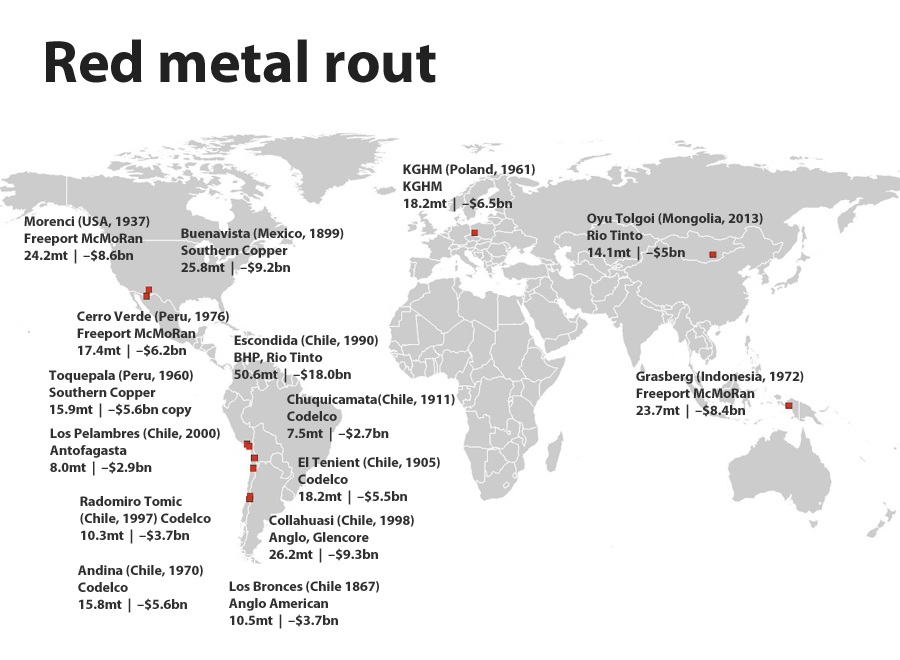

Top 15 copper mines worth $103bn less than a week ago

Chuquicamata

It's been a brutal November on copper markets with a only one up day of trading since the start of the month. Just over the last week the price has fallen more than 7%.

In New York on Wednesday the copper price dropped to a low of $2.0670 or $4,560 a tonne, the lowest since March 2009 and down 27% so far this year.

Copper traded below today's level for seven months at the height of the global financial crisis on its way to a record above $4.40 a pound just 18 months later. For a sustained period below $2.10 you have to go back a decade.

Between them the planet's top 15 producing mines have proven and probable reserves (ore that can be economically mined) of more than 50 billion tonnes. At current grades contained metal at these giants total 289 million tonnes.

A crude calculation shows the past week's decline translates to a combined loss (or write down of asset worth if you will) of value at the mines of $103.1 billion dollars. That's $20 billion per trading day.

The 15 largest mines produced a combined 5.1 million tonnes of refined copper in 2014 representing more nearly one quarter of the world total, meaning 2015 has shaved $8.3 billion off annual revenues. And that without taking into account the decline in byproduct earnings from gold and silver at mines like Grasberg and molybdenum at a few others.

Given its outsized share of world production the billions lost would also have a huge impact on Chile, and South America as a whole.

Of course the reserve numbers represent assets still buried in the ground and the impact on earnings will be smoothed out over a year, but it's nevertheless a sobering exercise to calculate just how much damage the red metal rout has done.

Data supplied by IntelligenceMine