Silver And Gold Rally On 'Everyone Wins Friday'

Silver and gold continue to rally.

Odd trading occurred on Friday.

The EU has been cut loose by Trump and will not likely stand.

The anti-dollar rally will likely continue this week.

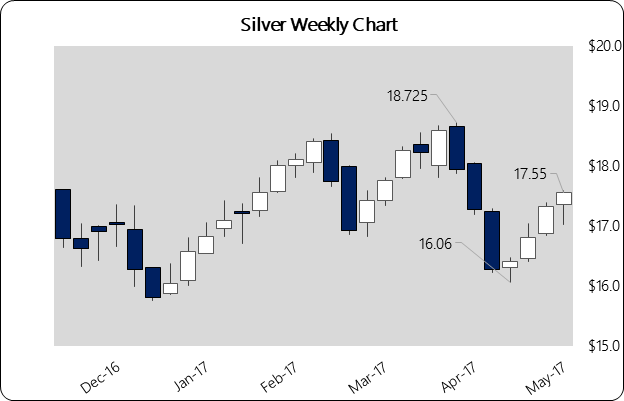

Silver (NYSEARCA:SLV) is on a tear. It has retraced more than half of a brutal sell-off that began in mid-April which saw more than $2.60 shaved off the price. That sell-off cut short a rally that looked strong enough to take it back to challenge the $20 level.

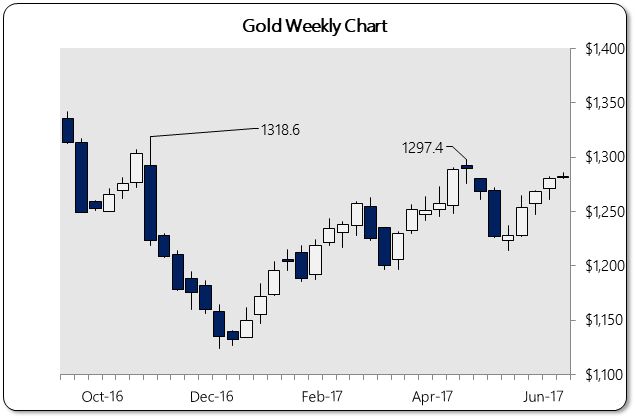

Gold (NYSEARCA:GLD) has been along for the ride and the question now is: how much more juice does the current rally in the precious metals have?

To answer that question, I have to go around the world and look at what's happening geopolitically, especially the fraying relationship between the U.S. and the EU.

Given the strong close on Friday which pushed both metals above their May highs, I'd say things look good for some room to the upside this week coming into the FOMC meeting.

Everyone's a Winner!

Friday's market action was odd in these binary risk-on/risk-off markets. The U.S. employment report saw traders stampede out of the U.S. dollar (NYSEARCA:UUP), confusing everyone.

Safe-haven assets like gold and U.S. Treasuries (NYSEARCA:TLT) were up strong. Treasuries, in particular, were very well bid, down 5-6 basis points across the yield curve. And yet, stocks hit an all-time high with the Dow Jones Industrial Average (NYSEARCA:DIA) closing at 21,206.29.

The euro (NYSEARCA:FXE) closed at $1.1280, challenging long-term overhead resistance at $1.1302 along with the Japanese yen (NYSEARCA:FXY) which now looks ready to test the ?108 low from April.

Even European bonds were well bid with the Italian 5-year bond yield down 3 basis points while carrying the highest credit default risk in Europe.

I note all of these moves to reinforce the idea that days like Friday are huge tells as to what smart money is doing with their money. Because while the Dax and German Bunds were also well-bid the amount of money it takes to move U.S. yields 7 basis points and the Dow 1% over two days is an order of magnitude more than it takes to move German assets.

This is the essence of capital flight. While everyone was selling the dollar on Friday (and to a lesser extent on Thursday) money was preferentially moving into U.S. assets over European. Even though most other asset classes except the dollar were winning late last week, some assets saw more capital inflow than others.

So, when you see gold, silver, U.S. Treasuries and U.S. stocks all moving up together that is a new kind of safe-haven trade. The longer the euro rallies here, the more those strong euros will seek a home in less over-valued assets than those in Europe.

We'll Never Have Paris

What kicked this off was the decision by Donald Trump to no longer honor President Obama's pledge to the Paris Agreement on climate change, capping off a week of him reassessing the U.S.'s commitments to the existing international arrangement that has existed since the end of World War II.

Between that and his remarks at the NATO Summit and the G-7 meeting, Trump is pulling back from the U.S.'s commitments to the EU and, in particular, Germany. This is an immense change that should have investors' interest.

It may prompt many NATO/EU countries to reassess NATO's mission and its priority to their future - and it prompted German Chancellor Angela Merkel to declare the U.S. and U.K. were no longer partners Germany could rely on.

These are watershed events which will have far-reaching effects on the political status quo. Merkel will now, without the U.S., have to deal with the animosity she's engendered in countries like Poland, Hungary and Greece while also being left with the mess in Ukraine as well as the EU's deteriorating relationship with Turkey.

The ECB's policy meeting is this week. President Mario Draghi is likely to unveil plans to securitize some of its mountain of EU sovereign debt to begin ending quantitative easing.

The hope is to off load the risk onto anyone who will take it.

This is the last resort with bond yields in Europe where they are. Draghi and the ECB are trapped. With the Fed ready to unwind its balance sheet the ECB has to follow suit. But, without the 'Draghi Put' underneath the EU sovereign debt market there is no way yields across Europe stay where they are.

Hence, the need to package up Greek junk debt with German good debt and create a synthetic product not unlike the $1.76 trillion in mortgage backed securities sitting on the Fed's balance sheet currently that can't be marked to market.

This is what we're flying into and why I think this move up in the euro since Macron was elected in France is a bull trap for euro longs.

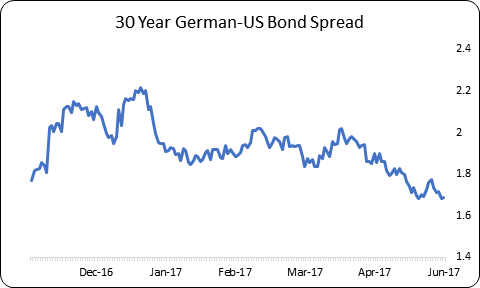

The spread between U.S. and German bunds has been tightening all year.

The monthly chart of 30-year U.S. debt is bullish. Foreign central banks were loading up on U.S. Treasuries in Q1, arming themselves for the next rally in the U.S. dollar. That includes, surprisingly, Russia and China, per the latest U.S. Treasury International Capital Report.

China added $27.9 billion in U.S. debt in March. Russia bought $13.5 billion, raising its stash of U.S. Treasuries to its highest level since before 2014's Ruble crisis.

Will Gold and Silver Have Legs?

Gold and silver's weekly charts are improving. But how much energy has been used up with their rallies to date? At some point soon there will be a definitive bottom in the U.S. dollar and a subsequent top in the euro. I don't think we're there yet.

Gold and silver have yet to respond definitively to the upside or the downside. They are still trapped looking for a signal that the loss of confidence in European leadership is terminal.

Friday's close on the euro was a breakout from near-term consolidation, so it looks like there is a bit of room to run from here in all three, gold, silver and the euro.

But the higher the euro goes the more violent the move down will be once the ECB is revealed to not having a workable solution to unwind its balance sheet.

Gold will need to best $1298 this week to have a shot at closing above $1319 in June.

Silver will have to continue its move up to challenge the Q1 high at $18.72 and retrace the entirety of that mid-April selloff to regain longer-term bullish posture.

The monthly chart is mixed while the quarterly chart, as I've shown in past articles, is still bearish. Silver needs a move to $19.43 this month to negate a quarterly bearish reversal signal thrown in Q4 of last year.

At this point in time the markets are giving off mixed signals. The FOMC will raise rates next week. Draghi will not this week. The Fed wants a weaker dollar and a rallying stock market to have cover to raise rates while macroeconomic data softens.

Gold and silver will only truly begin new bull markets when it becomes clear the market no longer believes the EU will ever get its sovereign debt troubles under control. That shift in sentiment may come this week when the ECB meets.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I own some gold and silver, a few guitars and a lot of goats