Galway Metals Intersects Wide, High-Grade, VMS Mineralization in Gap Area at its Estrades Project in Quebec

TORONTO, ON / ACCESSWIRE / July 26, 2018 / Galway Metals Inc. (TSX-V: GWM, OTC PINK: GAYMF) (the "Company" or "Galway") is pleased to report assay results from 10 additional drill holes plus two extensions (7,224 metres) at its former producing, 100%-owned, 20,915 hectare, Estrades polymetallic property located in the northern Abitibi of western Quebec, Canada. This brings Galway's total drill results reported to date at Estrades to 20,707 metres in 34 holes (plus 3 stopped due to deviation) plus three wedges (in addition to 501 m in one hole at Newiska; 2,191 m in five holes at Newiska are pending); a total of approximately 200,000 metres have been drilled on Galway's Estrades property since discovery in the 1970's. The drill program was designed to expand the existing resource on the periphery of known zones at shallow depths, and to probe deeper holes close to potential high-grade hydrothermal source vents.

"We are pleased that our drilling of the gap area immediately east of the cross fault and ramp continues to yield strong gold, silver and zinc mineralization over wide widths. This drilling continues to confirm expectations as indicated by the Titan geophysical anomaly in this area. We are looking forward to incorporating these and other drill results in the pending Estrades resource update, which will be out in the third quarter," cites Robert Hinchcliffe, President and CEO of Galway Metals.

Drilling Highlights

Located East of the Cross Fault and Ramp in a Gap Between the Main and Central Zones Outside the Resource;

Remains Open Above and Below (Figure 1)

- 4.3 g/t Au, 115.2 g/t Ag, 11.0% Zn, 0.8% Cu and 0.9% Pb over 7.1 m (5.2 m true width (TW)) at a vertical depth of 288 m below surface, (including 6.0 g/t Au, 212.5 g/t Ag, 16.2% Zn, 0.6% Cu and 1.8% Pb over 2.85 m), in GWM-18E-48.

- 3.0 g/t Au, 176.0 g/t Ag, 17.9% Zn, 0.3% Cu and 0.9% Pb over 5.4 m (3.4 mTW) at a vertical depth of 456 m below surface, in GWM-18E-32.

Located in the Central Part of the Central Zone, Down Dip From and Outside the Existing Resource;

Remains Open Below

- 1.3 g/t Au, 88.1 g/t Ag, 6.5% Zn, 0.7% Cu and 0.3% Pb over 4.8 m (3.3 m TW) at a vertical depth of 321 m below surface, (including 1.7 g/t Au, 95.0 g/t Ag, 14.5% Zn, 0.5% Cu and 0.8% Pb over 2.0 m), plus 0.6 g/t Au, 74.5 g/t Ag, 3.0% Zn and 4.1% Cu over 1.0 m (0.7 m TW) in GWM-18E-42.

- 1.5 g/t Au, 40.0 g/t Ag and 3.9% Zn over 6.8 m (5.1 m TW) at a vertical depth of 286 m below surface, (including 1.8 g/t Au, 35.3 g/t Ag and 4.8% Zn over 4.7 m (3.5 m TW) in Hole GWM-18E-43.

Extends Copper-Rich Shoots Along the Eastern Side of the Central Zone in Areas That Were Previously Believed to be Waste and Therefore Outside the Existing Resource; Remains Open Below

- 15.7 g/t Ag and 2.2% Cu over 1.9 m (0.9m TW) at a vertical depth of 531 m below surface, (including 4.4% Cu over 0.6 m (0.3m TW), plus 37.9 g/t Ag, 0.3% Zn and 2.9% Cu over 0.8 m (0.4m TW), plus 22.3 g/t Ag and 1.9% Cu over 0.5 m (0.2m TW) in GWM-18E-46B.

- 1.0 g/t Au, 11.9 g/t Ag and 2.2% Cu over 1.8 m (0.9 m TW) at a vertical depth of 419 m below surface, (including 2.2 g/t Au, 18.5 g/t Ag and 4.7% Cu over 0.6 m), plus 0.5 g/t Au, 64.8 g/t Ag and 3.6% Cu over 0.8 m (0.4 m TW) in GWM-18E-18.

Notes: Holes were not drilled in sequential numerical order. Holes GWM-17E-20, 22, 33-40, and 44 were not drilled; holes 23, 25 and 26 were stopped short of target. Initial attempts at drilling holes 21 and 46 equaled 792m, and were stopped due to excessive deviation.

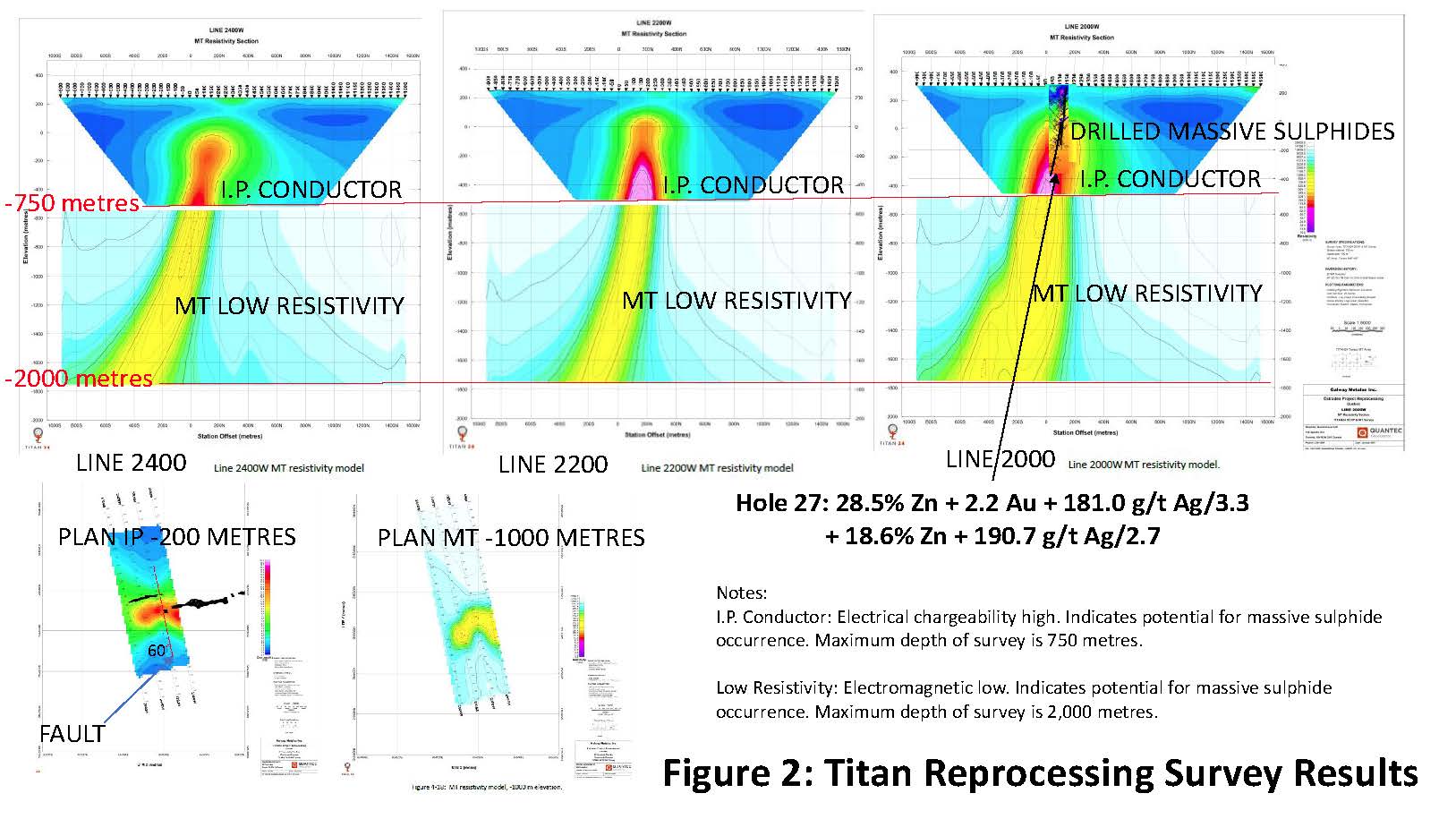

The four Galway holes in the area just east of the cross fault and ramp are all high-grade and represent what is likely to be a significant extension to the current resource, which will be updated in coming weeks (see below). The TITAN geophysical survey undertaken by Quantec Geoscience for Galway appears to indicate that this new zone is continuous to depths greater than 2,000 metres on three lines covering 400 metres of strike length (Figure 2). These results are within the chargeability high and resistivity low anomaly identified by the Titan survey. The MT-referenced IP chargeability models show clear high responses to their maximum depths of 750 m, while the MT-referenced EM resistivity models show clear low responses as continuous structures to depths greater than 2,000 m. As expected, the IP high and EM low responses are spatially coincident with each other. Drilling has been stopped since the end of April (end of the winter drilling season). Future plans are to drill the area above hole 48 this coming winter.

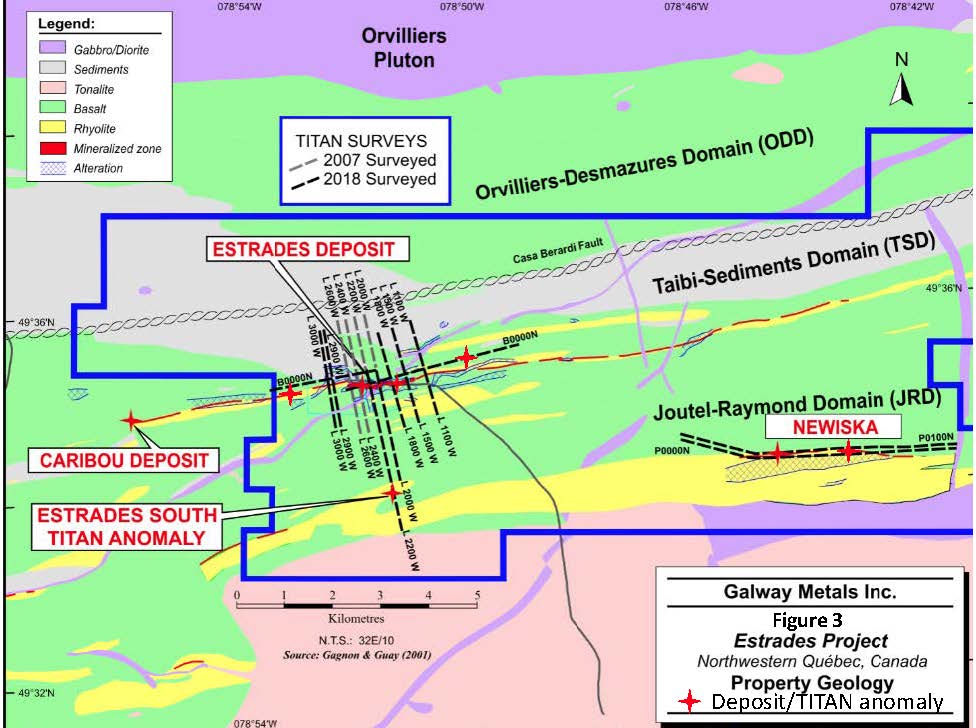

"We believe the new area will make the economics of the deposit far more enticing because this large area of wide, high grade mineralization would be the first zone encountered if development from the existing ramp were to take place going east. A gravity survey to be completed in the next couple of months should augment the TITAN survey which has identified numerous strong anomalies on the property (Figure 3)," cites Mike Sutton, VP Exploration of Galway Metals.

Review of Drill Results:

Results from hole 48 of 7.1 metres grading 11.0% Zn, 4.3 g/t Au, 115.2 g/t Ag, extends toward surface the previously intersected high-grade mineralization (holes 27 and 24) that exists immediately east of the cross fault and ramp and remains open for 236 metres above (Figure 1). This drill hole extended mineralization 45 m above, and 58 m east of hole 24, which returned 5.2 g/t Au, 198.7 g/t Ag and 15.7% Zn over 1.5 m, and 158 m above hole 27, which returned 2.2 g/t Au, 181.0 g/t Ag and 28.5% Zn over 3.3 m, plus 190.7 g/t Ag and 18.6% Zn over 2.6 m at vertical depths of 435 metres and 453 metres, respectively. None of these holes are in the current resource estimate and remain open above and below.

Results from the extension of hole 32, which returned 5.4 metres grading 17.9% Zn, 3.0 g/t Au and 176.0 g/t Ag, extends to the east and to depth previously intersected high-grade mineralization. The zone remains open below this hole and the strong mineralization encountered in hole 27. This drill hole extended hole 27 mineralization 49 m to the east (and 12m below), and is 111 m below hole 24, and 158 m below hole 48, Together, these drill results represent a strong vertical corridor of high-grade mineralization that coincides with the Titan IP and EM anomaly that measures 400 metres along strike and at least 2,000 metres deep. These drill intersects will, for the first time, be incorporated in the pending resource update, and remains open to surface and to depth.

Holes 41, 42, 43 and 45 add mineralization to the central part of the Central Zone either in areas that were previously believed to be waste or down dip from the existing resource, and they remain open below. The intersections in hole 42 (1.3 g/t Au, 88.1 g/t Ag, 6.5% Zn, 0.7% Cu and 0.3% Pb over 4.8 m) exist in a necked down narrow portion of the resource (it was drilled in an area that was previously thought to contain below cutoff grade mineralization) and is located 50 m west of hole 43 (1.5 g/t Au, 40.0 g/t Ag and 3.9% Zn over 6.8 m) and 188 m above hole 41 (1.9 g/t Au, 13.9 g/t Ag and 5.3% Zn over 0.7 m). The intersection in hole 43 exists 35 m from the closest resource hole in this area and would extend the resource into an area previously thought to be barren. None of these holes are in the current resource estimate.

Holes 18, 29, 46B and 47 were drilled to extend high grade copper shoots on the eastern side of the Central Zone that were in areas previously believed to be waste. Hole 46B (15.7 g/t Ag and 2.2% Cu over 1.9 m) extends mineralization 35m from the mineralization encountered in hole 29 (37.3 g/t Ag and 1.3 Zn over 2.0 m) and 217 m below previously released hole 16 (22.4 g/t Au, 199.3 g/t Ag, 10.4% Zn and 2.0% Pb over 1.6 m), and is also not in the resource. Hole 46B is 296 m vertically below the closest resource hole in this area. Hole 18 (1.0 g/t Au, 11.9 g/t Ag and 2.2% Cu over 1.8 m) extends mineralization 123 m below previously released hole 17 (0.2 g/t Au, 76.1 g/t Ag, 0.4% Zn and 3.7% Cu over 1.6 m). Both of these holes, as well as holes 14, 16, 29, 46 and 47, were drilled in an area that was previously believed to be waste. These drill intersections will be incorporated in the pending resource update, and they remain open below.

Hole 21, and the extension of hole 28, did not reach their targets; further extensions or wedges will follow after downhole geophysics is undertaken. Hole 21 did intersect extremely altered rhyolite with abundant talc and with an assay of 1.0% Zn over 1.4 m (TW Unknown) at a vertical depth of 1,150 m below surface at the end of the hole. The TITAN survey appears to indicate strongly anomalous geophysical responses in the vicinity of this hole. This is the deepest hole drilled at Estrades. It targeted the down-plunge extension of the Main Estrades deposit below the bottom of the current resource. Before extending or wedging this hole, downhole geophysics will take place to see if the Main zone extension might be just to the south. The entire 400-metre area of interest beneath the resource can be drilled by wedging off of this hole.

Updated Resource Expected in Third Quarter

Galway drilled at Estrades in an effort to expand the existing resource, and has completed 34 holes (plus 3 stopped due to deviation), plus 3 wedges since the existing resource was announced, which coincided with the project's acquisition in August 2016. The company has been successful, with drilling located outbound from existing resources, at returning intersections such as:

- 72.5 g/t Au over 1.6 metres (1.0m TW) in Hole GWM-17E-01,

- 7.4% Cu over 1.9 m (1.2m TW) in Hole GWM-17E-05,

- 5.1% Cu and 62.0 g/t Ag over 1.65 m (1.2m TW), including 12.9% Cu and 159.0 g/t Ag over 0.55 m (0.4m TW), in hole GWM-17E-04, and

- 22.4 g/t Au, 199.3 g/t Ag, 10.4% Zn and 2.0% Pb over 1.6 m (0.8m TW), in Hole GWM-17E-16.

The Company has also been successful at drilling newly identified zones, with intersections returned such as:

- 2.2 g/t Au, 181.0 g/t Ag and 28.5% Zn over 3.3 m (2.1m TW), plus 190.7 g/t Ag and 18.6% Zn over 2.6 m (1.7m TW), plus 5.7 g/t Au and 43.2 g/t Ag over 2.6 m (unknown TW), plus 4.7 g/t Au, 67.5 g/t Ag, 4.9% Zn, 2.1% Cu and 1.0% Pb over 1.8m (1.1m TW) in GWM-17E-27,

- 5.2 g/t Au, 198.7 g/t Ag, 15.7% Zn and 1.3% Pb over 1.5 m (0.8 m TW), plus 2.3 g/t Au, 65.7 g/t Ag and 12.6% Zn over 2.1 m (1.2 m TW) in GWM-17E-24,

- 6.9 g/t Au, 78.5 g/t Ag and 1.7% Zn over 6.4 m (4.4m TW) in GWM-18E-31, and

- 1.1 g/t Au, 95.2 g/t Ag and 4.2% Zn over 17.7 m (including 1.7 g/t Au, 190.9 g/t Ag, 9.7% Zn and 1.3% Cu over 4.5 m, and 1.0 g/t Au, 147.6 g/t Ag and 8.3% Zn over 2.0 m) (unknown TW) in GWM-17E-08.

The priority was to drill off gaps in the 1.8 km long resource to create more resources along this sheet of vertical mineralization.

On August 18, 2016, Galway published a NI 43-101 compliant Estrades resource estimate (Table 1), which included Indicated Resources of 518,000 ounces at 12.4 g/t gold equivalent (or 652,000,000 lbs at 22.8% zinc equivalent), plus Inferred Resources of 290,000 ounces at 7.4 g/t gold equivalent (or 366,000,000 lbs at 13.6% zinc equivalent) (refer to Galway's website at www.galwaymetalsinc.com for details on the Estrades resource estimate). The Estrades project was previously mined via a 200 metre deep ramp, with production in 1990-91 totaling 174,946 tonnes grading 12.9% Zn, 6.4 g/t Au, 1.1% Cu and 172.3 g/t Ag. Galway is planning to release an updated resource in the third quarter, taking into account new drilling results received since the 2016 resource.

Table 2: Drill Result Highlights

| Hole ID | From (m) | To (m) | Intercept (m) | TW (m) | Au Eq* (g/t) | Zn Eq* (%) | Au (g/t) | Ag (g/t) | Zn (%) | Cu (%) | Pb (%) | Type** |

| GWM-18E-48 | 342.7 | 349.8 | 7.1 | 5.2 | 14.3 | 26.3 | 4.3 | 155.2 | 11.0 | 0.8 | 0.9 | MSS |

| including | 345.0 | 347.9 | 2.9 | 2.1 | 19.7 | 36.3 | 6.0 | 212.5 | 16.2 | 0.6 | 1.8 | MSS |

| GWM-18E-45 | 503.8 | 506.0 | 2.2 | 1.5 | 2.8 | 5.1 | 1.3 | 20.6 | 2.2 | MSS | ||

| GWM-18E-43 | 331.7 | 338.5 | 6.8 | 5.1 | 4.2 | 7.7 | 1.5 | 40.0 | 3.9 | MSS | ||

| including | 331.7 | 336.4 | 4.7 | 3.5 | 4.9 | 9.0 | 1.8 | 35.3 | 4.8 | MSS | ||

| GWM-18E-42 | 361.8 | 366.6 | 4.8 | 3.3 | 14.8 | 1.3 | 88.1 | 6.5 | 0.7 | 0.3 | MSS | |

| including | 361.8 | 363.8 | 2.0 | 1.4 | 23.7 | 1.7 | 95.0 | 14.5 | 0.5 | 0.8 | MSS | |

| and | 352.9 | 354.0 | 1.1 | 0.8 | 2.6 | 1.3 | 33.9 | 1.1 | 0.4 | MSS | ||

| and | 359.2 | 359.7 | 0.5 | 0.3 | 36.4 | 1.3 | SMS | |||||

| and | 371.4 | 372.4 | 1.0 | 0.7 | 0.6 | 74.5 | 3.0 | 4.1 | SMS | |||

| GWM-18E-41 | 531.4 | 532.1 | 0.7 | 0.4 | 5.0 | 9.2 | 1.9 | 13.9 | 5.3 | SMS | ||

| and | 533.1 | 533.7 | 0.7 | 0.4 | 0.5 | 21.9 | 0.9 | SMS | ||||

| GWM-18E-32 | 490.3 | 495.7 | 5.4 | 3.4 | 29.8 | 3.0 | 176.0 | 17.9 | 0.3 | 0.9 | MSS | |

| GWM-18E-47 | 405.9 | 414.3 | 8.4 | 5.1 | 5.1 | 0.2 | 25.9 | 2.4 | 0.5 | 0.1 | DSS | |

| including | 405.9 | 407.8 | 1.9 | 1.2 | 8.2 | 0.4 | 42.7 | 4.3 | 0.6 | 0.2 | DSS | |

| which includes | 407.3 | 407.8 | 0.5 | 0.3 | 14.7 | 1.0 | 62.8 | 6.9 | 1.2 | 0.7 | DSS | |

| including | 411.0 | 411.8 | 0.8 | 0.5 | 0.6 | 31.6 | 3.5 | 3.6 | SMS | |||

| and | 400.5 | 401.0 | 0.5 | 0.3 | 5.1 | 88.5 | 2.7 | DSS | ||||

| and | 416.5 | 417.5 | 1.0 | 0.6 | 15.9 | 0.5 | 1.9 | DSS | ||||

| and | 420.0 | 421.0 | 1.0 | 0.6 | 4.0 | 10.5 | 2.2 | 0.5 | DSS | |||

| GWM-18E-46B | 473.1 | 475.0 | 1.9 | 0.9 | 15.8 | 2.2 | DSS | |||||

| including | 474.4 | 475.0 | 0.6 | 0.3 | 4.4 | SMS | ||||||

| and | 388.3 | 388.8 | 0.5 | 0.2 | 0.7 | DSS | ||||||

| and | 436.6 | 437.2 | 0.6 | 0.3 | 2.5 | 4.7 | 0.9 | 26.4 | 2.3 | DSS | ||

| and | 442.4 | 442.9 | 0.5 | 0.2 | 8.7 | 0.8 | 63.2 | 3.5 | 0.5 | 0.6 | SMS | |

| and | 451.7 | 452.4 | 0.8 | 0.4 | 0.3 | 37.9 | 0.3 | 2.9 | DSS | |||

| and | 464.4 | 465.0 | 0.6 | 0.3 | 0.3 | 0.9 | DSS | |||||

| and | 466.4 | 466.9 | 0.5 | 0.2 | 22.3 | 1.9 | DSS | |||||

| GWM-18E-29 | 391.0 | 393.0 | 2.0 | 1.0 | 0.6 | 37.3 | 1.3 | 0.4 | SMS | |||

| including | 391.0 | 392.0 | 1.0 | 0.5 | 1.2 | 58.5 | 1.4 | 0.7 | SMS | |||

| and | 404.0 | 404.5 | 0.5 | 0.2 | 0.4 | 23.6 | 1.6 | SMS | ||||

| and | 440.4 | 441.2 | 0.8 | 0.4 | 7.7 | 2.3 | SMS | |||||

| and | 445.7 | 446.3 | 0.6 | 0.3 | 1.3 | SMS | ||||||

| and | 447.3 | 448.1 | 0.9 | 0.4 | 1.2 | SMS | ||||||

| and | 459.0 | 460.0 | 1.0 | 0.5 | 5.5 | 10.2 | 3.4 | 0.6 | SMS | |||

| and | 475.0 | 478.0 | 3.0 | 1.5 | 4.9 | 0.1 | 0.5 | SMS | ||||

| including | 475.0 | 475.8 | 0.8 | 0.4 | 19.6 | 1.1 | SMS | |||||

| including | 477.5 | 478.0 | 0.5 | 0.2 | 0.7 | 0.6 | SMS | |||||

| GWM-18E-18 | 424.5 | 426.3 | 1.8 | 0.9 | 1.0 | 11.9 | 2.2 | DSS | ||||

| including | 425.7 | 426.3 | 0.6 | 0.3 | 2.2 | 18.5 | 4.7 | DSS | ||||

| and | 381.8 | 382.5 | 0.6 | 0.3 | 4.1 | 0.3 | 27.5 | 1.9 | 0.2 | DSS | ||

| and | 388.9 | 390.4 | 1.5 | 0.7 | 0.4 | 25.5 | 1.0 | SMS | ||||

| and | 420.4 | 421.2 | 0.8 | 0.4 | 0.5 | 64.8 | 3.6 | DSS |

Notes:

*Au (Eq g/t) and Zn (Eq %) represent the in-situ metal content expressed as Au and Zn equivalents.

Equivalents are not provided when the underlying Au and/or Zn metal content is below 25% of the intersect value.

Preliminary analysis indicates that no metal is dominant; however, Au and Zn are the largest contributors to the Estrades resource.

Equivalencies are calculated using the following metal prices (US$) and exchange rate (US$/C$) provided by RPA:

Au $1,450/oz, Ag $21.00/oz, Zn $1.15/lb, Cu $3.50/lb, Pb $1.00/lb, US$0.80/C$1.00.

** MSS = massive sulphide, SMS = semi-massive sulphide DSS = disseminated and stringer sulphides.

Holes were not drilled in sequential numerical order; holes GWM-17E-20, 22, 33-40, and 44 were not drilled.

If true width (TW) is not specified, the orientation of the zone is unknown at this time.

Estrades, Newiska, and Casa Berardi Geology and Mineralization

Information on Geology and Mineralization can be found on the Estrades project page of our website at www.galwaymetalsinc.com along with a complete Table of Drill Results released to date.

Review by Qualified Person, Quality Control and Reports

In compliance with National Instrument 43-101, Mr. Mike Sutton, P.Geo., is the Qualified Person responsible for the accuracy of this news release. Mr Reno Pressacco, P. Geo., is the Qualified Person responsible for preparation and disclosure of the Estrades Mineral Resource estimate, and is independent of Galway. The drill core is sawn in half with one half of the core sample shipped to Swastika Laboratories situated in Swastika, ON, which has accreditation of ISO/IEC 17025. The other half of the core is retained for future assay verification. Other QA/QC measures includes the insertion of certified reference standards (gold and polymetallics) and blanks into the sample stream, and the regular re-assaying of pulps and rejects at alternate certified labs. Gold analysis is conducted by fire assay using atomic absorption or gravimetric finish for samples greater than 10 g/Mt gold. Other Metals (Ag, Cu, Pb, Zn, Co, As) have full acid digestion and analyzed by AAS; with over limits (5000 PPM) analyzed by AAS using method dilutions, and the Silver (Ag) over limits (> 200 ppm) analyzed by fire assay (FA) & gravimetric finish. The laboratory re-assays at least 10% of all samples and additional checks may be run on anomalous values.

Table 3: Drill Hole Coordinates

| Hole ID | Azimuth | Dip | Northing | Easting | Hole Length (m) |

| GWM-18E-48 | 176.0 | -59.0 | 5494933 | 654553 | 369 |

| GWM-18E-45 | 327.0 | -70.0 | 5494583 | 654821 | 522 |

| GWM-18E-43 | 359.0 | -66.0 | 5494618 | 654950 | 444 |

| GWM-18E-42 | 334.0 | -67.0 | 5494618 | 654950 | 450 |

| GWM-18E-41 | 326.0 | -77.0 | 5494618 | 654950 | 552 |

| GWM-18E-32 | 175.0 | -66.0 | 5494933 | 654553 | 150 |

| GWM-18E-47 | 15.0 | -70.0 | 5494618 | 654950 | 501 |

| GWM-18E-46B | 22.9 | -80.2 | 5494732 | 655146 | 522 |

| GWM-18E-29 | 1.0 | -79.0 | 5494732 | 655146 | 486 |

| GWM-18E-21EW3 (+wedges+21) | 220.7 | -81.0 | 5495152 | 654315 | 1,901 |

| GWM-18E-18 | 316.0 | -78.0 | 5494732 | 655146 | 453 |

| GWM-18E-28C | 135.6 | -69.5 | 5494951 | 654406.2 | 823 |

About the Company

Galway Metals is well capitalized with two projects in Canada: Clarence Stream, an emerging gold district in New Brunswick, and Estrades, the former producing, high-grade VMS mine in Quebec. The Company began trading on January 4, 2013, after its successful spinout to existing shareholders from Galway Resources following the completion of the US$340 million sale of that company. With substantially the same management team and Board of Directors, Galway Metals is keenly intent on creating similar value as it had with Galway Resources.

Should you have any questions and for further information, please contact (toll free):

Galway Metals Inc.

Robert Hinchcliffe

President & Chief Executive Officer

1-800-771-0680

www.galwaymetalsinc.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

This news release contains forward-looking information, which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements made herein with respect to, among other things, the Company's objectives, goals or future plans, potential corporate and/or property acquisitions, exploration results, potential mineralization, exploration and mine development plans, timing of the commencement of operations, and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, exploration results being less favourable than anticipated, capital and operating costs varying significantly from estimates, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, risks associated with the defence of legal proceedings and other risks involved in the mineral exploration and development industry, as well as those risks set out in the Company's public disclosure documents filed on SEDAR. Although the Company believes that management's assumptions used to develop the forward-looking information in this news release are reasonable, including that, among other things, the Company will be able to identify and execute on opportunities to acquire mineral properties, exploration results will be consistent with management's expectations, financing will be available to the Company on favourable terms when required, commodity prices and foreign exchange rates will remain relatively stable, and the Company will be successful in the outcome of legal proceedings, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information contained herein, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

SOURCE: Galway Metals Inc.