Pure Gold Improves Its Madsen Gold Project

A few days ago Pure Gold released new data on its flagship Madsen gold project.

In my opinion, this data should have a positive impact on the project's economics.

In this article I discuss the way a decent mining company is developing its gold project.

A few days ago Pure Gold (OTCPK:LRTNF), a gold development company, released new data on its Madsen gold project. In my opinion, this data should have a positive impact on the project's economics.

Introduction

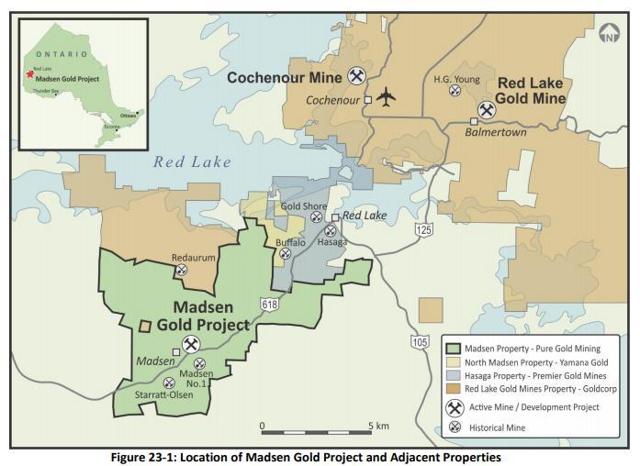

The Madsen Gold project is located in the Red Lake gold camp in Ontario, one the most prolific gold districts in Canada. Since the 1930s the camp has delivered around 30 million ounces of gold but today there is only one large gold mine operating here (the Red Lake gold mine owned by Goldcorp (GG)).

source: Pure Gold

source: Pure Gold

On the other hand, there is a number of mining companies operating in the district and running gold projects at various stages of exploration or development. In my opinion, Pure Gold and its flagship Madsen gold project is one of the most interesting projects in the Red Lake gold camp. What is important, it seems that Pure Gold is very determined to put Madsen online in two / three years. The latest release is another small but relevant step bringing the company closer to its target.

Madsen project

I discussed the Madsen gold project in my previous article (the link is here) so now I would like to remind only a few most important details to my readers.

According to the latest preliminary economic assessment (PEA), Madsen has 5,785 thousand tons of ore grading 8.86 grams of gold per ton of ore, classified as indicated resources (1,648 thousand ounces of gold, in total). Apart from that, there are 587 thousand tons of ore grading 9.42 g/t, classified as inferred resources (178 thousand ounces of gold). However, the current mine plan is limited to 2.9 million tons of ore, attributable to 911 thousand ounces of gold (so the upside potential is quite impressive).

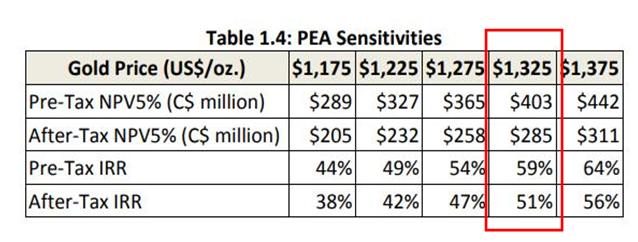

Now, according to the preliminary economic assessment, at a gold price of $1,325 per ounce (which is very close to the current price of gold) the project is supposed to deliver net present value of C$285M (the column marked in red):

Source: Pure Gold, the PEA, page 18

Assuming the diluted share count of 241.6 million (as of the end of 2017) and cash on hand of C$14.9M we may very easily find out that one share of Pure Gold is worth C$1.24 (or $0.98 using the exchange rate between the Canadian dollar and the US dollar of 0.79:1).

However, the project's economics does not take into account the latest data disclosed a few days ago. Let me discuss this data.

Recoveries

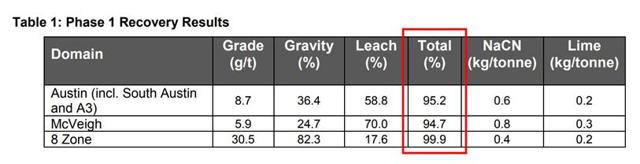

According to the PEA, the gold recovery rate should stand at 92%. However, after a few metallurgical tests made on the material coming from three main deposits (8 Zone, McVeigh and Austin), the average recovery rates were between 94.7% and 99.9%:

Source: Pure Gold

Now, the company is not specific from which deposits it will feed the Madsen mill. The only thing I know is that the plant feed will be delivered from the Madsen deposit (the satellite deposits, Fork and Russet South, are excluded from the current mine plan and constitute the upside potential). However, the largest deposit at Madsen is Austin - it contains 3,591 tons of ore grading 7.79 grams of gold per ton of ore classified as indicated resources. Assuming that the Austin recovery rate will constitute a new, model recovery rate for the entire project, the gold should be recovered at a rate of 95.2% (instead of an initial recovery rate of 92.0%)

If that is the case, the total amount of gold recovered should go up from 911.5 thousand ounces (the initial figure disclosed in the PEA) to 943.2 thousand ( an increase of 31.7 thousand or 3.5%). In other words, the Madsen mine should extend its mine life by additional half a year (the average annual gold production is estimated at 66.1 thousand ounces).

Mill consumable costs

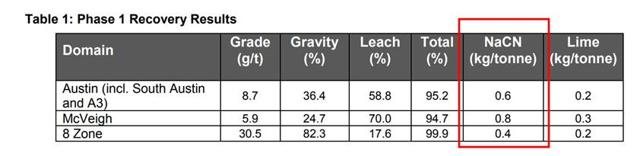

The Madsen processing facility (mill) will need a number of reagents to extract the gold from the ore. The most important reagent is sodium cyanide (NaCN). According to the company (the PEA, page 213):

"Sodium Cyanide (NaCN) is the principle reagent used for dissolution of gold in the cyanidation leach circuit. The sodium cyanide will be delivered in 1 ton tote bags and will be mixed in the cyanide reagent mixing area of the existing mill"

Now, according to the PEA, to process 1 ton of ore the mill needs 1 kilogram of sodium cyanide. However, according to the latest tests, the sodium cyanide consumption is going to be 20% - 60% lower (the column marked in red):

Source: Pure Gold

Let me assume that the average consumption is 0.6 kilogram per ton (the Austin deposit). If I am correct, to extract the gold the company will need 40% less sodium cyanide. Using the data disclosed in the PEA (page 214) it may be easily calculated that the cost of sodium cyanide should stand at C$2.1 per ton milled. In other words, instead of spending C$767 thousand (sodium cyanide consumption) per year, the company will spend C$460 thousand. It means that over the entire life of the mine the cost savings will be C$4.2M (mine life of 13.8 years x (C$767 thousand - C$460 thousand)).

What does it all mean?

The latest tests conducted by the company should improve the project's economics. Let me summarize these positive effects:

The improved recovery rates should increase an undiscounted pre-tax cash flow by C$53.2M (from C$585.9M to C$639.1M) Lower consumption of sodium cyanide should result in savings of C$4.2M As a result, the total positive effect should be C$57.4MNow, although the above discussed higher revenue and savings will definitely have a positive impact on the project's economics, it is not possible to calculate the Madsen's updated net present value. Simply put, there is no detailed data to build a new, detailed cash flow model for the project. However, it is not my intention. The aim of this article is to show in what way a decent mining company develops a mining project.

First of all, a mining company has to have a reliable block model based on a sufficient amount of data. I have discussed this issue in my previous article on Pure Gold. Then, to go further, a miner has to conduct additional drilling programs (to convert resources into reserves or increase its mineral base), perform many technical tests, prepare economic studies etc. The test results discussed in this article show that Pure Gold is heading for the right direction - recovery rates seem to be much better than previously and the Madsen ore needs fewer amounts of reagents to extract the gold.

Interestingly, it looks like Pure Gold share prices measured against GDXJ (a gold mining ETF replicating the share price action of a number of precious metals junior mining companies) are breaking above their strong resistance (the blue circle on the chart below):

Source: Stockcharts.com

Definitely, this good performance is fuelled by positive data delivered by the well-run company (for example, the latest release). Hence, although I am generally a big skeptic (my subscribers know it very well), in my opinion, Pure Gold is a relatively safe mining developer (covered, among a few other picks, in my Marketplace service).

Did you like this article? If yes, please, visit my Unorthodox Mining Investing section where I manage a portfolio of up-to-ten mining picks, discuss new investment ideas and provide my subscribers with a medium-term outlook on a few financial markets (particularly the base / precious metals market). Most recently I have introduced a new section called "Developers". This service is dedicated to mining companies planning to open new mines within one or two years.

Disclosure: I am/we are long CEF, GDX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Follow Simple Digressions and get email alerts