Study of private investors shows how risky mining can be

According to a new study of private capital in the resources sector from industry tracker Preqin investment firms now have $400 billion assets under management after 10 years of uninterrupted growth.

Of this $239 billion represent unrealized value with the remaining $161 billion so-called dry-powder capital ready to invest.

2015 could be the first year since 2004 in which positive net capital has been distributed to natural resources investorsPreqin says unrealized value as a proportion of assets under management has remained relatively constant in recent years, representing approximately 60% of total industry assets each year since 2010.

As investments mature, the gap between capital called-up and proceeds distributed has narrowed. For the first time, in September 2015 (the latest data available), the amount distributed to investors ($38bn) exceeded the amount called up by fund managers ($36bn).

Should trends continue, 2015 should be the first year since 2004 in which positive net capital has been distributed to natural resources investors in unlisted funds says the London-HQed research firm.

Some $131.3 billion is available for investment in energy (oil, gas, coal and renewables) which is by far the number one sector targeted by these funds, but the growth in dry powder since 2010 across natural resources has been phenomenal with the metals & mining sector capital ready to invest seeing a fourfold increase.

Only $6.2 billion of the dry powder money in 2016 is for metals and mining although a portion of energy capital and the diversified funds' $9.7 billion will also go into projects and assets in the sector. Fund managers also still have to exit some $8.7 billion in mining investments.

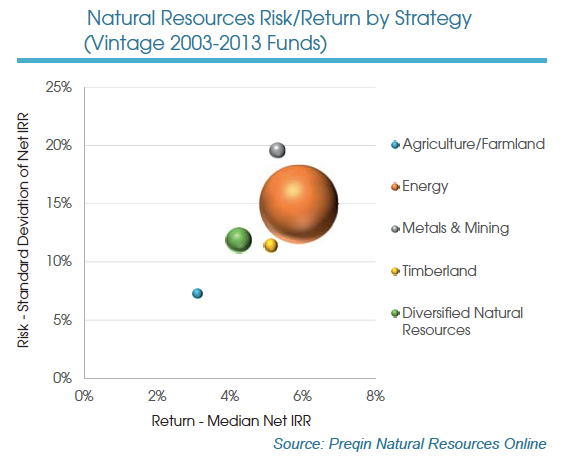

Preqin data show in terms of risk versus return energy funds have the highest median net internal rate of return (+5.9%) but the second highest risk profile, with a standard deviation of net IRR at 14.9%. Unlisted metals & mining funds have the highest risk (19.6%) and the second highest median net IRR (+5.3%). Of the funds tracked by the research firm agriculture and farmland funds have the lowest risk-return profile.