Codelco eyes $600 million in savings, more job cuts in 2016 as copper in the pits

Codelco's Chuquicamata is the world's largest open pit copper mine.

The world's biggest copper miner, Chile's Codelco, will continue reining in costs next year rather than curbing output to navigate a slump in prices that are hitting fresh six-year lows almost daily, the company's chief executive Nelson Pizarro has said.

In a weekend interview with local newspaper El Mercurio (in Spanish), Pizarro said the goal for 2016 is to save around $600 million, mainly by boosting efficiencies and managing critical supplies. Output, however, will remain untouched, the executive said.

Pizarro also said the company hopes not to have to slash more jobs next year, though he warned he was unable to rule that measure out at the moment. "It will all depend on how copper prices evolve," he said.

Last month, Codelco announced it was cutting almost 3,900 jobs, including contractors, in response to low copper prices and weak demand. The fresh and massive cuts brought the number of people that Codelco has let go this year to over 4,000, making it the mining company in Chile that has chopped the highest amount of positions since metal prices began their decline over a year ago.

The copper giant also slashed in November the premium it charges Chinese buyers by 26% - the most since the global financial crisis-, as it seeks to sustain sales to the world's largest consumer amid weakening demand.

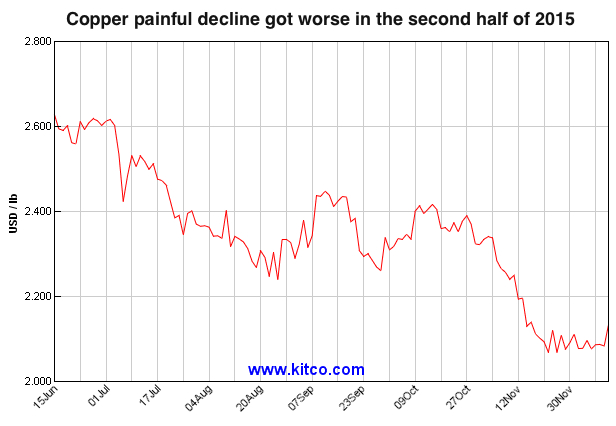

Source: Kitco Metals.

Copper prices have fallen almost 40% since their last peak in June 2014, but the plunge has yet to be arrested by production curbs, most notably the 400,000 metric-ton that Glencore (LON:GLEN) removed from the market after closing its mines in Africa.

Codelco instead has restated it would push ahead with its annual target of producing 1.6 million to 1.7 million metric tons this year and in 2016.

Meanwhile, the red metal took another hit on Monday - prices slid 0.7% to $4,669.5 a tonne.