Nickel price rally 'on shaky ground'

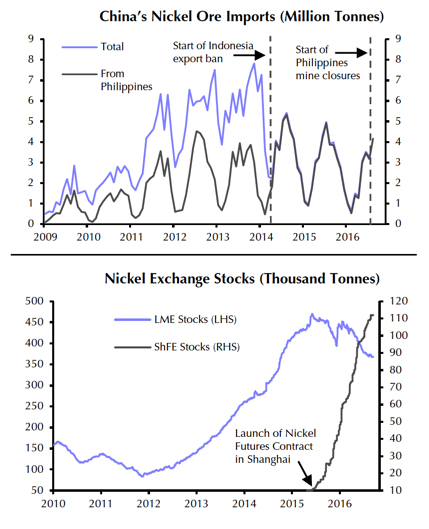

On Tuesday, nickel exchanged hands for $10,490 a tonne in London holding onto most of its 3% overnight gains. The nickel price has now advanced 20.7% in 2016. Measured from its multi-year trough of $7,725 a tonne struck in February, the price of the metal mainly used in steelmaking is up 38% thanks to a ban on exports from former top supplier and a crackdown on mining in the Philippines.

Nevertheless, it's still nowhere near where it was in early in 2014 when Indonesia's ban on ore exports led many to believe the volatile metal is entering a bull market. And the threat of a partial lifting of the ban, still elevated stockpiles and moderate demand growth could spoil 2016 rally.

Were Indonesia to resume exports at 2013 levels, this would mean an extra 60 million tonnes of ore available to the market in 2017

Source: Capital Economics. Data: Thomson Reuters, Bloomberg

In a research note Capital Economics argues that the nickel rally could be on shaky ground:

Were Indonesia to resume exports at 2013 levels, this would mean an extra 60 million tonnes of ore available to the market in 2017, more than compensating for the closure of the entire nickel mining industry in the Philippines. That said, what seems more likely is that mining firms which are in the process of building in-country smelters, will be allowed to export. This would lead to a maximum of 10-15m tonnes in ore exports.

Indonesia has already floated plans to allow 15 million tonnes low grade ore to leave the country for processing elsewhere reports Bloomberg. The Philippines exported 33 million tonnes of nickel ore last year.

Following Indonesia's ban Chinese pig nickel industry became wholly dependent on Philippine miners but Rodrigo Duterte, sworn in as the Philippines president at the end of June, has ratcheted up the rhetoric against mining companies operating in the country, threatening to close mines considered to be in breach of environmental rules.

The Philippines natural resources ministry started an audit of all mining operations within the country in July and have already shut down more than 40 mines, eight of them nickel producers. On Monday, firebrand Environment and Natural Resources Secretary Regina Lopez, revoked the licence of another nickel operator which received its export licence only in June.

The reason behind the suspension of the potential 50,000 tonnes of exports destined for China is because the mine is located near a UNESCO World Heritage Site, and Pujada Bay, a marine protected area according to a Reuters report.

Capital Economics does not see a large correction in the nickel price but says the current rally "may lose steam":

Indeed, we are sticking with our end-2016 price forecast of $10,250 per tonne. However, even if Indonesia does resume limited ore exports in 2017, we expect the market to remain in deficit and forecast prices to rise to $12,000 per tonne by end-year.