Copper price: Escondida deal beginning to look distant

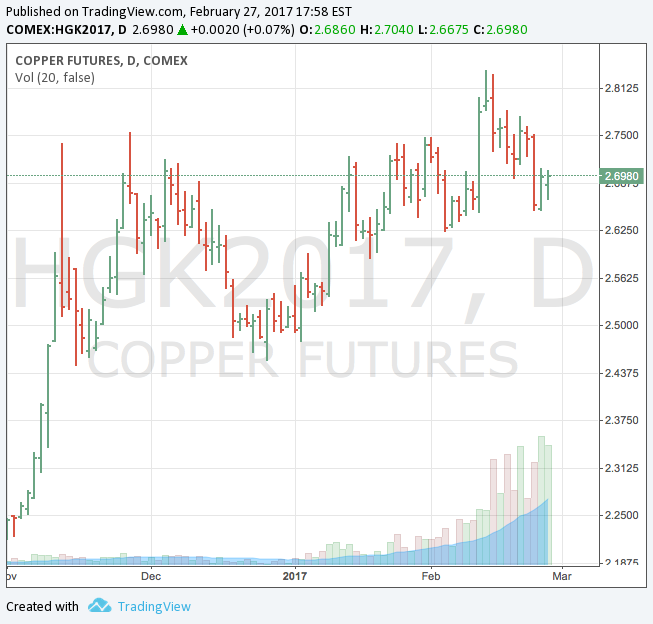

In New York on Monday copper for delivery in May was trading slightly for the better at $2.6980 per pound or $5,940 a tonne after conflicting reports about talks between BHP Billiton and workers at its Escondida mine in Chile.

Two weeks ago copper jumped to its highest level since late May 2015 after Escondida workers first went on strike and is showing year-to-date gains of 7%.

In a television interview with BHP CEO Andrew Mackenzie said talks had resumed with the main union representing 2,500 workers at Escondida, the world's largest copper operation by a wide margin adding that the miners are "extremely well paid".

But he was contradicted by a spokesman of the union who said last Monday's government mediated talks were the last time the parties had been around a table. While this type of brinkmanship is not uncommon in wage negotiations it could indicate that the strike may take longer to resolve.

"Copper traders are voting with their feet that a resolution to the strike isn't close as the red metal finishes near highs despite mixed messages from BHP and union leaders," Tai Wong, director of commodity products trading at BMO Capital Markets, told Bloomberg in an e-mail.

"Copper traders are voting with their feet that a resolution to the strike isn't close"BHP, which operates and majority owns the mine with fellow Melbourne diversified giant Rio Tinto, declared force majeure at the mine on February 10. The previous labour deal was signed four years ago when copper was trading around $3.40 a pound.

In its financial results released last week BHP expected full-year production at Escondida of 1.07 million tonnes, wh

ich gives the mine a nearly 5% shares of global primary copper production. BHP also cut full year guidance by 40,000 tonnes to 1.62m tonnes.

ich gives the mine a nearly 5% shares of global primary copper production. BHP also cut full year guidance by 40,000 tonnes to 1.62m tonnes.

Trouble in Indonesia

In Indonesia top listed copper producer Freeport McMoRan's Grasberg mine faces a concentrate export ban as it negotiates a new licence from the government of the Asian nation.

Phoenix-Arizona-based Freeport said last week in an update as a result its operating subsidiary in the country PT-FI "is proceeding with its plan to suspend investments in Papua, reduce its production by approximately 60 percent from normal levels and implement cost savings plans involving significant reductions in its work force and spending levels with local suppliers."

Freeport is proceeding with its plan to suspend investments in Papua and reduce production by approximately 60%Freeport said its 25%-owned smelter in the Asian nation which has been hit by a strike expects to resume operations in March, but warned that its first quarter production has taken a substantial hit:

Assuming resumption of PT Smelting's operations in March and a continuation of the ban on exports, FCX estimates its first quarter sales will be reduced, resulting in deferrals of approximately 170 million pounds and 270,000 ounces, representing a reduction of approximately 17 percent for copper and 59 percent for gold of its consolidated first quarter sales.

In January Freeport said for each month of delay in obtaining approval to export, the Indonesian subsidiary's share of production is projected to be reduced by approximately 32,000 tonnes of copper and 100,000 ounces of gold.