2018, A Big Year For Victoria Gold

Victoria Gold develops its Eagle gold mine in Yukon.

It should produce almost 200,000 toz gold per year, at AISC below $650/toz, with the first gold pour expected in early 2019.

At the current gold price, the after-tax NPV (5%) of the project is around $475 million.

The problem is that a notable share dilution seems to be inevitable so as to cover the construction funding gap.

Despite the probable share dilution, there is more than 100% upside potential over the next 18 months, while downside is limited.

Although Victoria Gold (OTCPK:VITFF) didn't make it into my "Top 5 Mining Stocks to Watch in 2018" list, the company hides a lot of potential. The construction of the biggest gold mine in Yukon is under way and although it isn't fully financed yet, there is no doubt that management will be able to cover the construction CAPEX gap of $40-60 million somehow. The gold production should start in Q1 2019. Moreover, the regional exploration provides some very positive results and the probability that the initial mine life of the Eagle gold mine will be expanded notably keeps on growing. It is also important to note that, given the economics of the project, its safe jurisdiction, and well-advanced development, Victoria is an imminent takeover target at its current market capitalization of only slightly more than $180 million.

Victoria's share price has experienced turbulent times over the recent years. After the gold bear market pushed its share price to the $0.1 level and market capitalization to $25 million, it started to grow quickly in 2016 as gold prices rebounded and started to rise. During the first months of 2017, Victoria's share price growth resumed, however, over the second half of the year it started to decline back to the late 2016 lows, mainly due to the weak gold price and some uncertainty regarding the financing of the remaining $40-60 million gap of the Eagle gold mine CAPEX and further working capital needs. But the mine construction is under way and after the financing question is resolved, the process of rerating from a developer to a producer should start.

The Eagle Gold Project

The Eagle gold project is located in the Yukon Territory, Canada. It lies on Victoria Gold's Dublin Gulch property that contains several gold deposits and exploration targets. The Eagle deposit alone contains reserves of 2.463 million toz gold at a gold grade of 0.66 g/t. The measured and indicated resources contain 3.631 million toz (including reserves) gold at a gold grade of 0.63 g/t. Moreover, a satellite deposit called Olive contains gold reserves of further 0.2 million toz gold at a gold grade of 0.95 g/t.

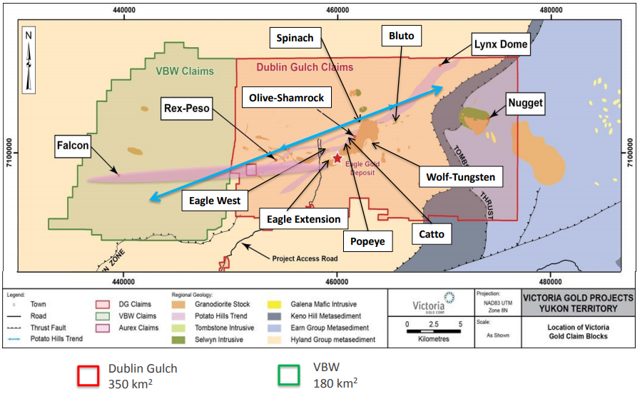

Although the resources and reserves aren't small, there is a high probability that they will keep on growing in the future. As shown in the map below, Victoria's claims covering 530 km2 of highly prospective land, include several very interesting exploration targets. Some of the more exciting drill results reported in 2017 include DG19-930C that intersected 0.56 g/t gold over 607.8 meters. This hole tested the Eagle Deep target that lies beneath the current Eagle gold deposit. The same target was tested also by DG17-922C that intersected 0.5 g/t gold over 624.1 meters. What is interesting is that the intersection covered the whole drill hole, which means that the intersected mineralization starts right at the surface and continues down below the 624.1 meters level. At Olive, Victoria drilled 33.3 meters grading 1.54 g/t gold (hole DG17-849C). At the Popeye target, drill hole DG17-832C intersected 46.63 g/t gold over a 4.3 meters long interval. Although the interval is relatively short, the gold grade is much higher compared to the average gold grades discovered at the Dublin Gulch property. Moreover, it is close to surface, approximately 20 meters deep. At Eagle West, a target right to the west of the Eagle deposit, drill hole DG16-805C intersected 0.87 g/t gold over 58.5 meters. Eagle West is an important target as it is close to the Eagle deposit and it may be an important addition to the mine plan. There will be more drilling in 2018 and continuing exploration success may help to push Victoria Gold's share price higher.

According to the September 2016 feasibility study, the Eagle mine should produce 190,000 toz gold per year at an AISC of $638/toz over the initial 10-year mine life. The initial CAPEX was estimated at $289 million. At a gold price of $1,250/toz and a USD/CAD exchange rate of 0.78, the after-tax NPV (5%) of the project was $396 million and the IRR was 29.5%. However, last year, the Yukon general corporate tax rate was reduced from 15% to 12% which should improve the after-tax NPV (5%) to $411 million and the IRR to 30%. At the current gold price of $1,320/toz, the after-tax NPV (5%) should be around $475 million.

The construction of the mine is under way. The first phase of construction has started in August. Its budget is $40 million and it includes road upgrades, camp expansion, detailed engineering, earthworks and cut and fill of the crusher foundation. The second phase of construction should start in late Q1 and first gold production is expected in Q1 2019.

Also in Q1, the financial package should be completed. According to the recent corporate presentation, Victoria plans to raise $80-120 million. The total financing package should equal $300-320 million. The company holds cash of $40 million, and the debt facility from BNP covers another $220 million. The construction funding gap equals $40-60 million and the management estimates that another $40-60 million will be needed to cover working capital, sustaining capital, interest and fees. As a result, it is possible to expect that Victoria Gold will raise around $100 million in the near future.

Although several options are being considered, the equity financing is listed as number one option (picture above). It is important to note that in the older presentations, the equity financing was listed in the lower half of the list. The upwards move indicates that the equity financing is very probable. This may explain also the recent share price weakness. At the current share price of $0.35, Victoria needs to issue more than 285 million shares to raise $100 million. It will increase the current share count by more than 50%. However, in this case there will also be a lot of potential left.

If a $100 million equity financing takes place at the current share price, the share count will end up around 800 million. However, the after-tax NPV (5%) of the project is approximately $475 million at the current gold price of $1,320. Given the safe jurisdiction, Victoria Gold's market capitalization should cross the $500 million level easily if the start-up process is smooth. This leads to a price target of $0.625 per share, which is 80% above the current share price.

Looking at it from a different angle, the Eagle mine should produce 208,000 toz gold over the first year of full production, which will probably be in 2020. At a more conservative AISC of $650/toz (compared to $638/toz presented by the feasibility study), at a more conservative gold price of $1,275/toz (compared to the current gold price of $1,320/toz) and after paying interest of around $13 million, the company should generate free cash flow of approximately $115 million. Using a conservative ratio of 7, Victoria's market value should climb to the $800 million level, which equals to $1 per share, assuming share count of 800 million.

Victoria Gold as an acquisition target

Given the relatively low valuation, the economics of the Eagle gold mine and its safe jurisdiction, Victoria Gold is an obvious takeover target. The most probable acquirer is Kinross Gold (KGC). Kinross is a major shareholder (it used to own 16% of outstanding shares, however, the exact number isn't provided in Victoria Gold's materials anymore). What is important is that Kinross owns the Fort Knox mine in Alaska. The mine is a heap leach operation, located in a cold climate, similar to the Eagle gold mine. The CEO of Victoria Gold claims that also the geology of both deposits is similar.

Fort Knox is one of Kinross' biggest mines, producing over 400,000 toz gold per year. The mine was originally projected to be closed in 2021, however, Kinross recently acquired an adjacent property with more than 2 million toz gold in resources which means that the mine life of Fort Knox will be probably expanded. Although Kinross' acute need to find a replacement for Fort Knox has been averted, the Eagle gold mine may represent a nice low-cost and low-risk addition to its portfolio of producing assets. As of September 30, Kinross held cash and cash equivalents of $992.1 million and it had also available credit facility worth $1.512 billion at its disposal. It means that if Kinross decides, it will be able to acquire Victoria Gold without any problem.

Conclusion

Although a significant share dilution seems to be inevitable, there is still a lot of upside potential left. Different approaches lead to different price targets, but it is reasonable to expect that the share price should cross the $0.8 level sometime in 2019 if everything goes well. It is almost 130% above the current price level, which is quite a nice reward for some 18 months of waiting. On the other hand, the downside is limited. The mine construction is under way, and a major share of financing was provided in the form of debt by BNP Paribas (OTCQX:BNPQY), one of the biggest financial institutions. Also, the political risk is low, as the mine is located in Canada. Finally, if some technical difficulties arise, Victoria has a very good relationship with Kinross Gold, which is a major shareholder with a lot of experience operating a similar type of mine in a very similar climate.

Disclosure: I am/we are long VITFF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.