What's Next for the Price of Silver in 2018

What I've seen from the price of silver this week suggests it may be done falling.

After peaking at $17.55 in January, silver prices are now down 12% and into what's widely considered correction territory.

Silver has now dipped below its December low and matched its low of July last year.

That could be a sign of a double bottom, so we may have seen the worst of this correction already.

Given what's been happening in the dollar, it could well start moving in silver's favor.

Powerful Investment Income Stream: The Treasury is sitting on an $11.1 billion money pool. By adding your name to a special distribution list, you could begin collecting $1,795 or more every month. Get the details…

We know that lately the dollar's been the biggest determinant for the direction of gold and silver. And the dollar looks like it may be done rising.

What's more is that, seasonally, silver's in a sweet spot that could possibly see it tack on a decent gain over the next couple of months if the stars should line up in its favor.

Before we get to my outlook for the price of silver in 2018, here's how the metal is trending now…

Why the Price of Silver Has Continued to Drop

Through the first half of last week, silver got pushed lower as a result of a rallying dollar. And the dollar got its shot in the arm from Fed Chair Jerome Powell's testimony to the Senate.

He told the panel that "for now" more rate hikes were the right path to take. Of course, the market interpreted that as two more rate hikes this year – and a stronger dollar as a result.

But remember that the market is a discounting mechanism. It's like that outcome has already been factored in, and the dollar's rally has topped out.

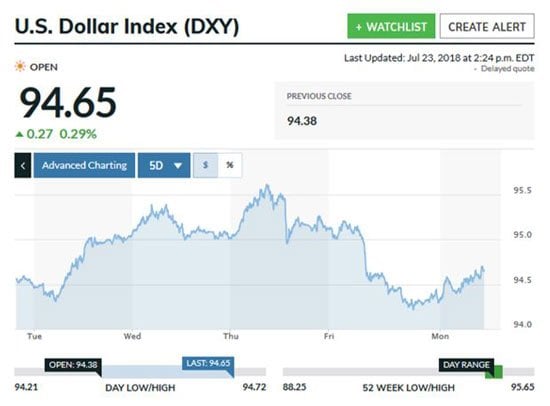

It looks like that's what may have happened by Thursday morning. The U.S. Dollar Index's (DXY) rally peaked at 95.59 by 8:40 a.m. But a report of U.S. President Donald Trump telling CNBC "I don't like all of this work that we're putting into the economy and then I see rates going up… Because we go up, and every time you go up, they want to raise rates again. I don't really – I am not happy about it. However, at the same time, I'm letting them do what they feel is best" was seemingly the excuse the dollar needed to peak.

The DXY suddenly reversed, and by Friday morning, it had retreated to 94.22. That helped power silver higher, and by the close on Friday, it had gained nearly 2.2% from Thursday's low.

Here's a peek at the DXY for the last five trading days.

Now let's look at some of the indicators we have for silver to help map out what may come next…

Peter Krauth

Peter Krauth