Gold: Resolution of Next Wedge

Barry Dawes of Martin Place Securities reviews the state of the U.S. dollar, the gold market, the banking sector, the copper sector, and crude steel.

Key Points

Goldo About to complete the next wedge

o Upside resolution would be strong

o New highs in most currencies

Nth Am Gold stocks continue to baseo Still within parabola

o XAU heading for 165

ASX Gold Stocks consolidating ahead of breaking necklineo H&S reversal pattern setup

o Much higher target levels generated

o NST looking for another sharp move

US equitieso S&P 500 looking to break sharply higher

o Could be heading for new highs on short covering

o Housing sector index at 16-month highs

Still housing shortageBanking sector bottoming on uptrend line?US$ - Heading Higher

Breaks 7-month downtrendEuro at a critical levelYen weaker againBHP Looking Strong

Copper bottomingChina crude steel output strong againGold

Gold seemed surprisingly calm overnight while it consolidates above US$2000.

The US$30 sell-off on Thursday clouded the US$20 recovery on Friday, so the volatility in gold is very positive for this market.

Note gold is now making new highs each week in other currencies.

Technically, gold is ready for another sharp move higher.

The resistance around US$2000 is now supported.

Gold making new highs in Euros.

Gold Stocks

Still within the parabolaGold stocks would be in wave 3Zone of maximum accelerationNext stop 165 on the XAU

The short term should see good support here.

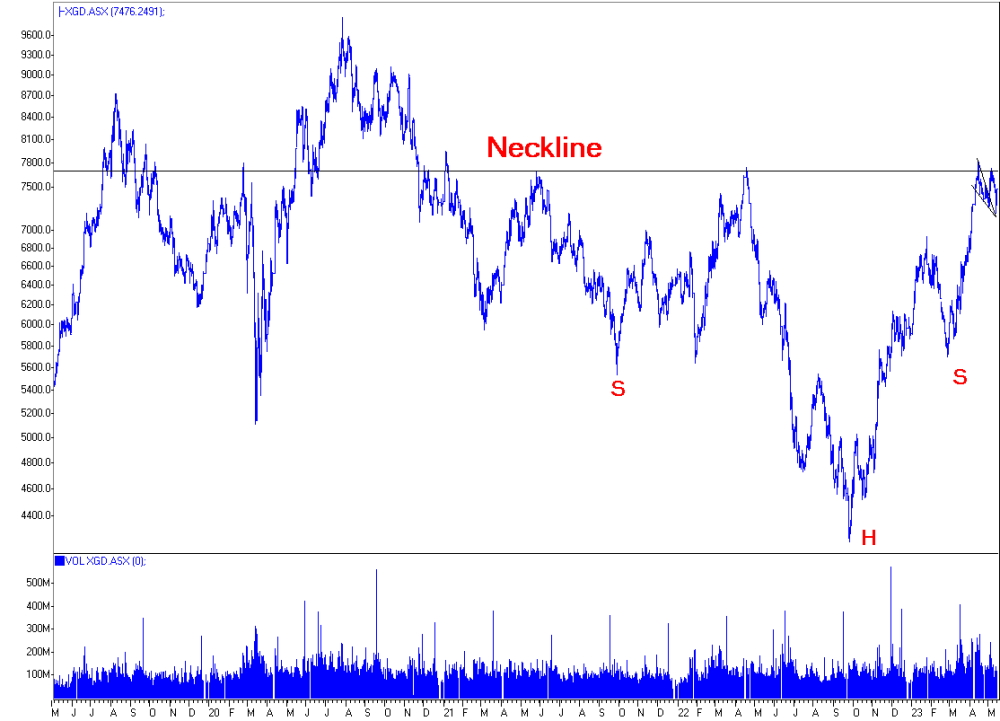

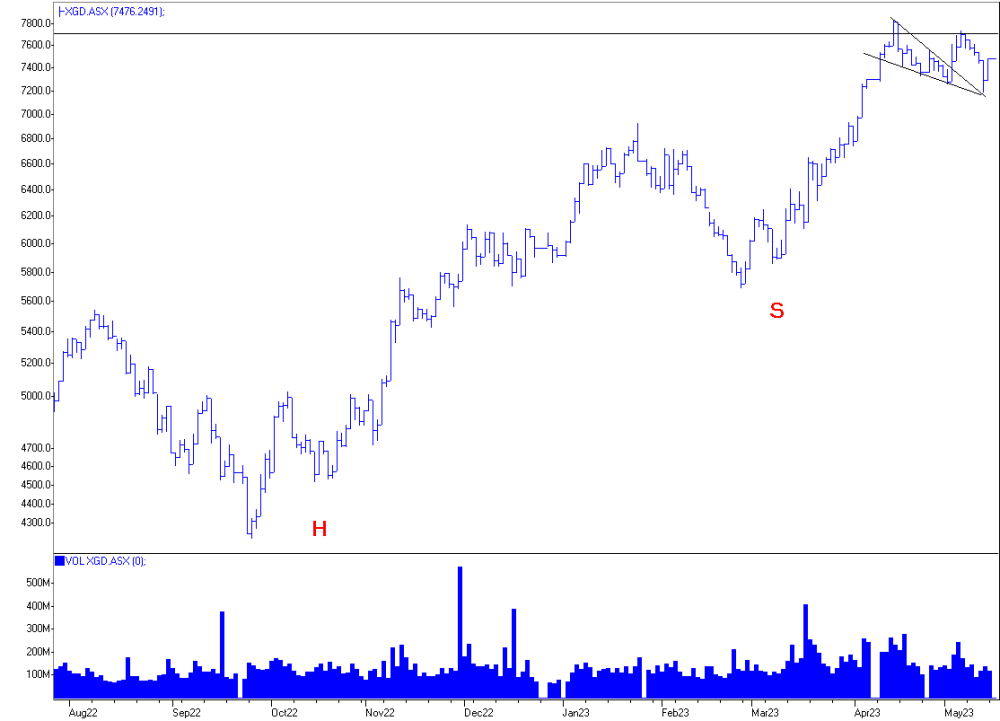

ASX Gold Index

Need to keep repeating the big picture here.

7700 is important long term resistanceClear 'Neckline' for Head and Shoulders reversalTarget is around 12,000 as intermediate after passing 9888 previous all time highOver 20,000 longer termNice consolidation pattern hereThe big picture supports a MASSIVE rise in the XGD.

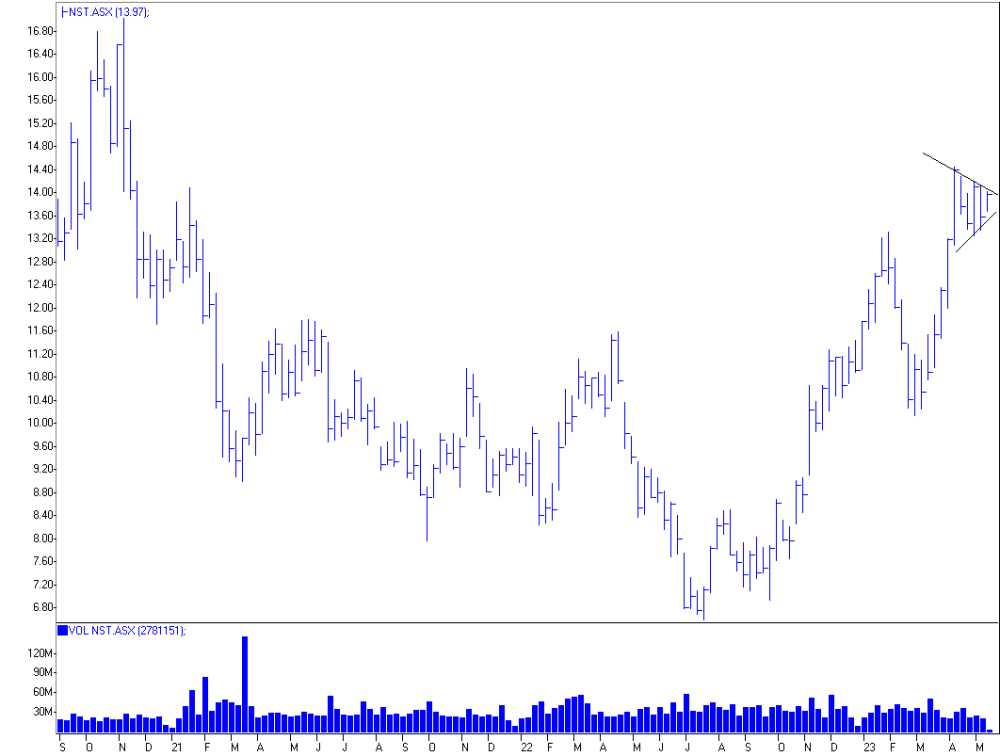

NST is Leading

Disappearance of NCM will only boost NST higher

US$ Index

Rally continuingOther currencies looking weak

Euro

Critical level hereShould bounceBreaking below 108 should lead to further weakness

Japanese Yen

Heading lower

US Equities

Short term is setting up for a big breakoutA breakthrough 4200 would signal a strong rise

Housing Sector Index

New 16 month high!

Big inventory catch up > 4 years.

Banking sector recovering.

Copper

Bottoming

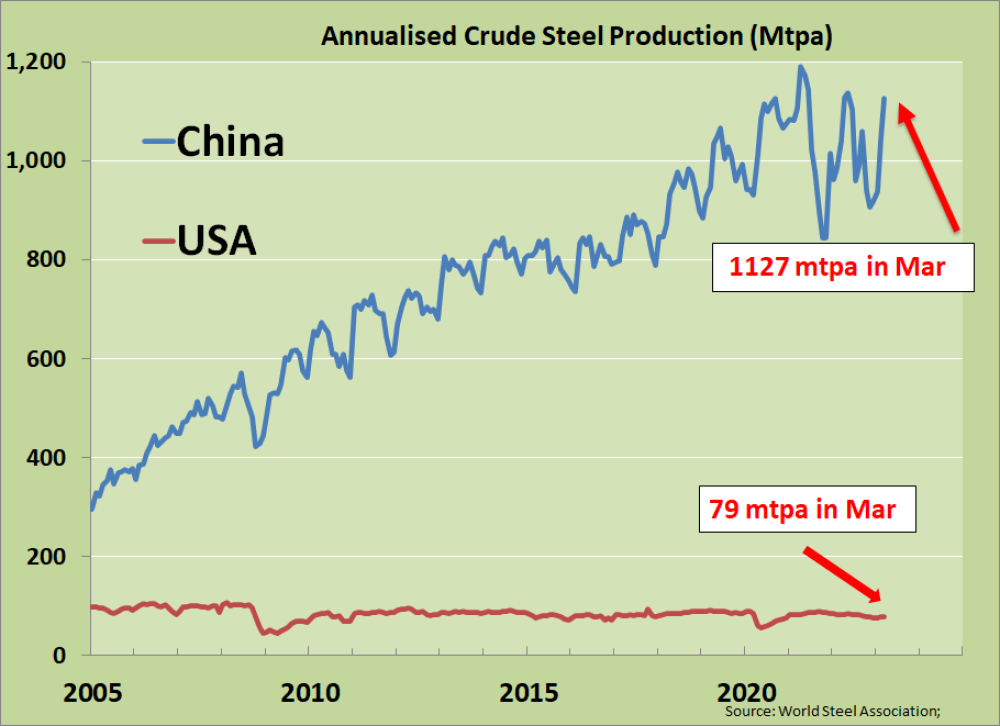

China Crude Steel Output

Strong recoveryNot far from all time highsIron ore should soon pick up again

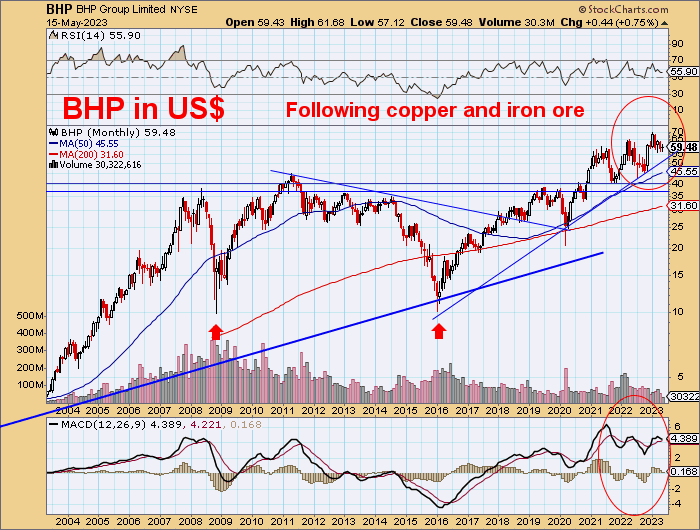

BHP

Following copper and iron oreLooks likely to see significant new highs in 2023Some short term pull back possible

Timing is everything.

Heed the markets, not the commentators.

| Want to be the first to know about interestingGold,Critical Metals andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.