Los Andes Copper Announces Positive PEA Results for Its Vizcachitas Project

After-Tax NPV8% of US$ 1.8 billion and IRR of 20.77% at US$ 3.00/lb Copper

Payback period of 3.4 years from initial operations; 5.4 years from initial construction

45 year mine life

0.53% CuEq average headgrade to mill over first 5 years of operation

C1 Cash Cost (net of by-product credits) of US$ 1.36/lb for first 8 years of operation; US$ 1.58/lb for LOM

1,284 million tonnes of Measured and Indicated Resources with a 0.45% CuEq grade and 0.40% Cu grade (at 0.25% Cu cut-off grade)

Vancouver, British Columbia--(Newsfile Corp. - June 5, 2019) - Los Andes Copper Ltd. (TSXV: LA) ("Los Andes", or the "Company") is pleased to announce the results of an updated Preliminary Economic Assessment (PEA) for its 100%-owned Vizcachitas Project, a copper-molybdenum porphyry deposit located in central Chile, approximately 150 km northeast from Santiago.

The PEA was prepared by Tetra Tech Chile S.A. (Tetra Tech), a leading global provider of consulting and engineering services.

The Project considers an open pit mine and concentrator plant that produces copper and molybdenum concentrates. The PEA evaluated three cases with mill throughputs of 55 ktpd, 110 ktpd and 200 ktpd. The 110 ktpd case has been recommended to advance into pre-feasibility. This case not only delivers the best economic results, with an After-Tax NPV8% of US$ 1.8 billion, an IRR of 20.77% and a payback period of 3.4 years, but also optimizes the mining and technical aspects for a mineral deposit of the size of Vizcachitas.

Highights:

Table 1

To view an enhanced version of Table 1, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_002full.jpg

(*) Referred to first year of mill production. Payback period considers nominal cash flows.

(**) Referred to the beginning of construction. Payback period considers nominal cash flows.

Notes

- Copper equivalent grade has been calculated using the following expression: CuEq (%) = Cu (%) + 3.33 x Mo (%) + 82.6389 x Ag (%), using the metal prices: 3.00 USD/lb Cu, 10.00 USD/lb Mo and 17.00 USD/oz Ag. No allowance for metallurgical recoveries has been considered

- Small discrepancies may exist due to rounding errors.

- The quantities and grades of reported Inferred Mineral Resources are uncertain in nature and further exploration may not result in their upgrading to Indicated or Measured status.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

Fernando Porcile, Executive Chairman, commented:

"We are delighted with the results of this PEA which highlight the significant opportunity that the Vizchachitas project presents and, we believe, it will be Chile's next major copper mine.

"The strong economic viability of the project, with an After-Tax NPV8% of US$ 1.8 billion, an IRR of 20.77% and the 3.4 year payback period, indicates that not only is it financially robust but it also has the ability to generate positive cash flows in a short period of time. Additionally, the C1 Cast Costs of US$ 1.36/lb for first 8 years of operation put us well within the second quartile of copper producers and supports a resilient cash flow generation through copper price cycles.

"Vizcachitas currently has a significant Measured and Indicated Resource of 1.284 billion tonnes at a copper equivalent grade of 0.45%, and production of 110 ktpd will only see half of the resource depleted by the end of the mine life. Additionally, the mineralization is open at depth and to the north, and Los Andes holds a significant land package in the district, therefore meaning that there is potential to increase the Resource substantially.

"Being located in Chile presents a huge advantage to Los Andes, with the country being identified as the most attractive jurisdiction in South America for mining investment. The relatively low elevation and regional infrastructure, including road and nearby power and rail connections enhance the Project viability.

"The positive results of this PEA allow us to continue to advance Vizcachitas to the next major phase of development, which will be the PFS, and we anticipate that this will be completed in Q4 2020. We look forward to keeping the market updated with our progress."

Preliminary Economic Assessment

Comparison to 2014 PEA

The most significant changes from the 2014 PEA are:

- The resources have increased significantly and include Measured Resources for 46% of the projected mill feed for the first 10 years of operation for the recommended case.

- The metallurgical test work resulted in the adoption of coarser grind for the rougher flotation circuit, increasing the P80 from 180 μm used previously to 240 μm.

- The conditions of the Chilean power market have improved drastically from those presented in 2014, with projected long term power prices decreasing from US$ 120/MWH to US$ 45/MWH.

- A new geological model confirmed the importance of the early diorite porphyry and hydrothermal breccias in controlling the higher-grade mineralization of the deposit. The new geological model also defined a near surface higher-grade supergene enriched mineralization outlining an area of 400 by 400 metres where all the drill holes have average supergene grades of greater than 0.5% Cu.

Project Location

Chile is a well established mining jurisdiction. It has the highest copper reserves and is the largest copper producer in the world. The country's track record of reliability has been built over decades of pro-mining policies that encourage long-term capital investment in this sector.

Chile is one of the most developed countries in Latin America, with a stable democratic political system, sustained economic growth, emphasis on social programmes and high investment grade credit ratings. The country has good universities as well as skilled engineers and administrators. The mining industry benefits from a highly qualified workforce. Most mining services, from engineering to equipment procurement, may be sourced from within the country.

The Project is in close proximity to extensive infrastructure, including:

- Railway line in San Felipe (65 km distance) with connections to:

- The Chagres smelter (90 km) and Ventanas smelter (140 km)

- The Port of Ventanas (140 km)

- Paved road access (only the last 25 km are unpaved dirt roads)

- Access to 220 kv power substation (105 km)

- Consumptive water rights (80 km)

There are several nearby cities and towns within a 100-km radius (Los Andes, San Felipe, Putaendo, Catemu, Panquehue, etc.) with a significant skilled and semi-skilled labour force in the mining sector.

The Project further benefits from a low elevation location permitting year-round access, no equipment de-rating, and no need for permanent camp installations during the operation phase of the project.

Land Tenure

The project includes 52 mining properties covering a surface area of 10,771 ha and 108 exploration claims for a combined total of 30,800 ha.

Vizcachitas Geology

The Vizcachitas Project is a mineralized copper-molybdenum porphyry system associated with a complex of hydrothermal breccias and porphyries within Miocene volcanic rocks.

In 2015 all the diamond drill core was re-logged. From this updated information, a new lithological, alteration and mineralization model was developed for the Project. The drilling carried out in 2015-2016 and 2017 confirmed the new geological model.

The results from the latest drilling, plus the information provided by historical drilling, show that the core of the Vizcachitas mineralized system comprises a high-grade early diorite intrusive complex (the average grade for this unit is 0.56% copper) and two inter-mineral intrusives namely, one early tonalite intrusive and a later granodiorite intrusive (the average grade for these units is 0.27% copper and 0.17% copper respectively). Associated with these intrusives are hydrothermal breccias and magmatic-hydrothermal breccia bodies, (the average grade the hydrothermal breccias is 0.54% copper). The final intrusive events comprise unmineralized phreatomagmatic breccias and a series of dacite dikes that cut the former units.

The copper mineralization is mainly hypogene, predominantly chalcopyrite with some bornite. There is a 100-120 m thick discrete "blanket" of secondary enrichment developed on the northeastern part of the system, comprised predominantly of chalcocite, covellite, pyrite and/or pyrite-chalcopyrite (the average grade of this domain is 0.50% copper).

The latest drilling has significantly improved the economic potential of the Project. By separating the geological and mineralizing events, it has enabled the mine plan to prioritize the higher grade zones in the early years of mine operation.

Drilling

Five different drilling campaigns have been undertaken on the property from 1993 to date. A total of 165 diamond drill holes have been drilled, with a total of 52,256 m.

Table 2: Summary Drilling Campaigns in Vizcachitas

To view an enhanced version of Table 2, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_003full.jpg

Resources

The mineral resources are contained within an open pit shell to demonstrate the prospects of eventual economic extraction. Only blocks within the Whittle pit shell are included in the mineral resources.

The tables below present a sensitivity analysis for the mineral resources under different cut-off grades. The base case for the estimation of resources is 0.25% Cu.

Table 3

To view an enhanced version of Table 3, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_004full.jpg

Table 4

To view an enhanced version of Table 4, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_005full.jpg

Table 5

To view an enhanced version of Table 5, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_006full.jpg

Table 6

To view an enhanced version of Table 6, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_007full.jpg

Notes

- Copper equivalent grade has been calculated using the following expression: CuEq (%) = Cu (%) + 3.33 x Mo (%) + 82.6389 x Ag (%), using the metal prices: 3.00 USD/lb Cu, 10.00 USD/lb Mo and 17.00 USD/oz Ag. No allowance for metallurgical recoveries has been considered

- Small discrepancies may exist due to rounding errors.

- The quantities and grades of reported Inferred Mineral Resources are uncertain in nature and further exploration may not result in their upgrading to Indicated or Measured status.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

Mineral Processing and Metallurgical Testing

The Vizcachitas Project has been the subject of a number of physical characterization and metallurgical test programmes to determine the process flow sheet and expected recoveries. Physical characteristics such as the Bond Work and Abrasion Indices have been used in the development of the process estimates in this Report. Leach and flotation test work has also been carried out to further validate process selection and recovery estimations.

The main conclusions of the test work programmes are summarized below:

- Mineralogical analysis showed that the principal copper mineral is chalcopyrite.

- In general, the results of the flotation tests showed both high grade copper concentrates and high recoveries of both copper and molybdenum are achievable.

- The results suggest that the rougher flotation recoveries are not significantly impacted by the P80 on the range analyzed and, on this basis, a coarser primary grind P80 of 240 μm is proposed.

- The results of the cleaner flotation tests indicated that three cleaner stages should be considered to achieve a high final concentrate grade.

- Based on the flotation tests, overall recoveries of 91% copper and 75% molybdenum can be expected:

- A copper recovery of 95% in the rougher circuit and 96% in the cleaner circuit

- A molybdenum recovery of 84% in the collective circuit and 89% in the selective circuit

Mining

A long-term mine plan study was conducted, which shows the production scenarios defined for the concentrator for each of the mill throughput cases. The mine plans are strategic and aimed at optimizing the cut-off grade profiles to obtain the best economic value. The analysis considered a wide array of mine capacity possibilities and the adjustment of stockpile cut-off grades.

The mineral flow in the mine plan was optimized by separating the mined material into four categories namely:

- Mine to Mill: mineral shipped direct to the mill, with a variable cut-off grade

- High-Grade Stockpile: mineral with grade below direct Mine to Mill and above a cut-off grade of 0.34% CuEq for the 55 ktpd and 110 ktpd cases (0.25% CuEq for the 200 ktpd case)

- Medium-Grade Stockpile: mineral with grade below High-Grade Stockpile and above a cut-off grade of 0.25% CuEq for the 55 ktpd and 110 ktpd cases (0.20% CuEq for the 200 ktpd case)

- Low-Grade Stockpile: mineral with grade below Medium-Grade Stockpile and above a cut-off grade of 0.18% CuEq for the 55 ktpd and 110 ktpd cases (0.15% CuEq for the 200 ktpd case)

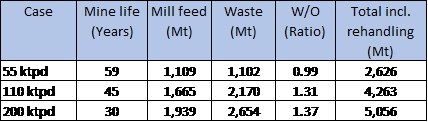

The following table summarizes the material moved for each case, including miil feed, waste and the re-handling of stockpiles.

Table 7

To view an enhanced version of Table 7, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_008full.jpg

Capital Cost Estimate

Capital cost estimates are comprised of the following:

- Direct cost of construction and assembly: Acquisition and supply of equipment, labour, auxiliary equipment for construction and building materials were included.

- Indirect costs of project: Transportation and insurance of equipment, general spare parts, vendor's representatives, detailed engineering, EPCM, start up and owner costs were considered.

- Contingency estimation based on Direct Cost, plus Indirect Cost.

- Sustaining capital is defined as that required to maintain operations and may include capital spent on expansion or new infrastructure items.

- Deferred capital is investment required to complete an expansion in the mine facilities and process plant during the life of the project.

After incorporating the recommended contingency, the capital cost estimate is considered to have a level of accuracy of +/-35%.

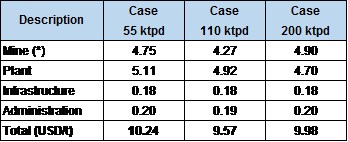

The following table summarizes the initial, sustaining and deferred capital requirements of the Vizcachitas Project for the different development cases.

Table 8: Capital Cost Summary (Nominal values)

To view an enhanced version of Table 8, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_009full.jpg

Operating Cost Estimate

Operating costs have been estimated for the operating areas of Mining, Process Plant, Infrastructure and Administration. Costs were reported under subheadings related to the function of each of the areas identified.

The operating cost estimates are based on long term power prices of US$ 45 /MWh and US$ 1.00 /l for diesel fuel.

Based on the assumption listed in the PEA, the operating costs are considered to have an accuracy of ± 35%t. All unitary operating costs are expressed in processed tonnes.

The following tables summarize the average unit operating cost by area for the first 8 years of operation and for the Life-of-Mine (LOM).

Table 9: Unit Operating Costs (USD/t plant feed; Nominal values, average first 8 years)

To view an enhanced version of Table 9, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_010full.jpg

(*) Mine costs include the strip ratio for the first 8 years of operation

Table 10: Unit Operating Costs (USD/t plant feed; Nominal values, LOM)

To view an enhanced version of Table 10, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_011full.jpg

(*) Mine costs include the strip ratio for the LOM

Mining Operating Cost:

Mine operating costs are based on owner mining and cover the following:

- Pit operations, drilling, blasting, loading, and hauling

- Construction and maintenance of mine haul roads, sumps, and safety berms

- Operating and maintenance labour

- Mine department supervision and technical services

- Crushing waste rock to supply aggregate for road surfacing and blast-hole stemming and other earthworks as may be required for day-to-day mining operations

Table 11: Mine Unit Operating Costs (US$/t) by Expense Item (Nominal values, for material moved)

To view an enhanced version of Table 11, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_012full.jpg

Process Plant Operating Cost:

Process plant operating costs were developed covering the following unitary operations:

- Primary crushing and stockpiling

- Grinding

- Copper-molybdenum bulk flotation

- Molybdenum flotation

- Thickening of concentrates and tails

- Filtering

- Concentrates handling

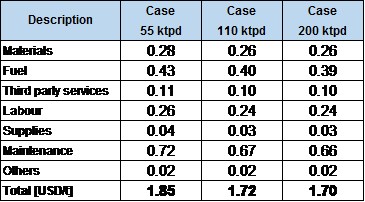

Table 12: Process Plant Operating Cost (USD/t plant feed) by Expense Item (Nominal values)

To view an enhanced version of Table 12, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_013full.jpg

Infrastructure and Administration Cost:

Infrastructure operating costs were developed considering the following areas:

- Tailings storage facility

- Tailings transport

- Water supply

- Power supply

- Administration buildings

- Others

For all cases an Infrastructure cost of 0.2 USD/t was assumed, which includes labour, energy, materials, spare parts and third-party services.

Administration costs include general administration of the Company. Administration cost is estimated at 0.2 USD/t.

C-1 Cash Costs:

Table 13: Average First 8 Year Cash Costs

To view an enhanced version of Table 13, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_014full.jpg

Table 14: Average Life of Mine Cash Costs

To view an enhanced version of Table 14, please visit:

https://orders.newsfilecorp.com/files/916/45346_8e6758fc0407e810_015full.jpg

The Technical Report is authored by independent Qualified Persons and prepared in accordance with NI 43-101. The contents of this press release have been approved by the following independent Qualified Persons:

Severino Modena, Tetra Tech, Member of Chilean Mining Commission

José Luis Fuenzalida, Tetra Tech, Member of Chilean Mining Commission

Mario Riveros, Tetra Tech, Member of Chilean Mining Commission

Antony J. Amberg, M.Sc., C.Geol., a qualified person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

For more information please contact:

Antony J. Amberg, CEO - Chief Geologist

Tel: +56 2 2954-0450

Aurora Davidson, CFO

Tel: 604-697-6207

E-Mail: info@losandescopper.com or visit our website at: www.losandescopper.com

About Los Andes Copper Ltd.

Los Andes Copper Ltd. is a Canadian company focused on the development of the Vizcachitas Project in Chile. Vizcachitas is one of the largest, advanced copper projects in the Americas not held by a major mining company.

Los Andes Copper Ltd. is listed on the TSX-V under the ticker: LA.

Certain of the information and statements contained herein that are not historical facts, constitute "forward-looking information" within the meaning of the Securities Act (British Columbia), Securities Act (Ontario) and the Securities Act (Alberta) ("Forward-Looking Information"). Forward-Looking Information is often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "expect" and "intend"; statements that an event or result is "due" on or "may", "will", "should", "could", or might" occur or be achieved; and, other similar expressions. More specifically, Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such Forward-Looking Information; including, without limitation, the achievement and maintenance of planned production rates, the evolving legal and political policies of Chile, the volatility in the Chilean economy, military unrest or terrorist actions, metal and energy price fluctuations, favourable governmental relations, the availability of financing for activities when required and on acceptable terms, the estimation of mineral resources and reserves, current and future environmental and regulatory requirements, the availability and timely receipt of permits, approvals and licenses, industrial or environmental accidents, equipment breakdowns, availability of and competition for future acquisition opportunities, availability and cost of insurance, labour disputes, land claims, the inherent uncertainty of production and cost estimates, currency fluctuations, expectations and beliefs of management and other risks and uncertainties, including those described in Management's Discussion and Analysis in the Company's financial statements. Such Forward-Looking Information is based upon the Company's assumptions regarding global and Chilean economic, political and market conditions and the price of metals and energy, and the Company's production. Among the factors that have a direct bearing on the Company's future results of operations and financial conditions are changes in project parameters as plans continue to be refined, a change in government policies, competition, currency fluctuations and restrictions and technological changes, among other things. Should one or more of any of the aforementioned risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from any conclusions, forecasts or projections described in the Forward-Looking Information. Accordingly, readers are advised not to place undue reliance on Forward-Looking Information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise Forward-Looking Information, whether as a result of new information, future events or otherwise.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/45346