Dow Set to Do This for First Time in 8 Years

Chilly U.S.-China trade relations have weighed on the index

Chilly U.S.-China trade relations have weighed on the index

While the major stock market indexes are higher today, they're still on pace for another week in the red. In fact, amid escalating concerns about U.S.-China trade, the Dow Jones Industrial Average (DJI) is pacing for a fifth straight Friday-to-Friday loss -- something we haven't seen since 2011. What's more, if history is any indicator, the blue-chip index could be vulnerable to more selling pressure in the short term.

Specifically, the last time the Dow suffered a five-week losing streak was in June 2011, nearly eight years ago. After that, the index dropped another 7.5% in the subsequent three months, per data from Schaeffer's Senior Quantitative Analyst Rocky White. Prior to that 2011 streak, the last five-week losing stretch was nearly 15 years ago, in July 2004. The longest ever weekly losing streak was in 1923, at eight weeks.

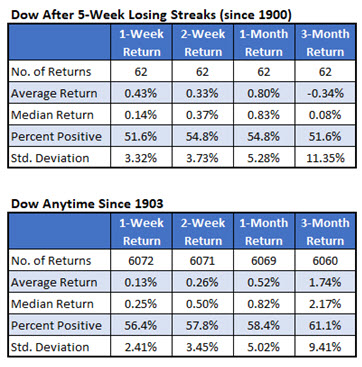

Since 1900, there have been 62 five-week losing streaks for the Dow. Afterwards, the index managed at- or above-average returns over the next month. However, at the three-month marker, the Dow was down an average of 0.34%, and was higher just 51.6% of the time. That's compared to an average anytime gain of 1.74%, with a win rate of 61.1%, looking at DJI stats since 1903. Plus, volatility ran hotter after five-week losing streaks, per the Standard Deviation stats below.

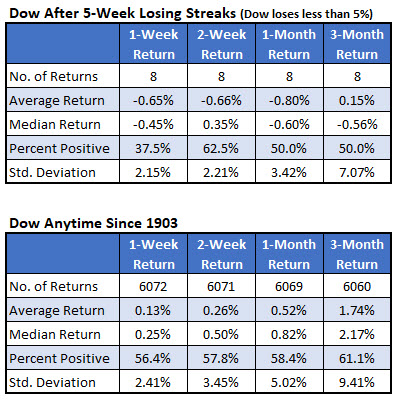

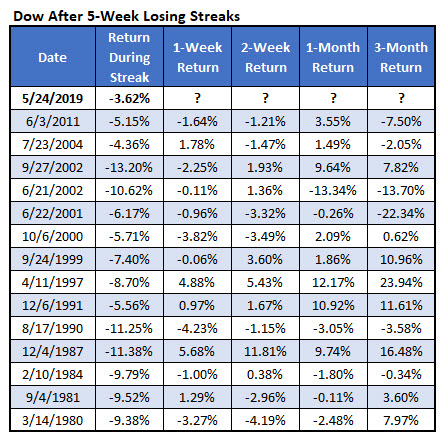

During the current losing streak, the Dow has surrendered less than 5%. Since 1900, there have been just eight similar streaks, after which the blue-chip barometer also experienced weaker-than-usual price action.

One week later, the index was down 0.65%, on average, and snapped its weekly losing streak just 37.5% of the time. That's compared to an average anytime one-week gain of 0.13%, with a win rate better than a coin flip, looking at data since 1903. It's a similar situation two weeks out, with the DJI averaging a loss, compared to an average anytime gain.

One month later, the Dow was down 0.8%, on average, and higher just half the time. That's compared to an average anytime one-month return of 0.52%, with a better win rate of 58.4%. And while the index averaged a gain three months out, it's a slim 0.15%, and pales in comparison to the Dow's average three-month gain of 1.74%.