Caterpillar says tariffs will wipe out up to $200M

Shares in Caterpillar (NYSE:CAT), the world's no.1 heavy machinery maker, retreated 2% despite posting record second quarter earnings per share Monday, while also bumping up its full-year profit forecast.

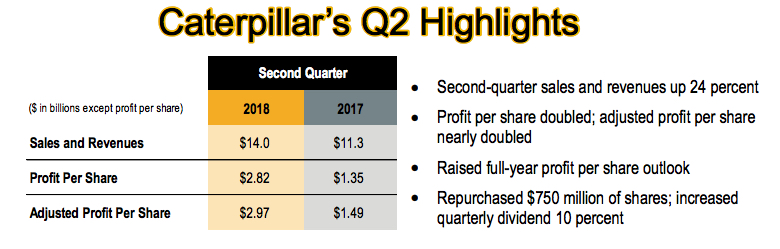

The Deerfield, Illinois-based company reported an adjusted profit of $2.97 a share in the three months to June 30, compared with $1.49 a share last year. For the whole year, Caterpillar now expects adjusted profit per share to be in a range of $11.00 to $12.00 in 2018, compared with $10.25 to $11.25 projected earlier.

Demand for mining as well as oil and gas equipment is so strong that the company said it was taking orders for delivery well into 2019.The manufacturer, which attributed the positive results to robust global demand for its equipment, also gave a figure to how much tariffs will affect its bottom line. It said it expected them to wipe out between $100 million and $200 million in the second half of the year, so would it would to offset the hit by raising prices.

The estimate comes after the US administration slapped tariffs on $34 billion of Chinese goods earlier this month. The country has also implemented tariffs on steel and aluminum imports from Mexico, Canada and the European Union. They have retaliated against those levies with tariffs of their own.

Caterpillar, considered a reliable bellwether of economic activity for being a global supplier of mining and construction equipment, saw sales increasing by 24% from a year ago to $14 billion.

In Asia-Pacific, which made up about a quarter of the company's revenues, equipment sales jumped 39% when compared to 2017 results, boosted by rising construction activity and infrastructure investment in China. Sales also got a lift from a stronger Chinese yuan.

Taken from Caterpillar's Second-Quarter 2018 Full Results.

Demand for mining as well as oil and gas equipment is so strong that the company said it was taking orders for delivery well into 2019.

Caterpillar's shares have slid nearly 11% this year and last month fell to its lowest level since late October before recovering modestly, partly due to mounting trading frictions and increasing costs.

Investors have also been cautious since the company chief financial officer, Brad Halverson, called Caterpillar's first-quarter earnings its "high-water mark" for the year, suggesting he did not expect anything higher than the $2.82 adjusted profits per share for the remaining three quarters.

Watch Caterpillar interim Chief Financial Officer, Joe Creed, deliver an overview of second-quarter 2018 results: