Put Options are Cheap on Downgraded Gap Stock

Bearish betting has been picking up speed on the retail stock

Bearish betting has been picking up speed on the retail stock

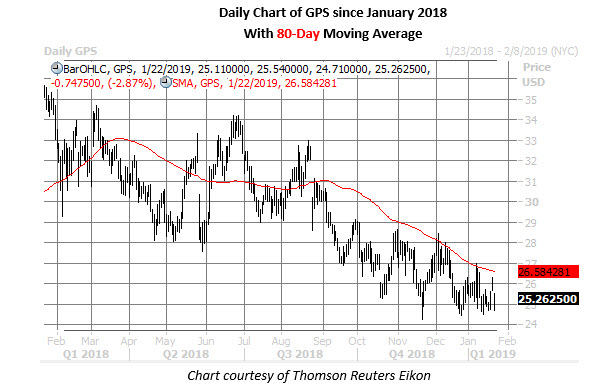

Analysts at Goldman Sachs are adjusting ratings on retail stocks today. For Gap Inc (NYSE:GPS), this meant a downgrade to "sell" from "neutral" and price-target cut to $23 from $27, with the brokerage firm citing concerns over slowing brand momentum. At last check, GPS stock is down 2.6% at $25.26, retreating from a trendline with historically bearish implications.

Looking closer at the charts, GPS came into 2019 struggling, but found a familiar floor in the $24.50-$25.00 neighborhood -- a region that marked bottoms in late November and December. A bounce off here brought the retail stock up to its 80-day moving average. According to Schaeffer's Senior Quantitative Analyst Rocky White, in the five previous times the equity has challenged resistance at this trendline, it was lower 15 days out 80% of the time, averaging a negative return of 2.1%.

Options traders have been betting on additional losses at a breakneck speed. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Gap's 10-day put/call volume ratio of 10.41 ranks in the 98th annual percentile, meaning puts have been bought to open over calls at a quicker-than-usual clip.

Drilling down, the March 26 put has seen one of the biggest increases in open interest over the past 10 days, with nearly 5,200 contracts initiated. Data from Trade-Alert points to buy-to-open activity here, meaning options bears have been targeting a move below $26.

With Gap earnings not expected until late February, short-term options are pricing in relatively low volatility expectations at the moment -- which could increase the benefit of leverage. The stock's Schaeffer's Volatility Index (SVI) of 33% ranks in the 16th percentile of its annual range.