CHART: Copper price slump devastating Chile state finances

Amid a broad rally in mining and metals, the red metal's performance has been lacklustre managing only a 2.2% gain in 2016, following a drop of 26% last year.

Chile is responsible for nearly 30% of the world's primary output of copper, with annual production of some 5.8 million tonnes.

In August, Chile's Codelco said it may soon change its focus from cost reductions to output cuts, with the chief executive of the world's number one producer calling it the "worst crisis" in the state-owned company's 40-year history.

Copper's woes is reflected in the South American nation's government finances. In a new research note, ratings agency Moody's says Chile's fiscal deficit is likely to end at 3.3% of GDP next year, up from 2.2% in 2015 which will push debt levels to 25.2% of GDP, the highest level in more than two decades:

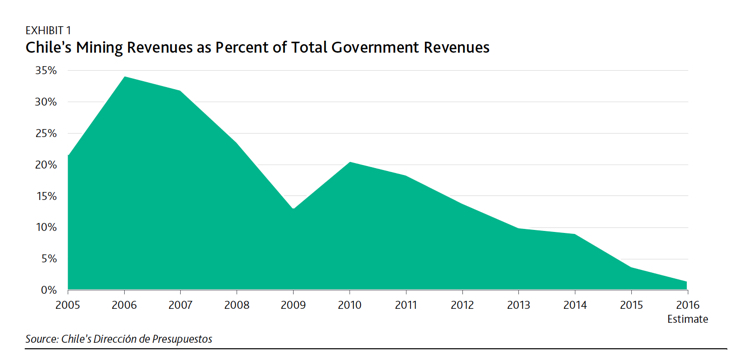

Government finances are under pressure because lower commodity prices have reduced the government's mining-related revenues. A few years ago, mining revenues accounted for 4% of GDP, but have since then dropped to nearly zero. In terms of total government revenues, mining-related income accounted for 1.5% this year, down from a peak of 34.2% in 2006.

Source: Moody's Investors Service

Moody's says the state's finance would've been in deeper trouble if not for once-off revenues including new methods of shareholder-level taxation, increased corporate income taxes and a spike in income from the repatriation of capital after taxpayers received the opportunity to report or repatriate foreign assets or profits at a onetime tax rate of 8% during 2015.

Without the tax reform, the government would have suffered a larger income loss says Moody's. And without a sustained pick-up in the copper price, the country's finances may look even less rosy in coming years.