Gold As A Safe Haven Asset Now Primed To Excel

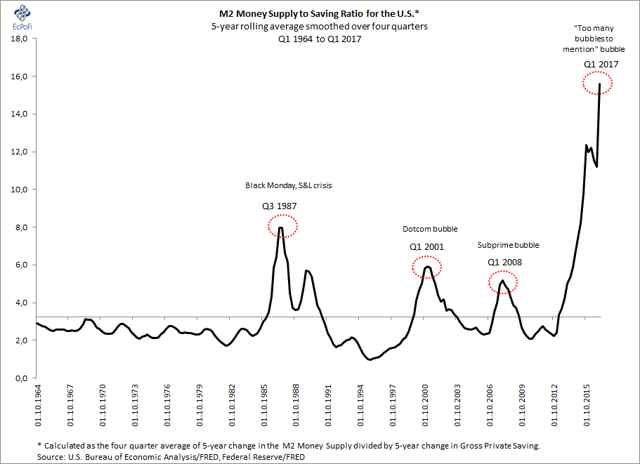

A peaking money supply to saving ratio is a warning sign that the economic distortions created during the upward swing of the ratio could be revealed.

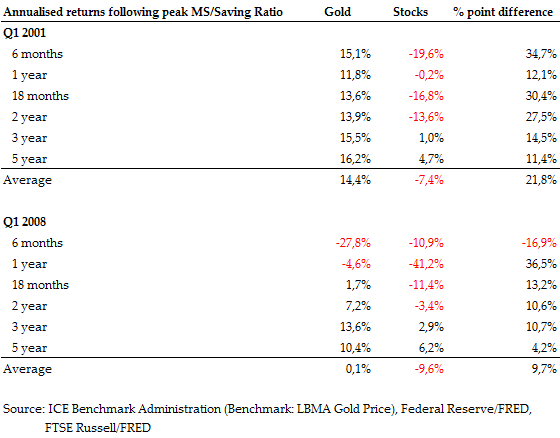

It is especially at this time that gold's properties as a safe haven asset are primed to excel.

Gold performed well in the aftermath of the two previous peaks in the MS/S ratio, especially compared to stocks.

Savings are not only paramount for economic growth. Frequently ignored altogether these days is the principle that an adequate amount of savings also helps promote economic stability. Since money is created as debt under the current monetary system, changes in the money supply relative to saving can therefore serve as an indicator of the degree of economic risk present in an economy.

As is well known among a minority of economists, the economic costs of monetary inflation are wide-ranging and include relative declines in the rate of saving, price distortions, overconsumption and malinvestments.

Enter the money supply to saving ratio (MS/S ratio), a ratio based on Hayek's insights, namely that...

...saving at a continuously high rate is an important safeguard of stability...

...and that a high rate of saving would also...

...tend to mitigate disturbances arising from fluctuations in credit.

Hayek here basically points out what once used to be viewed as little more than common sense even in the field of economics; namely, that saving is a good thing (a "safeguard of stability") while monetary inflation is the opposite (as it creates "disturbances"). The relation between the two is therefore of utmost importance. Generally speaking, the higher the MS/S ratio, the potentially greater the economic distortions and the higher the risk of boom bust cycles. If accumulated savings are at insufficient levels in an inflationary environment, both consumers and producers will sooner or later discover they have not set aside enough money to sustain their current spending and necessary investment levels. This becomes evident when new credit becomes difficult to come by or whenever the costs of that credit rise. Both spending and investment must then fall as a result. Deflationary pressures set in and the economic distortions are revealed in the form of a correction and a GDP recession (see The Austrian Theory of The Business Cycle).

An economic reaction must sooner or later occur when the MS/S ratio expands as it cannot continually increase in the long term. It simply must eventually drop as an inflating money supply will ultimately either produce intolerable levels of price inflation or as banks ultimately cut back lending as delinquency and default rates increase (which may trigger a banking crisis). The latter has been the biggest problem during the last couple of decades. As the money supply to saving ratio indicates the extent of consumption and investments above means, consistent expansions of the ratio is in any case impossible over the longer term as the economy will eventually run out of available resources, which are, after all, scarce.

As for the denominator in the ratio (saving), people and businesses will increase the proportion of income saved when uncertainty increases. This may take place in tandem with, or even be induced by, a declining money supply growth rate. What is important to note however is saving preferences, especially increases, can change substantially quicker and more violently than the money supply.

The drop in the ratio is therefore brought about by a decrease in money supply growth relative to saving or, alternatively, an increase in saving relative to the money supply. The drop will necessarily reveal the economic distortions brought about by the previous rise in the ratio. Together with the increased uncertainty that follows, these reactions might induce a flight to cash and safe haven assets, a reaction which likely benefits the price of gold. This is especially true when the two factors combined provoke an economic crisis.

That the quantity of money usually grows substantially faster than the quantity of gold is a primary reason why gold is superior as a permanent store of value over time compared to cash in hand or ordinary bank savings. In the current low or negative real interest rate environment, this is even truer today. As a general rule therefore, the price of gold benefits from monetary inflation as would many financial and real assets and commodities that also expand at a slower pace than the money supply. The strength of gold of course is its non-perishable properties, its scarcity, and the fact that its quantity increases less than most other assets and commodities.

An exception to the general rule mentioned above is during times of exuberance when investors become substantially less risk-averse and increasingly pursue quick gains. The 1990s is a case in point, a decade during which the quantity of money doubled, the S&P 500 index surged 310% (15.1% p.a.), while the price of gold plummeted 31%. Gold might at times therefore underperform relative to increases in the MS/S ratio, especially during the mid to final stages of the upward swing of the ratio when speculation in other assets thrives. But as the ratio peaks and the likelihood of a correction increases, it is particularly at this point gold is primed to show its true colours as a safe haven asset and appreciate in both absolute and relative terms.

The chart below reveals how peaks in the MS/S ratio for the U.S. economy regularly are associated with the end of inflationary booms and the onset of financial crises:

And gold did indeed prove its true colours in the aftermath of previous peaks in the MS/S ratio, most notably following the 2000 and 2008 peaks. The table below depicts the annualised price changes in gold (US$/oz.) and stocks (Russell 3000) for six different time periods following the 2000 and 2008 peaks in the ratio. For example, the table shows that gold appreciated 13.6% on an annualised basis during the 18-month period following the Q1 2001 peak in the MS/S ratio while stocks declined 16.8% on the same basis. Gold hence outperformed stocks by 30.4 percentage points (annualised) over this period. Overall, gold appreciated considerably over 18-month intervals following peaks in the ratio and decisively outperformed stocks on all occasions but one; the six month period following the 2008 peak.

Though the ratio has just reached an extravagant new high, timing peaks in the ratio is more art than science. It is therefore impossible to know if this is the peak or not. But in general, the higher the MS/S ratio and the longer it remains elevated, the greater the probability of an economic reaction and hence the greater the chances gold, with its safe haven properties, will appreciate. With the ratio just having hit an extravagant new high, it could therefore prove to be a wise move to increase the allocation to gold as gold benefits from the uncertainty and even panic that sets in when the ratio eventually drops.

Based on the above observations and the theory underpinning the MS/S ratio, it would not be unreasonable to be prepared for future declines in the ratio and another financial crisis. As the ratio just hit an extravagant new high in Q, it also would not be unreasonable to expect gold to once again soon show its true colours as a safe haven asset.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.