Anglo American officially out of the Middle East

Anglo American's overhaul reflects the dire straits the global mining industry is in these days. (Image: Screenshot from Anglo American video via YouTube)

Anglo American (LON:AAL) announced Tuesday it has finally completed its exit from the Middle East by selling its Tarmac business to Colas Moyen Orient, a subsidiary of French engineering and construction company Bouygues Group.

The full sale follows a deal last year that saw Anglo unloading 50% of the UK building materials group to LafargeHolcim.

The deal ends Anglo's seven-year exit from the collection of businesses it acquired when it bought Tarmac in 1999.

The joint venture operations in the Middle East that fell within the Tarmac division were in the United Arab Emirates, Oman and Qatar.

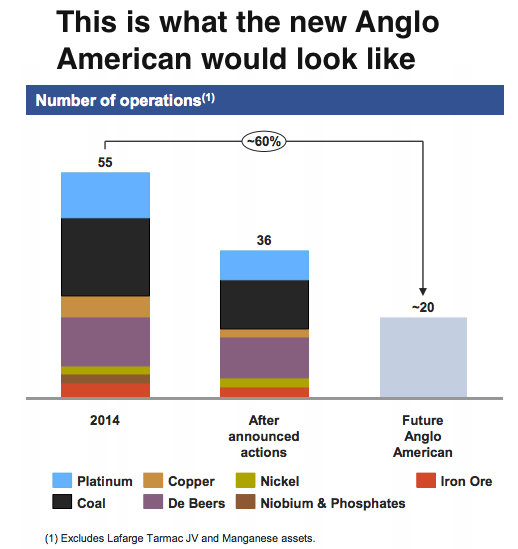

The world's number five diversified miner has been selling assets to reduce debt and said last month it would only focus on diamonds, industrial minerals including platinum, and bulk commodities such as iron ore and coal. At the end of last year, Anglo had only 55 mines left, but the goal is to reduce them to the "low 20s".

As part of Anglo American's drastic response to the relentless plunge in commodities, the company is seeking to consolidate its business into three units from six. It has also increased its target for selling assets to $4 billion from its previous minimum of $3 billion, including the sale of its phosphates and niobium businesses.

Source: Mark Cutifani's presentation to investors, Dec. 8, 2015.

The pared-back business will remain broadly diversified among base metals such as copper, bulk materials such as coal and iron ore and diamonds, the company added.

Anglo American will be "a very different company" after it follows through on the restructuring plan, chief executive Mark Cutifani promised last month, when he unveiled the firm's "radical portfolio restructuring."

Investors reacted positively to the news. The stock was up 2.4% to about $236p mid-afternoon in London. However, the company has lost 21% of its value in 2016's first week of trading alone.