China racking up copper inventories

China is stashing away copper from London warehouses at a breakneck pace, which may put downward pressure on the price.

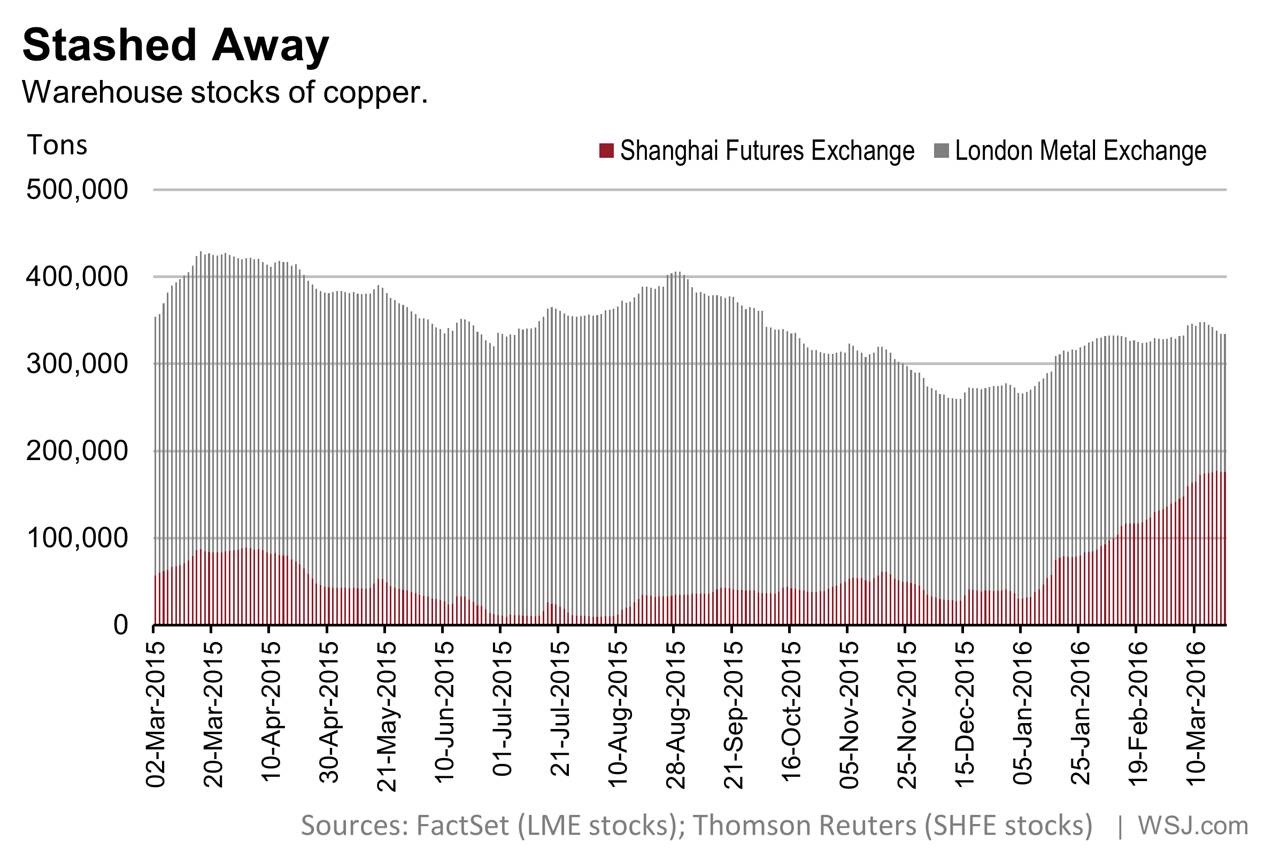

While copper has rebounded 15 percent since mid-January, copper investors may be lulled into a false sense of security. That's because there is mounting evidence that the industrial metal is really just being stockpiled rather than imported to satisfy increasing demand for copper to be used in construction and other applications. The reason is that Chinese traders are taking advantage of an arbitrage opportunity to buy copper stockpiled at LME warehouses in London, and move it to Shanghai, where it can be sold at a higher price on the Shanghai Futures Exchange.

"Most of it, I would say, ends up in the warehouse," a senior account executive at London-based broker Sucden Financial told the Wall Street Journal last week.

Copper in Shanghai traded at around US$4,750 a tonne in late January compared to $4,440/t in London.

Source: Wall Street Journal

According to Nikkei Asian Review, LME copper inventories have fallen by 40 percent since the start of the year, while China's copper imports have risen by over 20 percent. The publication also notes that Chinese investors have been buying copper in anticipation that copper in yuan-denominated prices will rise, if the currency is devalued against the dollar.

That spells trouble for the price, because the piled-up inventories will eventually drag down the Shanghai price and then the LME price, notes Nikkei Asian Review.

So far, however, the price has held up reasonably well since surging 2.8 percent on March 17, along with other metals - copper's highest close since November 4.

Last Thursday copper for May delivery ended the day at $2.29 a pound, the same price as on March 17, after slumping 5.6 cents for the week.