BHP Billiton back into the black, pays higher-than-expected dividend

World's largest miner BHP Billiton (ASX, NYSE:BHP) injected fresh optimism into the mining industry Tuesday after announcing it had swung from loss to profit for the first half of the 2017 financial year, adding it was rewarding shareholders with a bigger than expected payout.

A welcome surge in the price of commodities such as iron ore and copper due to renewed appetite in China for imported raw materials helped BHP boost its balance sheet and make a profit of $3.2 billion for the six months to the end of December.

For the first time since commodity prices crashed, all of the ones BHP mines are in positive territory.That compares to a $5.7 billion loss in the same period a year earlier because of massive write-downs and lower commodity prices.

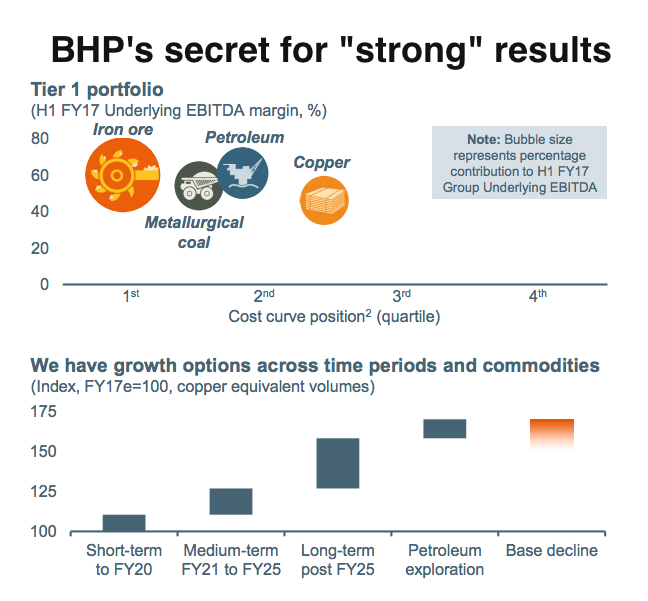

BHP chief executive officer Andrew Mackenzie said the "strong results" also reflected several years of productivity improvements and a redesign of the firm's operating model.

He said that while the company remains focused on paying down debt, BHP's emphasis on copper and oil as its preferred long-term growth commodities allowed it to take full advantage of a period of higher prices.

As a result, the Melbourne, Australia-based miner rewarded investors with an interim dividend of 40 US cents a share, higher than the 30 cents a share mandated by its policy. The move emulates Rio Tinto's decision earlier this month to lift dividends and announce a $500 million share buyback.

Earlier this month, the company said it would spend $2.2bn to expand its Mad Dog oil venture in the Gulf of Mexico led by BP, while it seeks to ramp up production at its Spence copper mine in Chile.

Source: Andrew Mackenzie's half year results presentation.

BHP highlighted it is still negotiating with striking workers at its Escondida copper mine in Chile, the world's largest. The labour action forced the company to declare force majeure at the operation earlier this month.

The company also noted net debt had fallen to $20 billion in the six-month period, from $26 billion a year ago.

Trump-triggered uncertainty

While the miner is quite confident on the long-term outlook for both, the company and the mining industry as a whole, it warned of rising political uncertainty as well as a surge in trade protectionism caused by the economic policies of US President Donald Trump.

"The outlook for the US economy is uncertain. The policy of the new administration points to a higher inflation environment than previously envisaged," Mackenzie said in the results statement.

He also revealed he held a he held a private meeting with Trump in early January, telling media representatives they talked about BHP's views on trade flows, the future of coal and climate change.

Mackenzie noted they discussed how BHP accepts "the science of climate change and a belief that strong investment in carbon storage is an imperative for the world," the Australian Broadcasting Corporation reported.

"Clearly behind that was our enduring support for the Paris agreement on climate which we hope withstands some of the pressures it's under at the moment," Mackenzie said.