Gold & Silver "Washout" - Get Ready For A Big Move Higher / Commodities / Gold & Silver 2020

Gold and Silver moved lower early on June 2nd and3rd. Our research teambelieves this is a “Washout Low” price rotation following a technical patternthat will prompt a much higher rally in precious metals. This type of washout price rotation is fairlycommon before very big moves after Pennant/Flag formations or just afterreaching major price trigger levels.

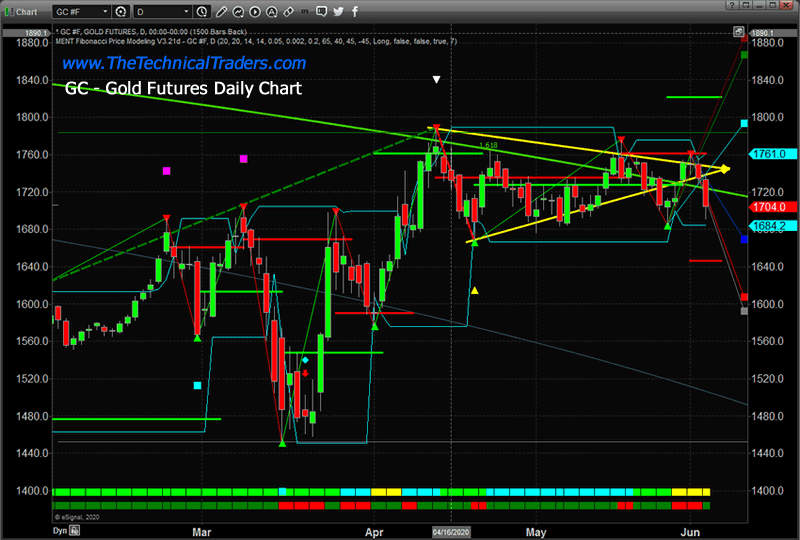

With Gold, a sideways Pennant/Flag formation has been setting up near our GREEN Fibonacci Price Amplitude Resistance Arc. We believe the downward price rotation recently is a perfect setup for skilled technical traders to take advantage of lower entry price levels. The GREEN Fibonacci Price Amplitude Arc will very likely be breached over the next 5 to 10 trading days and the price of Gold should rally well above $1850 in the process. We believe this Washout Rotation is a process of running through the Long Stops just below recent price activity that will end with a defined upside price rally over the next 2 to 5+ weeks.

Before we continue, be sure to opt-in to our free-market trend signals

before closing this page, so you don’t miss our next special report!

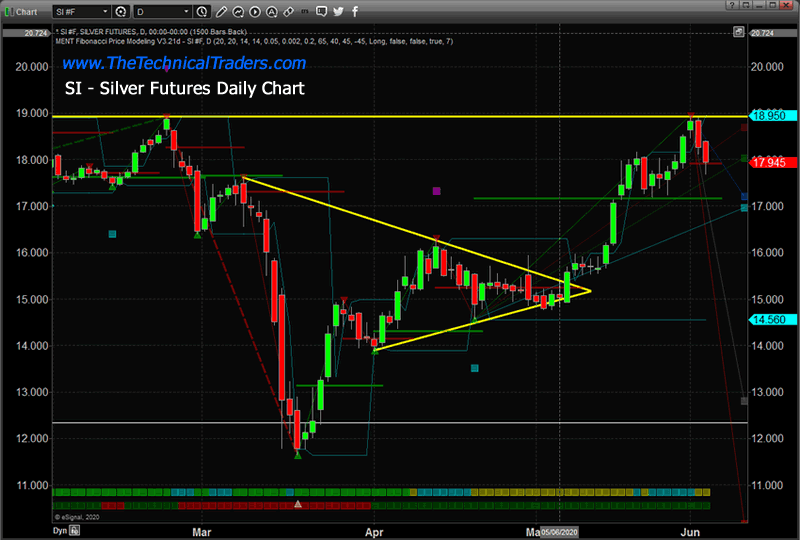

Silver has set up a completely different type of price pattern – a true Double-Top pattern. The downward price rotation recently in Silver is indicative of a weaker reaction to this massive resistance pattern and Double-Top. The likelihood that Silver will find support above $17 and mount a further upside price rally over the next 2 to 5+ weeks is still very strong. After the deep downward price collapse in Silver took place, just like what happened in 2009 and 2010, the upside potential for Silver is still massive – likely targeting $65 per ounce of higher.

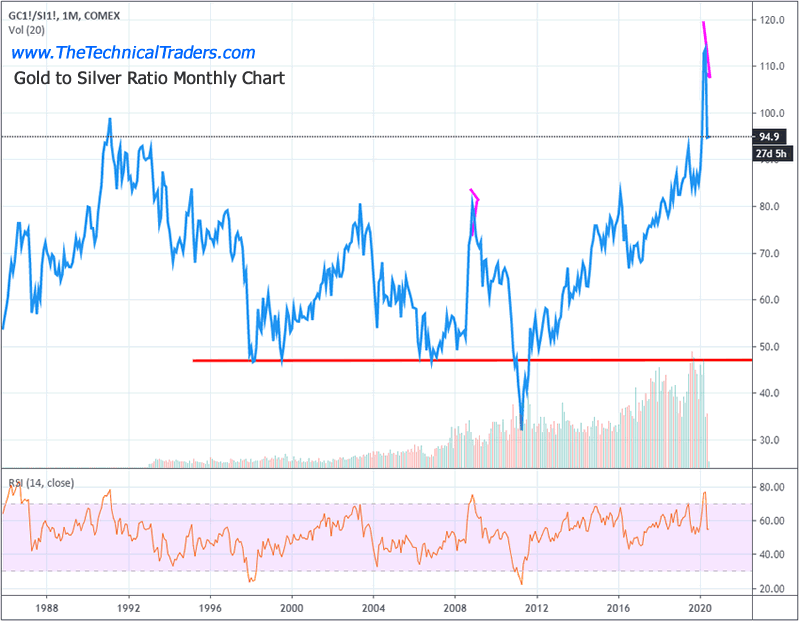

This current Gold to Silver Ratio Monthly chart highlightsthe recent collapse in the ratio level as Silver rallied from near $12 towardscurrent levels near $18. A similar spikein the Gold to Silver Ratio took place in 2008-09 – just before the broadermarket collapse in the US and Global markets took place. This happens as the initial reaction to riskin the global markets pushes Gold prices a bit higher while Silver, the oftenoverlooked store of value, typically declines in value.

Once the price of Silver starts to rally, pushing the Gold toSilver ratio below 60 typically, both Gold and Silver start to align in priceand begin to rally together. The currentlevel of the Gold to Silver ratio is 94.9. This suggests that both Gold and Silver have quite a way to go in termsof reaching the “alignment phase”. Ourresearchers believe Gold will rally above $2100 to $2400 and Silver will rallyabove $40 to $50 before the two metals align and begin to rally together inalmost equal strength.

Concluding Thoughts:

Pay attention to what happens to precious metals over the next 10 to 15+ days. If our research is correct, both Gold and Silver will rally higher by about 7.5% to 14% – setting up new price highs for both metals. When the washout pattern completes, usually a fairly aggressive price trend begins where new price highs are established fairly quickly. Get ready, this should be a really nice upside price swing in precious metals over the next 6+ months or longer.

The next few years are going to be full of incredible opportunities for skilled traders and investors. Huge price swings, incredible revaluation events, and, eventually, an incredible upside rally will start again.

I’ve been trading since 1997 and I’ve lived through numerousmarket events. The one thing I teach mymembers is that risk is always a big part of trading and that’s why I structureall of my research and trading signals around “finding profits while reducingoverall risks”. Sure, there are fastprofits to be made in these wild market swings, but those types of trades areextremely risky for most people – and I don’t know of anyone that wants to risk50 or 60% of their assets on a few wild trades.

I’m offering you the chance to learn to profit, as I do with my own money, from market trends that I hand-pick for my own trading. These are not wild, crazy trades – these are simple, effective, and slower types of trades that consistently build wealth. I issue about 4 to 8+ trades a month for my members and adjust trade allocation based on my proprietary allocation algo – the objective is to gain profits while managing overall risks.

You don’t have to spend days or weeks trying to learn mysystem. You don’t have to try to learnto make these decisions on your own or follow the markets 24/7 – I do that foryou. All you have to do is follow myresearch and trading signals and start benefiting from my research and trades. My new mobile app makes it simple – downloadthe app, sign in and everything is delivered to your phone, tablet, or desktop.

I offer membership services for active traders, long-term investors, and wealth/asset managers. Each of these services is driven by my own experience and my proprietary trading systems and modeling systems. I have a small team of dedicated researchers and developers that do nothing but research and find trading signals for my members. Our objective is to help you protect and grow your wealth.

Please take a moment to visit www.TheTechnicalTraders.com to learn more. I can’t say it any better than this… I want to help you create success while helping you protect and preserve your wealth – it’s that simple.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involvedin the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader,and is the author of the book: 7 Steps to Win With Logic

Through years ofresearch, trading and helping individual traders around the world. He learnedthat many traders have great trading ideas, but they lack one thing, theystruggle to execute trades in a systematic way for consistent results. Chrishelps educate traders with a three-hourvideo course that can change your trading results for the better.

His mission is to help hisclients boost their trading performance while reducing market exposure andportfolio volatility.

He is a regularspeaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chriswas also featured on the cover of AmalgaTrader Magazine, and contributesarticles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.