Spring Has Arrived, Will Gold also Bloom?

Recent positive news suggest the US economy spring revival. But what about gold? Will it blossom? Will the gold love trade take reins from gold as a safe haven play?

Retail Sales Surge

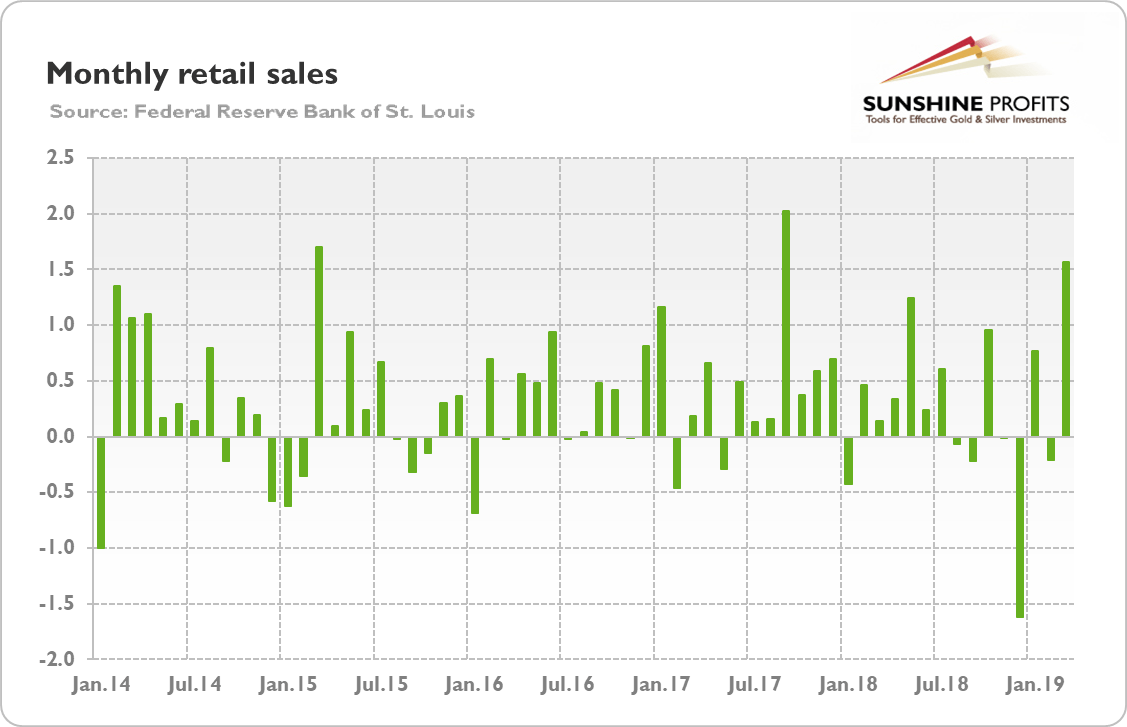

Last week, the government has released its latest report on the retail sector. The retail sales jumped 1.6 percent in March, the best results since September 2017, as one can see in the chart below. The change was above expectations (the economists polled by MarketWatch forecasted sales to climb 1.1 percent) and it was solid (0.9 percent) even if we set gas and autos aside.

Chart 1: Retail sales (monthly % change) from January 2014 to March 2019.

The strong retail sales added to mounting evidence that the US economy is firming up. As we have reported, the nonfarm payrolls rebounded in March, while jobless claims dropped below 200,000 in the first week of April for the first time since 1969. Hence, the recent economic reports suggest that the US labor market remains healthy: we have steady hiring, declining jobless claims, rising wages and the lowest unemployment rate in half a century.

The fears about softening US economy have thus turned out to be overblown, just as we have been repeating for a long time. Since the Great Recession, weak first quarter (however, the GDP growth in Q1 2019 might be higher than previously estimated) and a rebound in spring has been a recurring pattern. We do not deny that the pace of growth will be slower than in 2018 – after all, the effects of fiscal stimulus vanished – but we reject the narrative about the looming economic slump. It's true that the yield curve has inverted, but the inversion was small and temporary. And China's government has provided a fresh stimulus, which should support the American economy as well. Last but not least, the trade talks with China are progressing well, while the chances of Trump's impeachment have fallen sharply with the release of the Mueller report. All these developments reduce the downside risks for the US economy.

Implications for Gold

What does it imply for the gold market? Well, the more vigorously growing American economy should not help the yellow metal. The risk appetite has revived, putting safe-haven assets in a difficult position. Another problem is that the US economic growth is accelerating, while the prospects for the Europe and Japan are much darker. Hence, the greenback could remain strong relative to the euro and the yen.

Moreover, the positive economic news may encourage the Fed to adopt a more hawkish stance, which should also hit gold. Or, at least, to spur such speculations and expectations. Indeed, traders have shifted from projecting a rate cut later this year to now putting the odds of a cut by December 2019 at only 50 percent.

We argue that even these reduced odds are excessively pessimistic. The FOMC may pause for a few months, but given the strong labor market and frothy valuations of certain assets, it shouldn't cut interest rates. Such a move would unsettle markets, which closely follow how the Fed sees the economy, while leaving the US central bank with less ammunition when the next economic crisis hits the economy. Therefore, when we get more positive economic reports, the market participants could change their views. This is bad news for the gold bulls, as the revised expectations of the future path of the federal funds rate would make gold struggle. The FOMC members will gather again next week – so Powell will provide us with more clues about the current Fed's stance.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.