How De Beers Sees Its New Synthetics Business

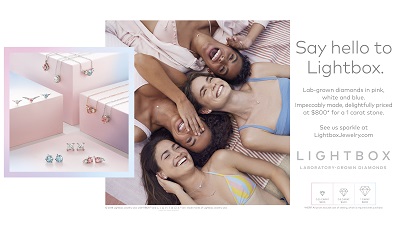

RAPAPORT... De Beers is launching a jewelry line featuring laboratory-growndiamonds - a venture that, according to CEO Bruce Cleaver, could eventually bring inrevenue of up to $200 million per year.That figure might be small compared with the miner's $6billion natural-diamond business, but Cleaver and his team are entering thesynthetics retail sector because they see an opportunity to make a profit. The new company De Beers is establishing, Lightbox Jewelry,will sell fashion jewelry containing lab-grown stones at affordable prices -$200 for a 0.25-carat stone, $800 for a carat. This reflects feedback fromconsumers, who like the idea of synthetic diamonds as a fun piece for casualoccasions, but don't think they're worth the amounts they'd spend on a naturalstone for an engagement ring or to mark the birth of a child or a majoranniversary. "They see diamonds as meaningful, in a way that lab-growndiamonds aren't - emotionally, financially," Cleaver said. "For them, the issuewith lab-grown diamonds is they're too expensive for what [consumers] think they are,but they're getting confused by the current offering, which seems to sort oftry to argue that they're the same thing." In an interview with Rapaport News, Cleaver (pictured, below) explains what'sbehind the strategy, why the stones won't get a color or clarity grade, and whycustomers would tolerate losing these products in the sea.

RAPAPORT... De Beers is launching a jewelry line featuring laboratory-growndiamonds - a venture that, according to CEO Bruce Cleaver, could eventually bring inrevenue of up to $200 million per year.That figure might be small compared with the miner's $6billion natural-diamond business, but Cleaver and his team are entering thesynthetics retail sector because they see an opportunity to make a profit. The new company De Beers is establishing, Lightbox Jewelry,will sell fashion jewelry containing lab-grown stones at affordable prices -$200 for a 0.25-carat stone, $800 for a carat. This reflects feedback fromconsumers, who like the idea of synthetic diamonds as a fun piece for casualoccasions, but don't think they're worth the amounts they'd spend on a naturalstone for an engagement ring or to mark the birth of a child or a majoranniversary. "They see diamonds as meaningful, in a way that lab-growndiamonds aren't - emotionally, financially," Cleaver said. "For them, the issuewith lab-grown diamonds is they're too expensive for what [consumers] think they are,but they're getting confused by the current offering, which seems to sort oftry to argue that they're the same thing." In an interview with Rapaport News, Cleaver (pictured, below) explains what'sbehind the strategy, why the stones won't get a color or clarity grade, and whycustomers would tolerate losing these products in the sea.  Rapaport News: What are consumers saying about lab-grown diamonds? Bruce Cleaver: We've spent a lot of time in the last year and a halfanalyzing consumers' views on lab-grown diamonds, and what consumers reallywant. What they tell us is the current lab-grown-diamond offering confusesthem. They don't actually know if it's the same thing as the natural type, orsomething different. But when we ask them what they think it is, they say theythink it's exactly what we're pitching in Lightbox, which is somethingcompletely different. For them, it's a fashion product, an accessible product,a fun product, a colorful product - one that doesn't really compete withnatural diamonds because it's a total different product, both from a pricing pointof view, and from the way it's positioned and pitched. That's actually the opportunity we see, and that's why wewant to launch this Lightbox business - to fill a space that no currentlab-grown producer fills, which is where we think consumers really want this.And we don't think that is contradictory with the natural business; we thinkit's complementary to it. Rapaport News: What does that mean for the type of lab-grown diamondsyou intend to sell? Cleaver: We're going to have a lot more color - blue and pink - and alot less white than you would see in a natural offering, because that'sconsistent with what people want in fashion, fun and light-hearted jewelry. We'renot going to grade them. Frankly, we don't think they deserve grading, becausethey're all the same. You can tell your reactor to make whatever you want againand again and again. They have no uniqueness and no rarity factor, so they don'tdeserve grading. Rapaport News: You're planning to sell 1 carat for $800. Does thatinclude the setting? Cleaver: The setting, given that it's a fashion product, is likely tobe silver, and is likely to be very inexpensive. Consumers tell us they don'tthink this lab-grown product belongs in the same space as a natural diamond. Withour technology [at Element Six, a De Beers subsidiary that has been makingsynthetic diamonds for industrial purposes for decades], and with the cost thatwe incur to produce these goods, we can make a profitable business positioninglab-grown diamonds where we think consumers want them, which is in the hundredsof dollars.

Rapaport News: What are consumers saying about lab-grown diamonds? Bruce Cleaver: We've spent a lot of time in the last year and a halfanalyzing consumers' views on lab-grown diamonds, and what consumers reallywant. What they tell us is the current lab-grown-diamond offering confusesthem. They don't actually know if it's the same thing as the natural type, orsomething different. But when we ask them what they think it is, they say theythink it's exactly what we're pitching in Lightbox, which is somethingcompletely different. For them, it's a fashion product, an accessible product,a fun product, a colorful product - one that doesn't really compete withnatural diamonds because it's a total different product, both from a pricing pointof view, and from the way it's positioned and pitched. That's actually the opportunity we see, and that's why wewant to launch this Lightbox business - to fill a space that no currentlab-grown producer fills, which is where we think consumers really want this.And we don't think that is contradictory with the natural business; we thinkit's complementary to it. Rapaport News: What does that mean for the type of lab-grown diamondsyou intend to sell? Cleaver: We're going to have a lot more color - blue and pink - and alot less white than you would see in a natural offering, because that'sconsistent with what people want in fashion, fun and light-hearted jewelry. We'renot going to grade them. Frankly, we don't think they deserve grading, becausethey're all the same. You can tell your reactor to make whatever you want againand again and again. They have no uniqueness and no rarity factor, so they don'tdeserve grading. Rapaport News: You're planning to sell 1 carat for $800. Does thatinclude the setting? Cleaver: The setting, given that it's a fashion product, is likely tobe silver, and is likely to be very inexpensive. Consumers tell us they don'tthink this lab-grown product belongs in the same space as a natural diamond. Withour technology [at Element Six, a De Beers subsidiary that has been makingsynthetic diamonds for industrial purposes for decades], and with the cost thatwe incur to produce these goods, we can make a profitable business positioninglab-grown diamonds where we think consumers want them, which is in the hundredsof dollars.  Rapaport News: How does pricing differ from that of natural diamonds?Cleaver: Pricing of lab-grown diamonds, because it's a fashion itemand there's no uniqueness, is completely binary. If it takes you a week to makea quarter of a carat and two weeks to make a half-carat, you'd expect thehalf-carat to sell for twice [the price of] the quarter of a carat. That's verydifferent to the natural business, where the pricing is different. It's reallyall in the offering and in being clear to consumers that this is a goodbusiness for us, a fun business, but it's a totally different business.Consumers tell us things like, for example, these are the kinds of things youcan take on holiday and you can lose in the sea. You'd never do that with your[natural] diamond. De Beers remains, and always will be, a natural-diamondbusiness. We are spending about $3 billion on our current expansion programs[in the natural-diamond space], and we're certainly not stopping [our focus on]those, we're going more and more into those. That puts this offering intoperspective, where we're going to spend $94-odd million building a new facility.We're serious about it, but it's nothing like the scale of our naturalbusiness. Rapaport News: Is this a way into the diamond category for first-time buyers?Cleaver: I don't see this is as an entry into the natural space. Isee this as a totally different offering that some consumers want toparticipate in. There's no real emotional value in lab-grown diamonds, because they'renot unique. They're grown again and again in the same way, if that's what youwant out of it. Rapaport News: You plan to launch Lightbox Jewelry online in the US, andannounce retail partnerships in due course. Do you ultimately intend to sellthese products just online, or also in physical stores? Cleaver: It'll be both. We will launch an online offering first inSeptember, when we'll start our first sales. We are in discussions with acouple of retailers about some trials in stores as well. Rapaport News: When could that happen? Cleaver: It's going to depend on how these discussions go, so I can'tgive an exact date, but I hope there will be some news relatively soon after welaunch the pilot online. Rapaport News: Are we right to assume that no Lightbox jewelry willappear in the Forevermark or De Beers Diamond Jewellers brands? Cleaver: Absolutely, it is a totally different business. I've beencareful to separate the management teams. The Lightbox team does not report tothe core marketing team that Stephen [Lussier, De Beers' executive vice president formarketing and CEO of Forevermark] and co. lead. Stephen and his team remainvery focused on our core, natural business. The Lightbox team is a totallydifferent team reporting in through a different structure. So I've been verycareful to make sure there is no confusion between these. Rapaport News: To whom does Steve Coe, the general manager of Lightbox, report?Cleaver: He reports in to Neil Ventura, the [De Beers] head ofstrategy, who reports to me. Rapaport News: Once Element Six has produced the rough lab-grown diamonds,who will cut and polish them? Cleaver: Element Six will produce them [using chemical vapordeposition, a method of creating synthetic diamonds], and already produces themat [its UK facility in] Ascot, and we're investing in an expansion facility inOregon. That's also an Element Six facility. We've been trialing cutting and polishing with a couple ofpeople in India who are going to be our contractors to cut and polish. Rapaport News: Could this cause any repercussions for or confusion aboutDe Beers' image? Cleaver: It's very important that we separate these brands within DeBeers. We've got separate management teams, separate marketing, very differentmarketing aimed at different people. Lightbox, although it's brought to you from De Beers, it'snot got the De Beers brand or the De Beers logo. De Beers remains synonymouswith diamonds, so we will continue to drive De Beers as a natural-diamondbusiness, and I think there's no reason to think it will have any impact on us,as long as we continue to focus the different brands in the way they should be.I'm not particularly concerned about that. Rapaport News: Which synthetic-diamond producers do you see as yourcompetitors? Cleaver: A lot of people have produced lab-grown diamonds and areselling them in retail, but no one that I'm aware of has positioned them in theway we are. I prefer not to think about competition; I prefer to think aboutwhat's the best way for De Beers to maximize the value of its Lightboxbusiness. For me and the team, it's about how do we do this best, givingconsumers what they want, and in return having a profitable business. I'll stress again the size of the natural business relativeto the size of the lab-grown business for us: It's a small part of our world.I'm focused on trying to find small adjacencies that are profitable to add tothe core business. Rapaport News: Can you give a rough figure for the annual revenue youare expecting from this business? Cleaver: The [new Element Six] facility in Oregon, when it's up and runningin 2020 and onwards, will, roughly speaking, be able to produce about 500,000carats of rough [per year]. Broadly speaking, you could say that equates to 250,000 caratsof polished. You could see that could be, all in, a business with a revenue of$150 million to $200 million, which is not insignificant, but is nothing at alllike our $5 billion to $6 billion [natural-diamond] business.Images: Matt Crabb/De Beers

Rapaport News: How does pricing differ from that of natural diamonds?Cleaver: Pricing of lab-grown diamonds, because it's a fashion itemand there's no uniqueness, is completely binary. If it takes you a week to makea quarter of a carat and two weeks to make a half-carat, you'd expect thehalf-carat to sell for twice [the price of] the quarter of a carat. That's verydifferent to the natural business, where the pricing is different. It's reallyall in the offering and in being clear to consumers that this is a goodbusiness for us, a fun business, but it's a totally different business.Consumers tell us things like, for example, these are the kinds of things youcan take on holiday and you can lose in the sea. You'd never do that with your[natural] diamond. De Beers remains, and always will be, a natural-diamondbusiness. We are spending about $3 billion on our current expansion programs[in the natural-diamond space], and we're certainly not stopping [our focus on]those, we're going more and more into those. That puts this offering intoperspective, where we're going to spend $94-odd million building a new facility.We're serious about it, but it's nothing like the scale of our naturalbusiness. Rapaport News: Is this a way into the diamond category for first-time buyers?Cleaver: I don't see this is as an entry into the natural space. Isee this as a totally different offering that some consumers want toparticipate in. There's no real emotional value in lab-grown diamonds, because they'renot unique. They're grown again and again in the same way, if that's what youwant out of it. Rapaport News: You plan to launch Lightbox Jewelry online in the US, andannounce retail partnerships in due course. Do you ultimately intend to sellthese products just online, or also in physical stores? Cleaver: It'll be both. We will launch an online offering first inSeptember, when we'll start our first sales. We are in discussions with acouple of retailers about some trials in stores as well. Rapaport News: When could that happen? Cleaver: It's going to depend on how these discussions go, so I can'tgive an exact date, but I hope there will be some news relatively soon after welaunch the pilot online. Rapaport News: Are we right to assume that no Lightbox jewelry willappear in the Forevermark or De Beers Diamond Jewellers brands? Cleaver: Absolutely, it is a totally different business. I've beencareful to separate the management teams. The Lightbox team does not report tothe core marketing team that Stephen [Lussier, De Beers' executive vice president formarketing and CEO of Forevermark] and co. lead. Stephen and his team remainvery focused on our core, natural business. The Lightbox team is a totallydifferent team reporting in through a different structure. So I've been verycareful to make sure there is no confusion between these. Rapaport News: To whom does Steve Coe, the general manager of Lightbox, report?Cleaver: He reports in to Neil Ventura, the [De Beers] head ofstrategy, who reports to me. Rapaport News: Once Element Six has produced the rough lab-grown diamonds,who will cut and polish them? Cleaver: Element Six will produce them [using chemical vapordeposition, a method of creating synthetic diamonds], and already produces themat [its UK facility in] Ascot, and we're investing in an expansion facility inOregon. That's also an Element Six facility. We've been trialing cutting and polishing with a couple ofpeople in India who are going to be our contractors to cut and polish. Rapaport News: Could this cause any repercussions for or confusion aboutDe Beers' image? Cleaver: It's very important that we separate these brands within DeBeers. We've got separate management teams, separate marketing, very differentmarketing aimed at different people. Lightbox, although it's brought to you from De Beers, it'snot got the De Beers brand or the De Beers logo. De Beers remains synonymouswith diamonds, so we will continue to drive De Beers as a natural-diamondbusiness, and I think there's no reason to think it will have any impact on us,as long as we continue to focus the different brands in the way they should be.I'm not particularly concerned about that. Rapaport News: Which synthetic-diamond producers do you see as yourcompetitors? Cleaver: A lot of people have produced lab-grown diamonds and areselling them in retail, but no one that I'm aware of has positioned them in theway we are. I prefer not to think about competition; I prefer to think aboutwhat's the best way for De Beers to maximize the value of its Lightboxbusiness. For me and the team, it's about how do we do this best, givingconsumers what they want, and in return having a profitable business. I'll stress again the size of the natural business relativeto the size of the lab-grown business for us: It's a small part of our world.I'm focused on trying to find small adjacencies that are profitable to add tothe core business. Rapaport News: Can you give a rough figure for the annual revenue youare expecting from this business? Cleaver: The [new Element Six] facility in Oregon, when it's up and runningin 2020 and onwards, will, roughly speaking, be able to produce about 500,000carats of rough [per year]. Broadly speaking, you could say that equates to 250,000 caratsof polished. You could see that could be, all in, a business with a revenue of$150 million to $200 million, which is not insignificant, but is nothing at alllike our $5 billion to $6 billion [natural-diamond] business.Images: Matt Crabb/De Beers