Ride The Wave Of Consolidation In The Gold Sector

The gold mining sector is a highly fragmented industry but is now seeing some aggressive consolidation among the large cap names.

In a public market that has massive market caps, the gold miners run the risk of becoming irrelevant.

Barrick and Newmont/Goldcorp have lit a pathway and many others will follow, whether they want to or not.

It might be worth owning some GG shares for the short term, but I still see the bigger premium plays being in the small to mid caps.

The gold mining sector is a highly fragmented industry. There are many players that churn out production of the precious metal - from tiny, 50,000 ounce per annum miners, to multi-million ounce producers.

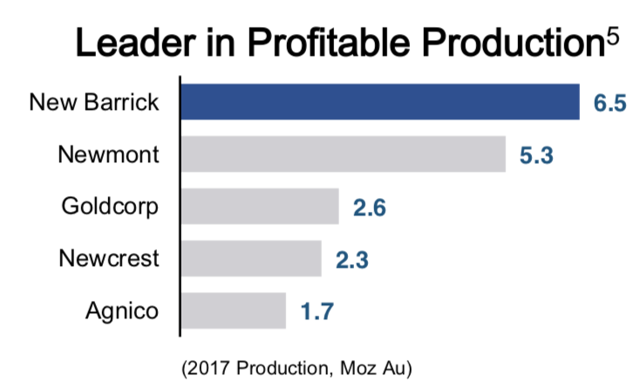

The sector, though, is now seeing some aggressive consolidation among the large cap names. In September 2018, Barrick (GOLD) and Randgold announced they were merging in an $18.3 billion deal - eclipsing the size of Newmont (NEM) which recently stole the crown from Barrick - and creating the largest gold company in the sector. The ABX/GOLD union just closed on January 1 of this year.

(Source: Barrick Gold)

Then last week, Newmont said to Barrick: "I will see your 1.3-1.4 million ounces, and raise you another 1.1-1.2 million ounces," as Newmont and Goldcorp (GG) announced a ~$29 billion deal between the two companies.

(Source: SomaBull)

In this article, I'm going to discuss why this consolidation is so desperately needed, why there are likely many more deals to come, and how I'm positioned to ride this wave.

Why Consolidation Among The Gold Miners Is Needed

While there is competition over projects and assets, when it comes to the day-to-day business, these gold companies are mining the same product and selling it for the same price (ignoring the slight variances in sale price that some see due to small hedging programs).

To survive in this industry, a company just needs to have decent margins, make sure their balance sheet doesn't get too stretched, and maintain access to additional liquidity.

A gold miner doesn't have to operate at the lowest cost in the industry and have a well fortified balance sheet to remain viable. There is no true competition in this space to drive the weaker players out of business and create stronger mining entities. And that's the problem.

This has allowed the sector to become fragmented, as most of these companies are trying to remain on an island - isolating themselves to their own little corner of the sector. Managements and boards of these companies are content, some fat and happy, many well entrenched. The sector has become a dependable meal ticket.

But this has come at the expense of shareholders, as many of these mining companies have seen their stock prices significantly underperform.

Mark Bristow, Randgold's last CEO and now CEO of the newly formed Barrick Gold, was making the rounds after the merger closed. In an interview on CNBC, Bristow made some very interesting comments about the gold mining sector, basically saying that it's quite a small industry (~$100 billion), and if you keep operating as small little companies in a public market that is a much larger entity, then you run the risk of becoming irrelevant.

Bristow is absolutely correct, in a public market that has massive market caps, it's easy for the small gold miners to become irrelevant.

Also, the smaller the mining company, the more defenseless they are in the market. They become easier targets to short, something that hasn't gone unnoticed by the big banks.

The best thing that can happen is to unite many of these companies, even if some might go kicking and screaming (as the rise of shareholder activism in the space is also helping to force this change).

When gold is going gangbusters, these gold stocks come alive and generate tremendous returns. But if there is flatness in the gold price, or worse, a severe downturn, then the gold mining stocks become irrelevant to the vast majority of investors and then they become easy targets for the shorts. That's when the greatest amount of shareholder destruction occurs.

The goal for all of these companies in the sector should be to reach a point where no matter what kind of gold market you are in, your stock can still command attention and compete for investors' dollars.

That hasn't been the mindset over the last 6-7 years, but that is changing quickly.

One of the reasons for the Barrick/Randgold merger was to create a company that stands apart from all of its peers. Which GOLD does. And it can go up against companies outside of the gold industry as well.

Now Newmont and Goldcorp have joined Barrick.

For the gold mining industry to stay relevant, at all points in the cycle, consolidation needs to occur. That means mega-gold companies created by the large caps and a significant amount of mergers among the small and mid-caps.

Many More Deals Ahead In The Sector

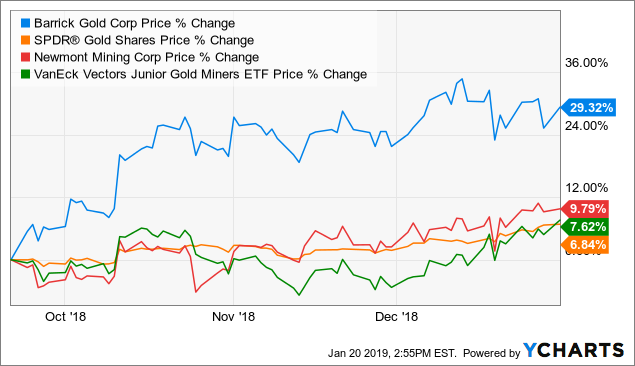

Between the date of the Barrick/Randgold merger announcement and the closing of the transaction, Barrick's stock appreciated by 29.32%. Trouncing not only the performance of the SPDR Gold Trust ETF (GLD), but its closest rival NEM. Even the high-beta junior gold stocks lagged GOLD by a wide margin.

GOLD data by YCharts

GOLD data by YCharts

The rest of the industry took notice, especially since Barrick offered zero premium for Randgold shares.

This showed that investors were highly receptive to mergers in the space and were willing to forgo a premium, instead focusing on the long-term benefits of this deal and the value that it would not only create but also unlock.

Barrick and Newmont/Goldcorp have lit a pathway and many others will follow, whether they want to or not. With the rise of shareholder activist groups like the John Paulson led Shareholders Gold Council, the days of "management first, shareholders last" are numbered.

Finding the optimal partner before they are snatched up by another miner is likely now a top priority. Underperforming management teams are feeling the pressure from the rise of activist shareholders to either do something soon to get their stock price up or run the risk of being kicked to the curb.

Times are changing.

Dominoes are falling.

How I'm Positioned To Ride This Wave

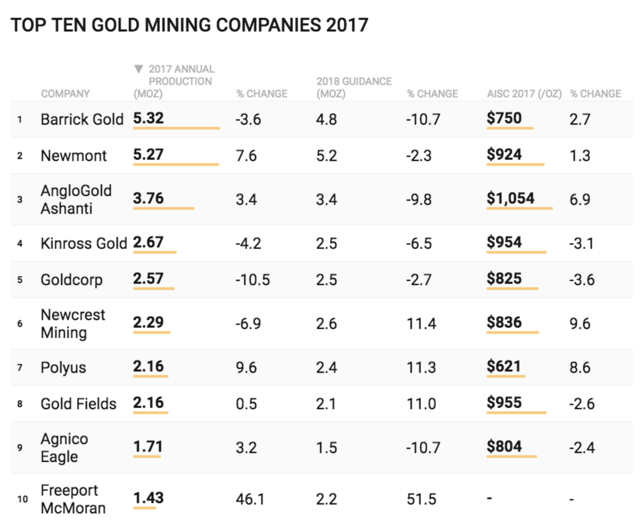

Below is a list of the top 10 gold mining companies using 2017 production figures. Barrick and Newmont have created more separation between themselves and the companies below them. Goldcorp was fifth but now it's off the board.

I see strong potential for some combination between AngloGold Ashanti (AU), Kinross Gold (KGC) and Gold Fields (GFI). Likely zero premium deals as well; more of a merger of equals that should unlock value. Newcrest (OTCPK:NCMGF) (OTCPK:NCMGY) was rumored to be pursing Goldcorp, they might be one without a chair when this is all said and done. Polyus (OTC:PGILF) is focused on Russia and doesn't have any natural partners. KGC has some assets in Russia, but I don't see Polyus/Kinross as a potential duo. Unless Agnico Eagle (AEM) wants to pursue a deal with Goldcorp, I see AEM as being more strategic and acquiring a smaller producer. I'm avoiding AEM given they are more likely an acquirer than acquiree. Freeport (FCX) is more of a base metal play and I don't think it's relevant to the discussion.

(Source: Mining.com)

As I mentioned in an article a few days ago, it might be worth owning some GG for the short term as two things are now working in Goldcorp's favor:

It has much more downside protection given it's now closely tied to Newmont's stock. The merger news has so far received a mixed reaction, but it's still early. If investors warm up to the deal, GG could put in a strong performance (? la ABX/GOLD) between now and when the merger closes.As the senior mining companies make their moves, this will filter down to the small and mid-caps. This is where I believe the most consolidation will occur. The difference here is there will be premiums with these deals as many stocks in this category are severely undervalued.

That's why I feel most of the focus should be on companies that are producing anywhere from a couple hundred thousand ounces a year to just over 1 million ounces.

The key is to identify the acquirers and acquirees.

One small-cap play that I like as a potential acquisition target by a larger miner is Alacer Gold (OTCPK:ALIAF). The jurisdiction they operate in (Turkey) is higher risk, but many companies are entering this region due to the low tax rate and pro-mining stance by the government.

Alacer has just completed construction of their ????pler sulfide project and the performance of the sulfide plant continues to meet expectations - with over 23,000 ounces of gold being produced during December 2018.

????pler is expected to average 300,000 ounces of gold production annually over the next 5 years while AISC will average just $645 per ounce over the LOM. Free cash flow per year will be ~$200 million on a 100% basis (Alacer owns 80% of ????pler) during the first 5 years of sulfide gold production and over $2 billion in free cash flow (on a 100% basis) over the 20-year life of mine.

This mine checks off a lot of boxes and it's immediately accretive. I believe this could be a good fit for somebody like IAMGOLD (IAG).

It's small caps like Alacer that should be high valued targets and receive at least modest premiums if they are bought out.

In Summary

Barrick and Newmont/Goldcorp have lit a pathway and others will have to follow, whether they want to or not. Which is why this year I expect to see some very interesting amalgamations in the gold mining industry. This will lead to stronger stock prices, greater shareholder value, and most importantly, more relevant mining companies. Throw in a rising gold price and it could be quite the year.

Why you should join The Gold Edge:

The fundamentals for the gold sector are outstanding - it's going to be a stellar performer over the next several years. Annual supply has peaked, debt and deficits are soaring, interest rates are rising and inflation is percolating.

The opportunity in this sector is here, but to succeed, you need a deep knowledge about these companies. The Gold Edge is my research intensive service that provides that knowledge. I'm actively covering miners that are best of the best, including deep value plays, prime acquisition targets, and explorers with huge upside potential.

Learn more here.

Disclosure: I am/we are long GOLD,GG,KGC,ALIAF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow SomaBull and get email alerts