Who Are the Top Rough-Diamond Buyers?

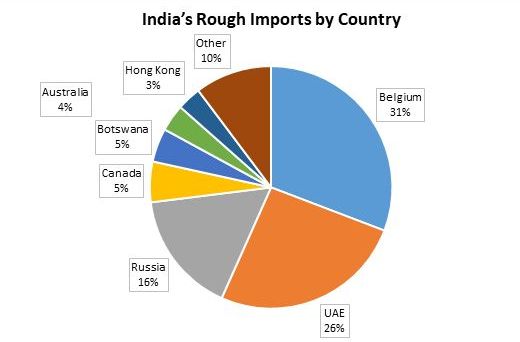

RAPAPORT... Much has been said about the journey a diamond takes frommine to market, particularly as the industry is increasing its provenanceclaims and tracking goods along the pipeline. While an estimated 80% to 90% ofdiamonds are cut and polished in India, they're typically not sent directlyfrom the mining centers to the factories.Rather, they stop in the trading centers along the way,with a large proportion of goods being sent to both Antwerp and Dubai beforereaching Surat for manufacturing. That marks a notable change in the diamond journey fromless than 10 years ago. Back then, for example, De Beers sent its productionfrom its mines in Botswana, South Africa, Namibia and Canada to London forsorting and sales. The goods were then shipped to Antwerp and traded before transportationto the factories, with the average rough diamond changing hands four or fivetimes before being cut and polished, one dealer told Rapaport News.After De Beers moved its sorting operations and sightlocation to Gaborone in 2013, the journey changed course, with Botswanaemerging as an important rough sales center. At the same time, some traders movedto Dubai due to tax and banking difficulties in Antwerp.Antwerp still remains the most important rough tradinghub, and has maintained its critical mass of rough activity, as noted in theMay issue of the Rapaport Research Report. An estimated 84% of all roughpasses through Antwerp, with many of the smaller and medium-size miners holdingauctions there. But Dubai has emerged as the second largest rough tradingcenter in recent years.Goods from both centers are largely then passed on toIndia, with Belgium accounting for some 31% of India's rough supply in fiscal2017, and the UAE contributing 26% of the total (see chart below).Approximately one-third of India's supply was sent directly from the miningcenters.

RAPAPORT... Much has been said about the journey a diamond takes frommine to market, particularly as the industry is increasing its provenanceclaims and tracking goods along the pipeline. While an estimated 80% to 90% ofdiamonds are cut and polished in India, they're typically not sent directlyfrom the mining centers to the factories.Rather, they stop in the trading centers along the way,with a large proportion of goods being sent to both Antwerp and Dubai beforereaching Surat for manufacturing. That marks a notable change in the diamond journey fromless than 10 years ago. Back then, for example, De Beers sent its productionfrom its mines in Botswana, South Africa, Namibia and Canada to London forsorting and sales. The goods were then shipped to Antwerp and traded before transportationto the factories, with the average rough diamond changing hands four or fivetimes before being cut and polished, one dealer told Rapaport News.After De Beers moved its sorting operations and sightlocation to Gaborone in 2013, the journey changed course, with Botswanaemerging as an important rough sales center. At the same time, some traders movedto Dubai due to tax and banking difficulties in Antwerp.Antwerp still remains the most important rough tradinghub, and has maintained its critical mass of rough activity, as noted in theMay issue of the Rapaport Research Report. An estimated 84% of all roughpasses through Antwerp, with many of the smaller and medium-size miners holdingauctions there. But Dubai has emerged as the second largest rough tradingcenter in recent years.Goods from both centers are largely then passed on toIndia, with Belgium accounting for some 31% of India's rough supply in fiscal2017, and the UAE contributing 26% of the total (see chart below).Approximately one-third of India's supply was sent directly from the miningcenters. Based on data from India'sCommerce Ministry. Russia and Botswana are naturally among the largestsources of rough supply to India and Belgium, given that they're the locationof Alrosa and De Beers sales, respectively. Who's buying production? These trends are evident in the locations of the majorbuyers of rough diamonds, as presented in the following pages of this report. Below,we list the companies that have long-term contracts or preferential supply agreementswith the top miners. Not all diamond mining companies have the scale ofproduction to provide the consistency of supply that the large manufacturersrequire for continuity in their operations. Manufacturers also need guaranteesto ensure polished supply to their jewelry wholesale and retail clients, whooften run programs with specific needs. Most junior and midsize miners sell via spot auctions ortenders, whereby buyers compete for rough in a bidding process. Only De Beers,Alrosa, Rio Tinto and Dominion Diamond Mines - which account for anestimated 70% of global supply volume - have the scale of production thatenables them to guarantee a scheduled, consistent supply of rough to a setgroup of clients.Between them, they're supplying 124 diamond companies, manyof which are buying from multiple sources. Among those companies, 41 areheadquartered in India, 38 in Belgium, followed by Israel with 15, seven ineach of Russia and the US, and six based in Hong Kong. Other locations include South Africa, Namibia and Switzerland. De Beers sells an estimated 90% of its production throughits long-term contracts with sightholders, with the current contract set to endin March 2019.The remaining 10% is soldat its auctions. The company has 67 global sightholders, 17 in Botswana, six inSouth Africa, nine in Namibia, one in Canada and three receiving industrialrough supply. Sightholders in southern Africa have to manufacture the majorityof their supply in those countries. De Beers also makes available any excesssupply - known as ex-plan - to 14 accredited buyers across its varioussights.Alrosa sells about 70% of its production throughlong-term contracts in its Alrosa Alliance program. It has 55 companies on theprogram and nine "Other" Alliance members who are candidates to becomecontracted buyers and can use any Alrosa branding in their own marketing.Along with the 18 Rio Tinto Select Diamantaires and 26companies buying from Dominion on a consistent basis, these manufacturersrepresent the premium buyers of rough on the market. How they buy and traderough and sell the resulting polished sets the tone of the diamond market, anddetermines the path along which the diamond takes in its journey along thepipeline.

Based on data from India'sCommerce Ministry. Russia and Botswana are naturally among the largestsources of rough supply to India and Belgium, given that they're the locationof Alrosa and De Beers sales, respectively. Who's buying production? These trends are evident in the locations of the majorbuyers of rough diamonds, as presented in the following pages of this report. Below,we list the companies that have long-term contracts or preferential supply agreementswith the top miners. Not all diamond mining companies have the scale ofproduction to provide the consistency of supply that the large manufacturersrequire for continuity in their operations. Manufacturers also need guaranteesto ensure polished supply to their jewelry wholesale and retail clients, whooften run programs with specific needs. Most junior and midsize miners sell via spot auctions ortenders, whereby buyers compete for rough in a bidding process. Only De Beers,Alrosa, Rio Tinto and Dominion Diamond Mines - which account for anestimated 70% of global supply volume - have the scale of production thatenables them to guarantee a scheduled, consistent supply of rough to a setgroup of clients.Between them, they're supplying 124 diamond companies, manyof which are buying from multiple sources. Among those companies, 41 areheadquartered in India, 38 in Belgium, followed by Israel with 15, seven ineach of Russia and the US, and six based in Hong Kong. Other locations include South Africa, Namibia and Switzerland. De Beers sells an estimated 90% of its production throughits long-term contracts with sightholders, with the current contract set to endin March 2019.The remaining 10% is soldat its auctions. The company has 67 global sightholders, 17 in Botswana, six inSouth Africa, nine in Namibia, one in Canada and three receiving industrialrough supply. Sightholders in southern Africa have to manufacture the majorityof their supply in those countries. De Beers also makes available any excesssupply - known as ex-plan - to 14 accredited buyers across its varioussights.Alrosa sells about 70% of its production throughlong-term contracts in its Alrosa Alliance program. It has 55 companies on theprogram and nine "Other" Alliance members who are candidates to becomecontracted buyers and can use any Alrosa branding in their own marketing.Along with the 18 Rio Tinto Select Diamantaires and 26companies buying from Dominion on a consistent basis, these manufacturersrepresent the premium buyers of rough on the market. How they buy and traderough and sell the resulting polished sets the tone of the diamond market, anddetermines the path along which the diamond takes in its journey along thepipeline.

Company Name

Recent NewsBullish bankers and bearish institutions split on gold forecastsJuly 01, 2024 / www.canadianminingreport.com

Gold stocks down on flat metal price and mixed equitiesJuly 01, 2024 / www.canadianminingreport.com

Snowline Gold reports Initial Resource EstimateJune 24, 2024 / www.canadianminingreport.com

Inflation subsiding and rate cuts starting internationallyJune 24, 2024 / www.canadianminingreport.com

Inflation rebound continues to reverseJune 17, 2024 / www.canadianminingreport.com

|