GDX Or Gold - Which One Is Better Now?

Investing long term in precious metals stocks is a very bad idea (with a few very rare exceptions).

On the other hand, there are periods when betting on precious metals shares makes sense; however, the problem is that these periods are becoming shorter and shorter.

Since January 2016, GDX has been performing better than gold; this period has lasted quite a long time, so now we may be close to the end of this pattern.

If I am correct, investors should change their strategy; in this article, I discuss how to do it.

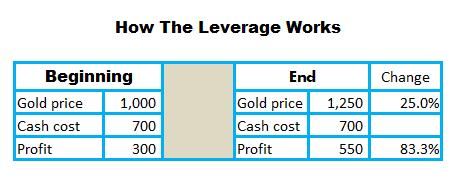

It is common knowledge that during a bull market in gold, precious metals stocks perform better than the metals themselves (gold and silver). In other words, when gold prices go, for example, up by 30%, precious metals stocks should go up more (by 60% for instance). It is called the leverage, and here is an explanation how it works:

Source: Simple Digressions

The table above presents a hypothetical case of a mining company producing gold at the cost of $700 per ounce of gold. The only variable is the price of gold:

At the price of gold of $1,000 per ounce, the company earns $300 per ounce of gold (revenue of $1,000 less the cost of $700) At the price of gold of $1,250 per ounce, the company earns $550 per ounce of gold (revenue of $1,250 less the cost of $700)So, a 25% increase in gold prices drives the company's profit by 83.3%. In other words, if gold prices rise 25%, the company's market valuation should go up by around 83% (the leverage is 3.33:1 (83.3% divided by 25%)). That is why during a bull market in gold/silver, investors load up on shares of precious metals miners. Is it logical? I think it is.

Logic and financial markets

However, financial markets are not logical (if they were, the philosophers would be the best investors). Look at the chart below:

Source: StockCharts.com

The chart shows:

The price action of the XAU index (the upper panel of the chart). XAU/gold ratio, which tracks the relative strength of precious metals mining shares against gold prices (the lower panel of the chart).Note: The XAU index consists of 29 precious metal mining companies (or related to the sector, as, for example, Wheaton Precious Metals (NYSE:WPM), which is a gold/silver streaming company).

Now, the thin, red rectangles on the lower panel of the chart indicate the periods when precious metal shares were outperforming gold prices. I think that even the naked eye will surely notice that:

The period between 1986 and 1996 (10 years) was the longest one when holding the shares of precious metals mining companies was a better idea than holding gold bullion. Since that time, the periods when the shares of precious metals mining companies were outperforming gold prices were shorter and shorter (2001-2004: three years; 2009: one year; since the beginning of 2016: 1.5 years, up until now). The general trend of the XAU/gold ratio has been down since 1984.I think that the last observation is particularly impressive because it means that investing long term in precious metals mining shares is a very bad idea. Look at the returns delivered by the XAU index and gold since January 1, 1984:

Gold: 229% The XAU index: -25.6%So investing long term in precious metals mining companies is an awful idea, but... I guess it is nothing new for precious metals investors because the precious metals sector is a cyclical one.

Investing in precious metals mining companies is sometimes more lucrative than investing in gold or silver, but the problem is that, as the chart above shows, this "sometimes" is a rare and short-duration event. So, to make money on gold/silver miners' shares, you have to be very lucky (pick the right moment).

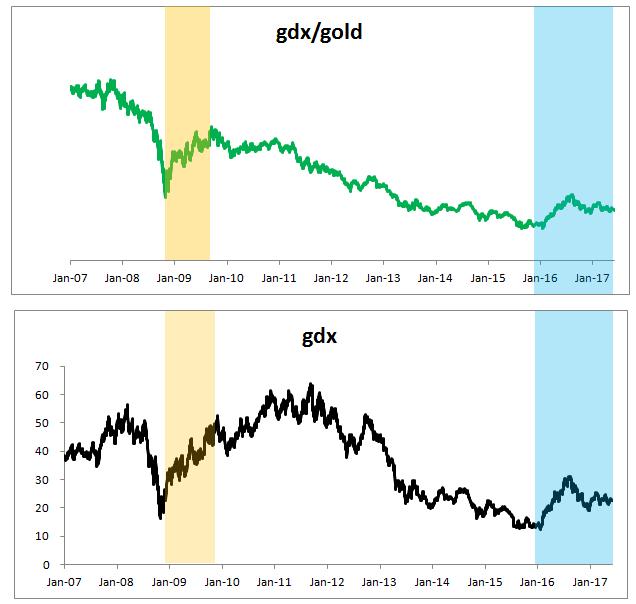

Further, it looks like the last right moment to invest in precious metals mining stocks is now. Or it was. As the charts below show, since January 2016, precious metals mining stocks have been performing better than gold:

Source: Simple Digressions

This time I am comparing the Market Vectors Gold Miners ETF (NYSEARCA:GDX) to gold. The upper panel of the chart shows the GDX/gold ratio. The yellow and blue areas indicate the periods when GDX was stronger than gold:

October 2008-September 2009: During that period, GDX went up by 190% and gold by 34%. January 2016 to now: GDX is up 83%, and gold only 21%Note that today we are in the 19th month of the current bull market in gold. What is more, during that period, precious metals mining stocks have been performing better than gold. It is quite a long time, so today one of the most important questions is:

Is the precious metals market going to revert to the old pattern of gold/silver miners underperforming gold?

Well, keeping in mind that the periods when precious mining shares are stronger than gold have been shortening over time, the chances of the GDX/gold ratio reverting to its major pattern (when gold is stronger than GDX) are growing.

Of course, I cannot predict the stock market. Who knows? Maybe we are back in the eighties and nineties and mining shares are going to be stronger than gold for additional 5-10 years. However, a cautious investor does not hope; they act. So, instead of betting on the thesis that "this time is different" (and GDX is going to perform better than gold for many years to come), a cautious investor may consider two options:

Adjusting their precious metals portfolio in order to get higher exposure to gold/silver (more gold/silver, less gold/silver mining shares). Betting on individual mining companies instead of the broad precious metal stocks market.The second option is what I am trying to do through my Marketplace service (the "Unorthodox Mining Investing"). Simply, I am trying to find stocks that should perform better than both GDX and gold.

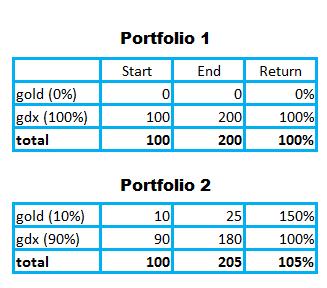

As for the first option, even adding a small amount of gold to the precious metals portfolio should improve the total return. For example, assuming that during a test period gold outperforms GDX by 50 percentage points. The two tables below show investment returns calculated for two variants:

There is no gold in the portfolio (Portfolio 1). Gold accounts for 10% of the portfolio (Portfolio 2).

Source: Simple Digressions

Note that the portfolio consisting of 10% gold and 90% GDX will return 105%, 5 percentage points above the return delivered by the portfolio consisting of GDX only.

Summary

History tells us that betting on precious metal mining stocks in the long term is a bad idea. Even bull markets in gold do not guarantee that precious metal miners' stocks will perform better than gold or silver. What is more, the periods when investing in precious metal mining companies delivers better results than investing in gold or silver are relatively short. That is why precious metals investors should consider alternative investment strategies than a simple bet on the broad precious metals stock market (tracked by GDX, GDXJ, etc.). In this article, I suggest that adding gold or silver (or both metals) to precious metal portfolios may be an example of such an alternative strategy.

Last but not least, there are some rare exceptions when investing in precious metals miners in the long term may deliver extraordinary returns:

Source: StockCharts.com

There were two stocks that performed better, or even much better, than gold in the long term:

Randgold (NASDAQ:GOLD): Since middle 2002, these shares have returned 1,840% (gold 312%). Fresnillo plc (OTCPK:FNLPF): Since June 2008, Fresnillo shares have returned 103% (dividends excluded) while gold returned 44%.However, the problem is that there are only two mining companies that delivered better investment results than gold (if anybody can correct me and find another mining company that performed better than gold, please do so). That is why my thesis on adding gold to precious metals portfolios may be helpful. In the long term, it is gold that wins...

Disclosure: I am/we are long GDXJ.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.