Copper Co. a Top Performer for Venture Exchange Picks

Analysts and investors seem to agree onWorld Copper Ltd.'s (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA) new direction, with its stock hitting highs not seen in more than a year. It topped one firm's list of Top Picks, outperforming its other picks on the TSXV.

As World Copper Ltd. (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA) switches focus from South America to its Zonia project in Arizona, analysts are agreeing with the decision and investors seem to like it, as well.

Fundamental Research Corp. (FRC) named the stock as the top performer of its picks last week as it went up 196% month-over-month, moving up from fifth place in a similar list in March.

Vancouver-based World Copper is focused on the exploration and development of its coppery porphyry projects in Arizona and Chile.

In a strategic move, the company decided to advance Zonia instead of its Escalones asset in Chile, which is currently at a permitting standstill, reported Taylor Combaluzier, Red Cloud Securities vice president and mining analyst, in a May 23 corporate update note.

"Given the current robust copper market environment, we believe the company's focus on developing its smaller-scale Zonia project is prudent and more feasible for a junior mining company to tackle," Combaluzier wrote.

FRC analysts' weekly "Analysts' Ideas of the Week" message notes its top picks and their performance. It said in April, companies on its Top Picks list were up 12.7% on average vs. 2.8% for the benchmark (the TSX Venture Exchange).

The Catalyst: An 'Underappreciated Critical Mineral'

Copper climbed above US$10,000 a ton in May on predictions of tighter supplies and rising consumption for use in electric vehicles (EVs) and power grids in the transition to green energy. It was US$9,260 per ton, up US$180, on Wednesday.

"Prices of copper have risen 17% this year on fears of shortages, with aging mines forecast to struggle to keep pace with demand," Mining.com reported.

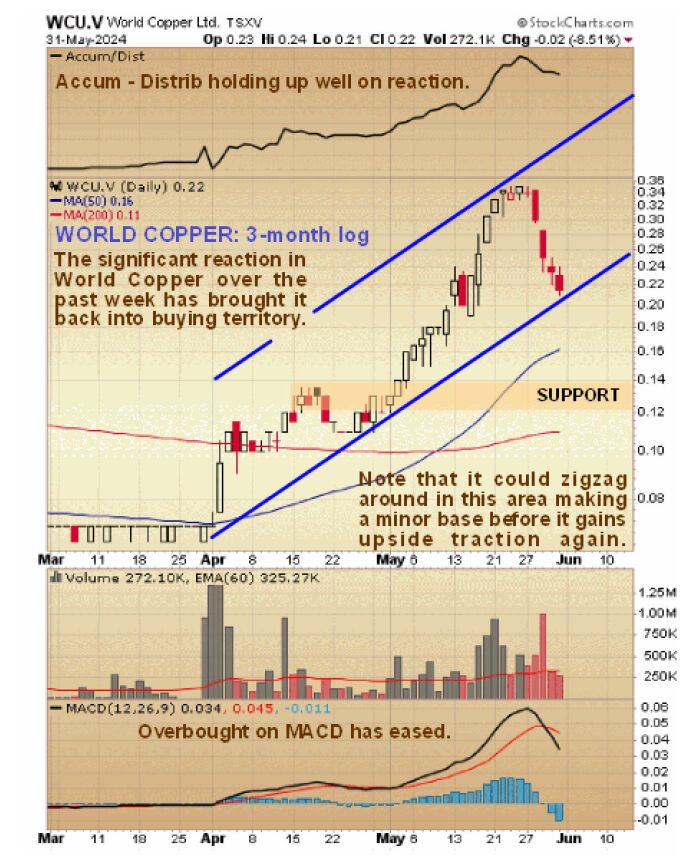

On June 2, Technical Analyst Clive Maund shared the above chart and noted that World Copper had been brought to his attention two weeks earlier, but "it had gotten too overbought to chase."EVs use more than three times as much copper as gas-burning cars. New copper production and investment in exploration will be needed to fuel the supply of those vehicles in the long term, analysts have said.

BMI analysts believe copper deficits could grow at an extreme pace over the coming decade as the clean energy revolution takes hold, predicting prices of US$11,500 per ton by 2032.

"In the longer term, we expect the copper market to remain in deficit as the green transition accelerates along with the demand for 'green' metals, including copper," BMI's analysts said, according to Stockhead.

"Based on industry-wide capital intensity data, we calculate that some US$196 billion of investment will be required," a market analysis issued by RFC Ambrian said.

An S&P report called copper "one of the most underappreciated critical minerals."

"Deeper electrification requires wires, and wires are primarily made from copper," the report said.

Analyst Says Co. Well Positioned

Analysts said World Copper is a good play in the sector, with Combaluzier maintaining Red Cloud's Buy rating on the stock with a CA$0.80 per share target price, a more than 200% increase over Wednesday's price.

"With a new management team and technical committee, along with a current cash balance of about CA$4.9 million, we believe the company is well positioned to execute on its refined U.S. strategy," wrote Combaluzier.

A major reason for the change in focus is the current situation with Escalones, which is in an area recently designated by Chile as a nature sanctuary, Combaluzier noted.

The company is in discussions with governmental authorities about moving forward with Escalones and obtaining drill permits. Given the uncertainty about this South American project's future, Red Cloud now estimates a production start there in 2035 instead of in 2030.

Escalones is about 100 kilometers from Santiago. Its PEA (preliminary economic assessment) estimates an inferred resource of 426 million tonnes of 0.367% copper, containing 3,447 pounds of copper. A coming catalyst includes a preliminary feasibility study (PFS) of Zonia's main deposit.

In the U.S., Combaluzier has noted in the past that Zonia "has lots of untapped potential" for copper. "It could either be rapidly developed for nearer-term production or potentially be expanded through exploration to increase the scale of the project," he wrote.

America is currently a better choice of jurisdiction in which to pursue a copper project and potentially mergers and acquisitions activity, World Copper has said. The country is home to numerous mining-friendly jurisdictions, offers various governmental funding programs for critical metals and has a robust domestic demand for the red metal.

An updated mineral resource estimate (MRE) filed for Zonia by World Copper increased total resources by about 90% to about 198 million tonnes from a 2017 estimate, with contained copper increasing by 55% to about 1.03 billion pounds.

On June 2, Technical Analyst Clive Maund shared the above chart and noted that World Copper had been brought to his attention two weeks earlier, but "it had gotten too overbought to chase."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

World Copper Ltd. (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA)

*Share Structureas of 5/28/2024Source: Thomson Reuters & World Copper Ltd."It's a good job that we held off because last week it suffered a heavy correction back to the lower rail of its uptrend channel and towards its rising 50-day moving average as we can on its latest three-month chart (at left),"

Maund wrote. "This correction has seen it lose about a third of its value from its recent high."

But he said it was viewed as a Buy following the correction.

"Overall, the chart looks strong, so it is viewed as a Buy again in this area," Maund wrote.

Ownership and Share Structure

Wealth Minerals Ltd. (WML:TSX.V; WMLLF:OTCQB) owns about 11.51% of World Copper.

About 27% is owned by management and insiders, including Director Robert Kopple with 8.37% and Board Chairman Hendrik van Alphen with 0.13%. CEO Neal holds about 0.96%. The rest is retail.

Its market cap is CA$46.29 million. It has 178 million shares outstanding, including 126 million free-floating. It trades in a 52-week range of CA$0.35 and CA$0.055.

| Want to be the first to know about interestingCritical Metals,Base Metals andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

World Copper Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of World Copper Ltd.Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.