Petra to Reduce Production Amid Weak Prices

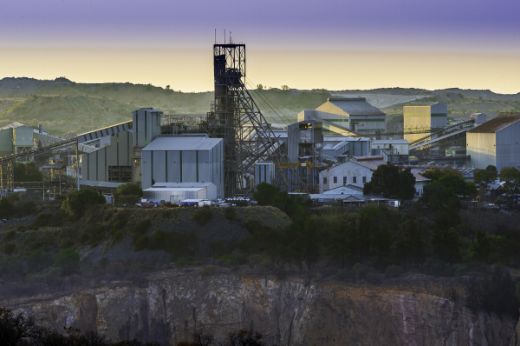

RAPAPORT... Shares in Petra Diamonds slipped 6% in early trading Monday after the minerreported it would lower its production for fiscal 2020. The company expects to produce about 3.8 million carats inthe financial year ending June 2020, as opposed to 3.9 million caratsin fiscal 2019, it said Monday. While run-of-mine production is expected toremain flat, the decrease will come from lower processing of tailings - the ore remaining after the first round of processing - atPetra's Cullinan mine in South Africa. "Tailings production at Cullinan will be curtailed...due to weak pricing especially evident in smaller size ranges," it said. "The economic evaluation of...[its] tailings resource will be monitored continuously and could be included in future mine plans should the market conditions and pricing of smaller diamonds improve."Petra's diamond prices were down 5% on a like-for-like basis during the fiscal year, it said. "Polished-diamond demand and prices were weaker as the market was challenged by higher than normal polished inventories and tightening cutting-center bank credit." Production for the fiscal year ending June 30 grew 1% to 3.9million carats. Revenue fell 6% to $463.6 million, with the miner selling 3.7million carats at an average price of $124 per carat. The company's debt increased to $560.5 million from $559.3 million at December31, as the result of devaluation charges on two of its mines. To pay off the debt, Petra has launched Project 2022, a three-year plan tosave $150 million to $200 million by implementing operational efficiencies, itexplained. "The focus in the short term is on driving efficienciesacross the business through Project 2022 to provide a stable, consistentoperating platform off which to drive improvements, supported by an appropriateorganizational structure and cost base to enhance our cash-flow generation andsignificantly reduce our net debt," said Petra CEO Richard Duffy. Petra operates the Cullinan, Finsch and Koffiefonteinunderground mines in South Africa, and the Williamson open-pit facility inTanzania. Image: The Cullinan mine. (Petra Diamonds)

RAPAPORT... Shares in Petra Diamonds slipped 6% in early trading Monday after the minerreported it would lower its production for fiscal 2020. The company expects to produce about 3.8 million carats inthe financial year ending June 2020, as opposed to 3.9 million caratsin fiscal 2019, it said Monday. While run-of-mine production is expected toremain flat, the decrease will come from lower processing of tailings - the ore remaining after the first round of processing - atPetra's Cullinan mine in South Africa. "Tailings production at Cullinan will be curtailed...due to weak pricing especially evident in smaller size ranges," it said. "The economic evaluation of...[its] tailings resource will be monitored continuously and could be included in future mine plans should the market conditions and pricing of smaller diamonds improve."Petra's diamond prices were down 5% on a like-for-like basis during the fiscal year, it said. "Polished-diamond demand and prices were weaker as the market was challenged by higher than normal polished inventories and tightening cutting-center bank credit." Production for the fiscal year ending June 30 grew 1% to 3.9million carats. Revenue fell 6% to $463.6 million, with the miner selling 3.7million carats at an average price of $124 per carat. The company's debt increased to $560.5 million from $559.3 million at December31, as the result of devaluation charges on two of its mines. To pay off the debt, Petra has launched Project 2022, a three-year plan tosave $150 million to $200 million by implementing operational efficiencies, itexplained. "The focus in the short term is on driving efficienciesacross the business through Project 2022 to provide a stable, consistentoperating platform off which to drive improvements, supported by an appropriateorganizational structure and cost base to enhance our cash-flow generation andsignificantly reduce our net debt," said Petra CEO Richard Duffy. Petra operates the Cullinan, Finsch and Koffiefonteinunderground mines in South Africa, and the Williamson open-pit facility inTanzania. Image: The Cullinan mine. (Petra Diamonds)