Caterpillar plummets after flagging tariffs-triggered high material costs

Shares in Caterpillar (NYSE: CAT), the world's no.1 heavy machinery maker, fell more than 7% in pre-market trading Tuesday, despite the company beating earnings estimates for the tenth time in a row.

The stock lost as much as $9.76 by 8:48 a.m. EST, dropping to $118.95, after closing at $128.71 on Monday, the lowest so far this year. The drop followed the mining and construction equipment manufacturer's disclosure of cost concerns as a result of the Trump administration's tariffs.

The Deerfield, Illinois-based firm said the ongoing trade war between Beijing and Washington, which has pushed up steel and aluminum prices and prompted retaliatory action from trading partners, resulted in $40 million in extra costs for materials during the third quarter.

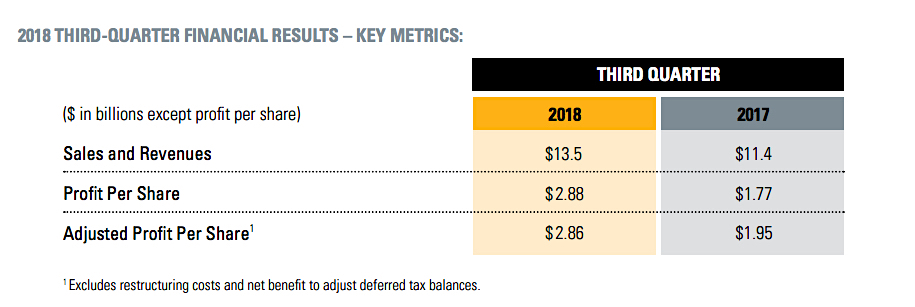

Shares fell even as Caterpillar said 2018 profit per share hit $2.88, a third-quarter recordCaterpillar, which is considered a reliable bellwether of global economic activity, said those additional costs were more than offset by higher prices for its products and cost cuttings during the period.

As a result, it now expects the impact of tariffs to come at the low end of a previously provided range of $100 to $200 million for the second half of this year.

The company also said it would have to increase some of its prices between 1 and 4% worldwide starting in January.

The world's biggest earthmoving equipment maker is one of the many large American manufacturers trying to keep a lid on expenses to cope with a 36% rise in the price of hot rolled steel over the past year and the tariffs impact.

"Manufacturing costs were higher due to increased material and freight costs," the company said in the statement. "Material costs were higher primarily due to increases in steel prices and tariffs."

Annual profit per share hit $2.88, a third-quarter record, said Caterpillar. After adjusting for restructuring costs and a tax benefit to adjust deferred balances, adjusted earnings per share in the third quarter of 2018 was $2.86, above the $2.85 expected by most analysts.

"This was the best third-quarter profit per share in our company's history," the company's chief executive Jim Umpleby said in the statement. "Our global team continues to do excellent work focusing on our customers' success and executing our strategy for profitable growth."

The numbers say it all: revenue in the quarter hit $13.5 billion, an 18 percent rise compared to the same quarter of 2017 and well ahead of the $13.2 billion the market was predicting. Sales in Caterpillar's largest divisions - construction, resource, and energy & transportation - all grew strongly, rising 16%, 35% and 15% respectively.

Watch the company's chief financial officer, Andrew Bonfield, discuss third-quarter 2018 financial results: