SolGold wants to tighten grip on Ecuador project, buy out minority shareholder

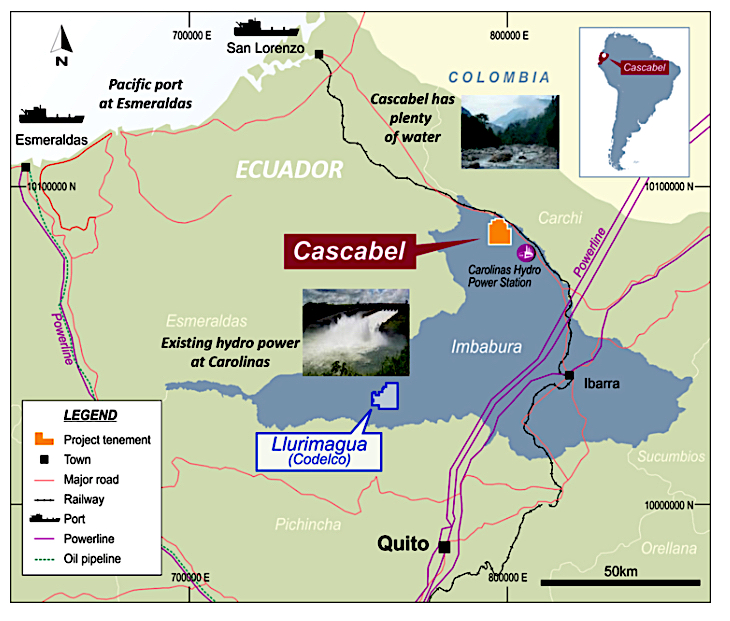

Ecuador-focused explorer SolGold (LON, TSX:SOLG) revealed Thursday plans to acquire Cornerstone Capital Resources (TSX-V:CGP), a Canadian firm which has a 15% interest in the miner's coveted Cascabel copper-gold project, located 180 km north of the capital Quito.

The takeover would see Cornerstone's investors receive 0.55 SolGold shares for each their shares, which SolGold said was a 20% premium.

In its pitch to Cornerstone investors, SolGold called the company's management 'disingenuous' in promoting its stake in Cascabel without making clear it would eventually need to cover its share of exploration financing."We are pleased to have reached the point where we feel an offer to combine SolGold and Cornerstone makes sense for Cornerstone shareholders," SolGold Chief Executive Nick Mather said in the statement.

"The combined entity will have tremendous economic upside, further de-risk the ownership structure and present a simplified and highly attractive value proposition for investors," he noted.

The company believes consolidating the ownership of Cascabel into one company makes "eminent" sense, and it said it has attempted to do this with Cornerstone in both 2017 and 2018.

It said the company had asked for far too much in return, including the removal of Mather as CEO and Brian Moller as chairman.

In its proposal to Cornerstone's investors, SolGold used rather harsh words to refer to the targeted-company's management. It said the firm has been "disingenuous" in promoting its stake in Cascabel without making clear it would need to cover its share of exploration financing at some point.

"Cornerstone's communications frequently refer to the carried nature of its 15% interest ambiguously, leaving shareholders and the investing public to assume that the interest is 'free-carried' through to the completion of a feasibility study on the Cascabel Project," SolGold said.

"This is not the case."

Cascabel project location. (Courtesy of SolGold.)

Ontario-based Cornerstone handed SolGold an initial 20% of Cascabel, one of the few new copper-bearing projects expected to come online in the near future, with an earn-in option over four years in 2012.

The asset now has a mineral resource of 2.95 billion tonnes at 0.52% copper, with $117 million spent on exploration.

Eyes on Cascabel

Cascabel has attracted quite a few major miners and boosted SolGold's position in the global market.

Australia's largest gold producer, Newcrest Mining (ASX: NCM), upped its stake in SolGold in December to 15.33% from 13.83%, to secure a portion of Cascabel.

The move further boosted Newcrest's position in SolGold against No.2 shareholder, BHP, which in September had bought a 6.1% stake in the explorer.

SolGold has a 100% interest in other 12 copper-gold targets in Ecuador, which it says is under-explored compared to Chile, the world's top copper producer.Ecuador has gained ground as a mining investment destination in the past two years, thanks to a revised regulatory framework and a major investor engagement campaign.

Almost a year ago, Newcrest Mining (ASX:NMC) took a 14% stake in Lundin Gold, which expects to bring its Fruta del Norte gold and silver mine in southeastern Ecuador into production by the end of 2019.

Anglo American (LON:AAL) also landed in the South American country last year. Through a deal with Canadian Luminex Resources (TSX-V: LR), it plans to develop two copper and gold concessions there.

Currently, the nation's emerging mining sector employs 3,700 people, but the government estimates the figure will rise to about 16,000 by 2020.

SolGold has a 100% interest in 12 copper-gold targets in Ecuador, which it says is under-explored compared to Chile, the world's top copper producer. The company also has assets in the Solomon Islands and Australia.