Gold Still Meandering Sideways, US$ Strong

Barry Dawes of Martin Place Securities takes a look at current movements in the gold and silver sector as well as one stock he believes is showing some constructive action.

Key Points

Gold

Gold still meanderingBut constructively!Nice intraday spikeGold Stocks

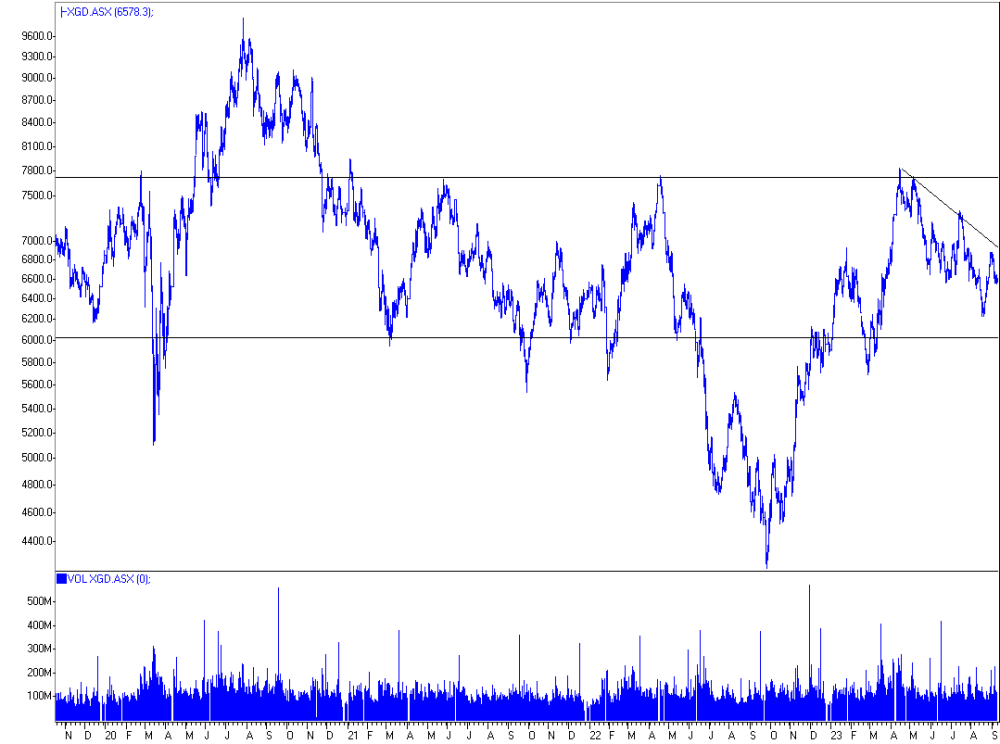

Looking positiveBarrick Gold breaking downtrendASX Gold Index

Steady for nowBut remember the big reversal underwaySilver

Well positionedBacktesting on downtrendSilver vs. Gold wedgingResolution soonUS$

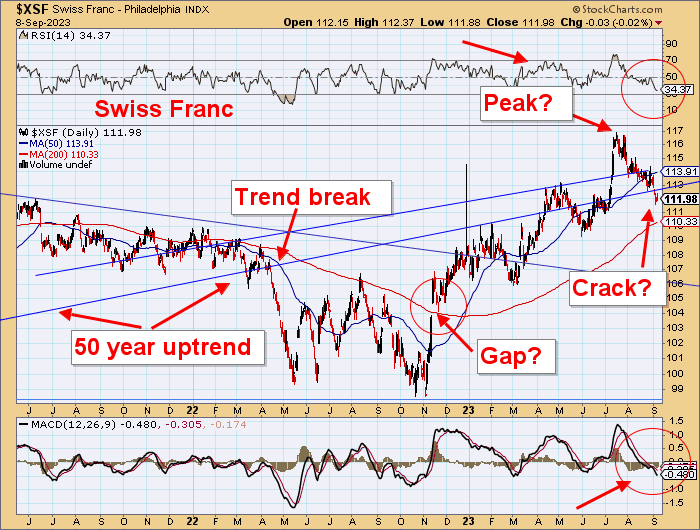

Heading higherExceeded May highMajor currencies still weak and going much lowerSwiss Franc cracks below 50-year uptrend againEuro making new month lowsYen makes new month lowBond Yields

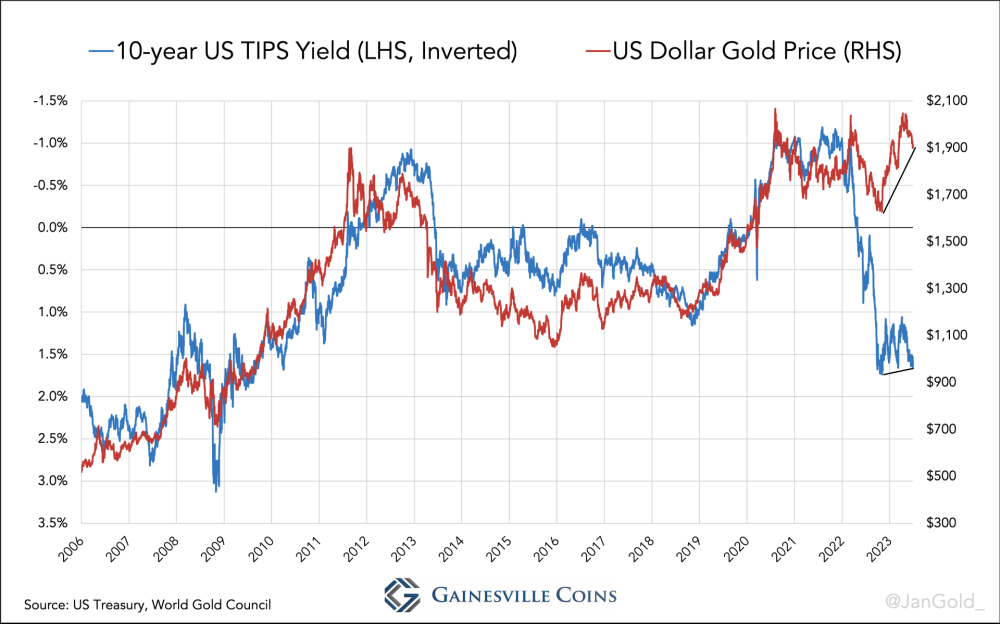

TIPS (Treasury Inflation-Protected Securities) yields decliningBig move lower is comingBond yields have peakedTIPS and Gold

Short positions in gold bullion, not just futures?Bitcoin

Looks like heading lower againIt seems that the summer doldrums are still with us with gold.

Gold is still at the same level as three months ago at the beginning of the northern hemisphere summer, and we haven't seen very much in terms of a seasonal uptick.

Gold's performance against a very strong U.S. dollar is very constructive.

It has been clear for quite some years that the real problems don't lie in the U.S. but rather in Europe and Japan and many other countries for that matter.

The U.S. speaks English, and it has a huge amount of information flow that is absorbed by everyone in the world.

The machinations in the political and bureaucratic spheres are now daily talking points, and so the problems are going to be dealt with one way or another.

In contrast, much of the debate is suppressed, particularly in Europe and the UK and here too.

So, the gold price in most of these currencies is very near an all-time high, while in US$, it is still about 7% below the all-time high.

There is action in the gold market, and that spike has shown it.

Meandering is probably the right term because the action is slow, but the river is wide and deep.

A change is coming, though.

See below on TIPS.

Gold stocks are also moving around without a lot of progress being made.

This meandering has obviously bored the market silly despite gold being only 7% below its all-time high in US$ and all-time highs in other currencies.

Sentiment amongst gold stock investors is very poor, and with this rate of change, we'll get back to the 2015/16 lows reasonably soon.

This indicator for the 200-week EMav Is giving a very clear buy signal.

It's always interesting to look at past periods of market moves without a clear direction but generally looking weak.

I'm sure most gold sector investors will remember the decline from 2011 to 2014 in the ASX gold index, where it fell 82%.

That was bloody.

This little period is interesting.

Sideways for six months and market sentiment miserable.

And then this happened!

Maybe.

Market leader Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) is showing some constructive action by breaking its downtrend since mid-July and backtesting on the downtrend and on longer-term support.

The bigger picture looks very constructive.

ASX Gold Index

There is a very big Head and Shoulders Reversal coming up here.

Silver

Silver seems to be doing the RHS of its own big Head and Shoulder Reversal.Very strong support has been obvious at US$22.Supporting on a downtrend with continual backtests.Technicals like this usually support big up moves.

The Sprott Silver Trust gives a more accurate view of the silver market.

It is equally positive

Silver is building nicely against gold.

This wedge should see silver jump very smartly.

US$

Strong US$ continues.

This long-term graphic for the US$ gets stronger every month.

And those currencies breaking 50-year uptrends are just getting weaker.

Even the so-called gold-related Swiss Franc is heading MUCH lower.

The Yen and Euro are lost causes.

And Bitcoin is heading lower.

Bonds

Yields have peakedBig fall in yields comingBond rally to be very largeTIPS breaking lowerThe Treasury Inflation Protection Securities (TIPS) are indicating real interest rates are falling.

The short term is showing this.

The longer term is quite ominous.

A major break lower is coming.

The yields on U.S. Treasuries have failed to go higher.

10 Years

Remember this graphic, too.

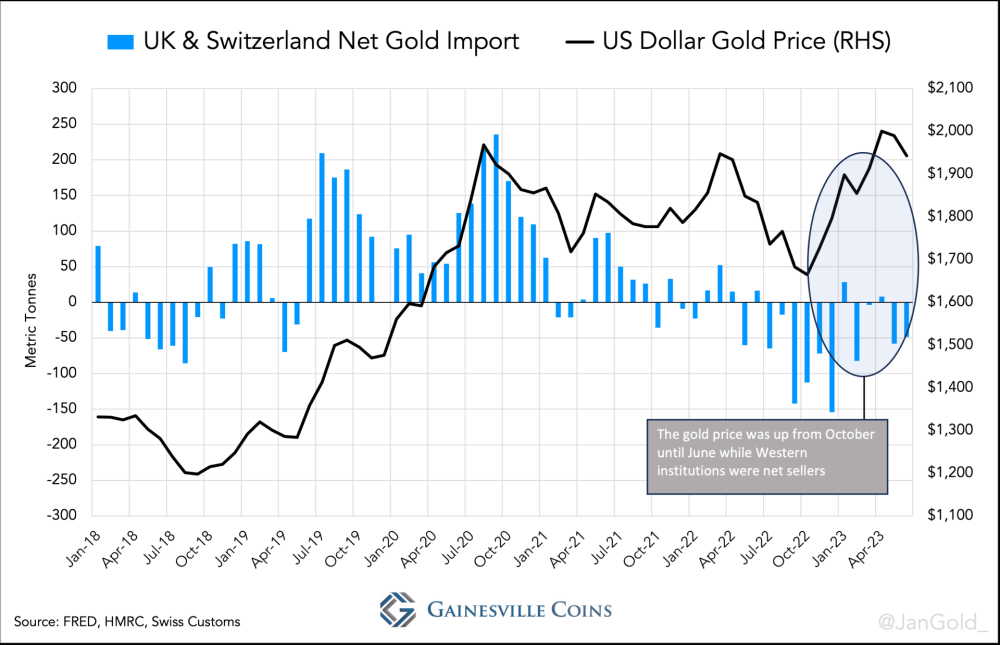

The suppression of the gold price from true animal spirits over the past 16 years has been this real interest rate control by gold investment institutions.

But gold held up this time when real rates rose to 1.5%, as shown by TIPS.

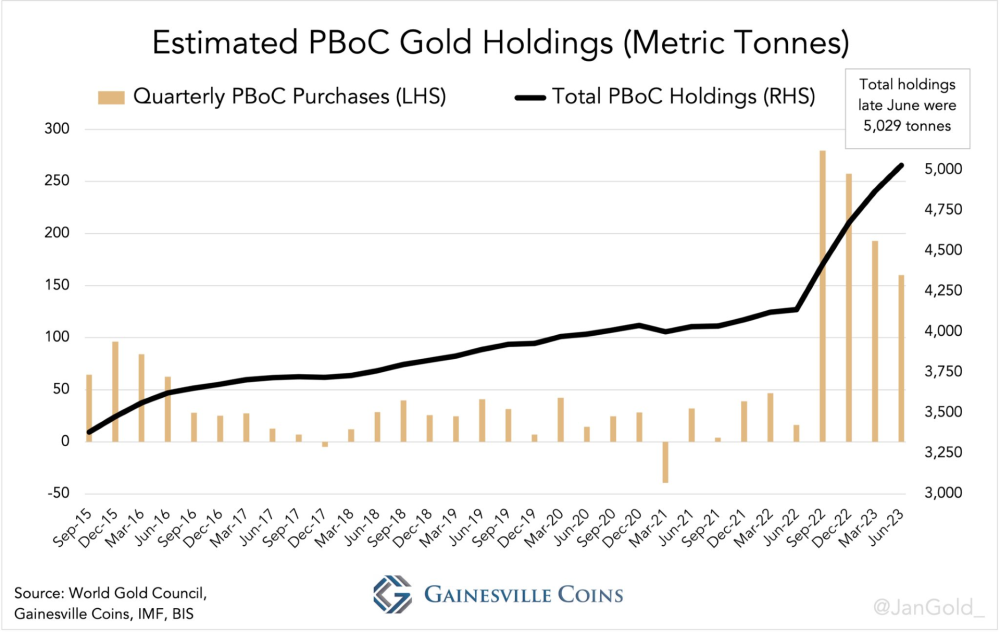

The West sold BULLION over this period.

Over 700 tonnes.

These bullion banks now either

Have less gold to influence the marketHave shorted the market and will need to buy it back.

And guess who probably bought it and won't be a seller?

And by the way, EO13848 was extended yet again.

Heed the markets, not the commentators.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp. Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.