronavirus which in February was mostly confined to China.

In March the central bank obliged,first cutting the federal funds rate by half a percentage point, then slashingit by another full percentage point, taking the Fed’s benchmark for short-termlending down to near 0%.

We also pointed out the spreadbetween 2- and 10-year Treasury yields, which in February was the flattestsince November. A yield curve inversion, when short-term yields push higherthan long-term yields, is a predictable recession indicator. Right again. Thecovid crisis is threatening to spin the global economy into the steepest, andworst recession since World War II.

On March 9 the entire US yieldcurve fell below 1% for the first time ever. When real interest rates(interest rate minus inflation) “go negative” (ie. below 0%) investors usuallyflock to gold.

How was gold reacting to all ofthis bad economic news? On Feb. 24 gold’s price hit a fresh 7-year high of$1,659 an ounce, and silver rose to $18.61/oz.

Reports of the covid-19 outbreakimpacting economic growth forecasts, earnings and stock prices, had investorspiling into safe-haven assets - precious metals and US Treasuries - despite thelatter’s record-low yields.

“Investors have suddenly got coldfeet and are running for the exits,” Bloomberg quoted Chris Rupkey, chieffinancial economist for MUFG Union Bank. “Bond yields and stock prices are backin sync as the plunging markets mean the economic outlook is not looking asgood this year as many thought.”

Curiously, gold and the US dollarin February rose in tandem, veering from their normal pattern of moving inopposite directions.

“Gold and the dollar are going upfor the same reason,” Kitco quoted Daniel Pavilonis, senior commodities broker with RJO Futures.“There is a flight to quality in the dollar and a flight to quality in goldbecause of the coronavirus.”

The latter was reflected in hugeETF inflows in January and February.

In a research note Ole Hansen, the head of commodity strategy at Saxo Banksaid “With the metal moving higher, despite the mentioned headwinds from othermarkets, it is difficult to see what at this stage can halt or pause therally.”

However in March the gold rally did pause, in fact gold pricesexperienced major volatility alongside plunging stock markets, as the virusspread rapidly from China to South Korea, Iran and Italy.

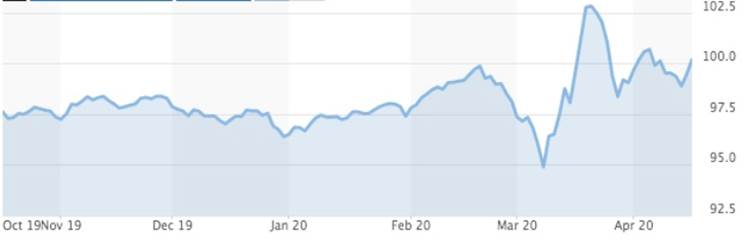

Seen in the 6-month gold chartbelow, within four days spot gold fell from $1,672 on Feb. 24 to $1,564,corresponding with the worst equities sell-off since 1987. The exception to thenormal inverse relationship between stock prices and gold prices was explainedby traders selling gold to cover massive losses in stocks.

A bounce to $1,674 was short-lived,with gold experiencing an even steeper downleg to $1,477 on March 18 - a 7-yearlow - before rising again to $1,660 on March 24.

As stock markets roiled, the USdollar index fell from 99.86 on Feb. 20 to 94.89 on March 9. Since then,continued flight to the US dollar and Treasuries has kept DXY close to100.

As we predicted, the Fed stepped into lower interest rates, twice within two weeks, while introducing a number ofstimulus measures aimed at keeping credit rolling through the financial system.A new round of quantitative easing, $700 billion in asset purchases, waschanged to “unlimited”. The Fed also announced a $300 billion credit programfor businesses and consumers. That was followed by a $2.3 trillion lendingprogram announced on April 6, whereby the Fed can purchase up to $600 billionin loans, buy downgraded corporate bonds, and purchase $500 billion in bondsfrom state and municipal governments.

At this juncture we pointed out thesimilarities and differences between the great bank bailout of 2008 and thecurrent covid-19 stimulus - the main difference being that in 2008-09, therewas no coronavirus to restrict consumer spending, which makes up around 70% ofUS GDP.

We stated: This, in our view, is the biggestrisk to the US economy, right now. How can the usual stimulus response of lowinterest rates and money-printing work, in an economy where citizens are tooscared to go out and spend? Could the lack of spending lead to deflation? Evena recession?

Again, our predictions were borneout.

A decline in consumer spending isthe canary in the coal mine for deflation.

We saw it happening as early asSeptember, 2019, when US retail sales fell for first time in seven months, as households slashed spending onbuilding materials, online purchases, and especially cars.

Three months later, sales atclothing stores declined the most since January 2009. And instead of going out andspending their hard-earned shekels, in 2019, many Americans were plowing theminto savings accounts.

Now, in the month since thecoronavirus lockdowns started in mid-March, an eye-popping 22 million Americanshave filed for unemployment benefits. With so many people sidelined from theworkforce, all that many households can afford are basic necessities, and forsome even that is a stretch.

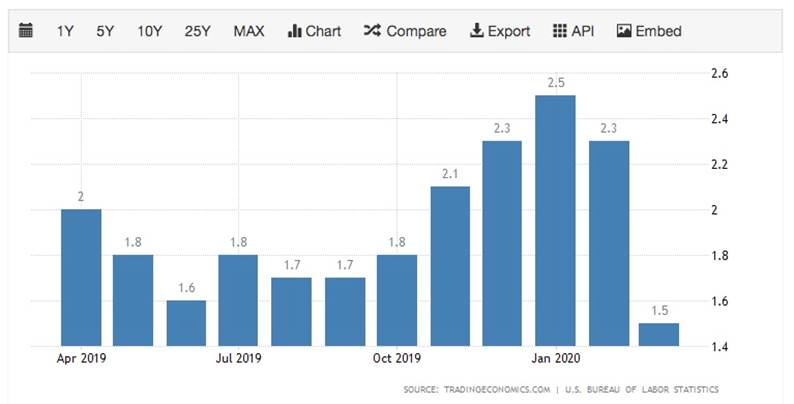

Their frozen spending is reflectedin falling prices, ie. deflation. In January US inflation was 2.5%, in February2.3%, and in March, when covid-19 hit the United States, inflation sunk to1.5%.

On April 14 Reuters reported that US import prices fell the most in five years, explainingthat,Restrictions on social movements to curb the spread of COVID-19 have greatlysuppressed demand, leading to slumping gasoline prices and record decreases inthe costs of hotel accommodation, apparel and airline ticket prices.

At the same time, the prospects ofa deep global recession and an oil price war between Russia and Saudi Arabia,which has since been resolved, have sent crude prices tumbling.

Present

The trends we identified asaffecting gold prior to coronavirus, are still in play, but the worseningeconomic fall-out has meant their effects are magnified, resulting in evenhigher gold prices. We are talking about low interest rates, quantitativeeasing, debt, GDP, declines in manufacturing and retail spending.

First, global GDP is anticipated toslide 3% this year, triple the slowdown in economic activity during the GreatRecession.

The forced closure of businessesacross the United States, and the sudden surge in unemployment, is expected to contract US GDP by 30%, at an annualized rate in thesecond quarter, and 5% overall in 2020.

That is huge.

In an earlier article we showed the close relationship between debt-to-GDP ratios andgold:

As the crisis continues to preventbusinesses from opening, and people from getting out from their homes andspending money in the economy again, GDP will continue to stagnate, orfall.

According to Bloomberg Economics’new GDP tracker, we were already in recession in March.

That’s the first part of a risingdebt-to-GDP ratio - a fall in GDP. The second part is an increase in debt. A Bloomberg article states the Federal Reserve is “poised tospray trillions of dollars” into the US economy:

Combined with an unlimitedquantitative easing program, the Fed’s souped-up lending facilities are set topush the central bank’s balance sheet up sharply from an already record high$4.7 trillion, with some analysts saying it could peak at $9-to-$10 trillion.

Wow. Consider what a $10 trillion Fedbalance sheet will do to the debt-to-GDP ratio. Already at 108%, a level notseen since World War II, it’s not inconceivable for the ratio to spike to$150%, or 200%. That would mean for every dollar the US economy produces, ithas to borrow $1.50, or $2.00. That’s insane.

As mentioned the US budget deficitthis year is expected to reach nearly $4 trillion, which amounts to 17.7% ofGDP. The deficit-to-GDP ratio didn’t even hit 10% during the financial crisis,and now predictions are it will double. According to Goldman Sachs, additional stimulus spending is likely, in the neighborhood of $500billion.

Meanwhile the US economy “patient”keeps getting sicker, despite the large doses of stimulus “medicine” beingadministered.

In March, US manufacturing output dropped the most in over 74 years (!) due to broken supply chainsowing to covid-19 business closures, layoffs and interruptions to normaloperations.

Reuters confirms what we notedearlier, that manufacturing was already struggling, due to the trade war withChina, well before the coronavirus landed on US shores.

Among the worst-hit sectors areoilfield services, like drilling and shaft exploration equipment, motor vehiclesand parts, which tumbled 28% last month, and construction supplies which fell5.8%.

Back in 2018 we predicted the deathof the shale gas boom by the early 2020s, due to the “Red Queen Syndrome”. Theproduction rate of shale gas wells falls off so quickly, it’s hard forproducers to get ahead - to keep production up, they have to keep adding wellsat a faster rate than previously. The Red Queen syndrome alludes to thecharacter in ‘Alice in Wonderland’ who famously declared that she had to runfaster and faster just to stay where she is.

A recent headline screamed, ‘Oil in the age of coronavirus: A U.S. shale bust like no other’

We could not of predicted thecoronavirus crashing shale oil, but we did correctly state that shale oilextraction is not a sustainable business model. For the past couple of years,poor returns have left producers scrambling to get financing.

Reuters explains:

The U.S. oil boom died on March 6,the day Saudi Arabia and Russia ended a four-year pact that curbed output andgave shale a price umbrella. Shale firms have accrued hefty debt during theyears of expansion, leaving them exposed to the price crash that followed.

As soon as oil prices dropped inMarch, to around $25 a barrel, these same producers faced well closures andeven more distress, with lenders refusing to grant them additional loans. Andwhile OPEC+ has agreed to reduce oil output by 9.7 million barrels of oil a day(Mbopd) - four times deeper than cuts made in 2008 - it is unlikely to offsetdemand for oil falling off a cliff. According to the IEA, global demand inApril will decline by 29 Mbopd, over one-quarter of the 100 million barrel aday daily demand figure for 2019 - the biggest drop in 25 years.

So despite Donald Trump heraldingthe recent truce between Russia and Saudi Arabia over crude oil supply cuts,“saving hundreds of thousands of US oil jobs,” they will in fact do nothing tosave US shale oil. Shale prices have dropped so low, they are below productioncosts; some producers are concerned they may not even be able to sell theirproduct. Pipeline operators are asking for proof that sellers have buyers fortheir oil, before connecting new and existing wells, so as not to add to theglut - by mid-May, storage facilities are expected to be full.

Consulting firm Rystad Energy predictsclose to 240,000 oil-related jobs will be lost this year - about one-third ofthe onshore and offshore workforce.

Beyond manufacturing and oil, US retail sales are collapsing. With over 22 million Americansthrown out of work and confined to their homes, retail fell 8.7% in March, thebiggest decline since the government started tracking it in 1992.

Auto sales crashed 25%, clothingsales were down 50%, furniture sales receipts plummeted 26% and spending atelectronics and appliance stores dipped 15%.

Economists forecast consumerspending will plunge at an annualized rate of at least 17% in the first quarter,the weakest performance since record-keeping started in 1947.

The worse the economic performance,the better it is for gold.

On April 14 spot gold hit a 7-yearhigh of $1,718 an ounce, due to concerns over global growth, and as a wave offiscal and monetary measures steered investors towards precious metals and awayfrom assets denominated in paper currencies.

“The flood of new money digitallyprinted by the central banks and huge debt pile by the states to fight thenegative impact of the coronavirus (are) helping gold,” said Commerzbank analyst Carsten Fritsch.

Holdings in the world’s largestgold-backed ETF, SPDR Gold Trust, surged to 1,009 tonnes Monday, the most sinceJune 2013.

The longer stimulus measurescontinue, including a creeping expansion of the Fed’s balance sheet and negative real interest rates (interest rates minus inflation)which are always bullish for gold, we see no reason to doubt that gold willkeep climbing.

In a recent column, Frank Holmes, CEO of US Global Investors, mentions a Bloombergcommodity strategist who observes that the price of gold appears to be seeking to revert to itslong-term mean relative to the S&P 500 Index. This would suggest that wecould see a new record high, driven largely by excessive money printing. (currentlyequal to US$2,800.00 gold – Rick)

“Unprecedented global monetarystimulus is a worthy catalyst for the per-ounce price of gold to revert to itslong-term mean vs. the S&P 500 Index, in our view,” McGlone explains.

On the supply side, gold’sfundamentals are bullish. Gold output peaked in 2018 at 3,503 tonnes, in 2019it fell to 3,463t - the first annual decline in 10 years. We believe it willcontinue to drop further, owing to continued depletion of the major producers’ reserves, the lack of new discoveries toreplace them, and production problems due to lower grades and temporary, possiblyprolonged, stoppages because of the coronavirus.

Regarding the latter, it was interestingto see mines in Quebec being deemed an essential service. Closed since March 23 due tocovid-19, Quebec’s premier said Monday the province will be allowed to resumemining on April 15. The good news prompted a number of Quebec gold miners toannounce plans to re-start operations, including Agnico-Eagle’s and YamanaGold's Canadian Malarctic open-pit mine, the La Ronde Complex and Goldex mine,Iamgold’s Westwood mine, and Eldorado Gold’s Lamaque operation.

Exploration, however, is on holduntil May 4.

Holmes notes gold and gold stocks areamong the highest-performing assets of 2020, with physical gold up about 13.8%through April 10, and senior gold miners advancing 2.8%.

In fact gold bars and coins are noteasy to come by. The US Mint reportedly sold over 56,000 one-ounce American Eagle goldbullion coins in the first two weeks of April - a volume 465% higher than allof April, 2019. The mad scramble for gold & silver amid the coronaviruspandemic is not likely to let up anytime soon; recently the Mint decided totemporarily halt production at its West Point, New York facility due to therisk to employees from covid-19.

The current gold-silver ratio, 111:1,is double the historical ratio of 54:1, meaning silver is more than on sale,it’s being given away. As we wrote in Hi-yo Silver Away! silver is expected to do well in 2020 through acombination of higher industrial and investment demand, and tightened supplyowing to mine production issues and output cuts.

Future

Like most people in mining, we knowthe ups and downs of the resource sector are nothing new; in fact they leave usuniquely qualified to deal with a black swan event like a global pandemic, thatsinks all boats.

We are optimistic about the future,but realistic. At this point, a V-shaped recovery looks unlikely. Some marketobservers think it will be more like a long fat U, with recovery slow andgradual, a return to some semblance of normal measured in years, notmonths.

According to JP Morgan, global GDP will slump 14% in the second half of 2020.In the United States, that could mean 25 million layoffs - as it currentlystands, 13% of the US workforce has been idled.

Just as bad, is how theeconomy-killing pandemic will impact corporate bottom lines; Morgan expectsglobal profits to plunge by 70% in Q2 2020. And they won’t be coming back forawhile. The investment bank predicts that even after rebounding from covid-19,global profits will be stuck 20% below their pre-virus levels at the end of2021. It may take another year or two after that, just to reach pre-pandemicbaseline financials.

If these awful predictions provecorrect, we may be looking at prolonged unemployment, rising corporate debt,and a moribund stock market until 2022-23. We realize that’s not what anyonewants to hear right now.

Eddie Hobbs, a columnist at the IrishExaminer, has some more pain points for you to think about.

First, he says there are threephases to this recovery - medical, financial markets and the real economy.Currently we are in the first phase, characterized by the pandemic onset andthe first countermeasures. As for what comes next, The deluge from the fractures willfollow. Capitulation will mark the bottom before recovery… There is no going back to the oldeconomy, this is going to be deeper and longer than before.

On the way, Hobbs expectsvulnerable countries to go bust, with at least one OECD country needing abailout. Economies with a lot of dollar-denominated debt could be hurt bad, asthe US dollar - still the reserve currency despite all the US economy’s, andits political leaders’ shortcomings - maintains strength against othercurrencies.

With so many unemployed, taxrevenues will collapse, leading to further rounds of quantitative easing tobail out local and state/ provincial governments. Here in British Columbia, theCity of Vancouver, highly overleveraged, teeters on bankruptcy and is alreadyasking for a handout.

With no vaccine in sight, andcovid-19 curves refusing to flatten, national health care systems could temporarilycollapse. Hobbs writes, The delay will have grim outcomes for tourism, airlines, sportsand other mass gathering events, those who survive will mop up, includingGovernments who nationalize flag carriers…

The very severe and sharp stop inlarge parts of the economy is likely to see economic activity plummet by afifth over Q1 and Q2 2020 with the potential to drag into H2. At best 2021 willsee sluggish growth, at worst further deflation. Each deflationary test will bemet by an air fleet of Keynesian, counter cyclical monetary and fiscal carpetbombing.

Unemployment will rise sharply toswamp a fifth of workforces and despite social welfare buffers and fiscalprogrammes such as tax suspensions, utility holidays and loan suspensions,consumer savings will deplete to service core lifestyle costs. This will leadto a severe weakening of consumer spending power on the other side untilsavings are replenished.

There will be negative priceexpectations due to the fall in demand for discretionary items. This willaffect many prices, including property. The decline in oil prices is a consumerbuffer, but hurtful to hydrocarbon producing economies and to national taxrevenues.

Overleveraged corporates andinstitutions without the cash buffers to withstand the cliff fall in economicactivity, especially in consumer discretionary, retail, transport, airlines,hospitality, etc., will become casualties. This means a slew of distressedsales, bankruptcies, administrations and takeovers as the weak are consumed bythe strong and flagships get nationalized where there is market failure.

The banking system, despiteliquidity operations becomes unsafe leading to problems at inter-bank level andwill require fresh emergency quantitive easing operations to prevent gummingup.

Not all banks will escape, thespike in non-performing loans will hit weaker balance sheets a blow that willlead to defaults and contagion and, if not rapidly contained, led to banksshutting for a spell during restructuring.

Only banks deemed of systemicimportance will be socialized, others will be subject to bondholder and depositholder haircuts.

After the deflationary shockcreated by the [Great Pandemic Crisis], it is difficult to see how a prolongedphase of high inflation will not eventually emerge from money expansion andrising velocity which will test the fundamental value of fiat currencies. Inthis climate the value of currency becomes a casualty and gold a king.

And that’s for the G20 countries.For poorer nations lacking the medical supplies, facilities, health careworkers, and whose economies do not have the monetary or fiscal resourcesneeded to ride out a global pandemic, the outcome could be dire.

CBC notes reports that civil unrest in Iraq, following the loss of oilrevenues, may be an indicator of wider economic and political fallout.

[Bessma Momani, a specialist ininternational financial institutions at Ontario's University of Waterloo] saysthe world's poorest people, not just in South Asia, sub-Saharan Africa andSouth America but in U.S. inner cities, too, will suffer the most, and in waysthat could lead to revolts. Places such as Venezuela, already chaotic, maycollapse into something worse.

The economist quoted by CBC notesthe IMF is not equipped to help so many countries likely to be swamped bycovid-19.

However, we are pleased to see thatfinance officials from the G20 have seen this coming. On Wednesday, they suspended debt service payments for the world’s poorest countriesthrough to the end of the year.

Looking into our own crystal ball,we predict lasting friction between the United States and China will continueto impede trade flows. With China now blaming the United States for thepandemic, suggesting it was carried to Wuhan by US Military athletes, and thetwo nations sparring over funding the World Health Organization, it’s hard toimagine trade negotiators sitting down anytime soon to hammer out a deal.

Also, we were fairly well convincedthat covid-19 originated in a Wuhan “wet market” and jumped from animal tohuman but now we’re not so sure. Recently Dr. Anthony Fauci, the US topinfectious disease specialist, claimed that the US was given inaccurate information about the coronavirus, “from the beginning.”

China recorded the first human tohuman transmission as early as December, but it didn’t tell anyone. Instead,Chinese officials stuck to their story that the disease was still in the“animal to human” phase. Had they given an earlier heads-up that the virus wasspreading between people, and could easily morph into a pandemic, countriescould have started preparing for it.

“Now we know retrospectively thatthere was ongoing transmission from human to human in China, probably at leasta few weeks before then,” Dr. Fauci said.

Moreover, it’s now come to lightthat the State Department raised concerns over safety issues at the Wuhanresearch lab studying coronaviruses in animals two years ago.

In 2018 diplomats said there wereissues at the Wuhan Institute of Virology, located near the seafood marketChinese authorities claim the virus emerged from, cables obtained by the Washington Post reveal…

A US delegation led by JamisonFouss, consul general in Wuhan, and Rick Switzer, the Beijing embassy’scounselor of environment, science, technology and health, visited the Wuhanlevel four biosafety lab multiple times from January to March 2018.

They voiced concern over a lack ofsafety protocols and the biosafety of the lab's research on coronavirus inanimals like bats and warned that if cautionary steps weren't taken, the lab'sresearch could spark a SARS-like outbreak.

One of the conspiracy theoriesaround covid-19 is that it began in a research lab then was either purposely oraccidentally leaked. Scientists have disputed that the virus originated in alab, arguing it mutated naturally, but now we are not so sure…

One thing we are sure about is China taking fulladvantage of the pandemic, to advance its own interests, economically,strategically and militarily.

When faced with the risk ofmillions of Chinese infecting the world with covid-19, the Chinese leadershipchose to hide the rapidly worsening epidemic. Given the choice of admittingthey had a huge problem, they instead suppressed information, including to thebody supposed to be in front of these things, the World Health Organization,cracked down on whistleblowers, “disappeared” dissenters, and is nowrestricting the publication of academic research on the origins of thevirus.

The fact that China is now tryingto sweep all that under the carpet and present itself as the covid-19 FlorenceNightingale, sending medical supplies to Canada, countries in Europe and theMiddle East, while flaunting its “Health Silk Road”, is frankly sickening. Evenmore so considering that the countries it is helping are the ones China sees asvulnerable to its influence - like Italy, Serbia, and all the countries thathave signed onto its Belt and Road Initiative.

For some eye-opening insights aboutChina's culpability, read Is it time to expel China from the world community?

We have also written extensively onthe Chinese Military’s maneuvers in the South China Sea and Strait of Taiwan.One would think these take a back seat to pandemic countermeasures but we arereading reports of Chinese activity in the region ramping up.

Zero Hedge reported, Days after China conducted a military drill with fighter jetsand an aircraft carrier near Taiwan, the US Air Force conducted its own 'showof force' demonstrating defense readiness with an 'elephant walk' of bombers onAnderson Air Force Base in Guam on Monday.

Is it a coincidence this ishappening during a time when the United States is in the throes of thepandemic, and several thousand American sailors on the USS Theodore Roosevelt,an aircraft carrier docked in Guam, had to leave the ship because it was hitwith an outbreak of coronavirus? We think not.

It seems pretty clear to us, thatthe People’s Liberation Army thought it was a fine time to show the Americanswho’s boss, in a region it considers economically and strategically important.Zero Hedge and CNN agree:

“A Chinese naval flotilla headedinto the Pacific over the weekend, evidence that the People's Liberation ArmyNavy has done a much better job controlling coronavirus than the US Navy,according to a story posted on the PLA's English-language website,” CNN reported, citing PLAEnglish-language media.

The opportunity to show strengthagainst the US wasn’t lost on another Asian nemesis, North Korea. The reclusivedictatorship marked the birthday of its founder, Kim Il Sung, by conductingmultiple cruise missile launches.

Conclusion

Precious metals are among the bestplaces to park your money in times of economic or political distress.

Gold and silver offer stabilityduring a period of extreme stock market volatility and low bond yields.

It is also, in my opinion, a smartstrategy to allocate a portion of gold and silver to your investment portfolio,knowing that precious metals can be used as a “fail-safe” currency in the eventof a total financial collapse.

The value of gold is not so much inits price, but its rock-solid value.

Investors love gold because ittends to hold its value through time. They see gold as a way to preserve theirwealth, unlike fiat currencies which are subject to inflationary pressures andover time, lose their value.

The precious metal is also boughtas a hedge against what investors see as government policies that createinflation - such as the quantitative easing programs currently being imposed bycentral banks as a way of stimulating economies shocked by the covid-19pandemic.

Silver has some of the sameproperties as gold, making it suitable for artwork, jewelry, and as a medium ofexchange in silver coins and bars.

But unlike gold, silver has manymore industrial applications - almost as many as oil. The precious metal isstrong, malleable and conducts heat and electricity better than any othermaterial.

Over 50% of silver demand comesfrom industrial uses like solar panels, electronics and the automotiveindustry.

When gold is over-valued comparedto silver, investors take advantage of the arbitrage opportunity, by sellingsome of their gold holdings to buy silver. The opposite occurs when silver isover-valued compared to gold.

On June 12, 2019, the gold-silver ratio hit a 26-year high by breaking through the 90-ouncemark - meaning it took over 90 ounces of silver to purchase one ounce of gold.The higher the number, the more undervalued is silver or, to put it anotherway, the farther gold is pulling away from silver, valued in dollars perounce.

The current gold-silver ratio,111:1, is twice the historical ratio of 50-60 ounces of silver to one ounce ofgold, meaning that silver is highly undervalued compared to gold. It means aninvestor with an ounce of gold could sell it for 111 ounces of silver.

The coronavirus has lit a fireunder gold prices, which have burned past $1,700 an ounce. All the bullishfactors for gold are in place: a “black swan” event that has created huge fearand uncertainty, imploding global stocks and sending traders/ investorsflocking to the safety of havens like the US dollar, US Treasuries and preciousmetals. The demand for Treasuries has pushed up their prices, causing theiryields to fall to new lows. Negative real yields (yields minus inflation) arebullish for gold, and we expect yields to remain negative for some time, evenif prices are beginning to deflate.

And then there’s debt. We’ve beenable to draw a very straight line between debt-to-GDP ratios and gold prices.Gold rises proportionally to debt. As long as governments are wrangling thecoronavirus, we fully expect national debt piles to keep growing. Indeed thepolitical pressure on governments to help the most vulnerable in society, forfear not only of losing power, but in some countries, extreme social unrest, isbound to keep the stimulus taps gushing.

Consider what a $10 trillion Fedbalance sheet will do to the debt-to-GDP ratio. Consider what it will do forgold!

Despite broad-based marketvolatility, now is an unbelievably good time to be investing in preciousmetals. The $1,700 per ounce question is, how?

Buying physical gold probably won’thurt you, but high prices do not make an attractive entry point and we don’tsee a significant pullback happening anytime soon.

Historically, and especially sotoday, for all the reasons to like gold, the greatest leverage to risingprecious metals prices has been owning the shares of junior resource companiesfocused on acquiring, discovering and developing precious metals deposits.

Importantly, juniors are acost-effective answer to the problem of gold reserves depletion. Because goldreserves are being used up faster than they are being replenished, it behoovesthe industry to come up with a strategy for reversing this trend – one thatdoesn't involve high-grading the best ore, which diminishes the value of thedeposit - and M&A. Do you want to own the cheapest gold and silver you can find toreap the maximum coming rewards? If you do, buy it while it’s still in theground.

We spend a lot of time scouring themarket for highly prospective juniors that can earn us a tidy profit. We wanttight share structures, cash in the bank, experienced management with a proventrack record, and as much potential ounces in the ground as possible.

This weekend, in our free weeklySaturday newsletter, we will feature some of the stocks that are doing verywell for us, and will, imo, continue to do well during the covid crisis andbeyond.

Sign up below, check your inbox onSaturday,.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.