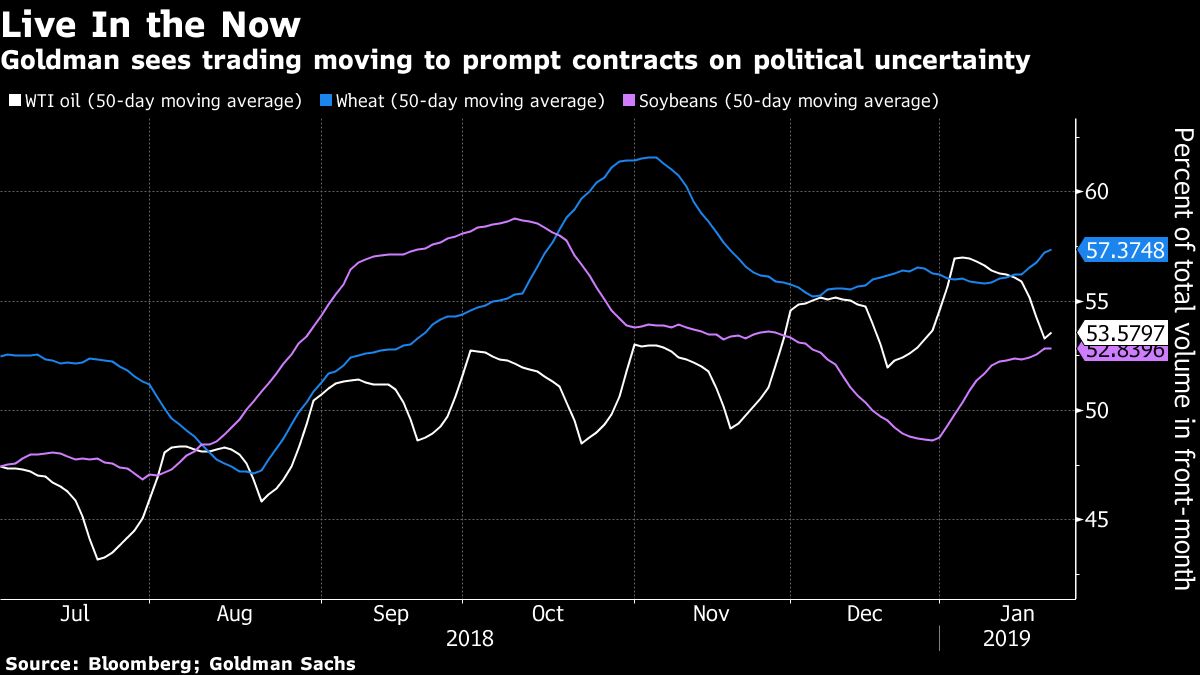

Goldman says commodity investors fear future in age of Trump

Political uncertainty means there's no time like the present when it comes to commodities trading, according to Goldman Sachs Group Inc.

Traders are less willing to buy and sell long-dated futures because of increasing risks associated with trade wars and other geopolitical fissures springing up around the globe, Jeff Currie, head of commodities research at Goldman, said in an interview on Bloomberg TV. Instead, more activity is moving into the nearest month's contract.

"The willingness of people that trade forward commodities has dropped because they're scared about the future and they move up to the prompt or they go hand to mouth""The willingness of people that trade forward commodities has dropped because they're scared about the future and they move up to the prompt or they go hand to mouth," Currie said. "That dynamic is becoming increasingly prevalent across commodity markets."

Trading volume for front-month contracts as a share of all contracts has increased for commodities such as West Texas Intermediate oil and Brent crude, as well as soybeans and wheat, according to data compiled by Bloomberg. To be sure, the trend isn't universal, as the share has fallen for London metals contracts such as aluminum and copper.

Global markets for everything from commodities to equities have been rocked for the past year by geopolitical chaos, with investors being kept on edge by everything from a trade war between the U.S. and China to President Donald Trump's decision to reimpose sanctions on Iranian oil and a still-ongoing partial shutdown of the American government. The Bloomberg Commodity Index is up 4.5 percent this year after falling 10 percent in the fourth quarter.

Other comments by Currie in the TV interview: While U.S. shale crude represents over 75 percent of global supply growth, OPEC is more afraid of international oil companies as their investments in long-cycle production provide about 20 years of "sticky supply". Demand for oil and other commodities is solid, and "significant upside" for crude seen. While the current situation in Venezuela is a "tad bullish" for oil prices if it generates more disruptions, supply changes may be ahead in the next 18 months with a new regime. Gold prices will be supported by investors seeking a hedge against recession fears, rising physical demand from top consumers India and China, as well as central bank buying.

(By Sharon Cho, Serene Cheong and Dan Murtaugh)