Australian Mining Co. Has Large Long Term Potential

Barry Dawes of Martin Place Securities shares the long-term potential he sees in Tolu Minerals Ltd.

Tolu Minerals Ltd. (TOK:ASX) provides details on near-mine exploration targets Tolukuma is a major epithermal gold mineralization region

Strong vein continuity here indicates gold endowment of epithermal veins is around 100koz/100m strike Tolukuma structure has 2000m of vein extension target The saki-Salat system offers 3000m wide x 800m off mine target Kimono has 1000m vein system target in NE

Combined targets of 2-3moz targets identified around the mine

The longer-term potential is much larger.

Key Points

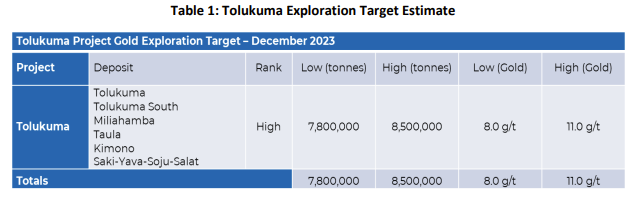

TOK targets combined 7.8-8.5m tonnes @ 8-11g/for 2-3mozCurrent endowment is ~100koz/100m through 1.5moz over 1500m (past production + current resource)Targets in vein systems extending the Tolukuma mine structure over an additional 2000m to SSETolukuma vein itself extends >2000m SSE from the mine areaMiliahamba-Kunda structure runs parallel to Tolukuma veinGulbadi structure continues 3000m to Taula structuresCross-vein structures have historically provided very high-grade oresOff-mine targets at Saki-Yava-Soju-Salat are 3000m wide x 800m exposed strikeKimono in NE has 1000m of vein systemLarge scale full year sampling, and drilling program commencing in 2024TOK has an existing 200ktpa mill to treat ores in 2024Market cap A$58m on 116m shares @ AU$0.50The Tolukuma Gold Mine produced ~1.0moz @15 grams per tonne (g/t) from high-grade epithermal veins on ML104 with a 4:1 silver:gold ratio.

The main veins were running NNW-SSE with a number of high gold content cross veins that included the Tinabar and the prolific Gulbadi structures.

Mining in the first decade had mine grades of >20g/t whilst later mining carried out without sufficient exploration or development fell to 6-8g/t to give the average of 15g/t.

The Tolukuma gold mine veins have so far shown strong continuity over about 1500m, and high grades have been noted in surface sampling and drilling that confirm the continuity of the veins to the south, and sub-parallel veins are also showing high grades at surface and in drilling.

The Tolukuma Gold Mine area has been prolific with this 1.5moz endowment but is only a very small proportion of the overall Tolukuma region structural system.

High grades have been continually encountered across the region and suggest this will become a major multi-million oz gold deposit.

The Saki system to the east is underexplored, but it also has high grades, and a small 128koz resource at 2.0g/t was defined by Frontier Resources prior to the sale of the tenements to Tolu Minerals in the IPO.

Frontier had also identified a Saki target of 0.6-1.0mt @ 5-9g/t for 100-300koz.

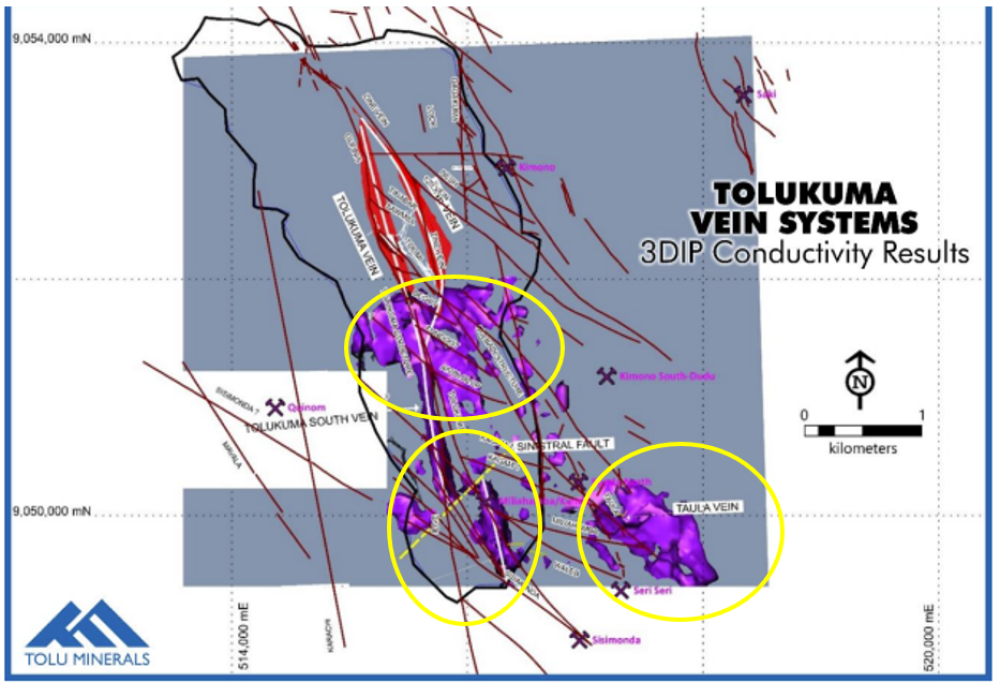

Tolukuma Gold Mine Area and nearby gold prospects

Tolukuma Gold Mine Area and nearby gold prospectsTOK had carried out 3D IP surveys that provided strong evidence of conductivity, indicating mineralization presence and continuing to depth.

The Tolukuma South vein and the Fundoot cross vein are important targets in the first ring. The Maliahamba Drive will be extended through Kunda down to Sisimonda (second ring). The Gulbadi vein structure continues to the large anomaly at Taula (third ring).

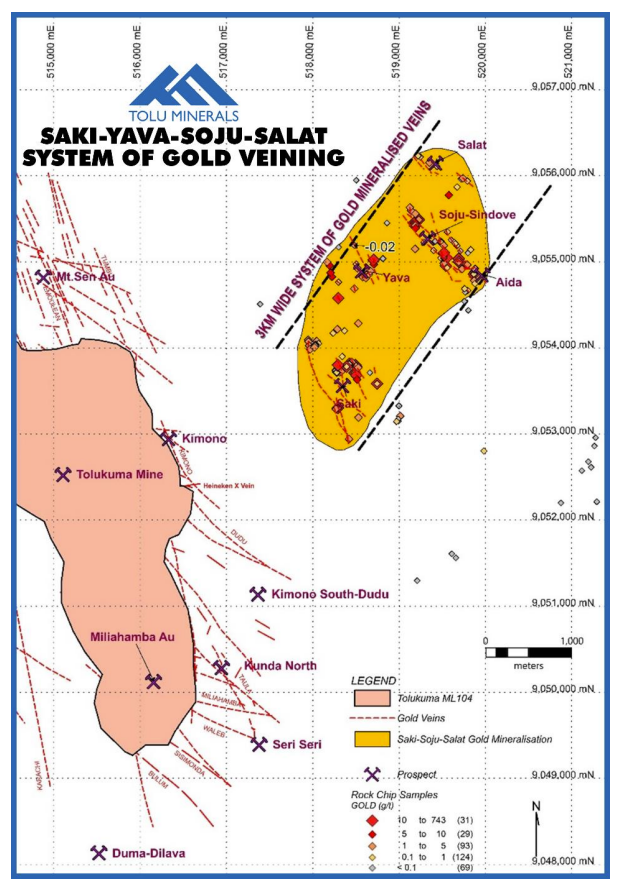

Tolu Minerals also has the Saki-Yava-Solju-Salat system, which has a 3000m wide surface expression with the same NNW-SSE orientation that is noted over 800m strike.

Frontier Resources had earlier identified 100-300koz at Saki at 5-9g/t.

Saki-Yava-Solu-Salat System of Gold Veining

Saki-Yava-Solu-Salat System of Gold VeiningThe combined Tolukuma exploration target is 2-3moz, and success here would give consideration to increasing the size of the current 200ktpa mill over time.

Source: Tolu Minerals

Source: Tolu Minerals2-3moz would make Tolu Minerals a very valuable company.

Heed the markets, not the commentators.

| Want to be the first to know about interestingGold andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.For additional disclosures, please click here.