Gold Breaks Out From Wedge and Promptly Backtests

Barry Dawes of Martin Place Securities looks at how various sectors have been doing this week, from gold and silver to uranium and housing.

Key Points

GoldBreaks up through wedgeAnd does that backtestNew US$ highs coming soonSilver still looking solidUS$ - heading higherRally to 105Euro, Yen, Sterling and Swiss Franc, etc., still look awfulNth Am Gold stocks starting a Wave 3Have completed C wave for 2Held the strong breakoutXAU still heading for 165ASX Gold Stocks starting a Wave 3Have completed Wave 2 pullbackBounced off major technical support hereAugust 2020 downtrend supportOct 2022 uptrend testHorizontal support around 6700Bigger picture H&S reversal pattern set upNeckline at ~7700Much higher target levels generatedU.S. equitiesS&P 500 exceed 42004300 coming and much moreDOW 30 about to surgeBreaking sharply higherHousing sector strongUranium readying to move quite sharplyGold

Surprised there was no initial backtest on the breakout from the wedge, but I guess it is here now. Maybe a pullback to the breakout while the USDXY heads to 105. Volatility remains high with another US$30 intraday move.

Gold is still holding above major support, not far from US$2000. But as has been pointed out, gold is technically ready for another sharp move higher.

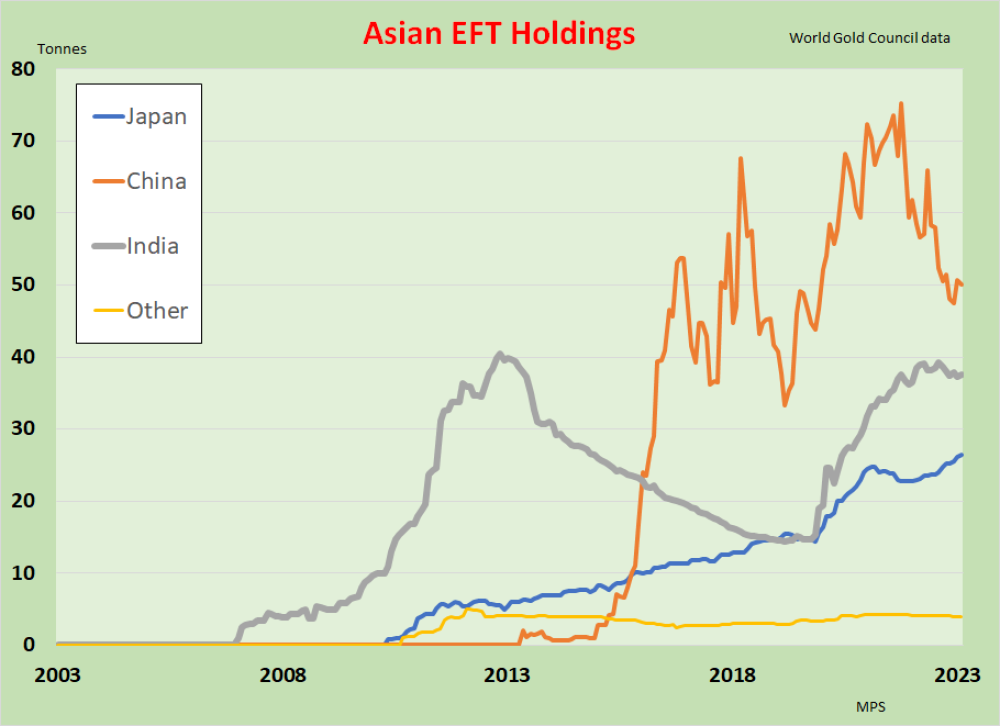

More detail from World Gold Council global data on gold ETFs.

The numbers for Asia are far smaller than for Nth America and Europe and are small against the very large traditional holdings in gold in China and India, but it is the direction that is of interest.

Individual country data for Asia.

Japan rising, with China and India possibly turning.

Also, the expected backtest to around US$1950 on this graphic didn't initially happen, but it might now. Maybe a week or two oscillating before moving higher.

All this might be confirming a low in May/June before moving seasonally higher in the Dec Half of the year.

Uptrend looks good.

Still holding above this long-term support level.

Gold vs. 10-Year T Bonds

Gold will strongly outperform bonds.Initially, gold heading higherThen bonds heading lower

Silver

This looks like a very strong setup for a sharp rise soon.

Gold Stocks

Gold stocks held on to gainsFive wave C Wave for the low in Wave 2 completed.Now starting Wave 3Zone of maximum accelerationNext stop 165 on the XAUFive waves down here from the B wave high to complete C and Wave 2. Strong breakout and a small pull back here.

Not sure how much backing and filling is required here, but it should not be too long.

Very nice bounce out of lower technical support and then support on the May 2022 downtrend.

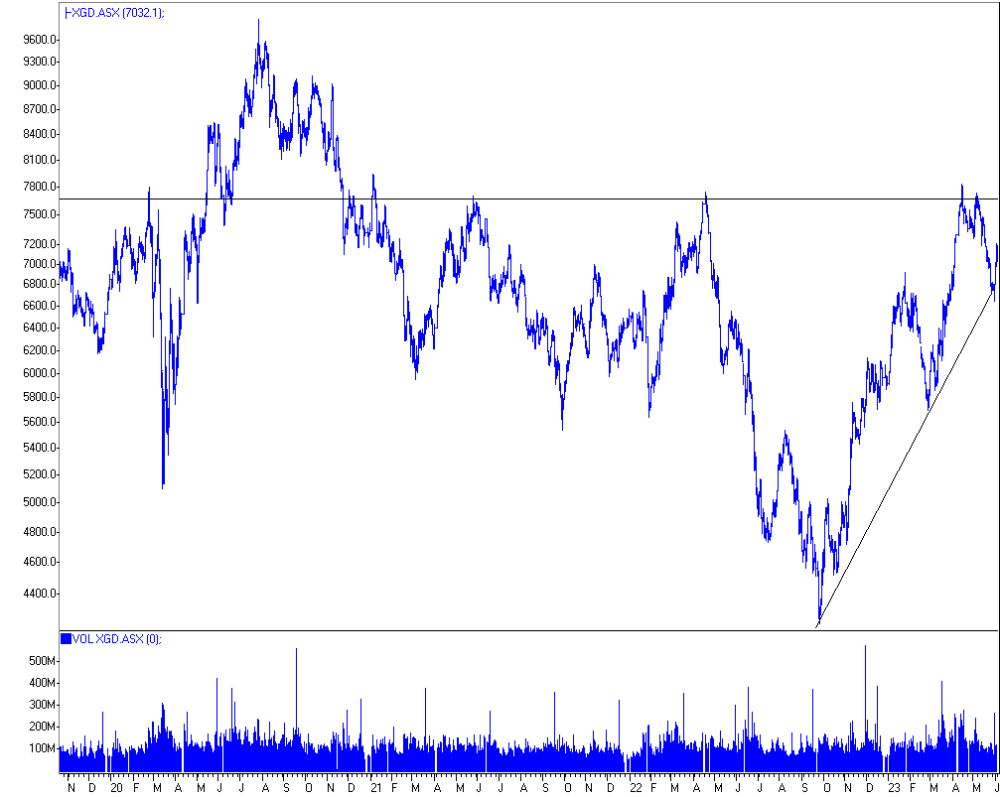

ASX Gold Index

Moving higher from strong technical support

July 2020 downtrendSept 2022 uptrendHorizontal support at around 6700

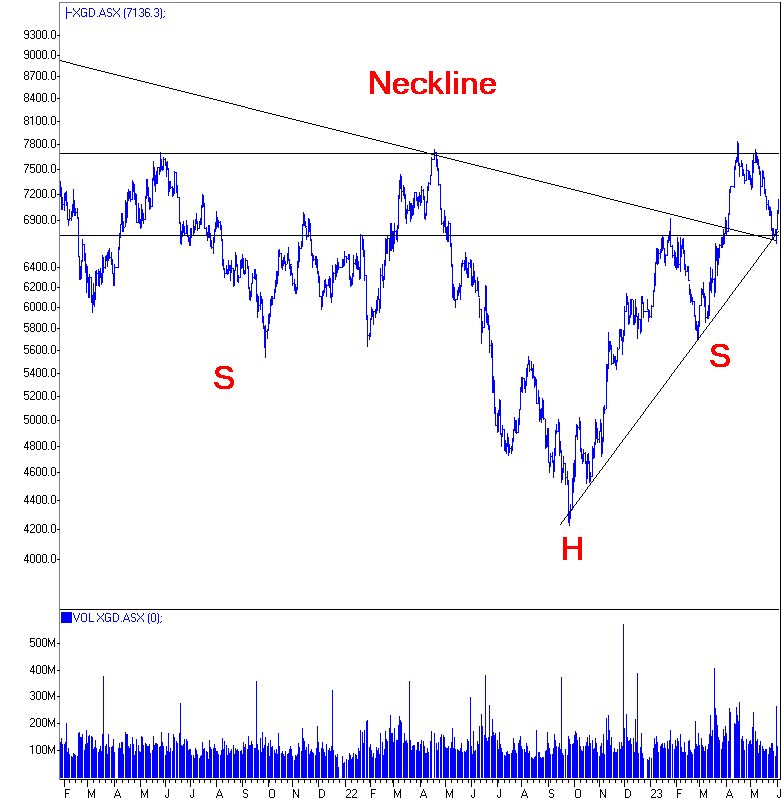

Need to keep repeating the big picture here

7700 is important long-term resistanceClear 'Neckline' for Head and Shoulders reversal.Target is around 12,000 as intermediate after passing 9888 previous all-time highOver 20,000 longer termXGD has completed 5 Wave C wave to complete Wave 2The big picture supports a MASSIVE rise in the XGD.

US Equities

Breakthrough 4200 achieved4300 will be nextDOW 30 is about to surge higherA strong rise comingShort covering driving

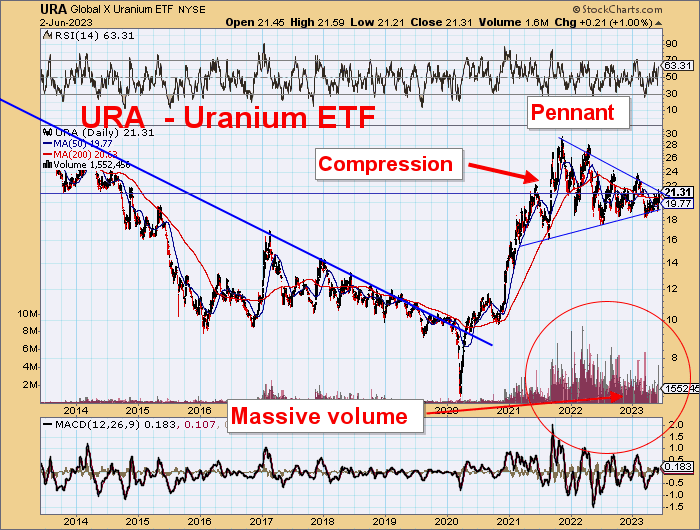

Uranium

Uranium is to break out strongly very soon.

Timing is everything.

Heed the markets, not the commentators.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.For additional disclosures, please click here.