Watch Roxgold As It Transitions To A Profitable Gold Producer

Roxgold achieved commercial production at the high grade gold Yaramoko mine in 2016 and is now raking in the first profits and paying back debt.

The company has a P / 2017E CF of 5.0 and P/E of 24.3 and it plan to grow production 50% in 2019.

Burkina Faso is a reliable jurisdiction and Roxgold could be a possible acquisition target as the region is subject to intense M&A activity.

Based on my valuation model, Roxgold is already well priced considering its current status and the price will certainly move up if the company continues its excellent track record.

Roxgold (OTC:ROGFF), released the company's Q1 2017 results on May 16, and I was impressed by the numbers and what the management team at Roxgold had to say during the earnings call.

The 16th marked the one year anniversary of Roxgold pouring its first gold from the Yaramoko mine in Burkina Faso. To date, it has seen a total production of over 125,000 oz at a cash cost of less than $400 per oz.

These are important milestones as the company became a producer in 2016 and is still awaiting re-rating. The one year stock price is flat, while gold is up slightly and the company de-risked the mine. It is now in actual production - as opposed to its status at the last rating - with brownfield and greenfield exploration potential and the possibility to expand production up to 50% at low cost. The company sports a P / 2017E CF (ratio) of 5.00, lower than its peers.

1y Roxgold stock price.

This article will open by presenting Roxgold's operations in Burkina Faso, specifically at the Yaramoko mine, the Bagassi South deposit as well as some other exploration targets. After this we will check the management track record and capital structure before moving onto the valuation section.

The Yaramoko Mine

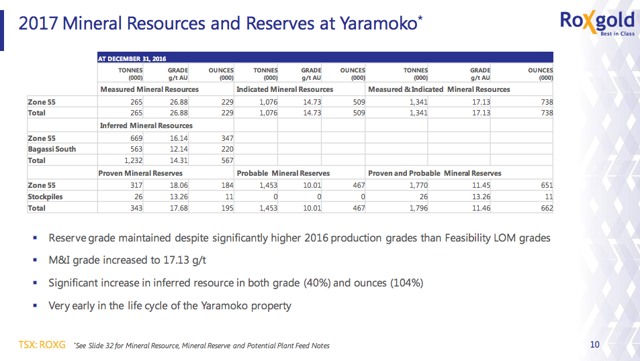

The Yaramoko mine is the main asset controlled by Roxgold. It is a high grade gold mine with 738,000 oz Au in the M&I category and 347,000 in the Inferred category (see table below).

Yaramako key datapoints (Corporate Presentation May 2017).

Production for 2017 is expected to be between 105,000 an 115,000 ounces of gold, with production cash costs of around $490 and AISC of $790 per oz Au.

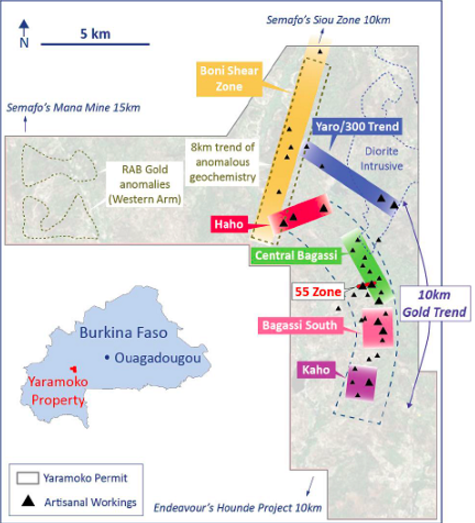

The Yaramoko permit covers approximately 196km2 and is located approximately 200 kilometers southwest from the capital city of Ouagadougou. Yaramoko lies contiguously south of the SEMAFO (OTCPK:SEMFF) property hosting its flagship Mana Gold Mine and lies within the north east portion of the Hounde greenstone belt.

Map of the property (Company Website).

In the same greenstone belt we find other gold explorers such as Acacia Mining (OTC:ABGLF), Sarama Resources (OTC:SRMMF) and Savary Gold (OTC:SVVYF). Burkina Faso can generally be considered a safe jurisdiction. The government approved more than 10 gold mines in the last few years, including deals involving majors the likes of B2Gold (BTG), Centamin (OTCPK:CELTF) and Teck (TECK), while there was also intense M&A activity in the last three years: the Orbis/SEMAFO merger, Endeavour ?s Mining (OTCQX:EDVMF) acquisition of True Gold and the Gryphon ?s acquisition by Teranga (OTC:TGCDF). In short, Burkina Faso's gold mining sector is on the rise and it looks like it will keep rising in terms of aggregate mine operations and gold production for the foreseeable future (while it is already the 4th biggest African producer).

To come back to the Yaramoko mine, what really stands out in the Q1 2017 operational highlights is the extremely high gold recovery rate of 99.2%; higher than was expected by the economic and engineering studies. Similarly, the gold grades found in the mine have also passed expectations.

Q1 2017 Operation Highlights (Corporate Presentation May 2017).

The company is now steadily producing from the mine while extending the mine life with nearby exploration. There is currently a deep drilling program ongoing in Zone 55, while in Q3 the company will focus on starting initial drilling at regional geophysical targets. During the construction phase, management wisely embedded some engineering features that will give room for an eventual, and this point certain, 50% hike in the production rate at relatively low cost.

The company is continuing to improve at Yaramoko. For instance, on February 1st, the company was connected to the Somerville high voltage national grid. They now have reliable power at 99% availability since the connection was made, meaning cheaper and more reliable power going forward. Moreover, Roxgold also achieved 2,000,000 hours free of lost-time-injuries in February. Surely, it is always good to see that workers are kept safe and there is no hindrance to the normal operations.

Overall, the most important thing to bring home is that the mine is performing above expectations (higher grade, higher recovery) and that the company plans to expand mine production by 50% in two years, when it will start to mine at Bagassi South using very similar ore.

Bagassi South and nearby exploration

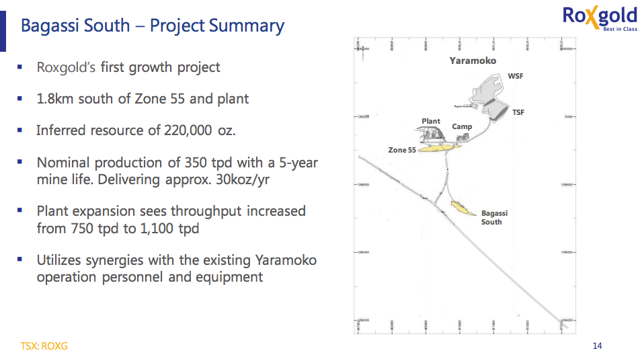

Bagassi South is a satellite deposit with 220,000 oz Au in the inferred category at a grade of 12.14g/t.

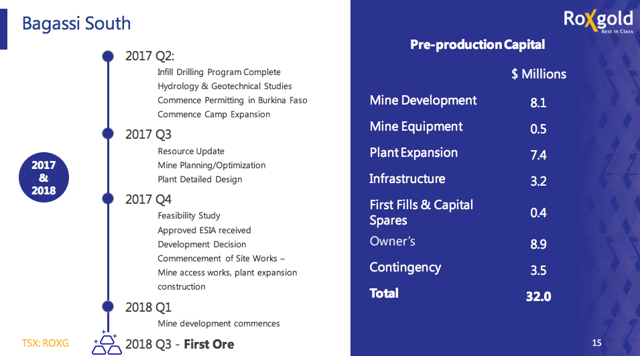

Exploration at Bagassi South is ongoing and the most recent program included 29,160m over 134 holes at Bagassi South with 134 holes drilled. The program was designed to infill the mineralized structure with sufficient additional intercepts to support the conversion of the existing inferred mineral resource to indicated resource status, as well as to test some extensions ahead of its potential inclusion in a feasibility study which is scheduled to be completed in Q4 2017.

Bagassi South Project Summary (Corporate Presentation May 2017).

The company released a press release on May 8 stating that the exploration program encountered mineralization starting at surface and with good consistency. An updated resource estimation is expected for Q3 2017.

The deposit is located at a mere 1.8km south from the Zone 55, meaning that it will be cheap to move the ore to the mill. Moreover, as the Yaramoko mine is already paid for, it will provide a very profitable mine feed, expected to produce cash flow starting in 2019 for at least 5 years.

Bagassi South production roadmap (Corporate Presentation May 2017).

The total costs to develop Bagassi South will be around $32m, including the expansion costs to increase throughput from 750 tpd to 1,100 tpd (mentioned earlier).

Exploration activities in 2017 are not confined only to the Bagassi South deposit however. The currently approved budget of $8m aims to support an overall organic growth strategy. For instance, as mentioned previously, a further round of drilling totaling approximately 11,000m will be undertaken in Q2 and Q3 at Zone 55 (the zone that is currently being mined). This program is currently ongoing with two drills and will primarily target resource growth at depth below and west of the Q4 2016 drilling program.

Four geophysical surveys are being conducted in Q2, consisting of 64 km of pole-dipole survey and 430 km of IP survey over the Boni Shear Zone and the Yaramoko Shear Zone . During Q3 this program will morph into a regional drilling program targeting geophysical anomalies following the completion the Q2 geophysical surveys.

Before we finish this section of the article I have to mention that Roxgold also owns two other projects in Burkina Faso: the Solna group of properties - a 373sqk in the Province of Yagha in Eastern Burkina Faso - and Bissa West, of which the latter specifically has some high grade potential. These properties have however not seen any recent (