US$ Index: 'Trump Bump' Has Evaporated While Gold Surges

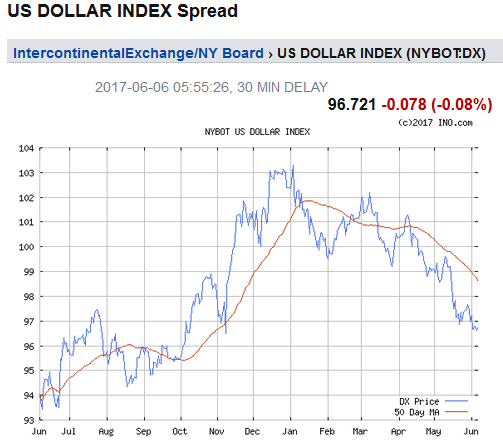

The U.S. dollar index has given back all the gain since Trump's election last November.

Meantime, geopolitical uncertainty is helping to drive gold higher.

Much of the geopolitical uncertainty is due to the Trump administration itself. And it appears to be growing on a daily basis.

The US$ Index is down again today and has now retraced all of the gains made since President's Trump election last November:

Source: ino.com

Meantime gold surged more than $10 in overnight trading and continues to move higher due to a combination of events:

A weakening U.S. dollar. A soft non-farm jobs report last Friday. The terror attack in London. More fraying of relations between the U.S. and the U.K. as President Trump belittles the Mayor of London Sadiq Khan after the terror attack. Kahn suggests the U.K. not "roll out the red carpet" and cancel a planned visit by Trump. Uncertainty of the outcome of the British election Thursday. Uncertainty of the outcome of ex-FBI Director James Comey's testimony on the Trump administration's ties to the Russians and a potential obstruction of justice charge against Trump himself. Uncertainty regarding the European Central Bank meeting on Thursday and Mario Draghi's monetary policy going forward. Uncertainty in the Middle East as Saudi Arabia and a few other Middle East nations have cut ties with Qatar after accusing that small country of promoting terrorism.Source: Apmex.com

Note how many times the word "uncertainty" appears in the list of bullets above. Uncertainty was the primary thesis of my first article on the Possibility of A Trump-Induced Bull-Run In Gold on December 30 of last year. Since then gold has increased by $142.19/oz or 11%.

The largest geopolitical uncertainty factor may be President Trump's apparent foreign policy pivot away from traditional U.S. democratic allies and toward countries like Russia and Saudi Arabia.

To the surprise of his own national security team, Trump did not even mention the most critical aspect of NATO - Article 5 - during his speech at the recent NATO summit. More worrisome is that, according to Politico, three of Trump's top advisers and cabinet leaders - National Security Adviser H.R. McMaster, Defense Secretary Jim Mattis and Secretary of State Rex Tillerson - had all worked on Trump's NATO address and included language reaffirming the U.S. commitment to Article 5, the provision in the NATO treaty about collective defense. It is unclear if Trump - or his chief advisor Steve Bannon - took Article 5 out of the speech. Regardless, the omission was seen by some - especially those in Europe - as one of the biggest foreign policy pivots in U.S. history.

Meantime, Trump's tweets appear ever more tone-deaf. His tweets about the "TRAVEL BAN" are seen to work against his goal of restoring a travel ban. Even Trump advisor Kellyanne Conway's husband - George Conway - a prominent lawyer who recently took himself out of the running to lead the Justice Department's Civil Division, posted on Twitter that the remarks might hurt the legal case.

These tweets may make some ppl feel better, but they certainly won't help OSG get 5 votes in SCOTUS, which is what actually matters. Sad.

OSG is short for Office of Solicitor General and SCOTUS is an abbreviation for the Supreme Court.

Summary & Conclusion

Geopolitical uncertainty is rampant. But it's not too late to hop on the gold train. Republicans are likely to push through significant tax breaks for corporations and ((OTCPK:SOME)) individuals. They are also likely to pass a significant infrastructure bill. It is not clear how they will pay for these programs, nor the $54 billion increase in defense spending suggested in a previous budget proposal. Odds are good that gold investors will continue to benefit from an increase in the overall Federal debt level. That said, there are some conservative Republicans who may use the up-coming debt ceiling debate as a tool to reign in government spending.

I continue to recommend investors hold a position in precious metals and prefer gold bullion as opposed to "paper gold" via the Spider Gold ETF (NYSEARCA:GLD). Yet GLD does have advantages over bullion - it is very liquid and there are no purchase or storage hassles and no shipping or insurance charges.

For short-term traders who prefer more leverage, the following bull ETFs can be considered:

DB Gold Double Long (NYSEARCA:DGP) Velocity Shares 3x Long Gold (NASDAQ:UGLD)For those brave souls that believe all the Trump/EU/Russia drama has been way overblown, the following gold bear ETF should be considered:

DB Gold Double Short ETN (NYSEARCA:DZZ)But beware - the DZZ fund is down 19% YTD.

Disclosure: I am/we are long GOLD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for investment decisions you make.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.