T'Boli Gold-Silver Project Exploration Update

VANCOUVER, British Columbia, Sept. 04, 2018 (GLOBE NEWSWIRE) -- Rizal Resources Corporation (TSXV: RZL) (“Rizal” or the “Company”)

- Detailed mapping highlights potential controls on the location of high grade gold at the T’Boli Gold Silver Project (“T’Boli” or T’Boli Project”).

- Trial mining activities with gold mineralization separation techniques have resulted in an improved delivered gold grade to the Processing Plant of over 4g/t for the month of July.

- Similar trial mining using the same mining method in the higher-grade South Veins are planned in late September with the objective of improving the grade to the Processing Plant.

- Processing of bulk samples from trial mining resulted in Gold (601oz) and Silver (1,059oz) produced and sold during the month of July with revenues exceeding the operating costs at T’Boli. Total revenue was CAD946,209 (unaudited), while operating costs totaled CAD658,912 (unaudited).

- In connection with trial mining and bulk sampling activities, refinements to the mining method and enhancements to the processing plant are ongoing with the objective of increasing tonnage throughput and processing capabilities.

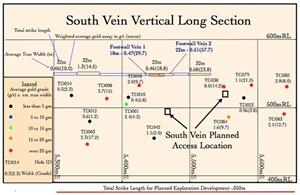

- Planned exploration development of drives accessing the South Veins will intersect two of the high-grade drill hole intercepts with 3.7m (true width) @ 15g/t (uncut) from TG008 and 8.0m (true width) @ 14.2g/t (uncut) from TG038, scheduled for completion in 2018.

Rizal has completed a further stage of underground exploration activities including detailed mapping and assaying, data collation and interpretation. There has been a substantial improvement to the understanding of the high-grade gold locations at T’Boli in recent months which continues to build on the Company’s ability to build up the information it requires to prepare deliver a current Mineral Resource estimate, and information required for development of a current mine plan.

In addition, as part of the ongoing effort to gather important geological, mining and processing information about the gold mineralization at T’Boli, a modified approach to the trial mining commenced in July. The adjusted mining approach has enabled the separation of some lower grade and higher-grade material, resulting in a higher delivered average grade to the processing plant.

Of particular significance for the planned activities in the coming months will be development of exploration drives providing access to some of the better drill hole intercepts found within the drilling database. There are a number of significant high-grade drill hole intercepts that exist on the defined South Veins underneath the previous development. The planned access into the South Vein will initially be located 10m drill hole TG038 which intersected 8.0m (True Width) @ 14.2g/t (uncut) and with development to the east planned soon after to access the South Veins in the vicinity of drill holes, TG079 (1.1m @ 21g/t) and TG080 (2.8m @ 8.0g/t) - see figure 4.

Growing the understanding of the high-grade gold at T’Boli

There is a general observation at the T’Boli Project that high-grade gold assay results (over 10g/t) exist at various locations in the drilling database and from the underground sampling data. It is considered that the geological understanding of these high-grade gold locations is the key driver for any assessment of the prospects for economic extraction of the mineralization at the T’Boli Project. Therefore, the geological understanding and possible continuity of the high-grade gold has been a focus of the technical work effort at T’Boli over the past 6 months.

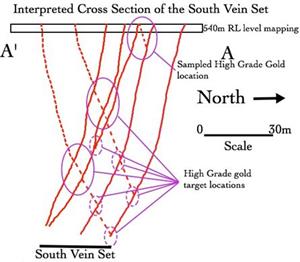

Earlier observations from mapping available in the North Veins had shown that the high-grade gold corresponded with intersection points between structures of various orientations. It has also been observed from the earlier underground development and sampling that the high-grade gold locations in the South Vein were of greater consistency and continuity than observed in the North Veins. However, until recently, accessing the development in the South Veins to validate the geological structures associated with these high-grade zones was not possible.

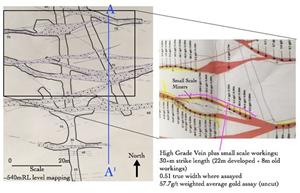

A more detailed review of the South Veins was recently completed after rehabilitation of the Mofoko underground workings was completed. This has revealed that there is a relationship between the smaller scale north dipping veins which link closely to the dominant South dipping veins and the locations of more consistent high-grade gold mineralization (Figures 1 and 2).

Trial Mining Activities

Given the complex vein array and linking structures that exist at the T’Boli mine, a modified and slightly more selective form of trial mining commenced in July. This approach looked at allowing sections of the stope to be collected and sampled prior to delivery to the processing plant. Not all stopes could be accessed to identify the geological location of the material derived from the open stope. However, selected sections of material gathered from the stope were sampled and stockpiled separately with the results used to determine which tonnes were sent to the processing plant and which tonnes were sent to a low grade or waste stockpile.

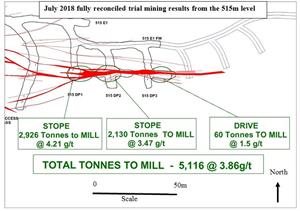

The bulk of the tonnes processed during July were from the 515 level access on the North Veins. The average grade of the bulk sample results for tonnes delivered to the processing plant are shown in figure 3 below. The results identified for each location have now been fully reconciled with the gold produced at the T’Boli processing plant during the month of July (allowing for estimated gold sent to tails and adjustments to surface stockpiles).

This approach and attempted selectivity has had an immediate positive effect on the average grade delivered to the processing plant in July. Prior to July, the average grade of tonnes processed was fully reconciled to average less than 2g/t. In July, the grade delivered to the Processing Plant has increased to over 4g/t, with an average reconciled head grade for the month of July of 4.2g/t.

This has also had a significant positive effect on the revenue raised during the month of July, which has exceeded the total operating costs at the mine site. A summary of the total operating costs for the trial mining activities and the recovered gold and silver for the month of July is summarized in table 1 (all results are unaudited).

| Activity | Tonnes/oz | Total Costs/Revenue (CAD) | Cost per tonne (CAD) | ||

| Total Mining Costs | 5,953t | $319,353 | $53.65/t | ||

| Total Processing Costs | 4,705t | $239,651 | $50.94/t | ||

| Other Site Costs & Royalties | 4,705t | $ 99,909 | $21.23/t | ||

| Total Site Costs (Operating) | $658,912 | $125.82/t | |||

| Gold Produced | 601oz | $931,479 | |||

| Silver Produced | 1,069oz | $ 14,730 | |||

| Total Revenue | $946,209 | ||||

Note: All revenue and operating costs reported are management prepared and unaudited

Table 1: Summary of total operating costs and Gold/Silver produced for the month of July, 2018. Gold and Silver Revenue is based on a realized gold price of CAD1,549.88/oz and CAD13.77/oz respectively. All costs estimates are calculated using a CAD:PHP exchange rate of 40.63.

Future Work Program

Work at the T’Boli mine is continuing with the trial mining on the North Veins and development is well underway to access the interpreted higher-grade material located on the South Veins. The initial level access into the South Veins is planned to be at 10 to 15m vertically beneath and in-between drill holes TG038 (Figure 4). A second deeper access location on the South Vein will be also developed in the coming months which is situated 80m to the east of, and 10 to 15m beneath the significant drill hole intersection identified in TD008 (Figure 4).

Important note regarding Mining and Processing Activities at T’Boli

Note that the T’Boli Project does not have a current Mineral Resource estimate or Mineral Reserves and that the absence of a feasibility study of mineral reserves demonstrating economic and technical viability is associated with an increased risk of failure of the mining operation due to increased uncertainty of results. Mining and processing activity at the T’Boli Project is ongoing on a small-scale basis associated with the Company’s underground exploration activities and this should not be construed as Rizal having made a commercial production decision.

Quality Control

Channel sampling undertaken within the exploration development drives are consistently taken on a horizontal line as rock chip samples between 1m to 1.5m above the floor of the development which is approximately perpendicular to the dominant dip of the mineralized structures. The dominant geological domains and mineralized structures dip to the South at between 60 and 90 degrees. Sample intervals vary from between 0.2m and 1.0m in width with the sample boundaries obeying the observed geological contacts.

Drill cores from the prior drilling programs were HQ, NQ and BQ in size. For drill core that was HQ or NQ size, selected sampling intervals were sub-sampled using different techniques depending on the nature of the drill core. Competent drill core was cut longitudinally in half with a core saw; Clay dominant or soft core was divided into two halves using a spatula; Broken core or rubble was physically separated into 2 separate and equal halves. For drill core that was BQ in size, the whole sample interval was taken for analysis. Sample intervals taken were predominantly at 1m or less, with sample interval boundaries selected to ensure that the sampling interval did not cross over a defined geological contact.

Of particular note with regard to the quality control of the prior drill core samples is that for many of the sampling locations the core recovery was reported to be poor. Based on the observations of the mineralized structures from the underground development this is interpreted to be a result of some clay rich sections that occur in close proximity to the mineralized structures. The underground channel sampling has also identified that the clay rich locations often contain significant gold mineralization. The above observations indicate that the core loss recorded in the prior drilling is due to the poor capture of the mineralized clay rich material surrounding parts of the larger structures at T’Boli. The loss of mineralized material may result in an underestimation of the gold content within some of the reported drilling intercepts.

Prior drilling samples were analysed by Interteck, which is an independent external laboratory, with the processing laboratory situated in Manila, Philippines.

Sampling preparation and analysis for the channel samples are undertaken at the Company’s internal laboratory situated at T’Boli.

For both the prior drilling and the current channel samples from the exploration development, the Company has maintained quality control systems which includes the insertion of blanks, standards and pulp duplicates. The control samples from the prior drilling information have been reviewed for any possible lab bias. The review has concluded that there are no material biases or inaccuracies in the assay database, with additional check data required to confirm an observation that there may be a slight bias of results on the low side resulting in a slight understatement in the reported gold assay information.

Qualified Persons

Steven Olsen, member of AIG, has reviewed the exploration data and prepared the scientific and technical information regarding exploration results contained within this news release. Steven Olsen, an Independent Consultant, is a “Qualified Person” as such term is defined in National Instrument 43-101 and he has verified and approved the contents of this news release.

About Rizal

Rizal is an exploration and development Company with a focus on its flagship T’Boli Project situated in the Philippines. The Company is using underground development to explore and define the extensive gold mineralization that exists at T’Boli.

Peter Main

President and CEO

pmain@rizalresources.com

For further information please visit our website at www.rizalresources.com,

Email us at info@rizalresources.com,

Phone: 778-370-1372 Fax: 604-608-5442

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/91dec7f4-2125-49b8-8120-1991de1eb065

http://www.globenewswire.com/NewsRoom/AttachmentNg/0e34aeb2-6eee-4156-9f9c-eba7cbe50860

http://www.globenewswire.com/NewsRoom/AttachmentNg/ce729d30-9192-42fc-a289-b322e9166375

http://www.globenewswire.com/NewsRoom/AttachmentNg/54c45c37-6ce2-481a-a06e-883db2d634c9