Headwinds Increase, But Gold Still In Demand

Dollar index rally will give gold a much-needed consolidation period.

China's industrial slowdown should bolster safe-haven gold demand.

Despite gold's headwind, mining shares still enjoy a powerful tailwind.

Gold is facing renewed headwinds in the form of a strengthening U.S. dollar and a comeback in equity prices. Yet despite these obstacles, an abundance of evidence shows that investors are exceedingly apprehensive about concerns ranging from Fed interest rate policy to the possibility of a global economic recession. In this report, I'll make the case that these ongoing uncertainties will support gold prices in the coming weeks. I'll also argue that the gold price will likely consolidate its recent gains during the dollar's latest surge and form a new base of support from which to launch a more vigorous rally later this summer.

In an unstable political climate, the one certainty is that investors are lacking confidence in the global economy. There is also an increasing amount of ambivalence in the U.S. economic outlook in some quarters. And when investors lack confidence, you can bet that they'll flock to the traditional safe havens of cash, U.S. Treasuries, and - when they get really scared - to gold. We've apparently reached the point where investors have lost so much confidence in the U.S.-China trade outlook that gold is in demand merely for its safety features, irrespective of the strong U.S. dollar.

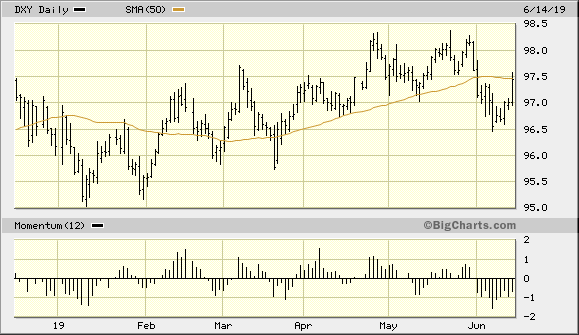

To put into perspective gold's impressive strides this month despite a strong dollar, the following graph shows the U.S. dollar index (DXY) approaching a 52-week high. The dollar index rallied sharply last week as U.S. retail sales for May rose 0.5%, the third consecutive month of increased sales. Industrial production rose 0.4% to its highest level in six months. The stronger sales gave international investors an excuse for owning dollars as other countries look weak by comparison.

Source: BigCharts

China meanwhile has reported its slowest industrial growth rate in 17 years for May, giving investors another reason to worry that the trade war could create a worldwide economic recession. Continued soft data from China is serving to increase gold's attractiveness as a safety hedge despite the concomitant strength in the U.S. dollar. And with trade war fears proliferating, gold's "fear factor" support doesn't look to diminish anytime soon.

As can be seen in the above graph of the dollar index, DXY didn't quite make it above its 50-day moving average on a weekly closing basis for the week of Jun. 10-14. That should provide gold bulls with at least some breathing room to consolidate the latest gains in the yellow metal. If the dollar continues to rally, it will rob gold of at least some of its steam, but it need not end the metal's turnaround attempt altogether. Gold could use some additional rest and consolidation in view of the magnitude of its June gains. Therefore, a dollar rally - assuming DXY doesn't rally in a runaway fashion - wouldn't be entirely unwelcome at this point.

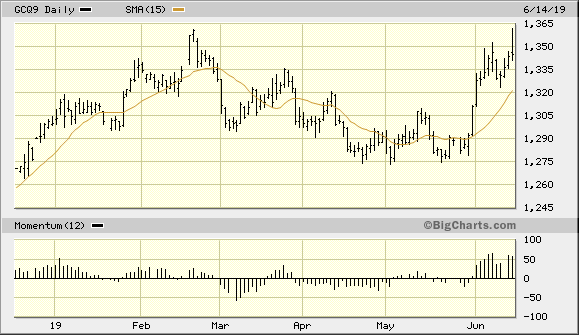

Turning our attention to gold's recent performance, the August gold futures price (below) hit its highest level since April 2018 on June 14. Gold briefly tested its previous peak at the February high last week before settling slightly under this level to close at $1,345 on June 14.

Source: BigCharts

The Feb. 20 high of $1,360 has a psychological significance to gold traders since this was the level that served as the previous intermediate-term peak for the metal. It proved to be too much to be overcome in the latest attempt, and with the U.S. dollar strengthening, gold might have to consolidate for a few days before attempting another rally above the February high. Investors should watch the $1,320 level in gold in the coming days as a potential support, for this is where the influence of gold's rising 15-day moving average will be encountered. A close below $1,320 would be disappointing for the short-term outlook, but as long as gold remains above this level the bulls should have no difficulty remaining in control of both the short term and intermediate-term trend.

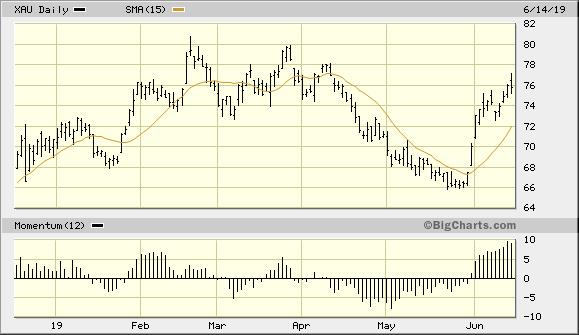

Now let's take a look at the gold mining stocks. There is still a lot of forward momentum and relative strength to be found in the actively traded shares of U.S.-listed production and exploration companies. I've argued in recent weeks that gold stocks would likely benefit from gold's rally as a leveraged trade for retail investors and hedge funds. Gold stocks of course carry more risk than bullion, but the upside potential of the gold shares during a precious metals rally is undeniably greater, in percentage terms, than that of physical gold.

To date, the progress that the gold producers have made in the aggregate can be seen in the PHLX Gold/Silver Index (XAU), below. Unlike August gold futures, the XAU index hasn't yet reached its previous high from February. I anticipate the XAU will at least come close to reaching the 80.00 level before its latest rally phase has ended. The XAU's failure to test the February high around 80.00, especially given the extraordinary internal strength in the mining sector right now, would be unusual.

Source: BigCharts

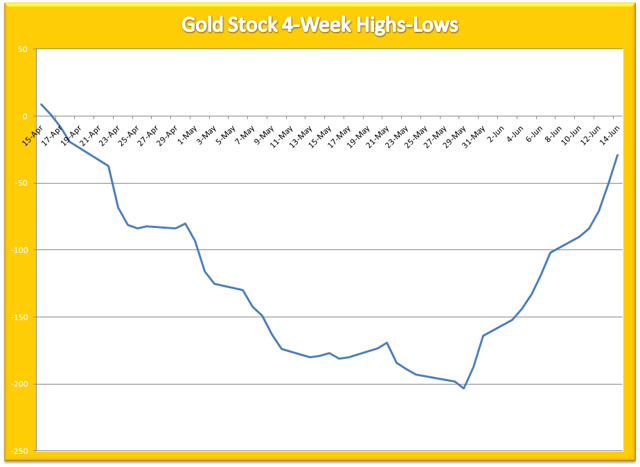

Speaking of internal strength, the most dominant feature behind this month's gold stock rally has been the rising trend in the new highs and lows of the 50 most actively traded mining shares. This is an important consideration since the new highs and lows indicate the incremental demand for gold shares. When the new highs-lows are viewed from a 4-week rate of change perspective (below), it provides us with a clear view of the near-term path of least resistance for the gold stocks as a group.

Source: NYSE

As you can see in the above graph, the 4-week high-low momentum indicator is still rising at an impressive rate. This suggests that gold stocks will continue to benefit from residual demand as nervous investors continue to look to gold for safety. And as long as the actively traded gold shares are making more new highs than new lows, I recommend that investors have at least some exposure to the gold mining stock sector. My favorite vehicle for participating in a gold stock rally is the VanEck Vectors Gold Miners ETF.

In conclusion, the U.S. dollar index has shown above-normal strength lately and this is a potential near-term headwind for gold. However, the widespread fears of a China-led global slowdown which first caused gold to rally beginning in May are still present, and gold should therefore benefit from continued safety demand. While gold must contend with a strong dollar headwind, gold mining shares currently enjoy a tailwind in the form of strong internal momentum. The gold miners should also continue to benefit from gold's increased safe-haven demand, and I anticipate the XAU index will reach its February high before the latest rally phase has ended. In view of these factors, investors can maintain longer-term investment positions in gold and gold ETFs.

On a strategic note, I'm currently long the VanEck Vectors Gold Miners ETF (GDX). After the recent rally to the March high in GDX, I recommend raising the stop-loss on this trading position to slightly under the 22.00 level on an intraday basis. This is where the technically significant 15-day moving average can be seen in the daily chart above. The latest weekly close under the 50-day moving average in the U.S. dollar index should help support the intermediate-term outlook for gold and gold stocks.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts