These charts are a big reality check for gold mining stock bulls

Despite a widely held view that gold should be trading north of $1,400 this year, since the February peak well short of that target, prices have gone in the other direction.

Gold mining stocks have fared slightly better after a flurry of mergers and acquisitions at the top end rekindled interest in the sector despite the lacklustre performance of the metal and all those burnt fingers from the M&A frenzy during the boom years.

A new report by McKinsey asks: "Can the gold industry return to the golden age?" The way to do this, according to the consultancy, is by solving the "looming reserve crisis."

Source: McKinsey & Company

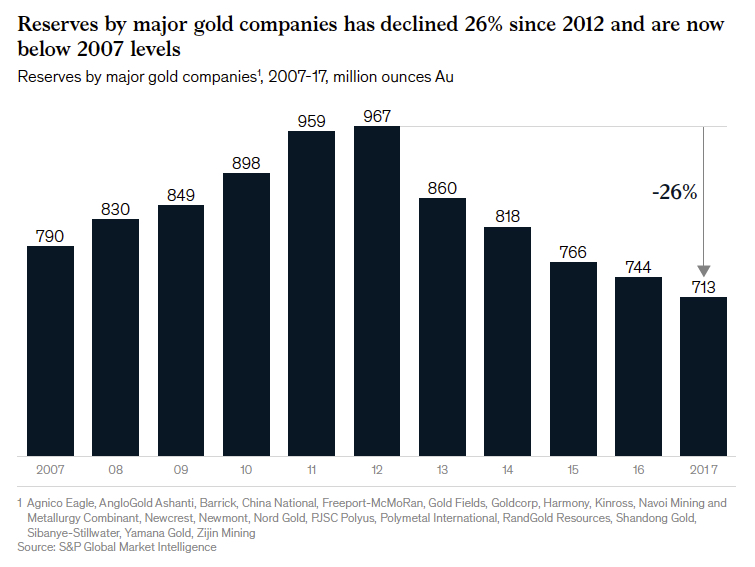

That crisis is in the offing because large gold companies (the report analyses the 20 largest gold miners) have cut exploration budgets by 70% since the go-go years, McKinsey says. At the same time, major greenfield discoveries have become ever more elusive.

This has resulted in reserves at the majors declining by 26%, or 254 million ounces since 2012, to the lowest level since 2007.

McKinsey answers the report's central question and calls for organic strategies including exploration innovation, advanced analytics and new technology including the internet of things (IoT) and blockchain.

But, say the authors, gold mining's top tier will also have to make acquisitions - inorganic strategies - to top up reserves provided "management teams rebuild trust with shareholders and investors."

That may not be so easy, given the industry's track record.

Source: McKinsey & Company

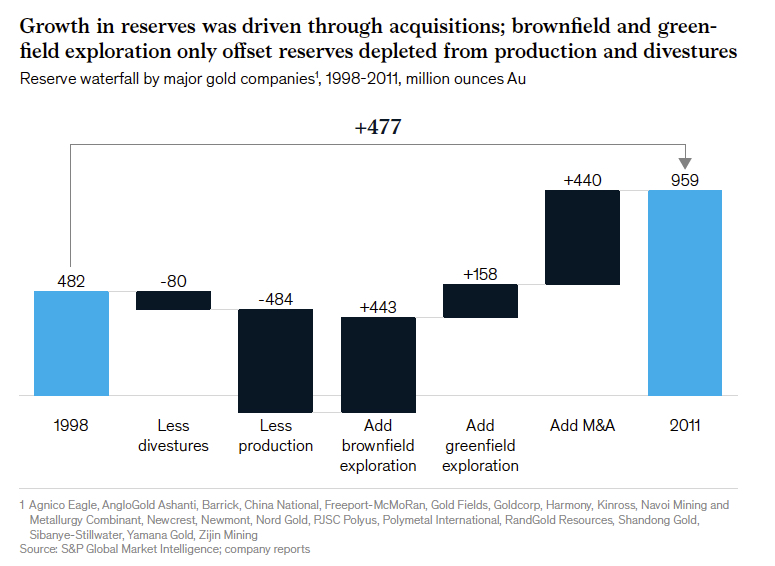

In the decade leading up to the 2011's gold price peak above $1,900 an ounce, the industry saw over 1,000 acquisitions with a combined price tag of $121 billion (2011 alone saw $38 billion worth of deals done) at premiums of 30% or more.

As the chart shows were it not for M&A activity these companies' gold reserves would have stayed flat. The belief in the industry clearly was that gold could only go up - the average price paid per ounce reserve in this peak period was often more than 300% higher than deals executed a decade earlier, says McKinsey.

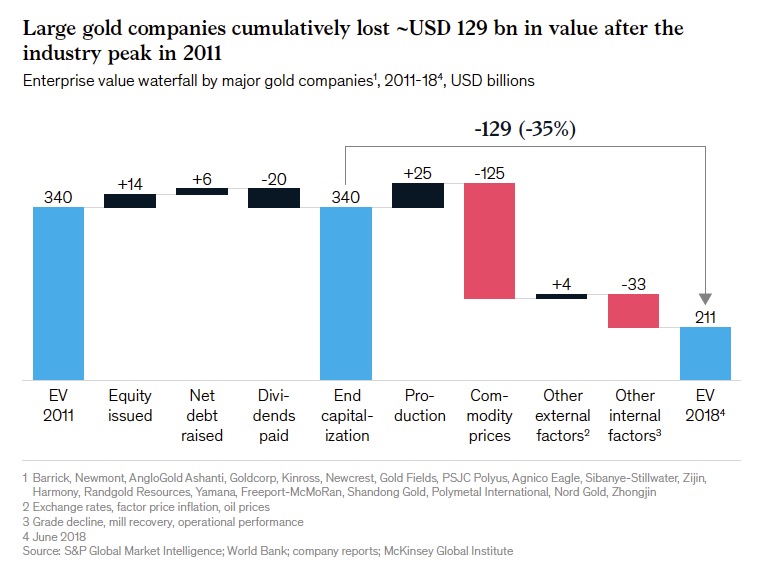

A full 80% of the transaction value of the eight largest deals between 2001 and 2011 has been impaired. Combine that with the industry-wide downturn in metal prices and you get this eye-watering chart.

Source: McKinsey & Company

The large gold mining companies have been mending fences with investors, McKinsey points out, by cutting capital expenditure and slashing costs. Weighted average all-in sustaining costs were reduced by 21% to $879 an ounce between 2012 and 2017.

The 20 largest gold companies spent $12 billion on new projects in 2016, $18 billion less than in 2012 when the gold price was suffering the first of a series of anni horribilis.

Whether skittish gold sector investors will allow these companies to ratchet up spending again is the proverbial $129 billion question.